The One Thing Driving the Market

The One Thing Driving the Market

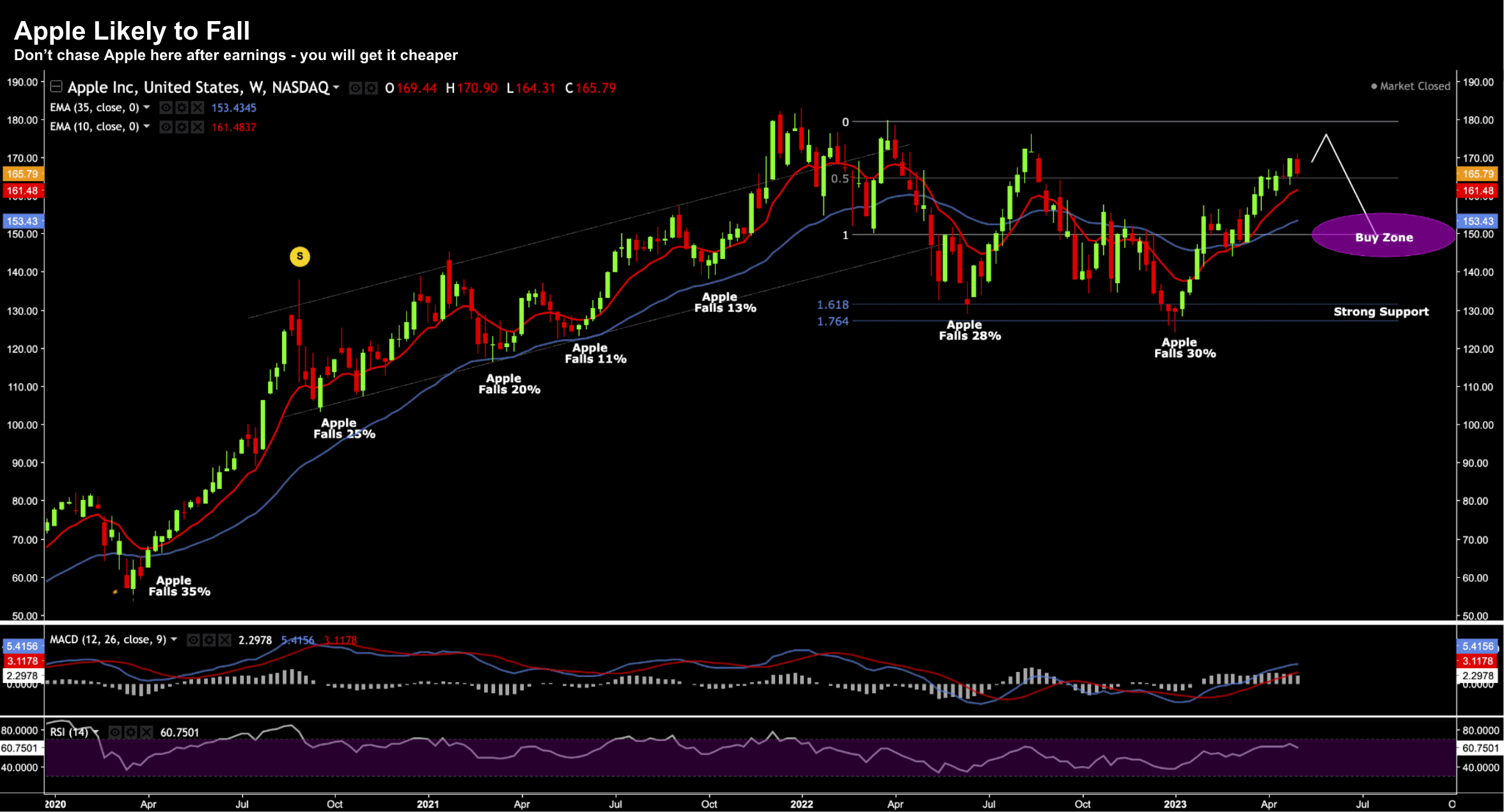

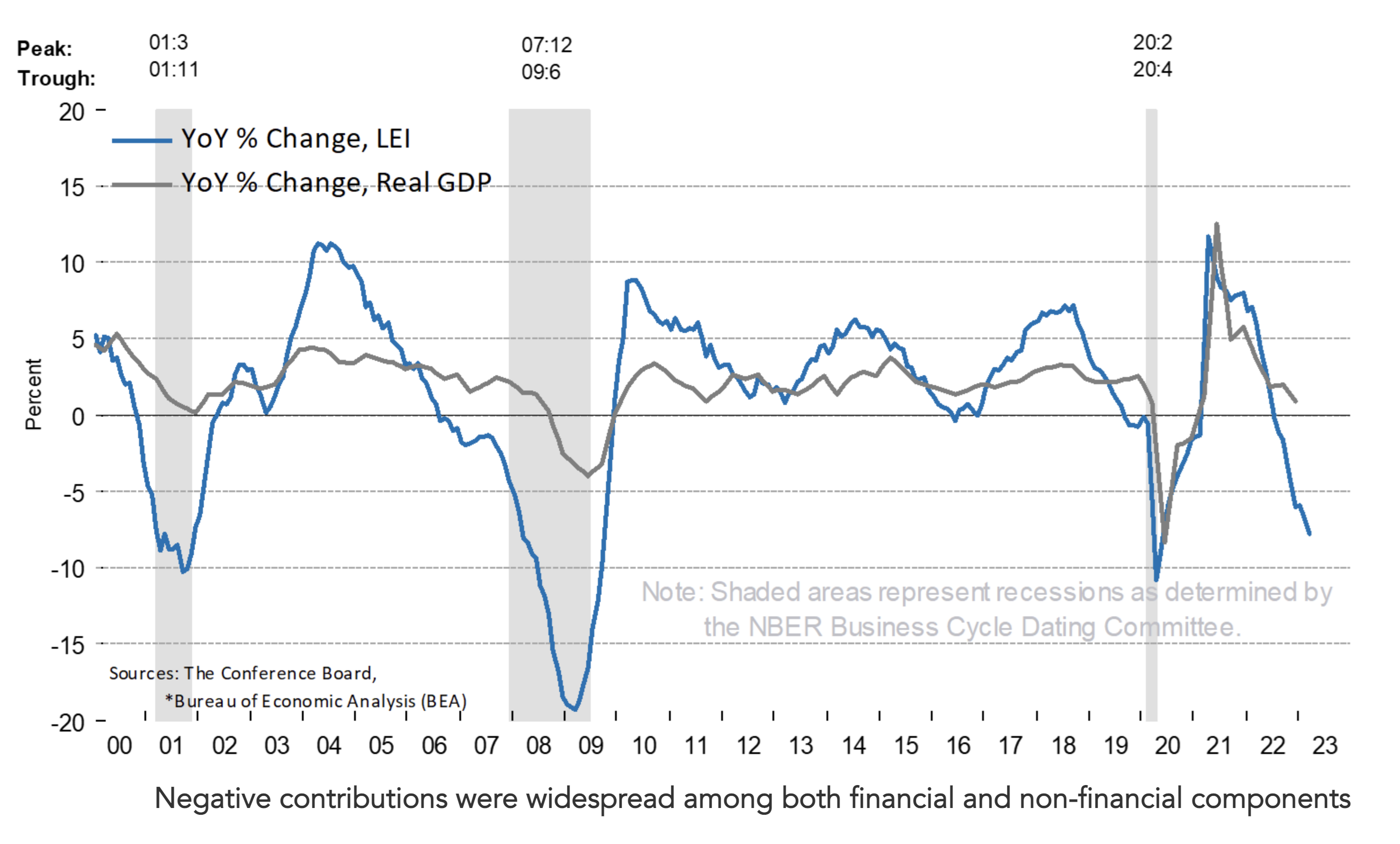

