Finding Value in Apple’s $3+ Trillion Moat

Finding Value in Apple’s $3+ Trillion Moat

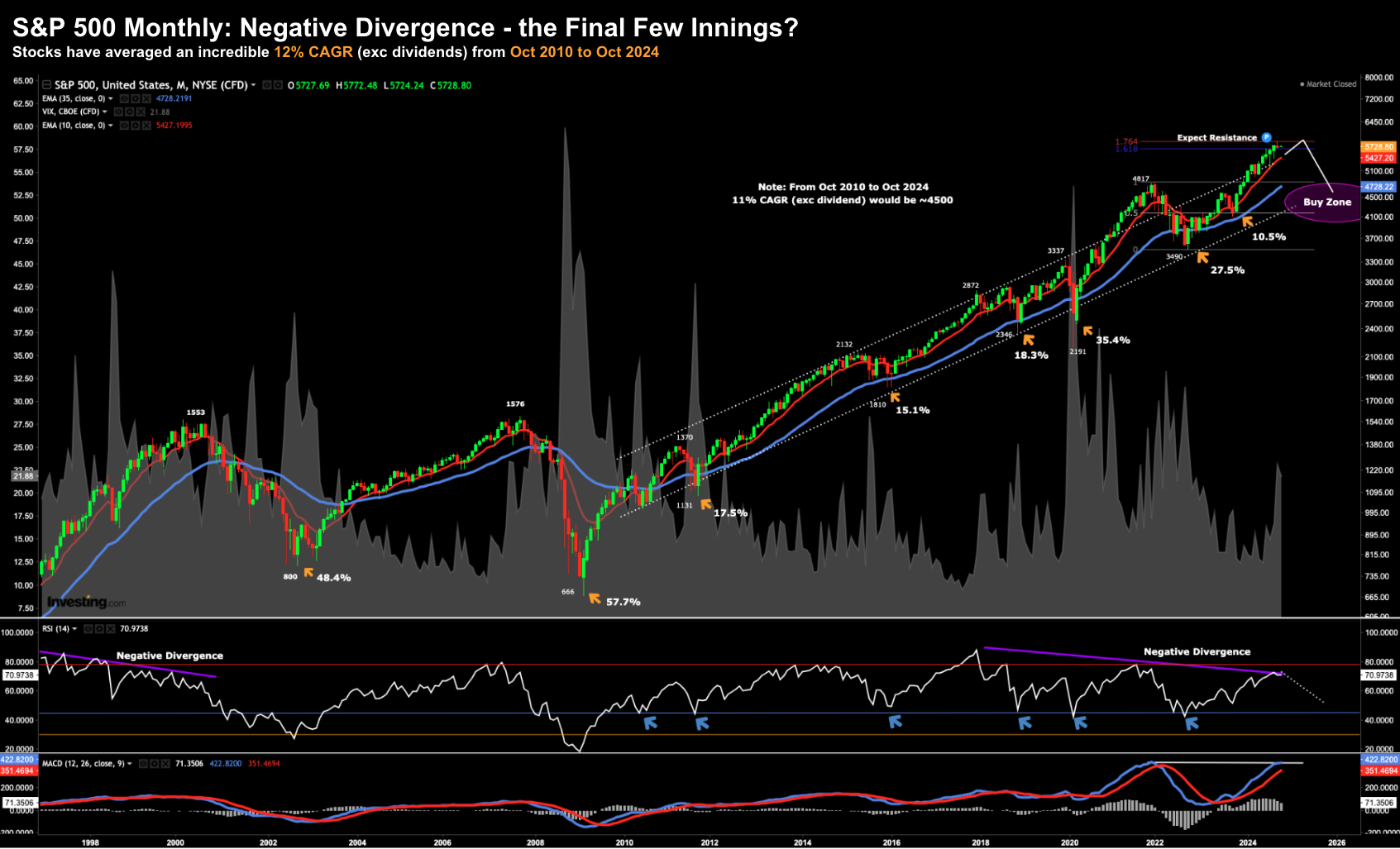

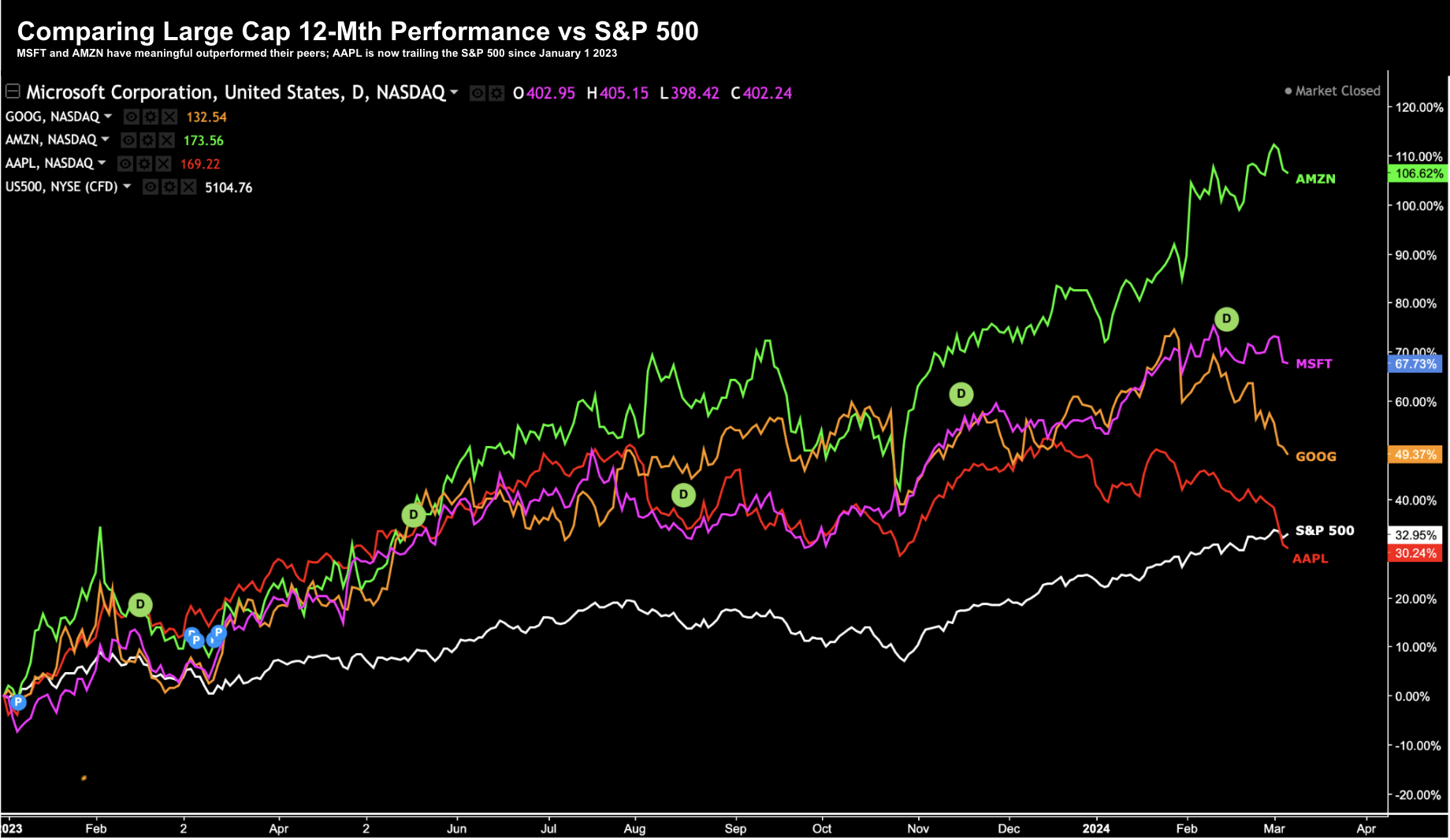

In the last three months of 2025, the tech sector experienced what some called a “correction”. But what is a true correction? Technicians will be quick to say a drop of 10%. But for me that doesn”t work… I would…