So Maybe Valuations Matter?

So Maybe Valuations Matter?

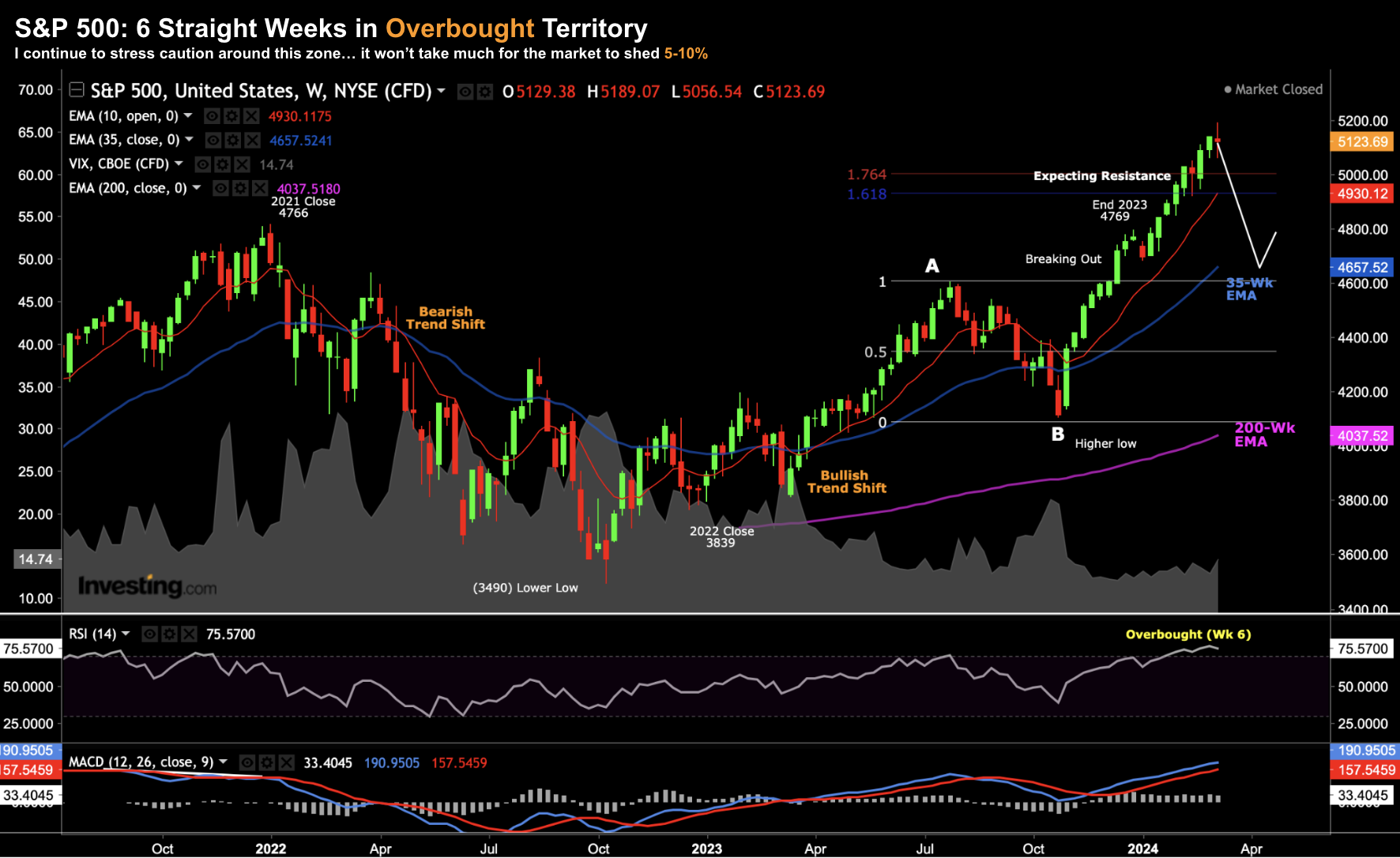

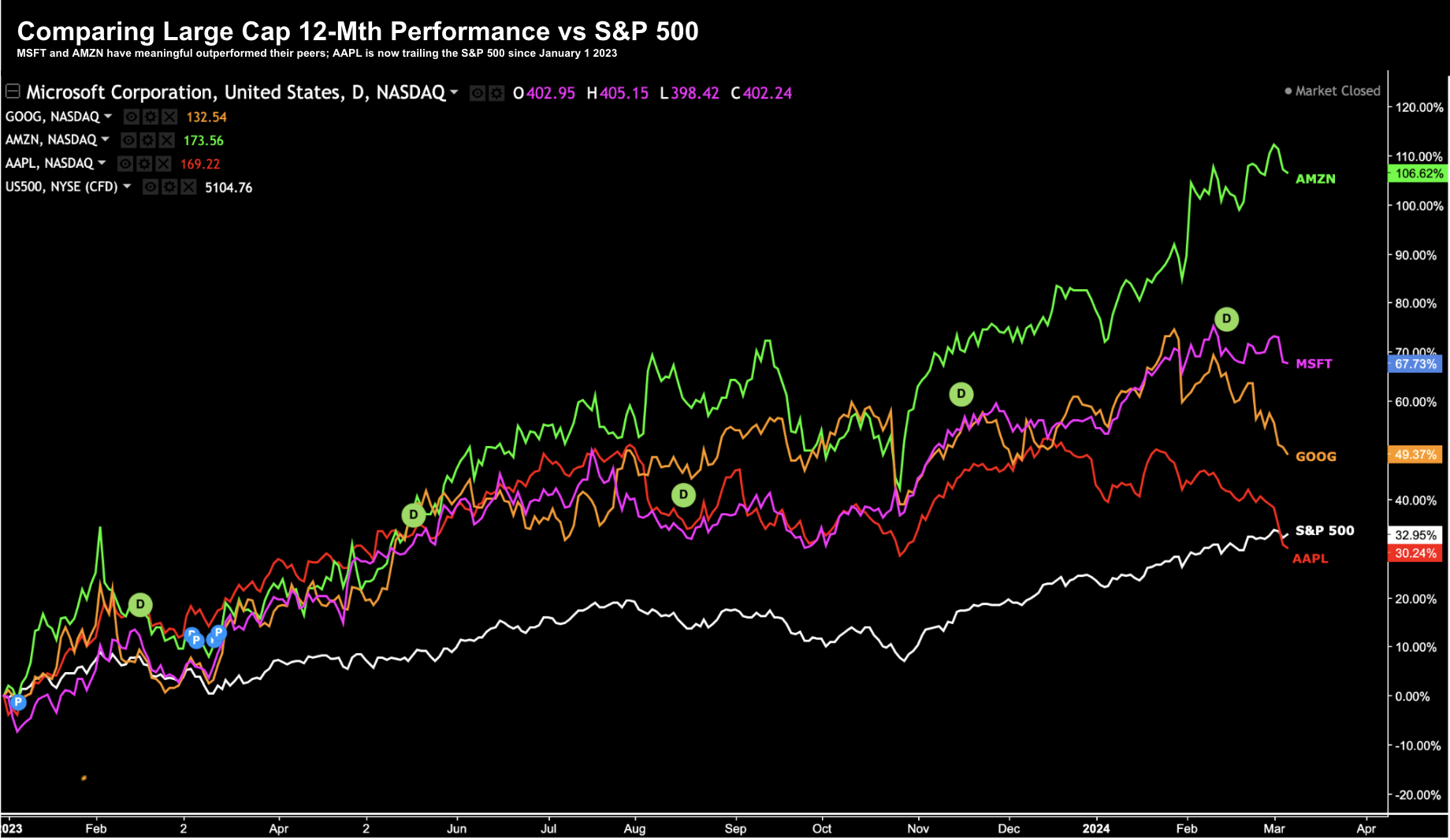

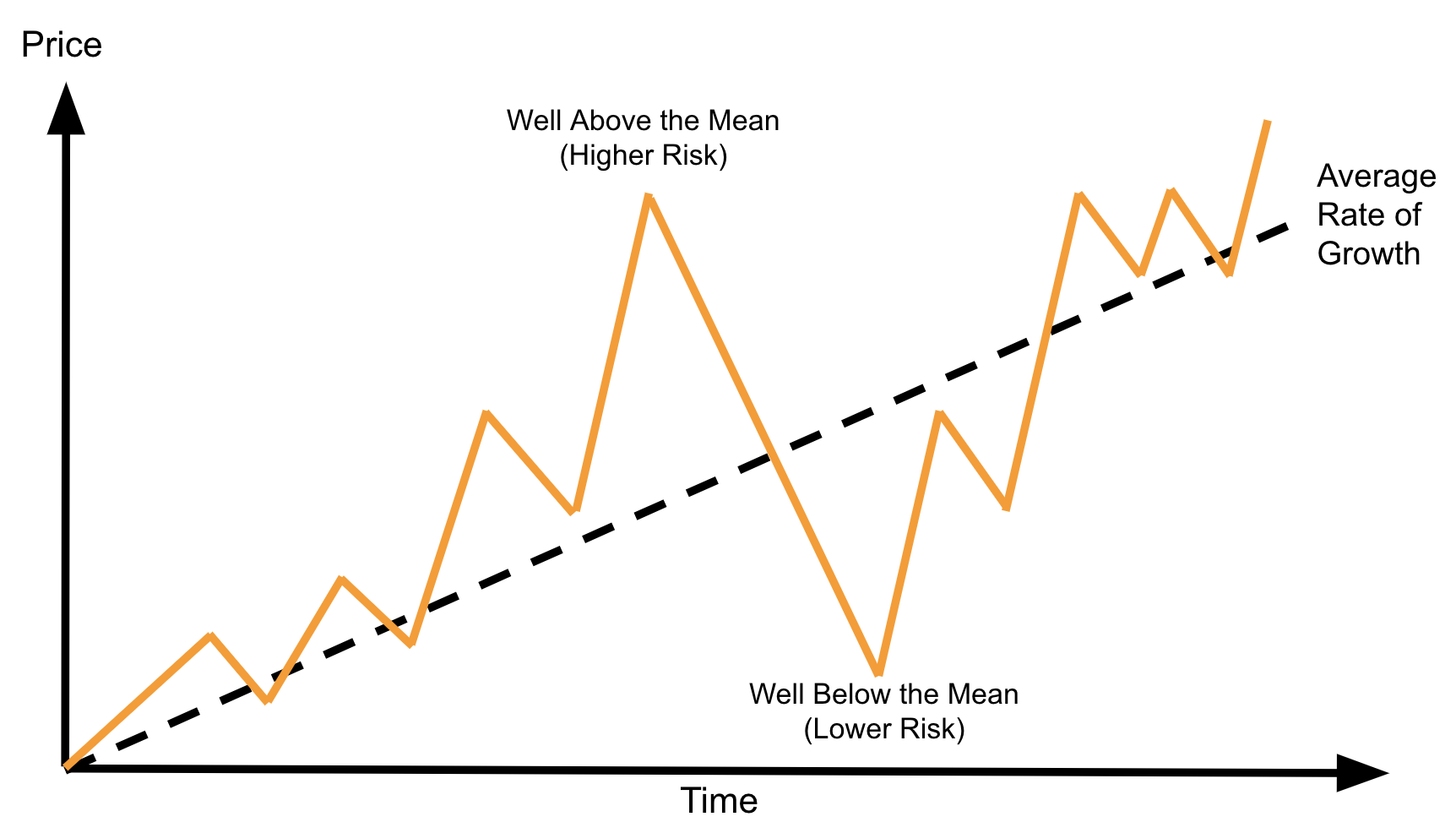

