3-Years Since ChatGPT Launched… What’s Changed?

3-Years Since ChatGPT Launched… What’s Changed?

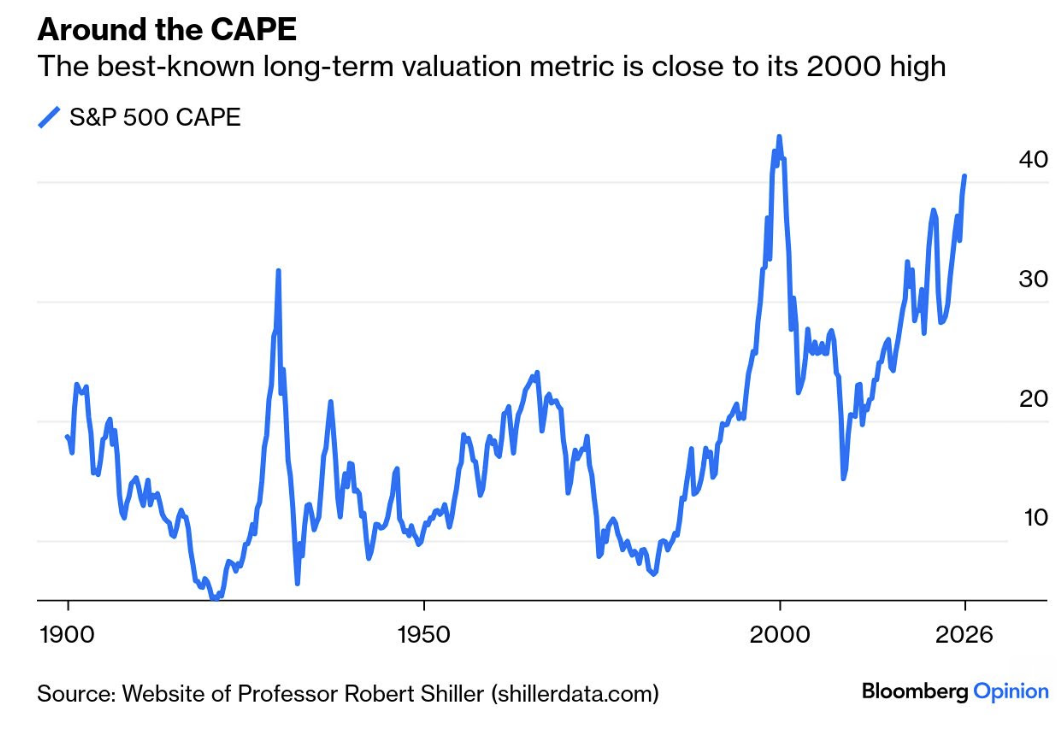