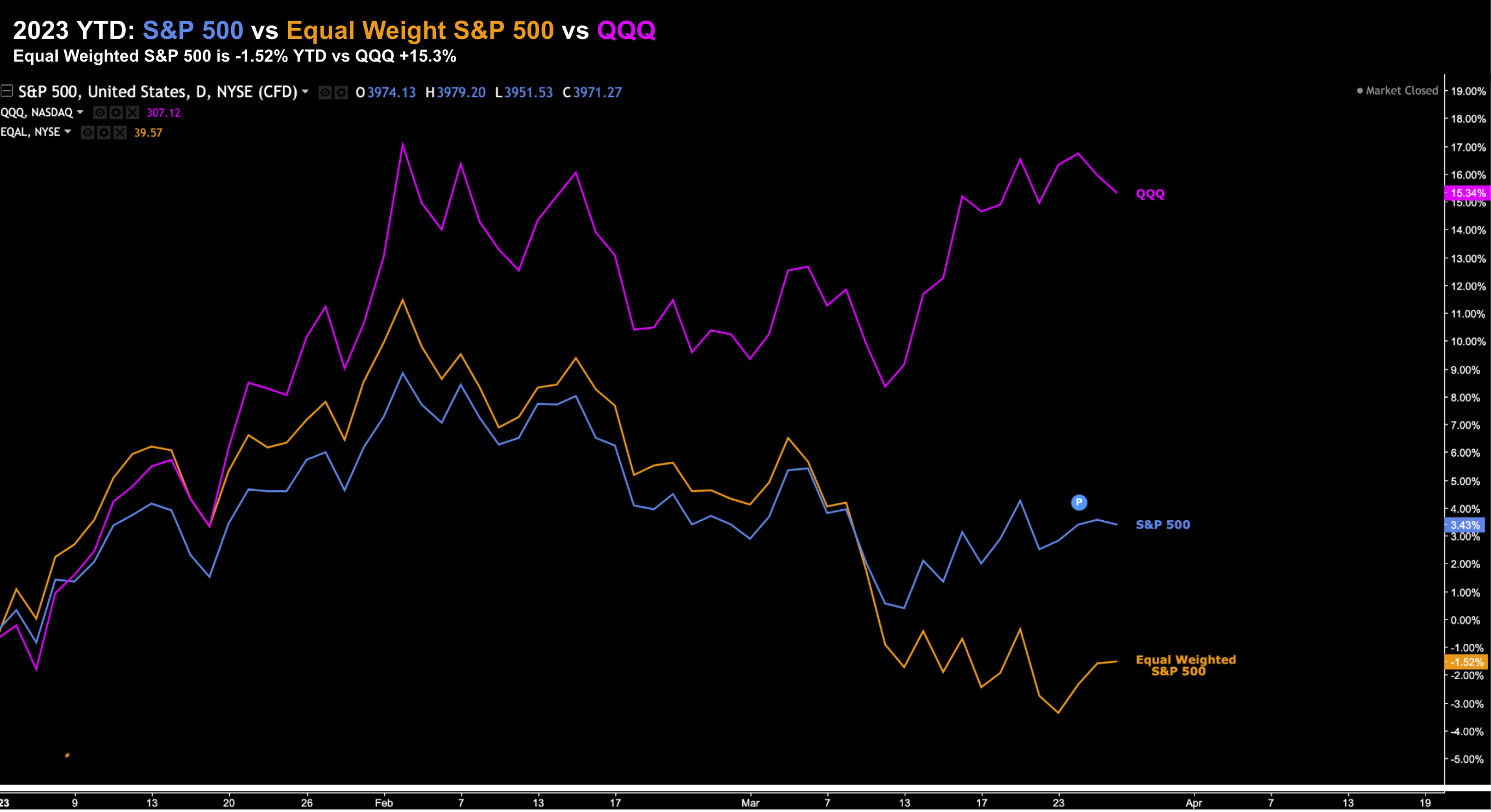

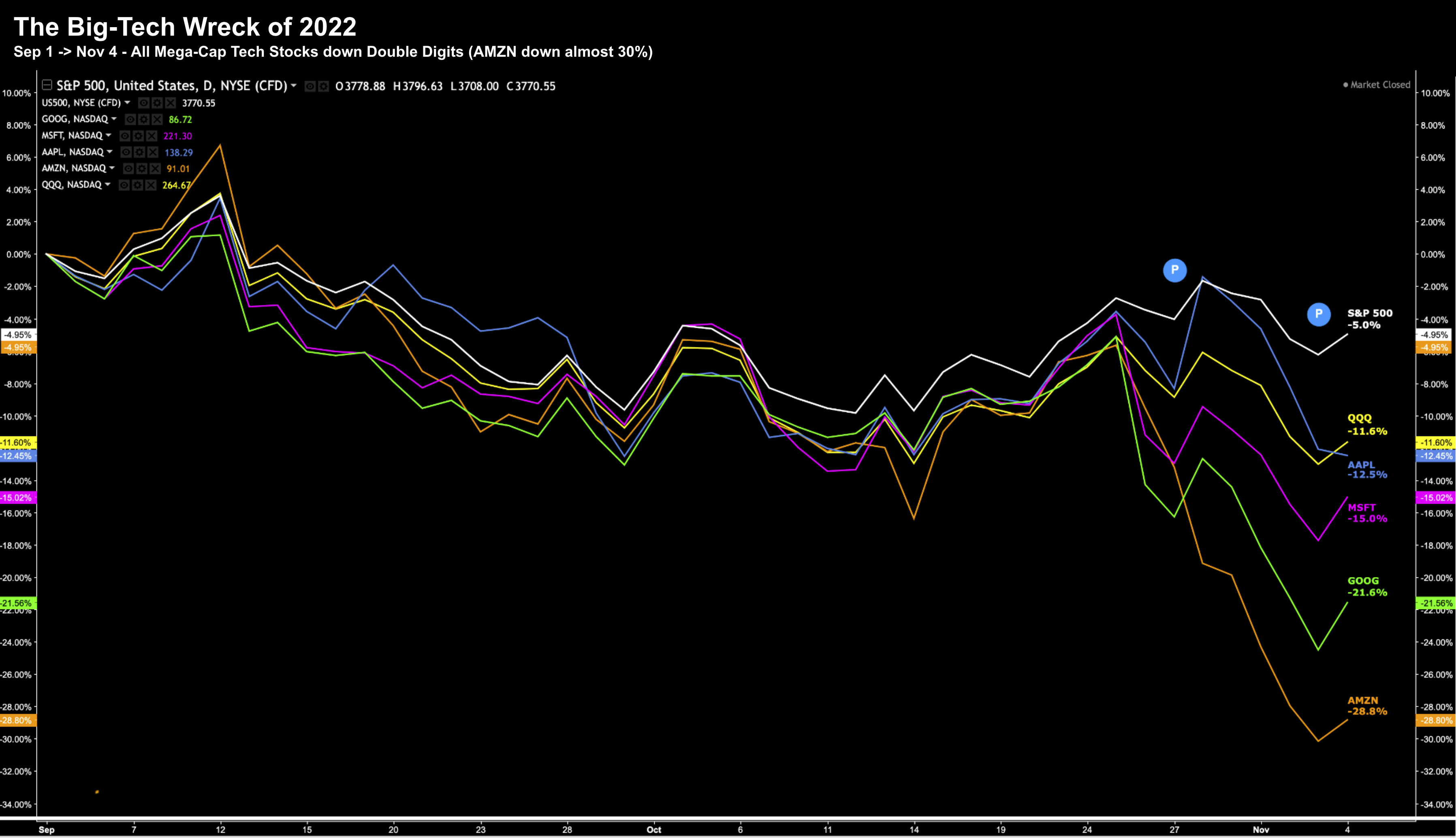

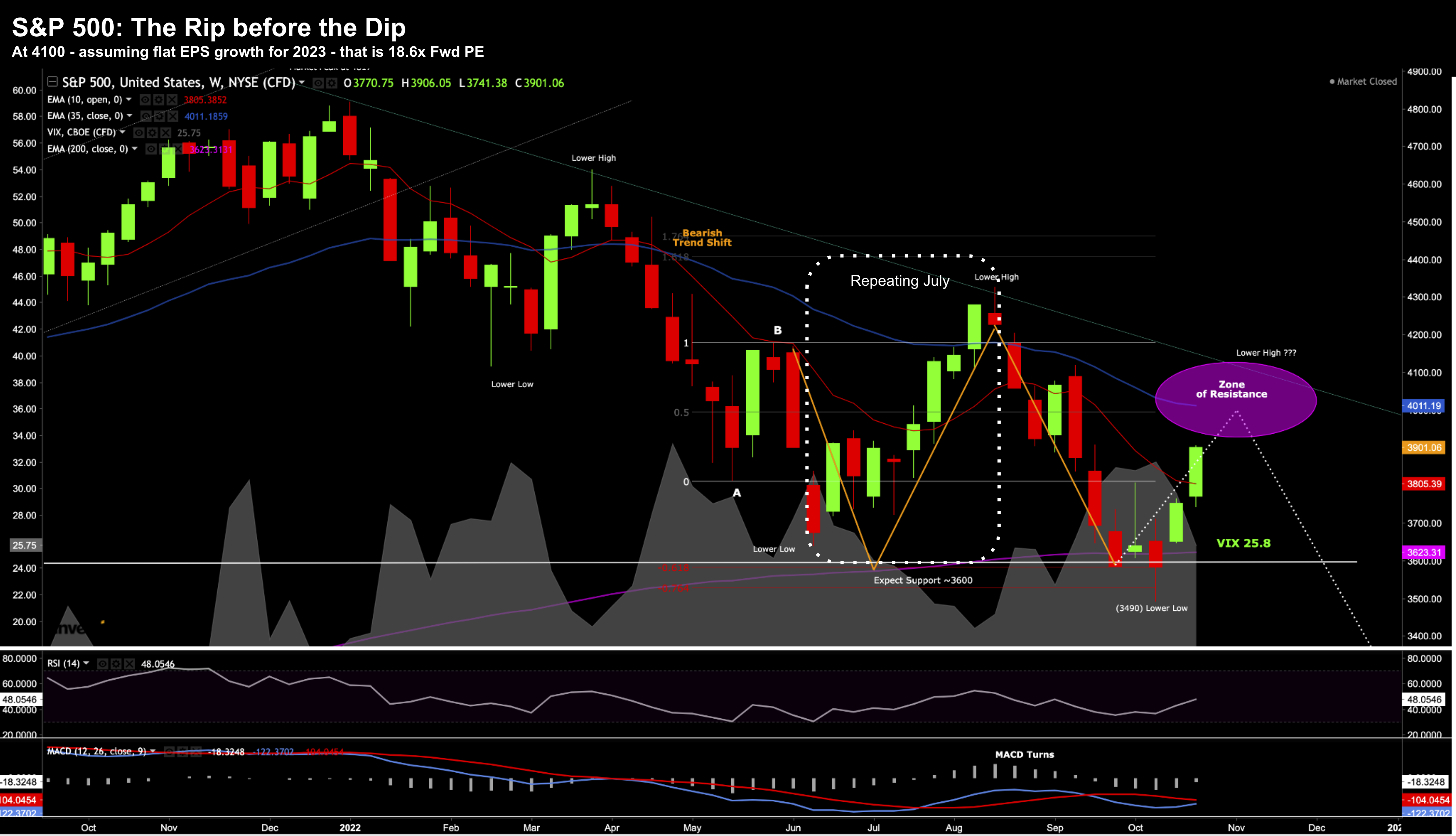

It's risk on. That's the market's sentiment. Question is whether that risk is worth it? There are only a handful of stocks carrying the market higher - a sure sign of both fragility and bearishness. Are there are only "10" stocks that can grow? We have not seen a market this narrow since the dot.com bust. Now should names like Amazon, Google, Apple, Microsoft, Meta and Tesla pull back from nose-bleed valuations - the whole house comes down with it.