When Will Bad News be Bad News?

When Will Bad News be Bad News?

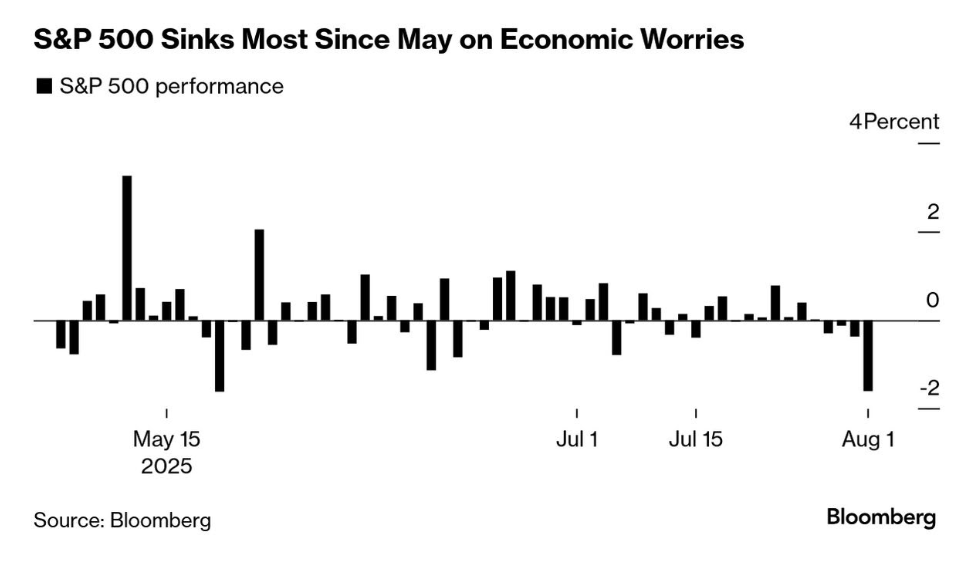

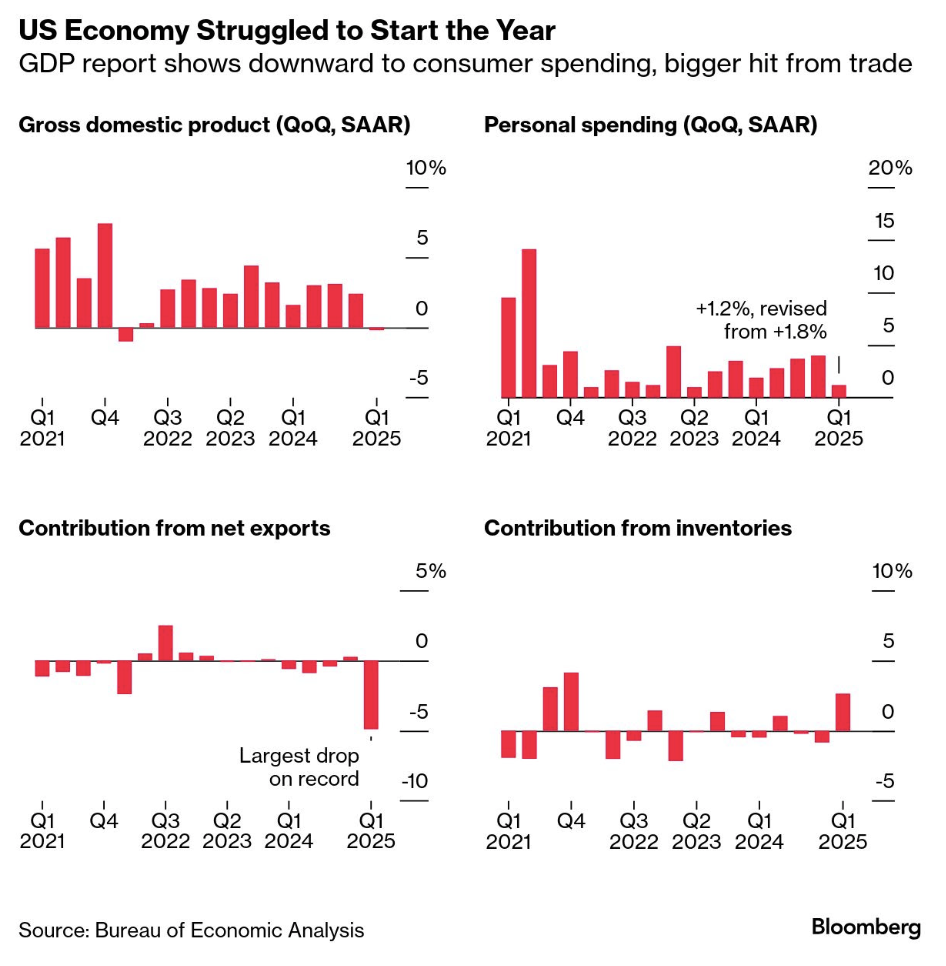