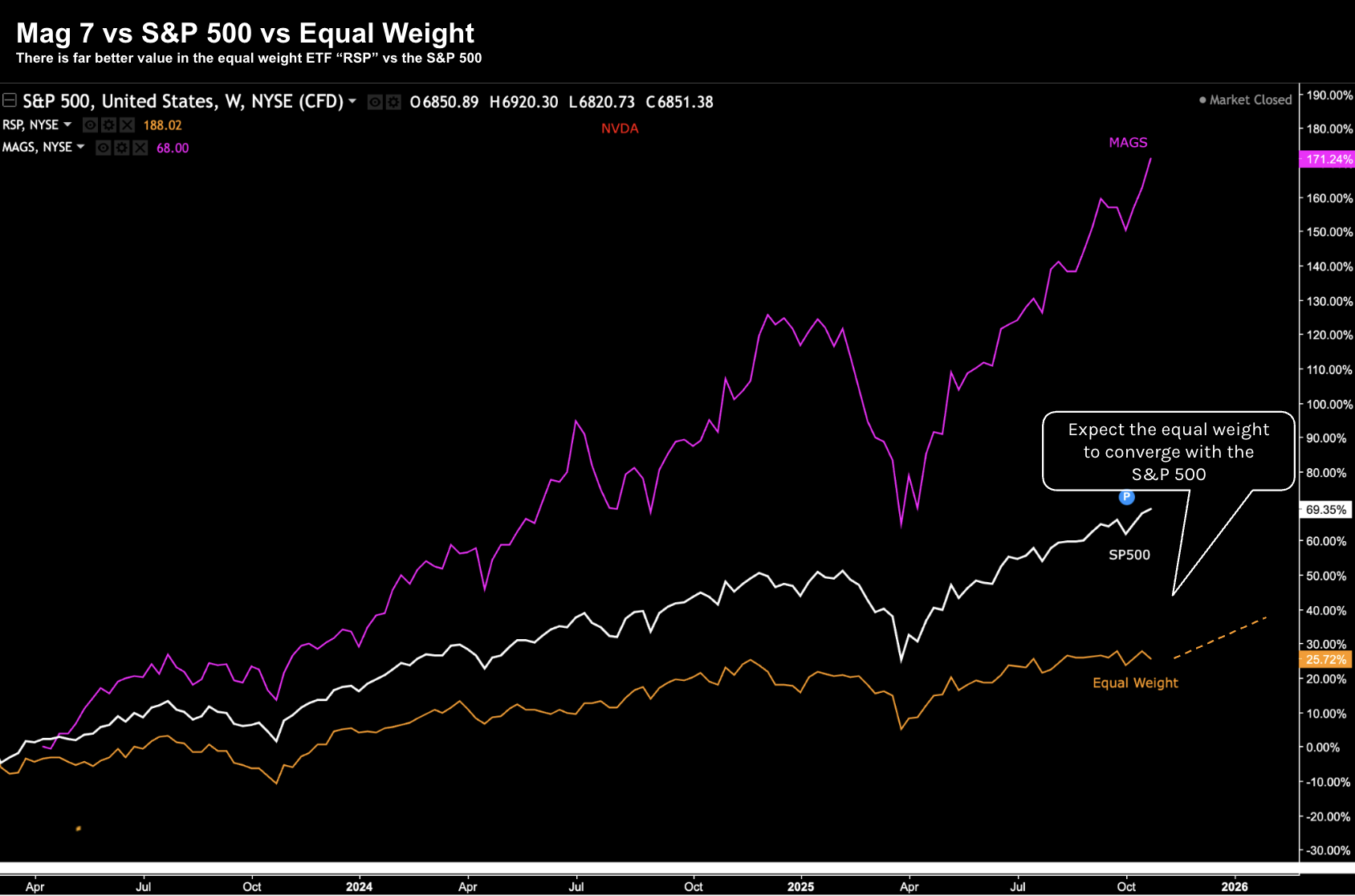

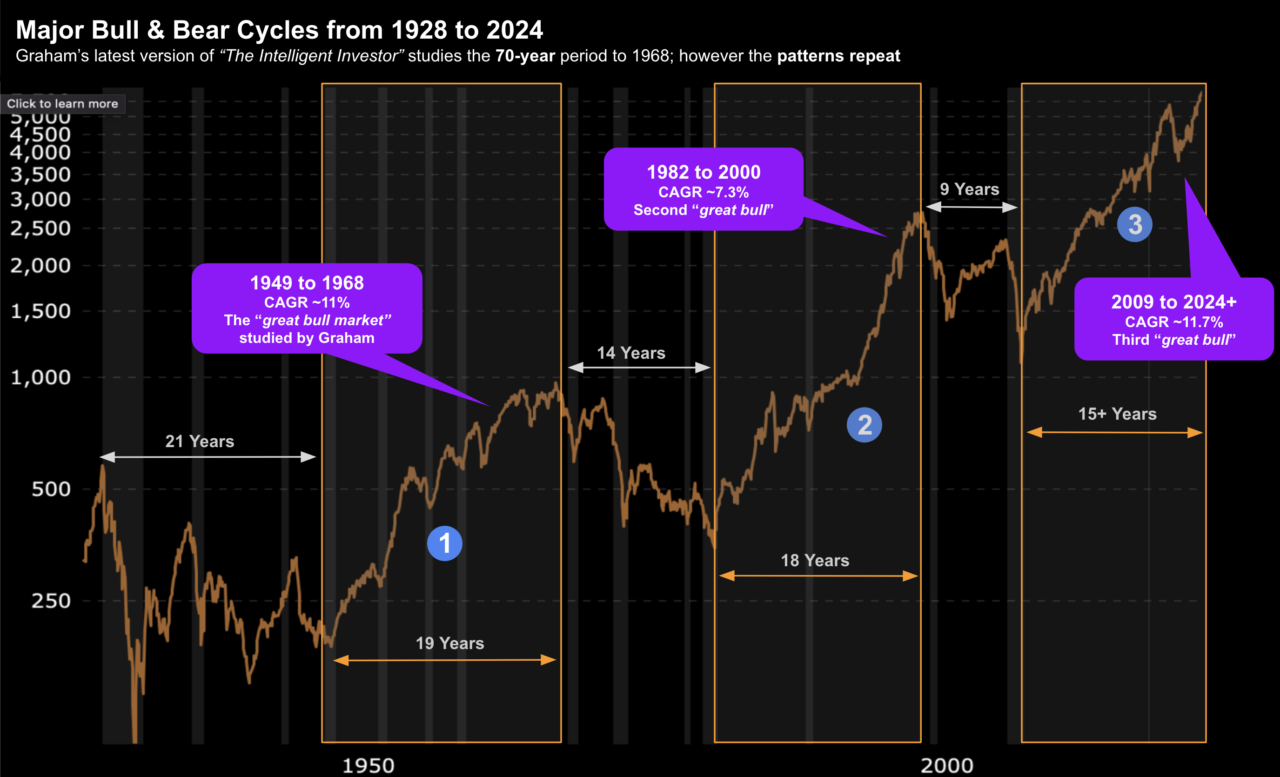

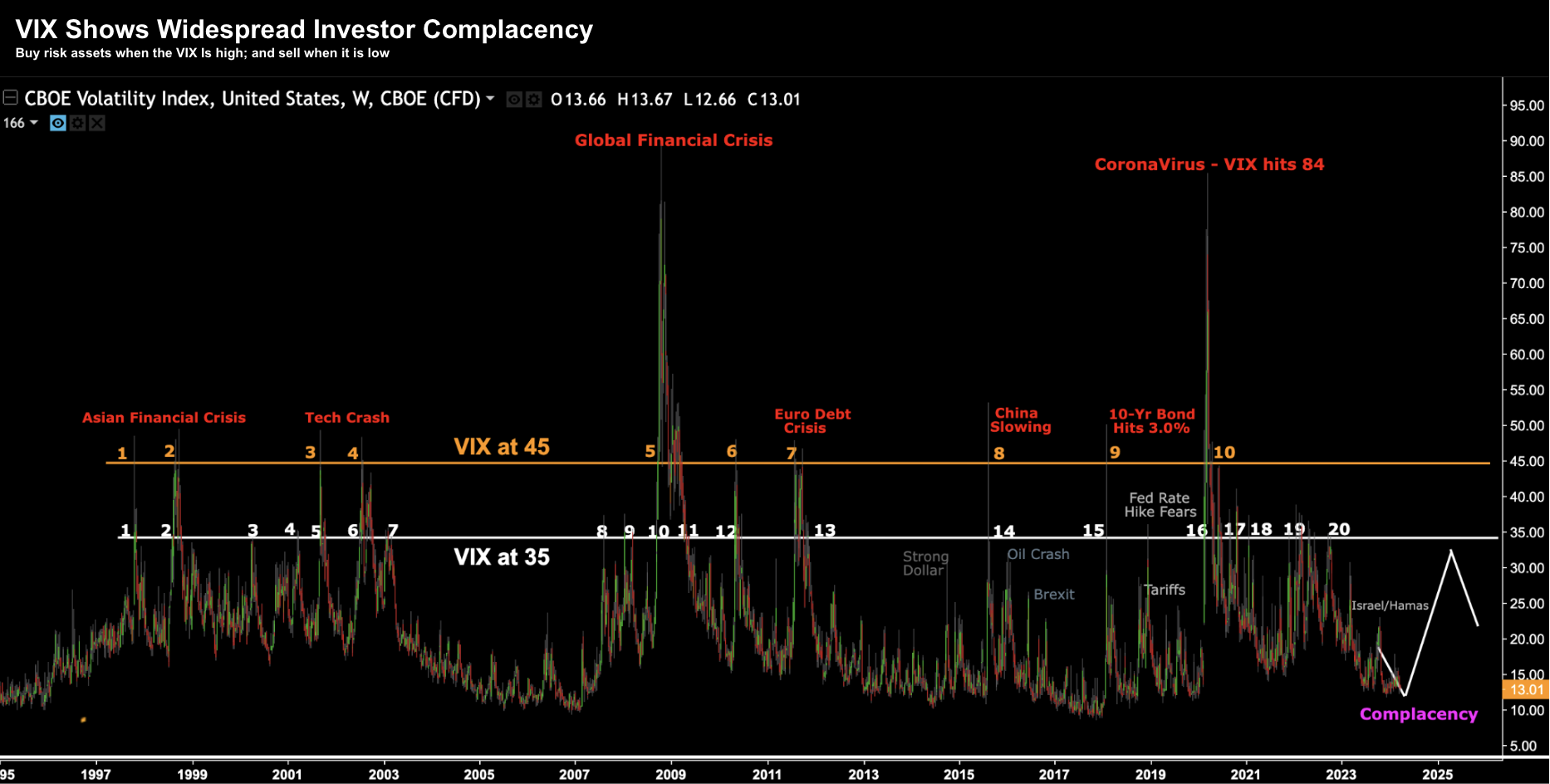

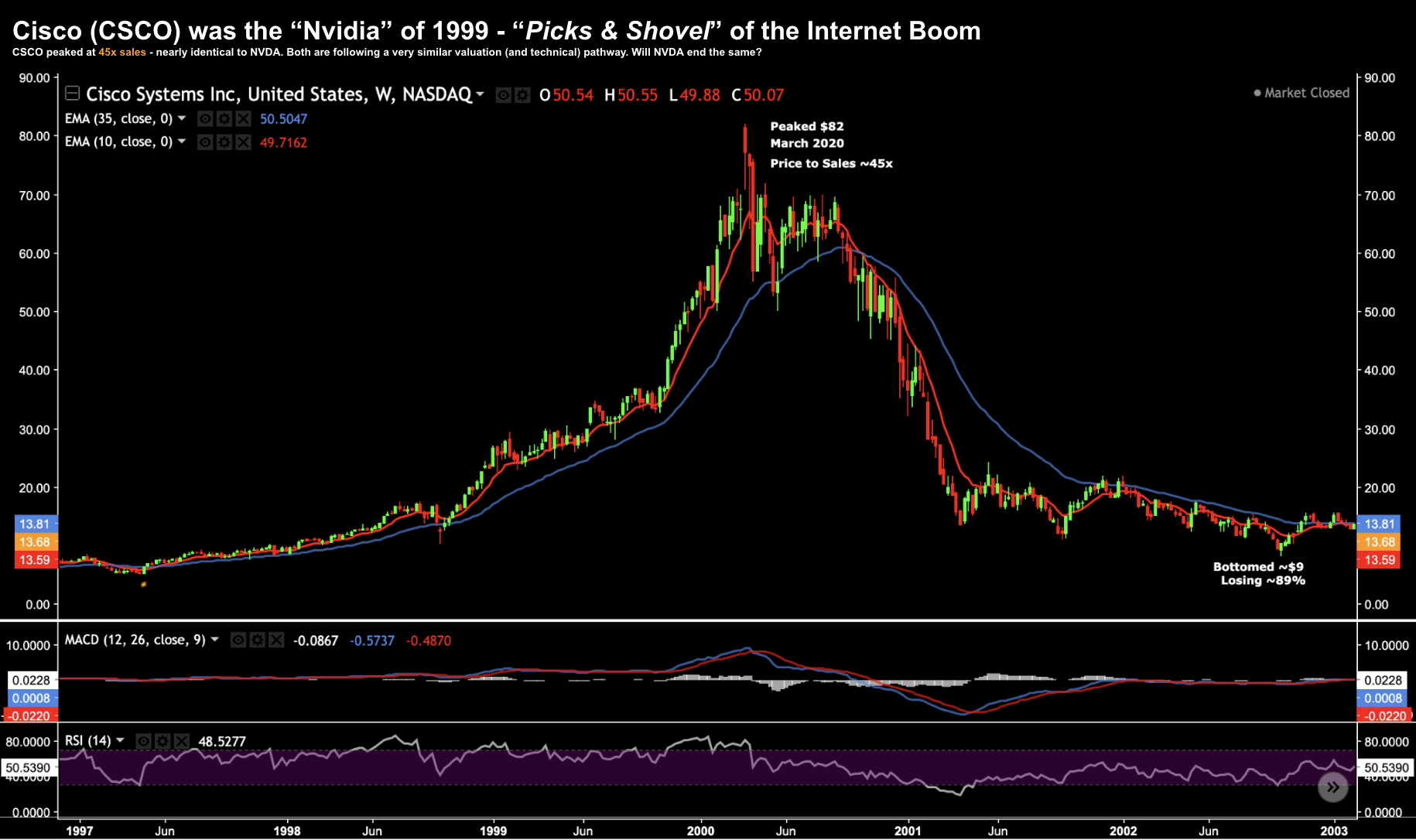

