Focus on High Quality in Challenging Markets

Focus on High Quality in Challenging Markets

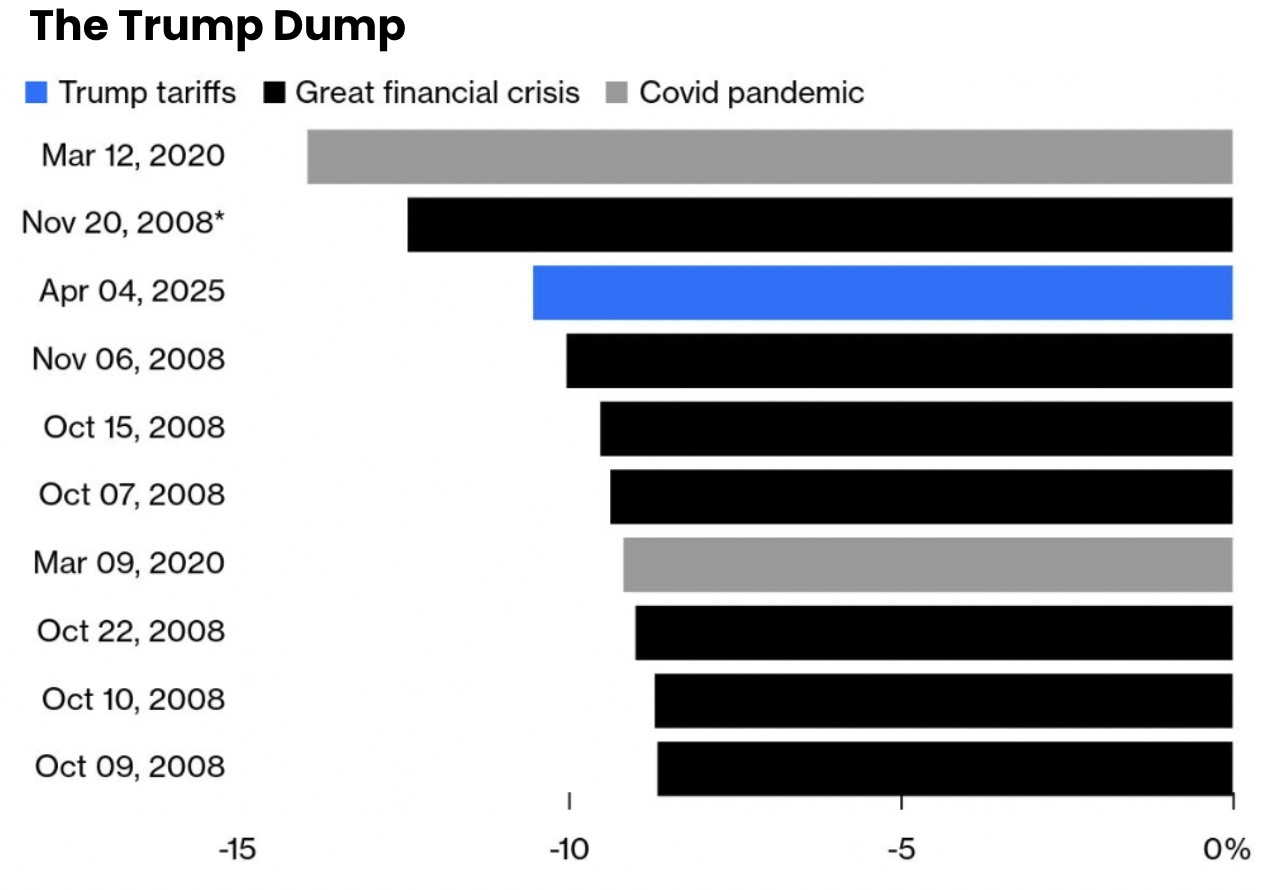

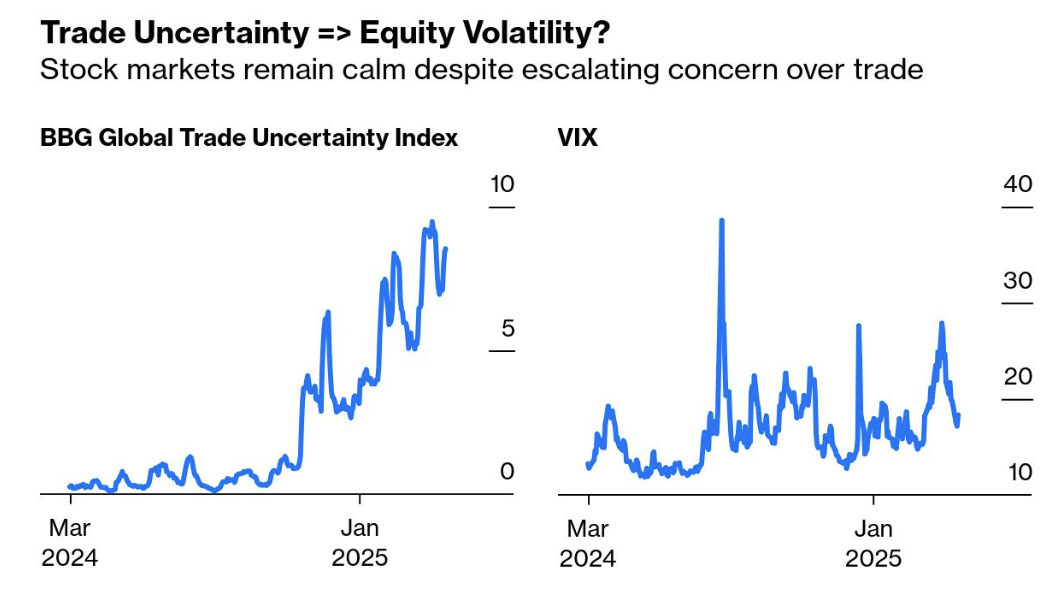

