Three Cheers for 5,000!

Three Cheers for 5,000!

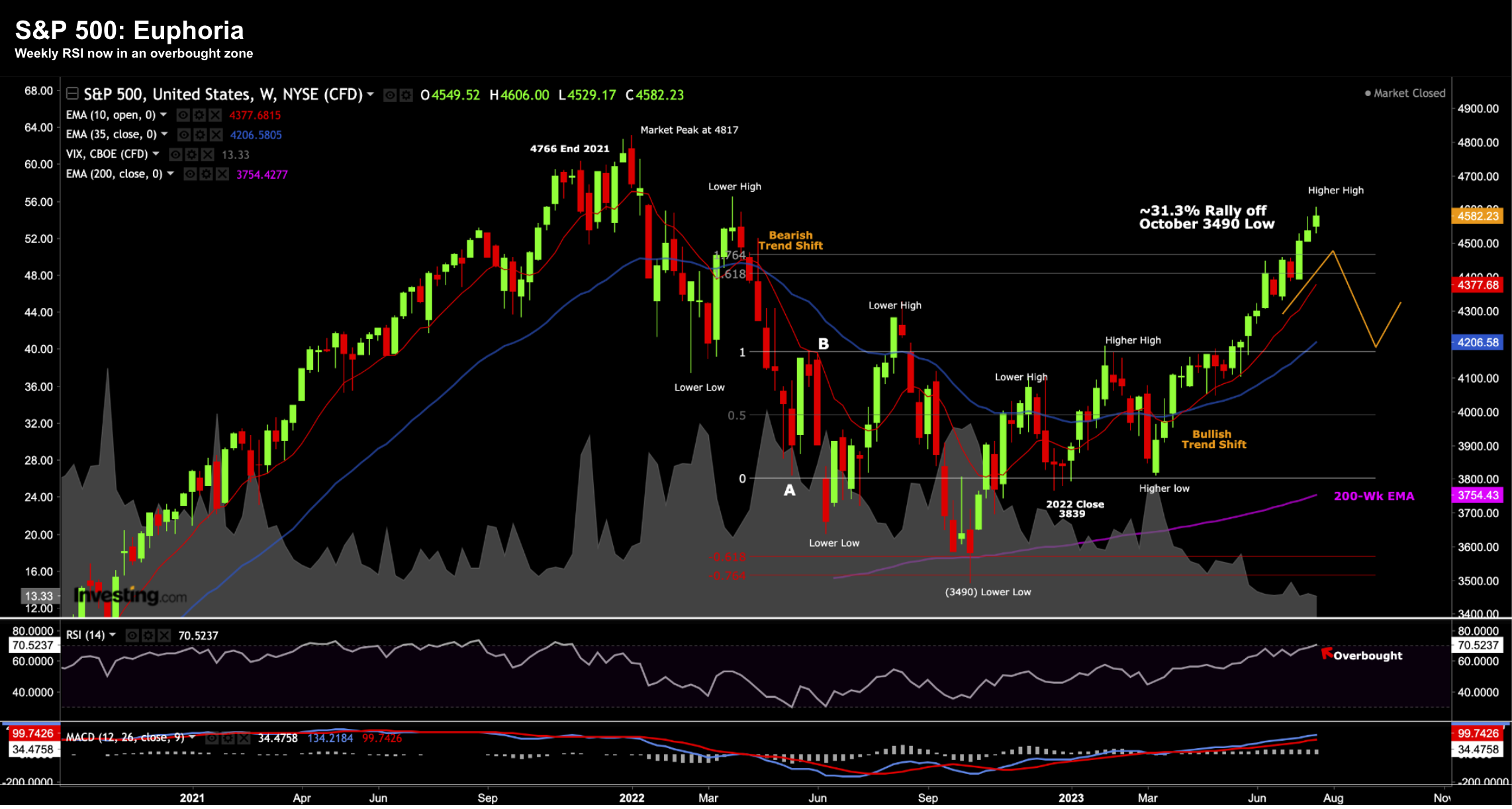

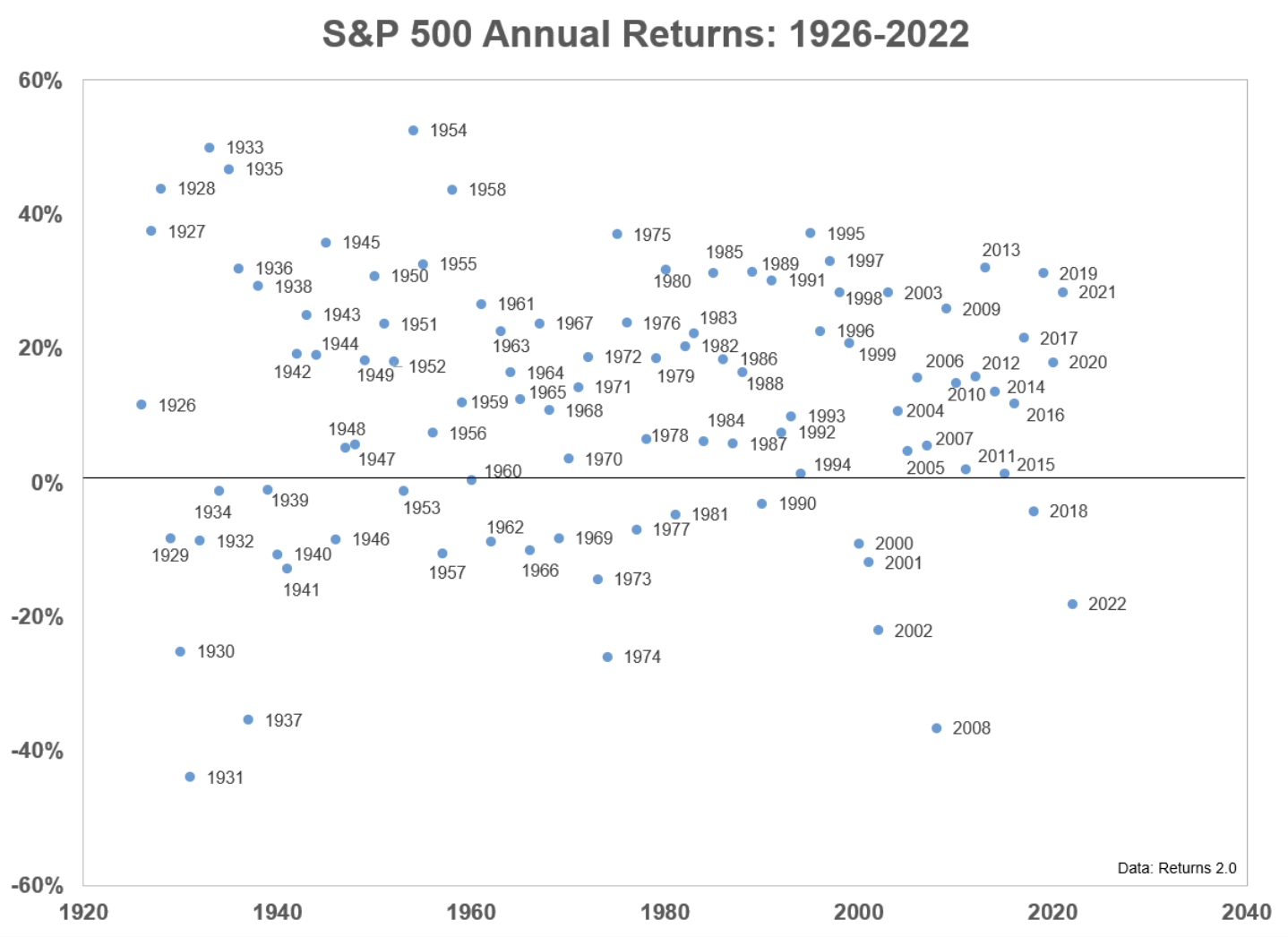

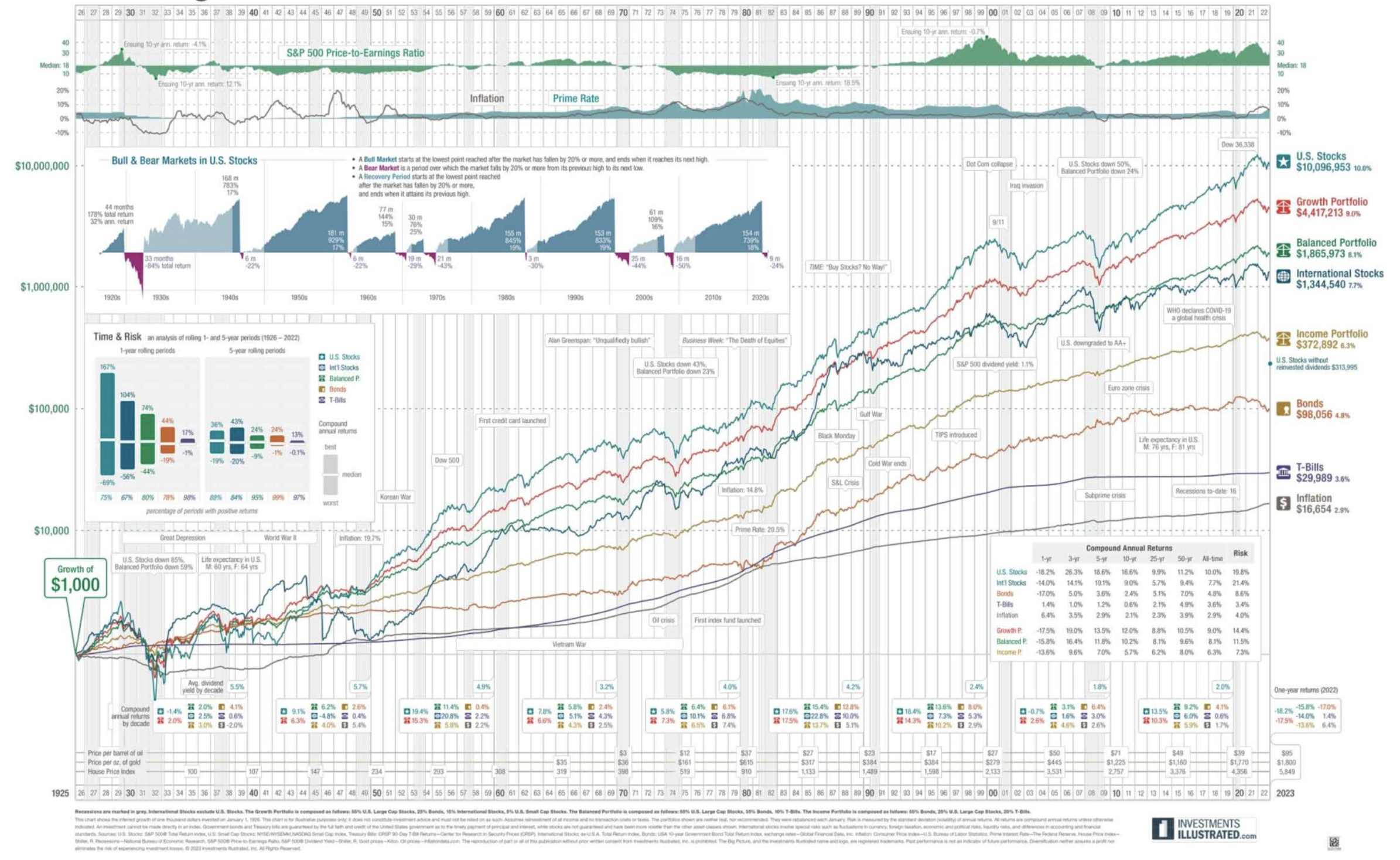

This week the S&P 500 closed above 5,000 for the first time. Another milestone as we climb the 'wall of worry'. Over the past 100+ years the S&P 500 has averaged capital gains of ~8.5% per year plus dividends of ~2.0%. That's a total return of close to 10.5% (on average). If you compound 10.5% per year over 20 years (i.e., 'CAGR') - that's a 637% increase. But as we know, the pathway is rarely smooth. Some years the market may "add 20%" and others it could give back a similar margin (or worse). And we saw this happen recently. However over the long run - markets will rise more often than they fall.