Market Refuses to Believe the Fed

Market Refuses to Believe the Fed

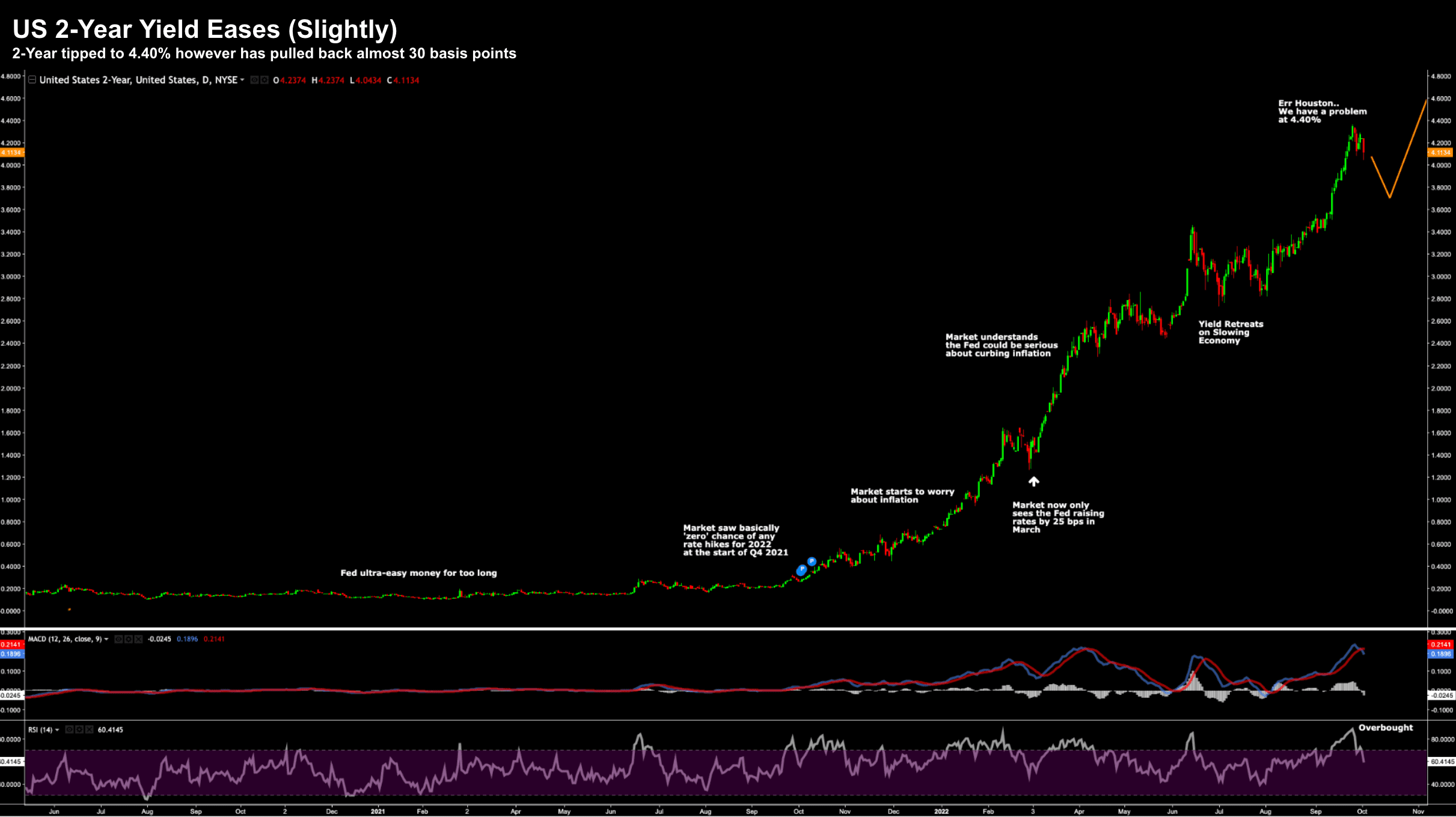

