Inflation: Pressure Below the Hood

Inflation: Pressure Below the Hood

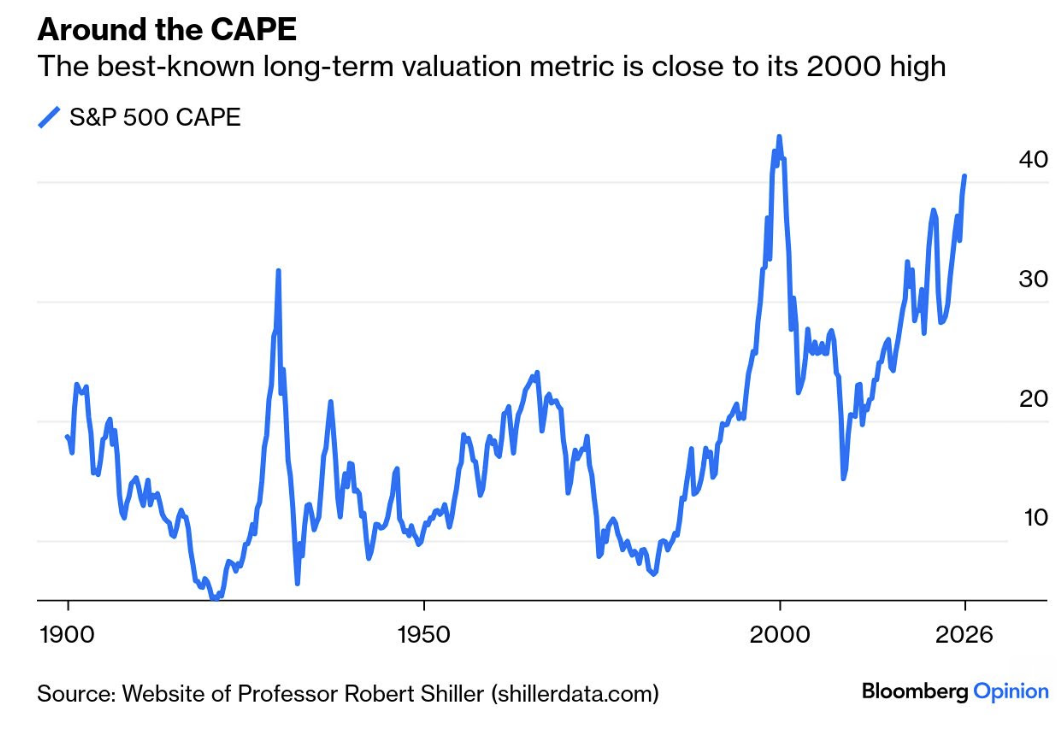

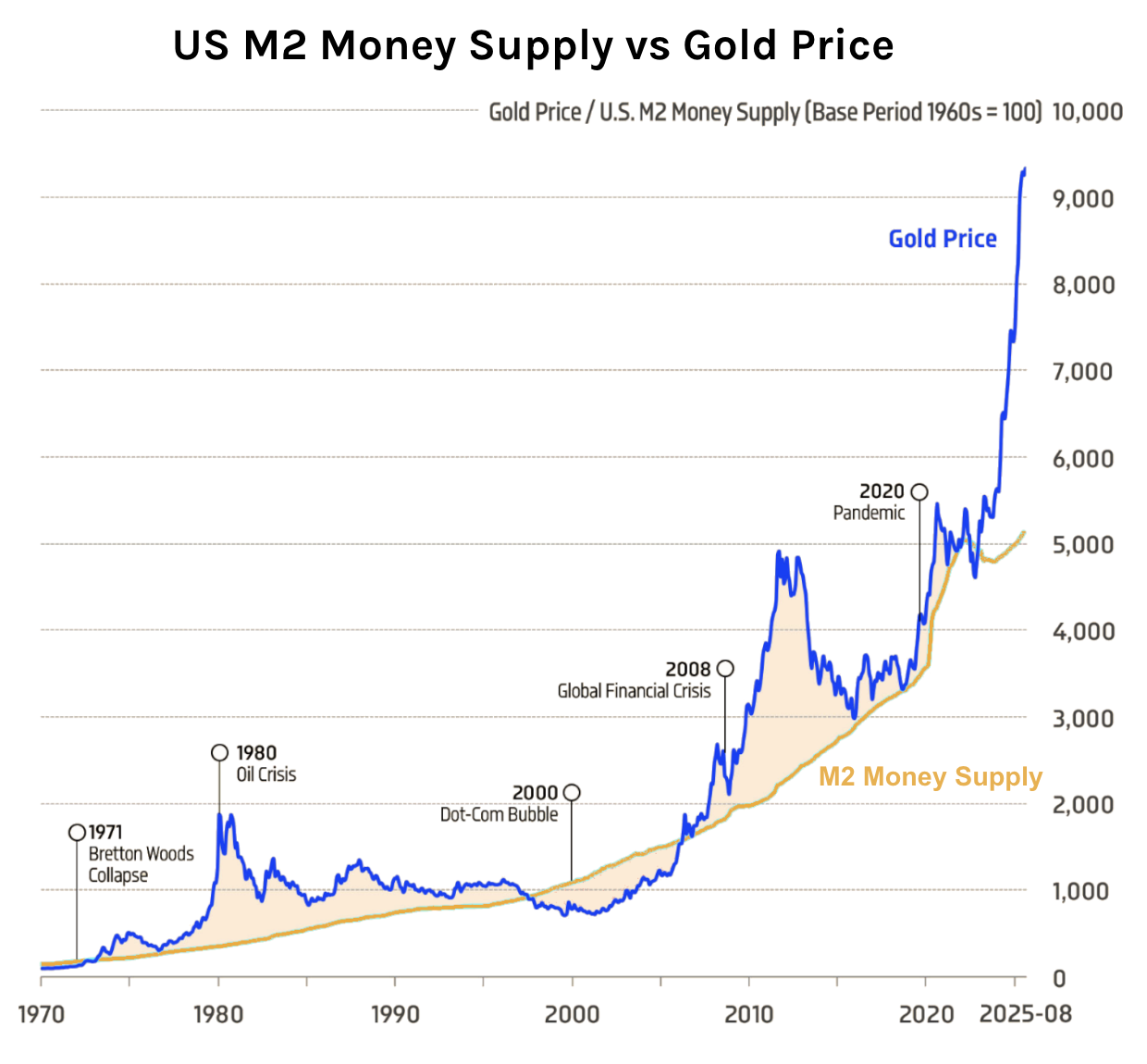

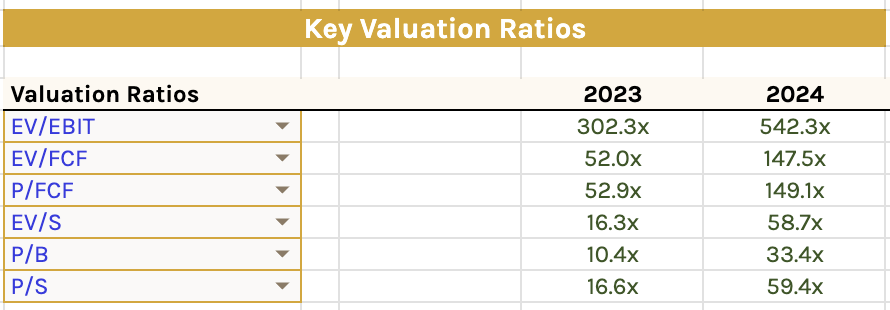

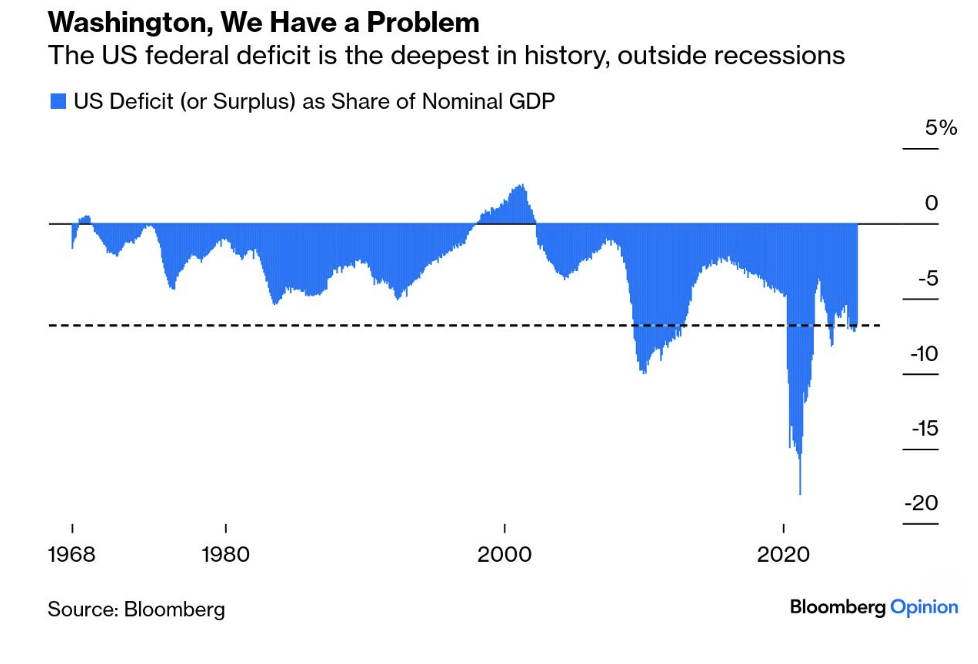