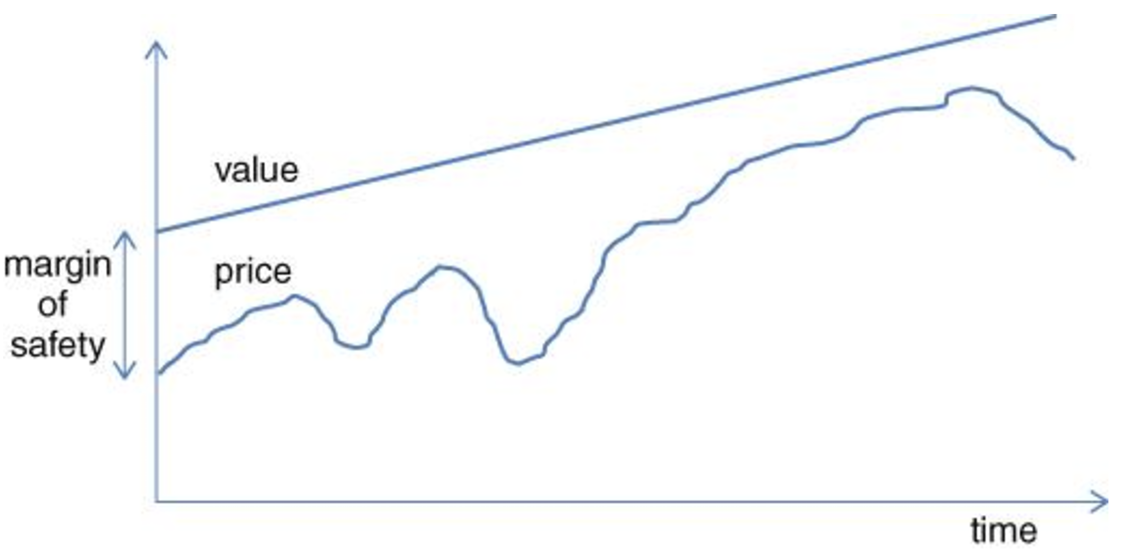

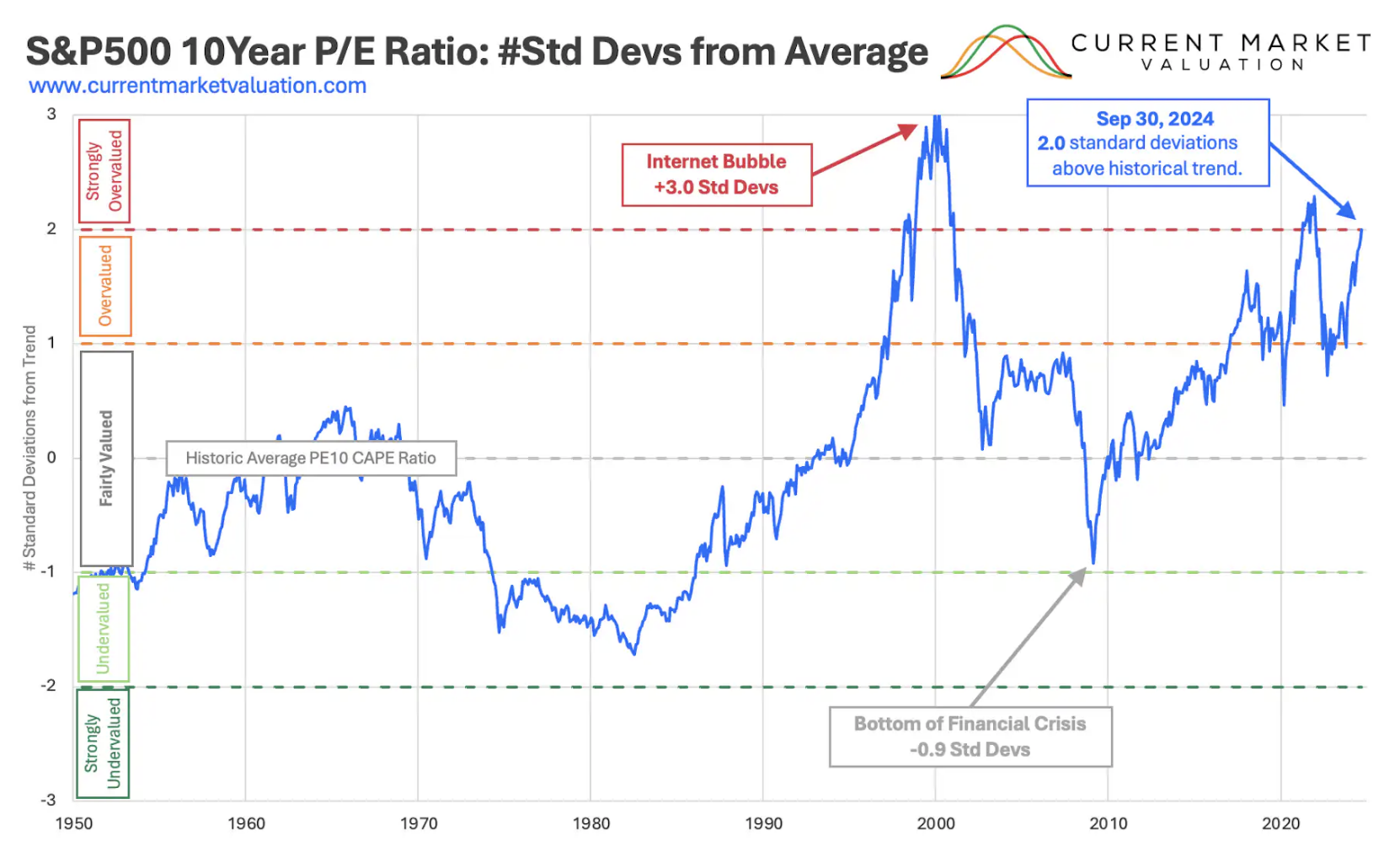

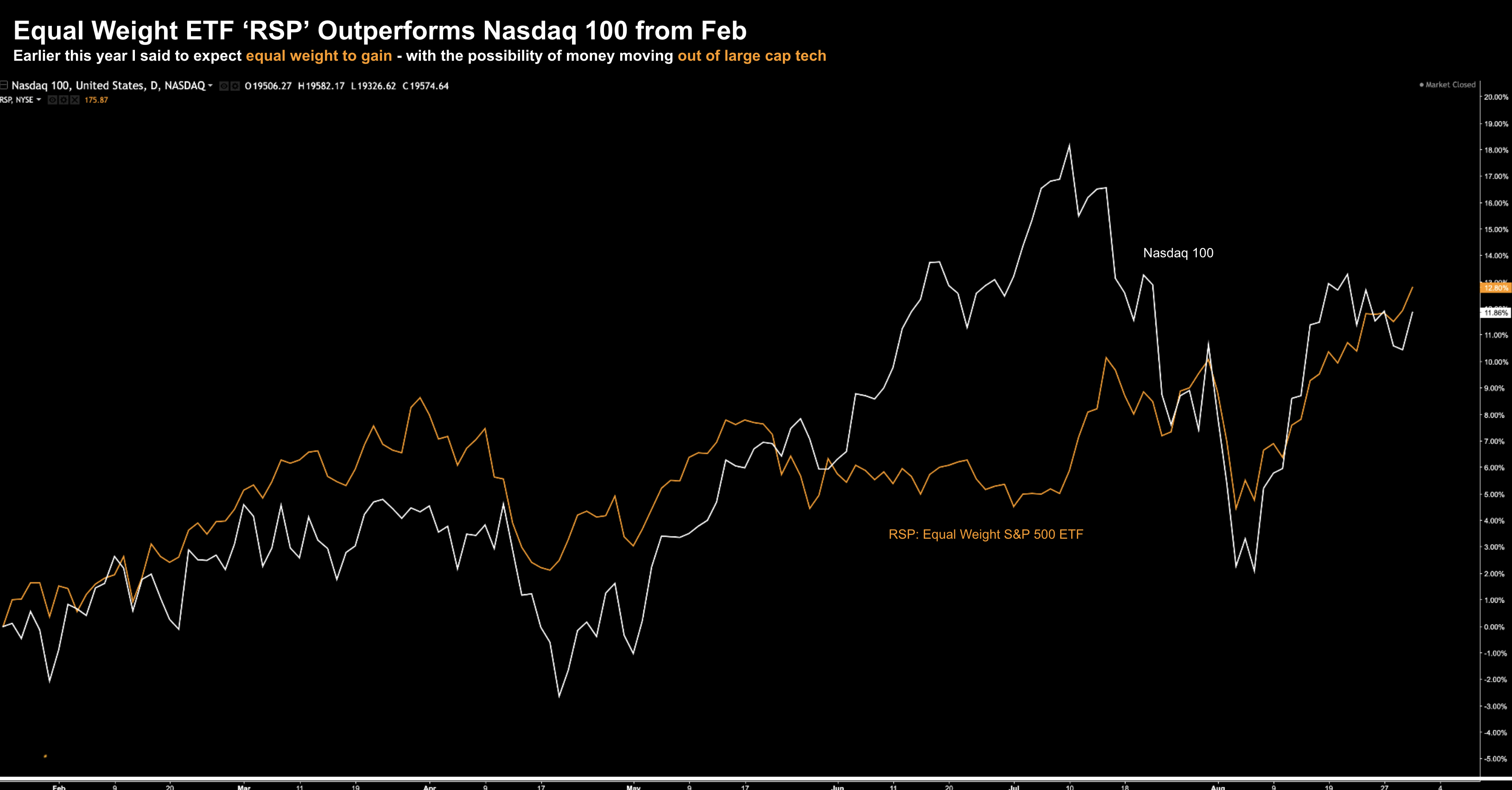

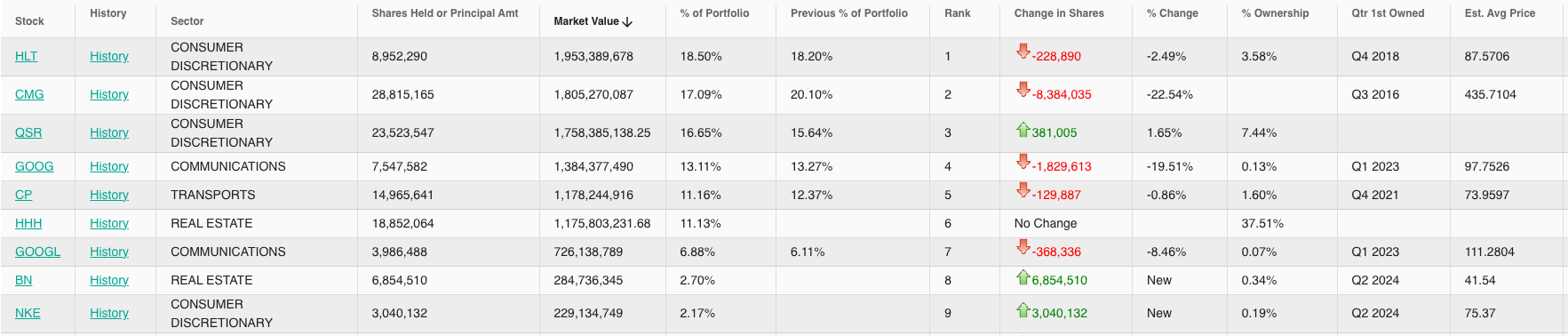

