US Dollar Rally Ahead?

US Dollar Rally Ahead?

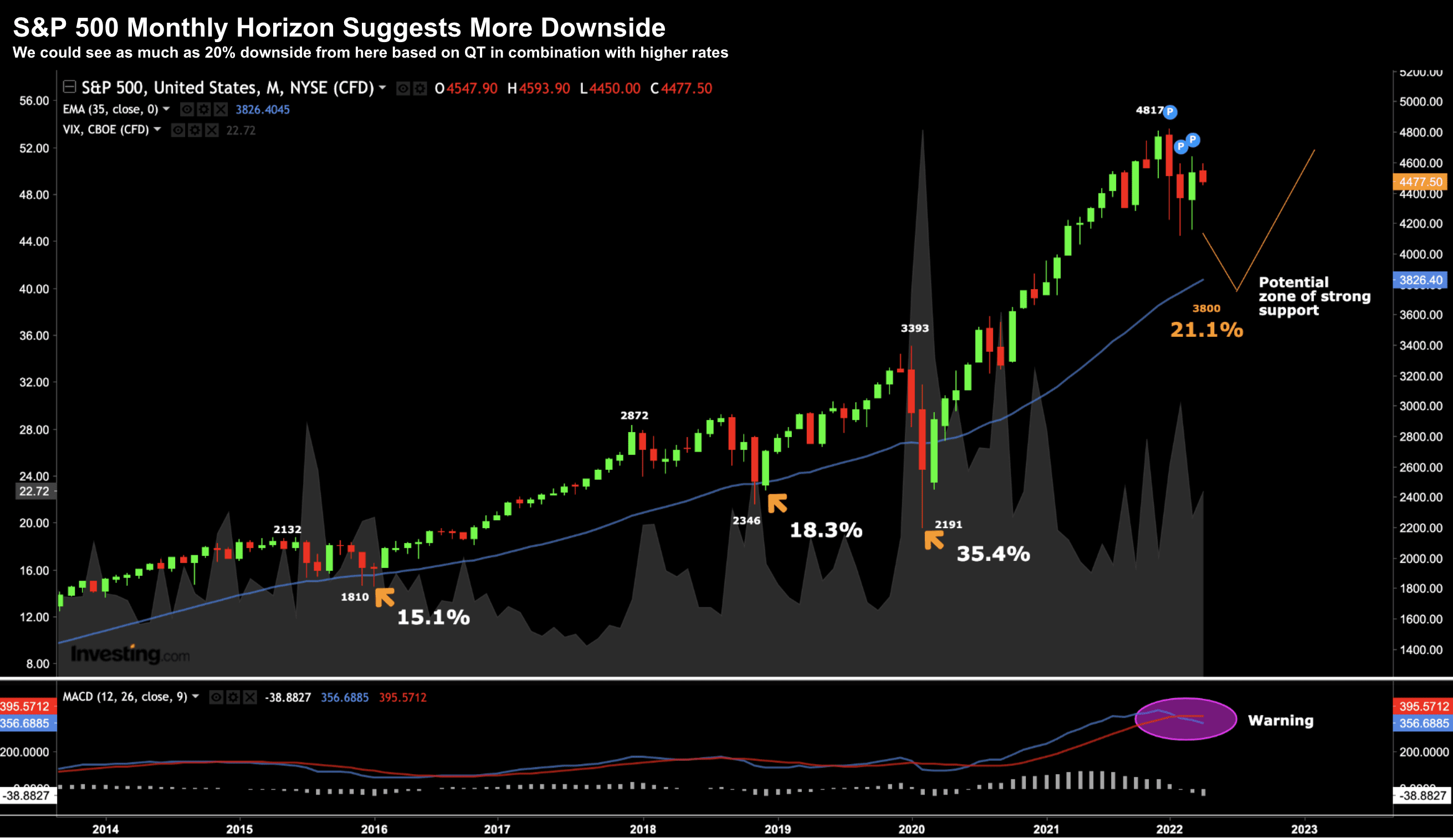

Are we about to see a US Dollar Index (DXY) rally sometime over the next few months? If I were to guess - yes. And if that's correct - it's not a tailwind for markets (or earnings). Before I look at the weekly chart - not all participants agree. Bank of America Securities views any strength in the US dollar index (which trades against a basket of six currencies) as short-lived and prefers to fade any greenback rallies. And that is probably accurate in the very short term.