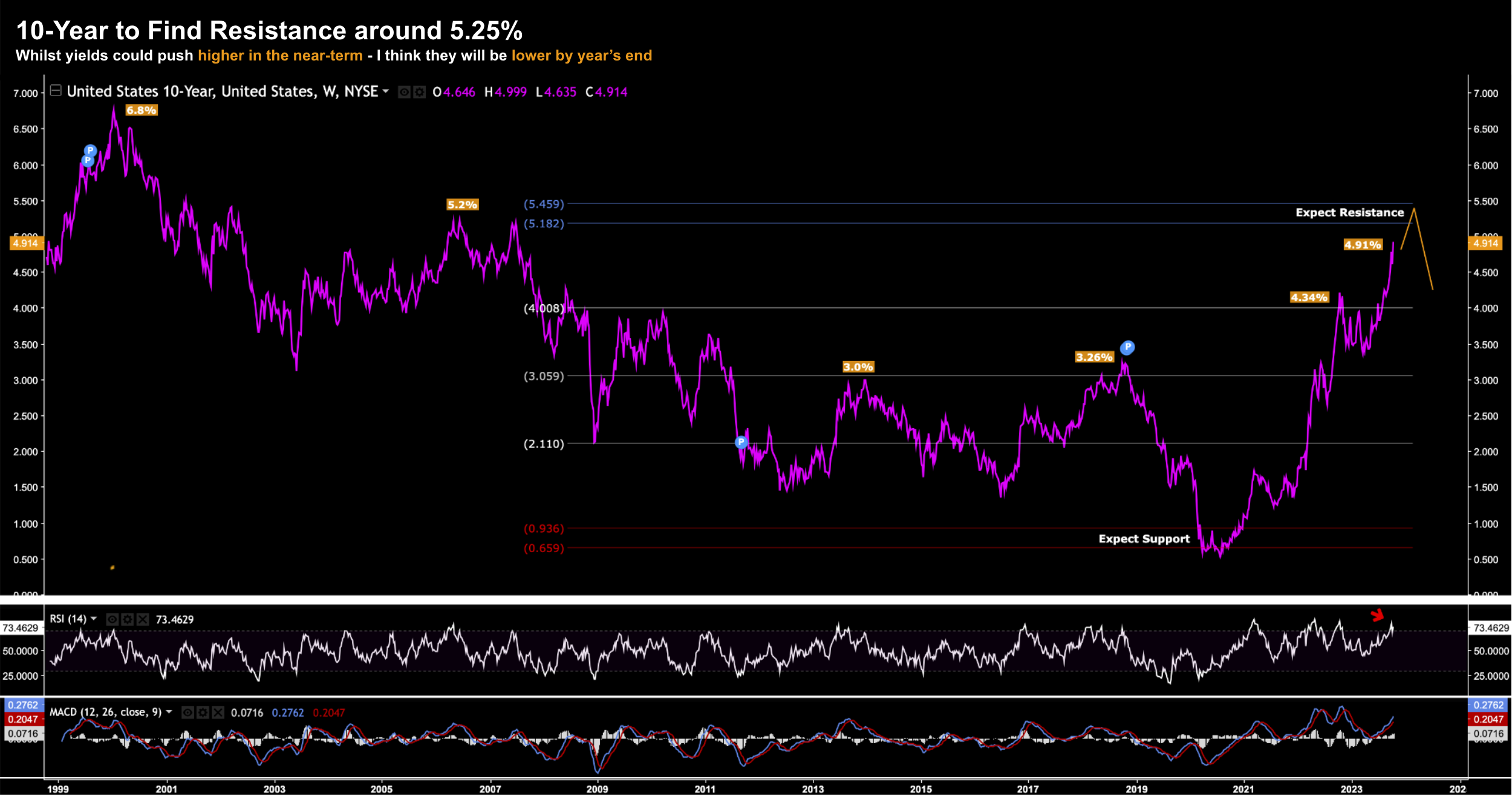

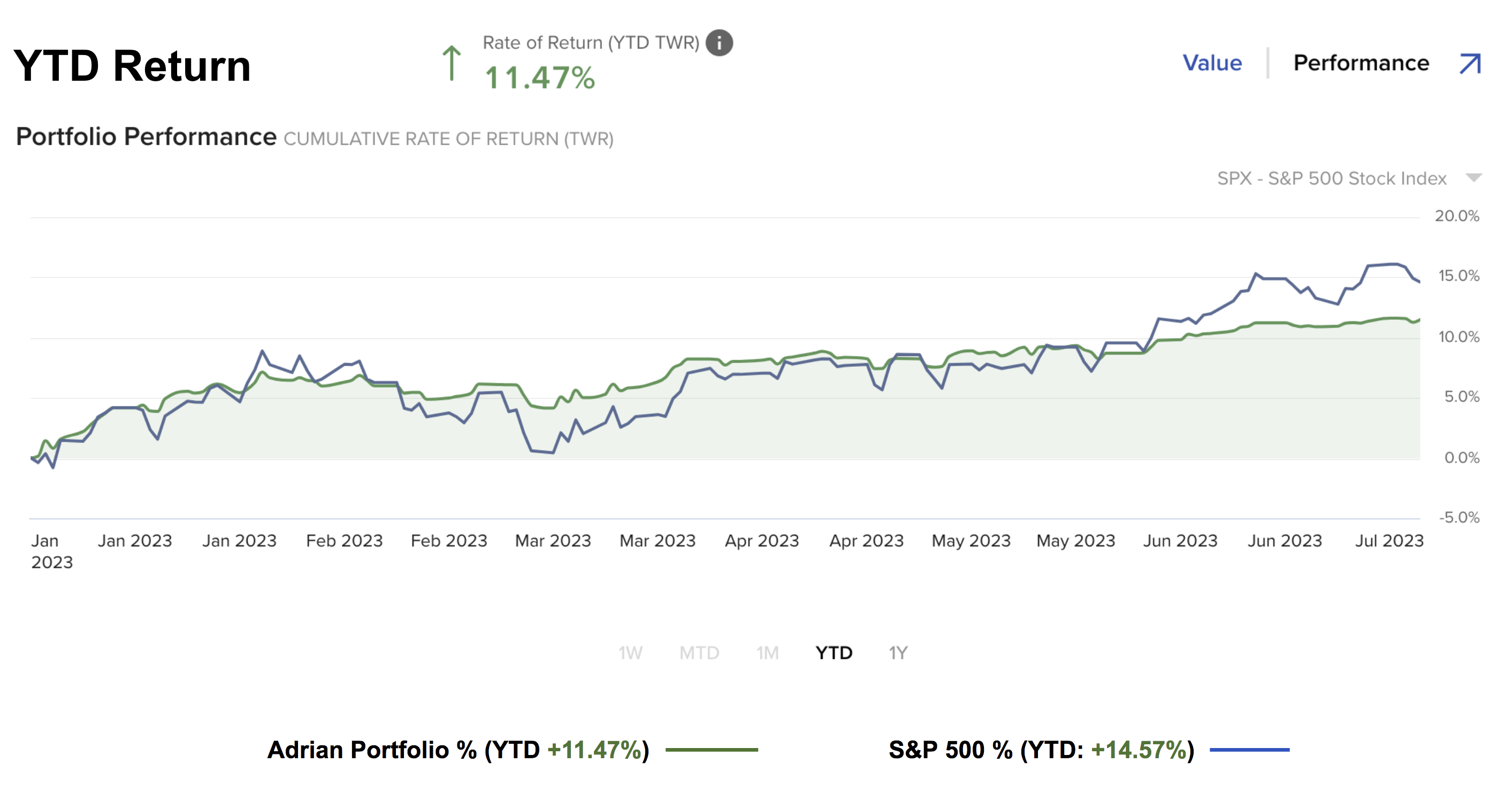

When I made the difficult decision to reduce my exposure to large-cap tech earlier this year - I wasn't sure how things would pan out. In the short-term - I looked foolish. These stocks surged higher without me. However, since then, large-cap tech is trading lower than when I sold it (on average). But is this a dip you should buy? I don't think so - not just yet. The broader index is only 6% off its all-time high. That's nothing in the larger scheme of things. I'm choosing to remain a little more patient - where I think the index could correct somewhere in the realm to 10-12%.