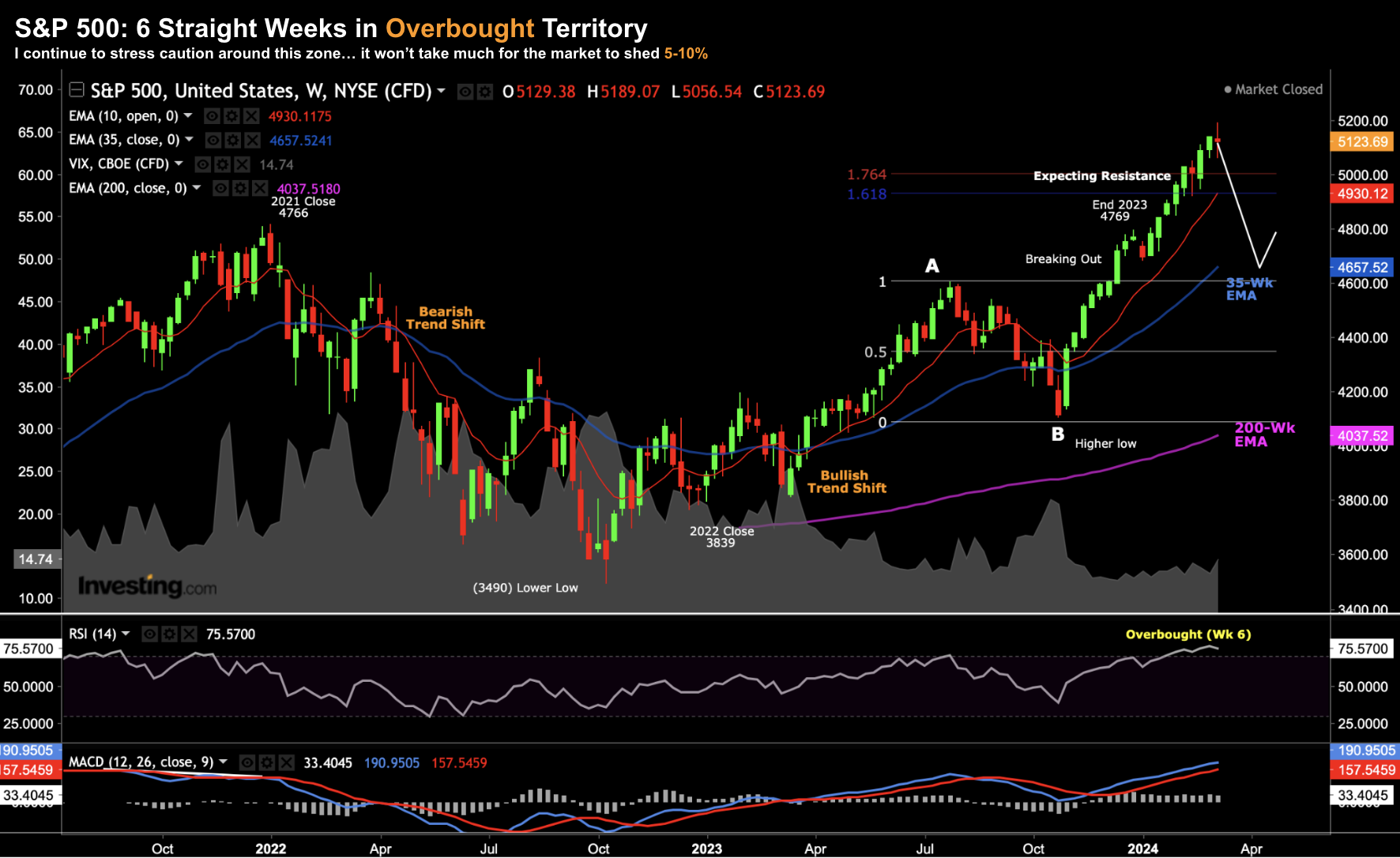

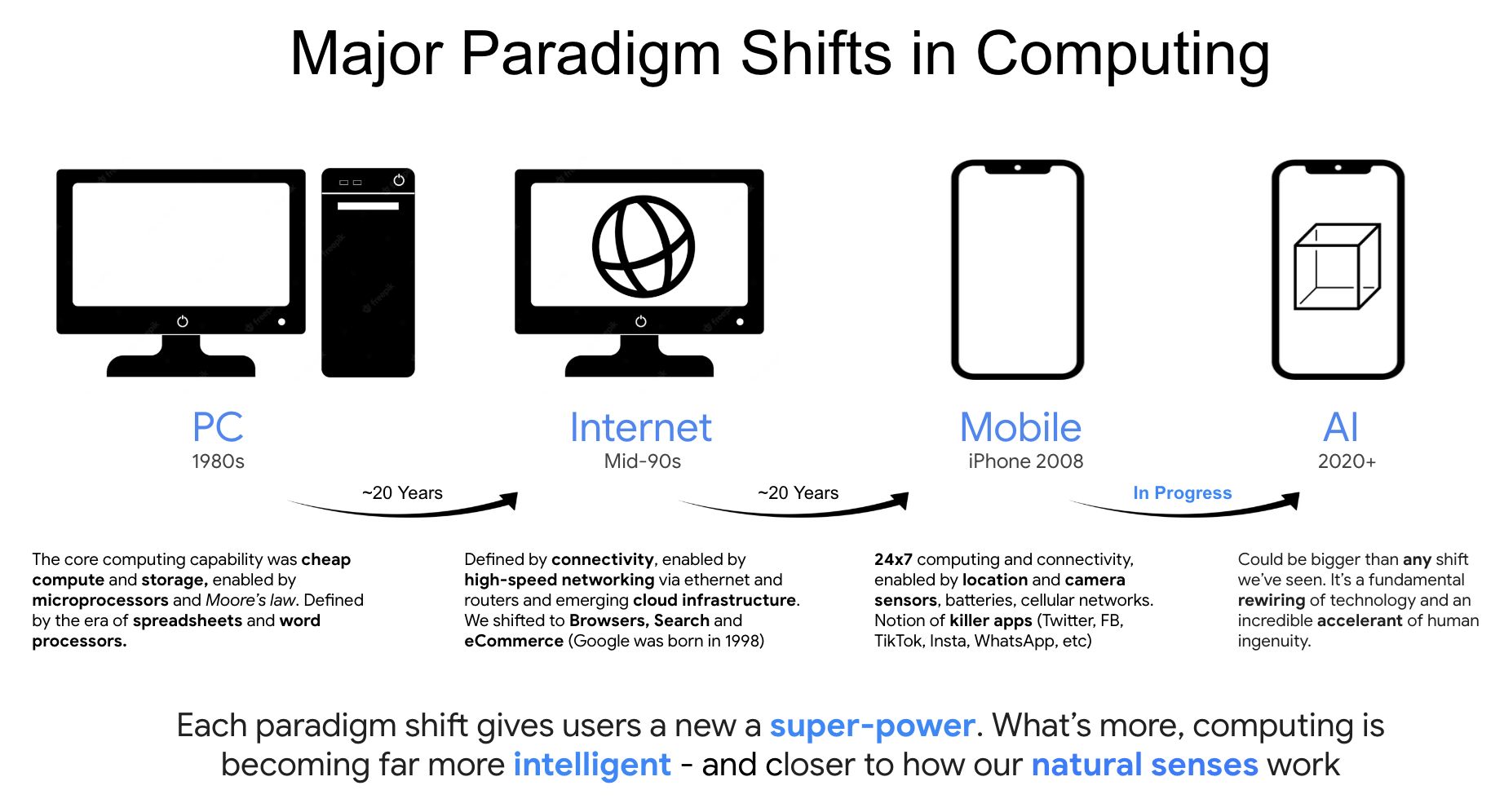

The seismic shift triggered by ChatGPT 3 years ago reminds me of 1995 when Netscape hit our screen. But as we approach the year 2000 - several "greey swans" emerged. Could 2026 be similar. This post discusses some of the possible risks looming for next year. This AI revolution has many of the hallmarks we saw some 30 years ago; i.e., creating extreme capital concentration in giants like Nvidia. As we enter what I think is a late-cycle phase, our focus shifts to systemic risks—from AI disillusionment to credit volatility.