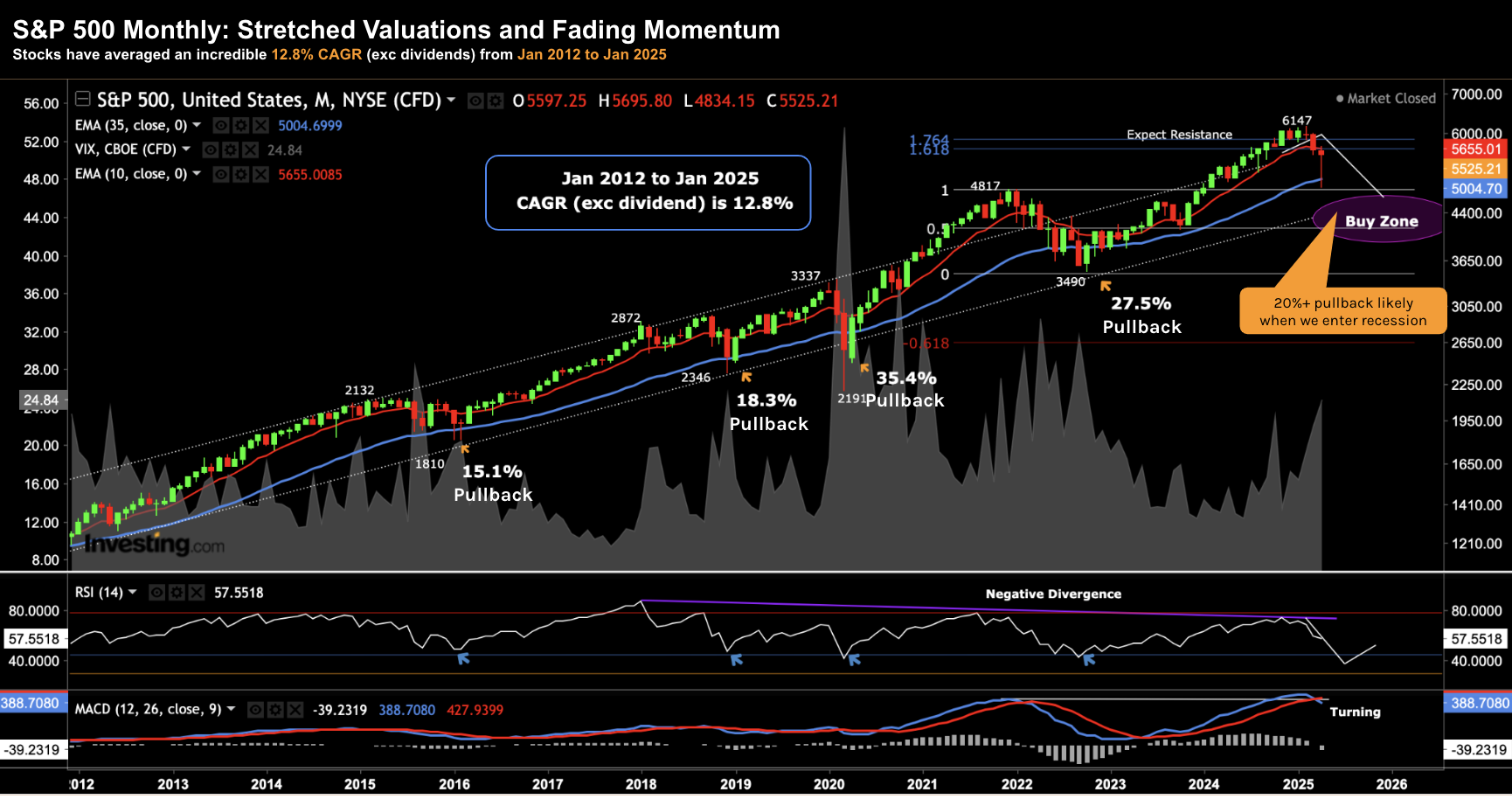

It's my thesis market returns over the next few years are unlikely to match what we've seen over the past decade. However, I'm also of the view that will create great opportunities for savvy patient investors who think long-term. This missive defines what is meant by "quality" investments - and the attributes investors should focus on. And if we are see a more challenging climate the next few years - it's higher quality assets which will shine.