Yields Rally on “Strong” Jobs Data

Yields Rally on “Strong” Jobs Data

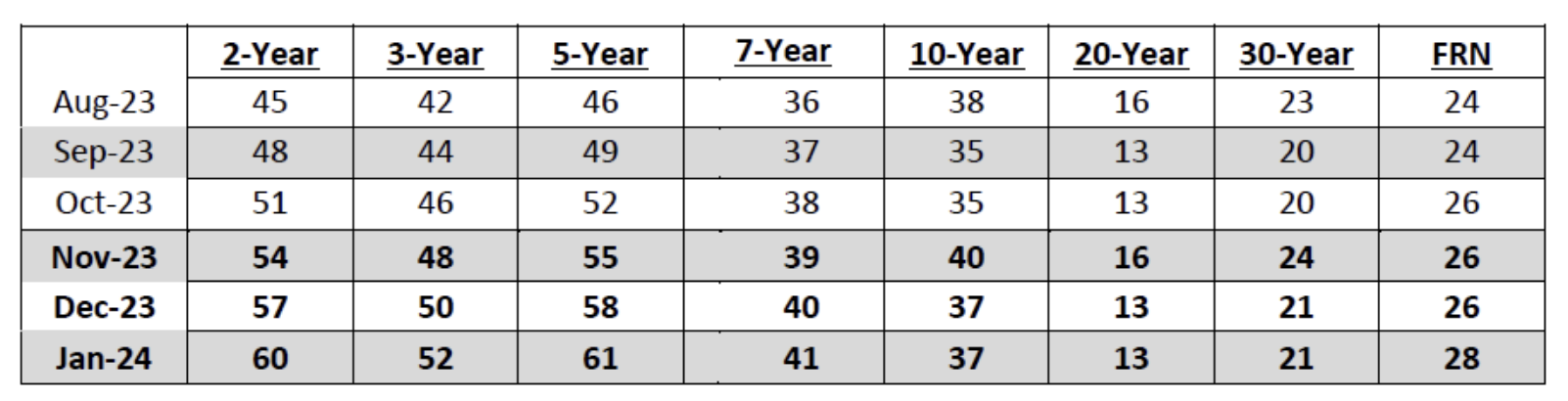

According to the BLS - we saw the strongest employment growth in 12 months alongside the fastest wage growth in 22 months (0.6% MoM). However, we also saw the lowest amount of weekly hours worked since 2010. Given the better than expect jobs gains and acceleration in wages (which remains well above the Fed's objective) - it seems less likely the Fed can justify rate cuts in March. Probabilities for a cut in 2 months stand at 38%. This was above 70% just a month ago.