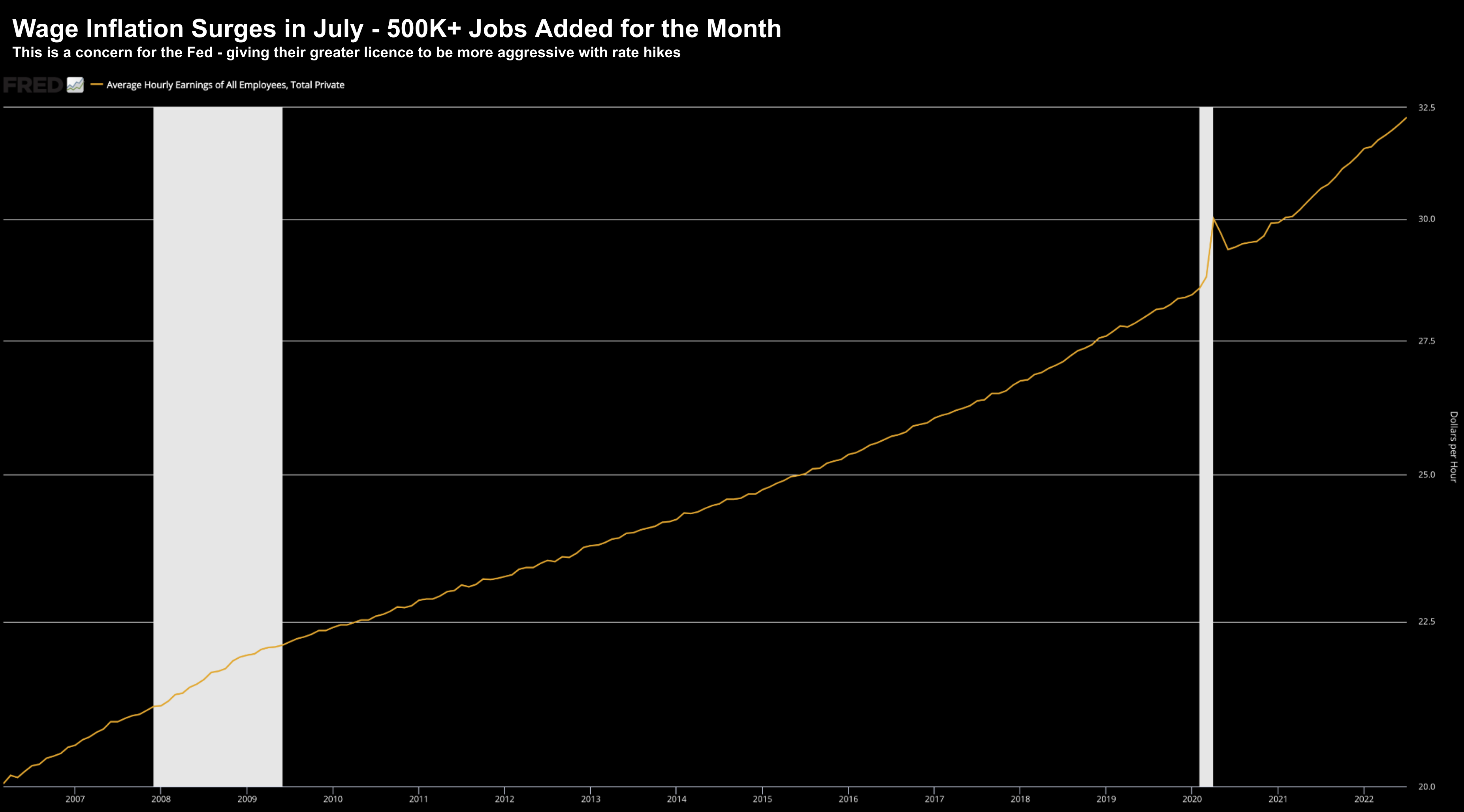

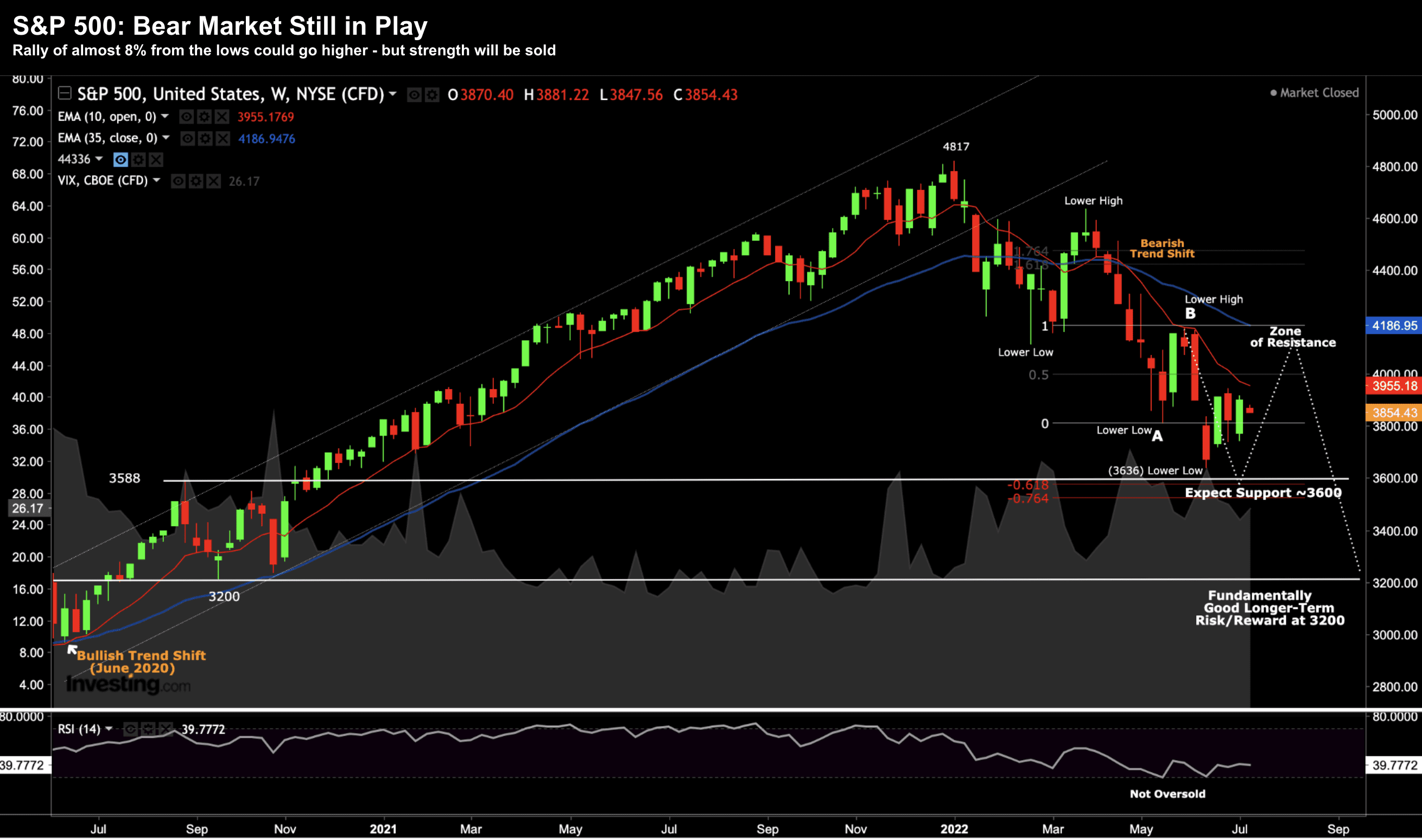

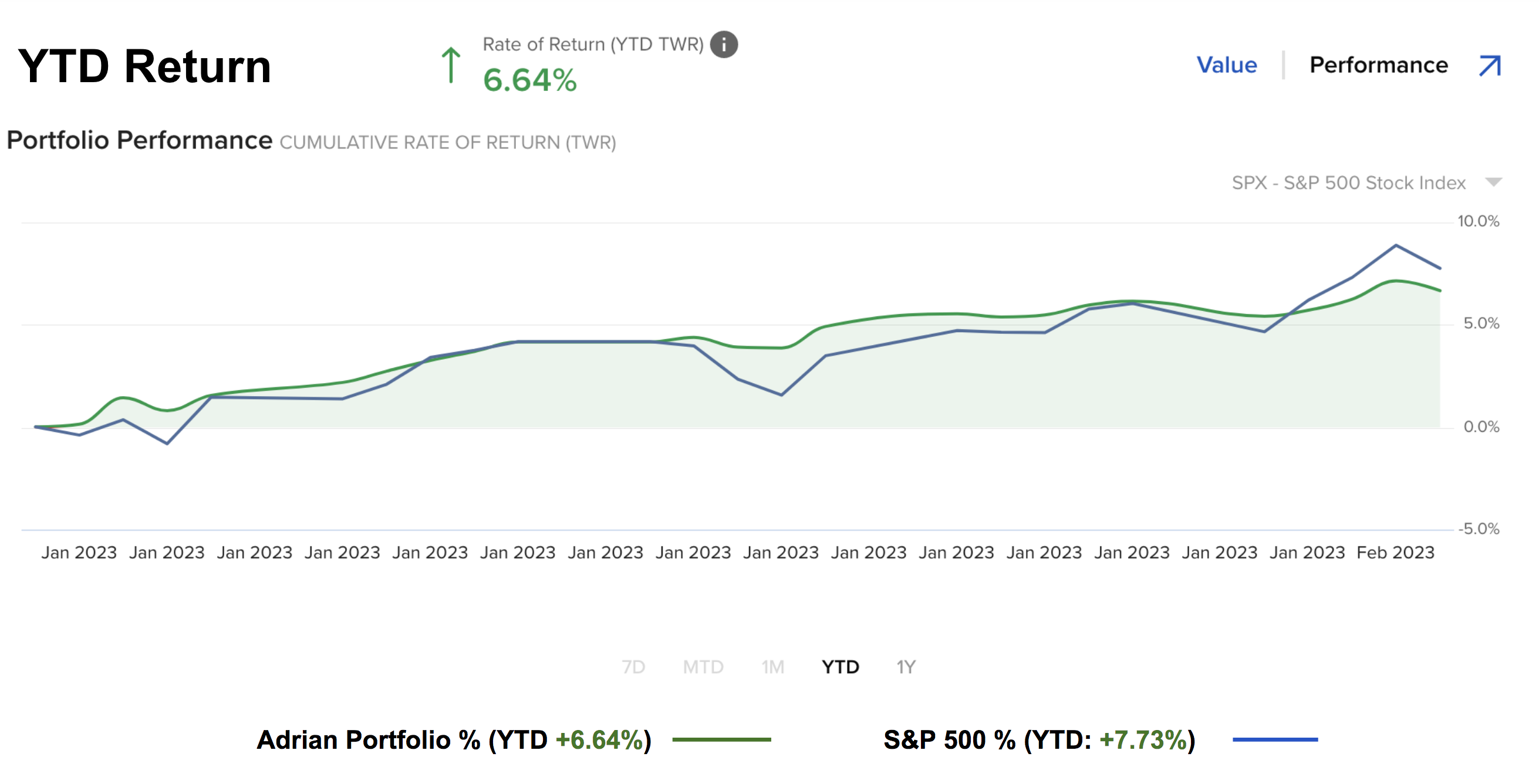

The S&P 500 is optimistic on three things (a) avoiding a recession; (b) rapidly falling inflation; and (c) two rate cuts before the end of the year. And the market could be right. However, I think it's optimistic. What's more, they are choosing to fight the Fed.