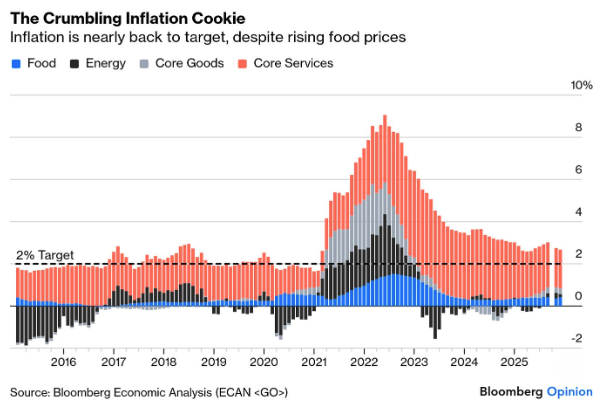

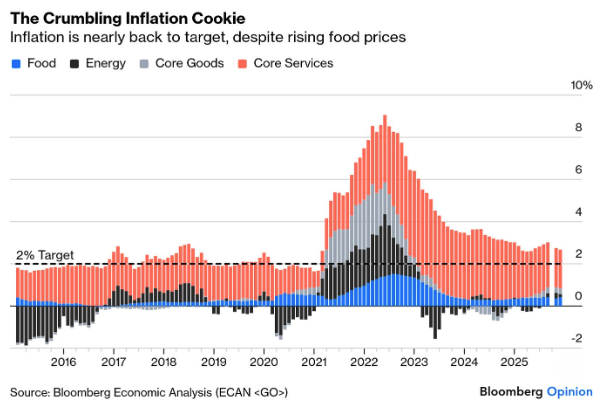

While the latest U.S. inflation print was celebrated as a “Goldilocks” outcome, a closer look suggests the disinflation story is far more fragile. Beneath the headline numbers, core and alternative measures imply inflation is likely to plateau near 3%, with important implications for Fed policy, equity valuations, and sector positioning in 2026