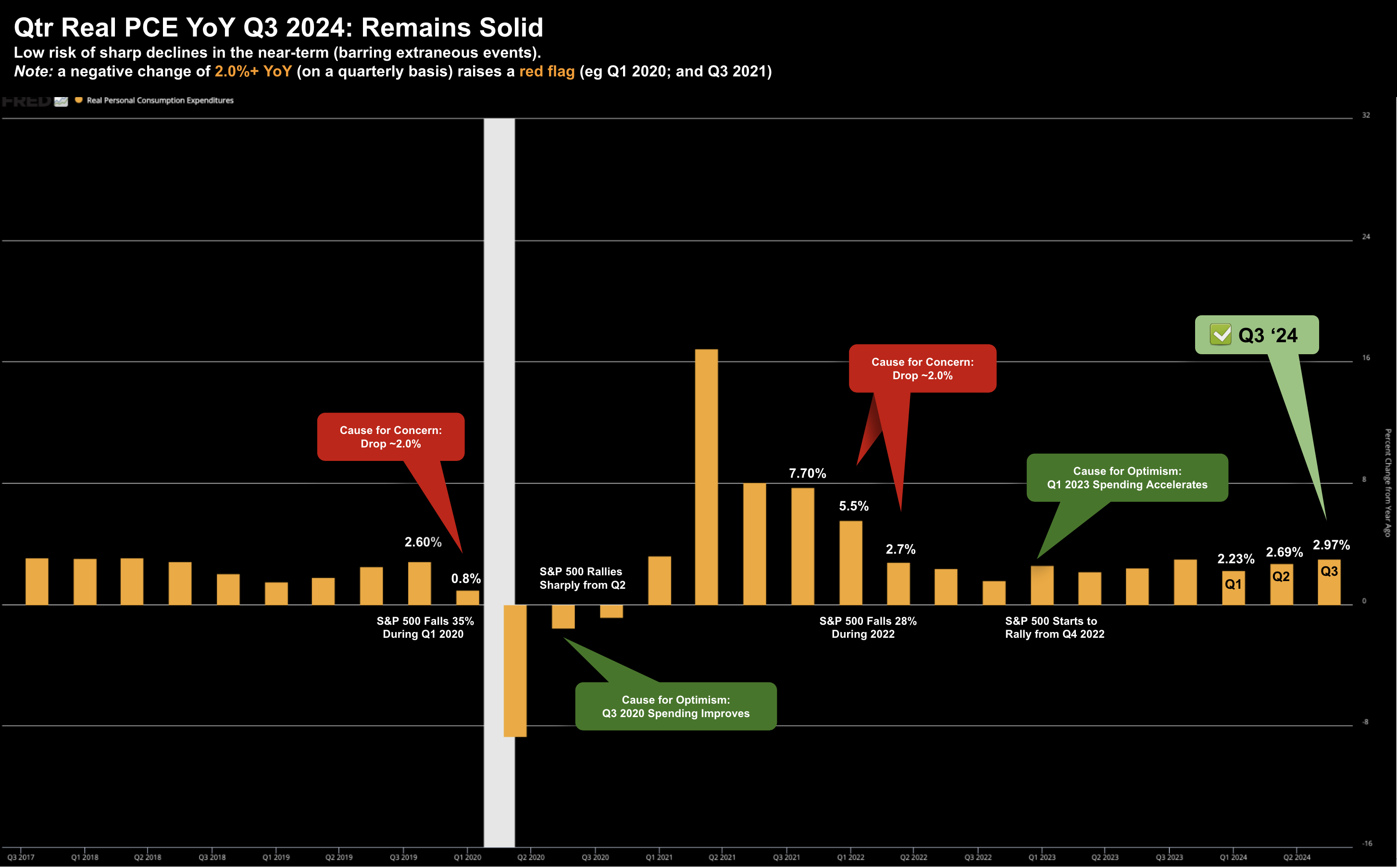

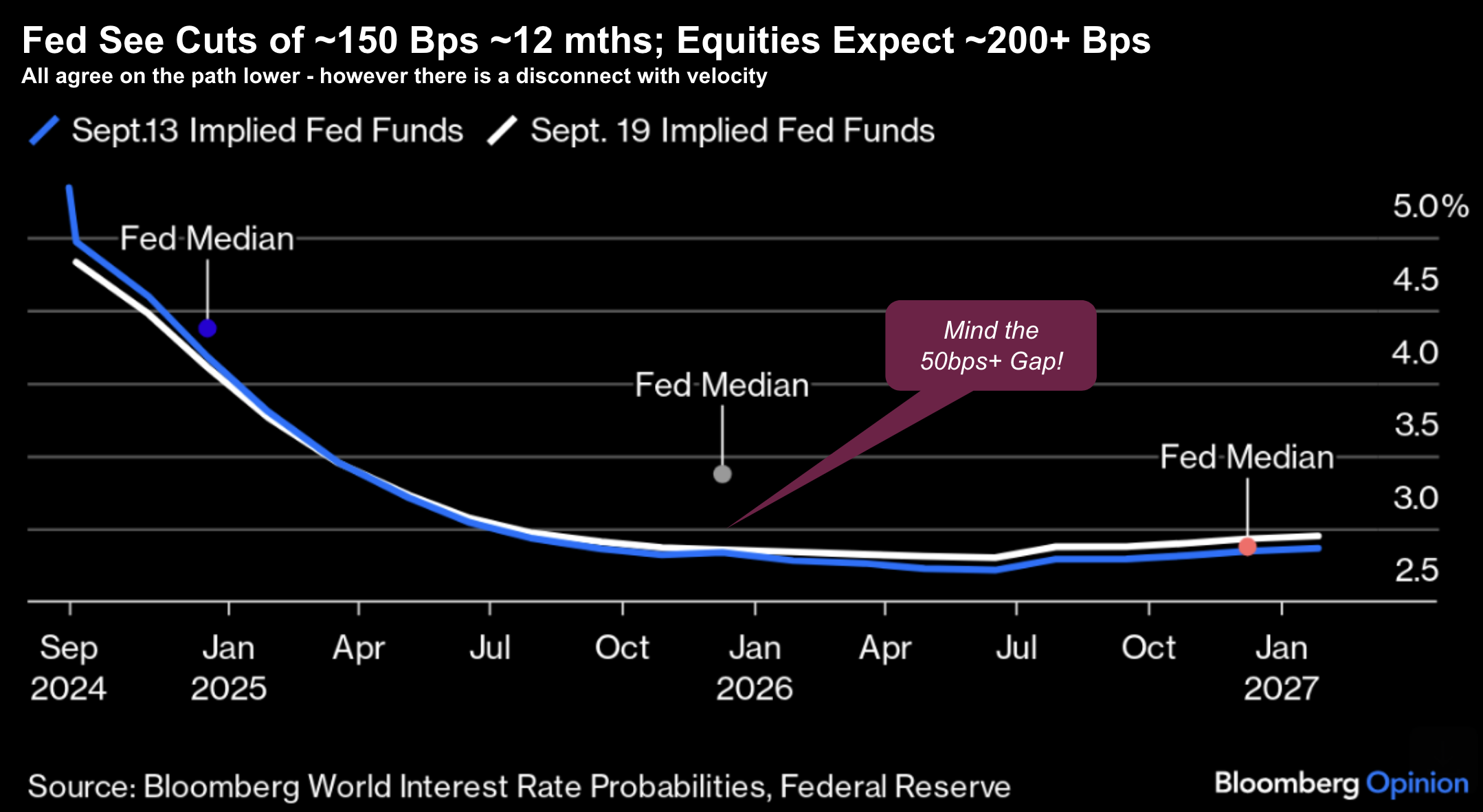

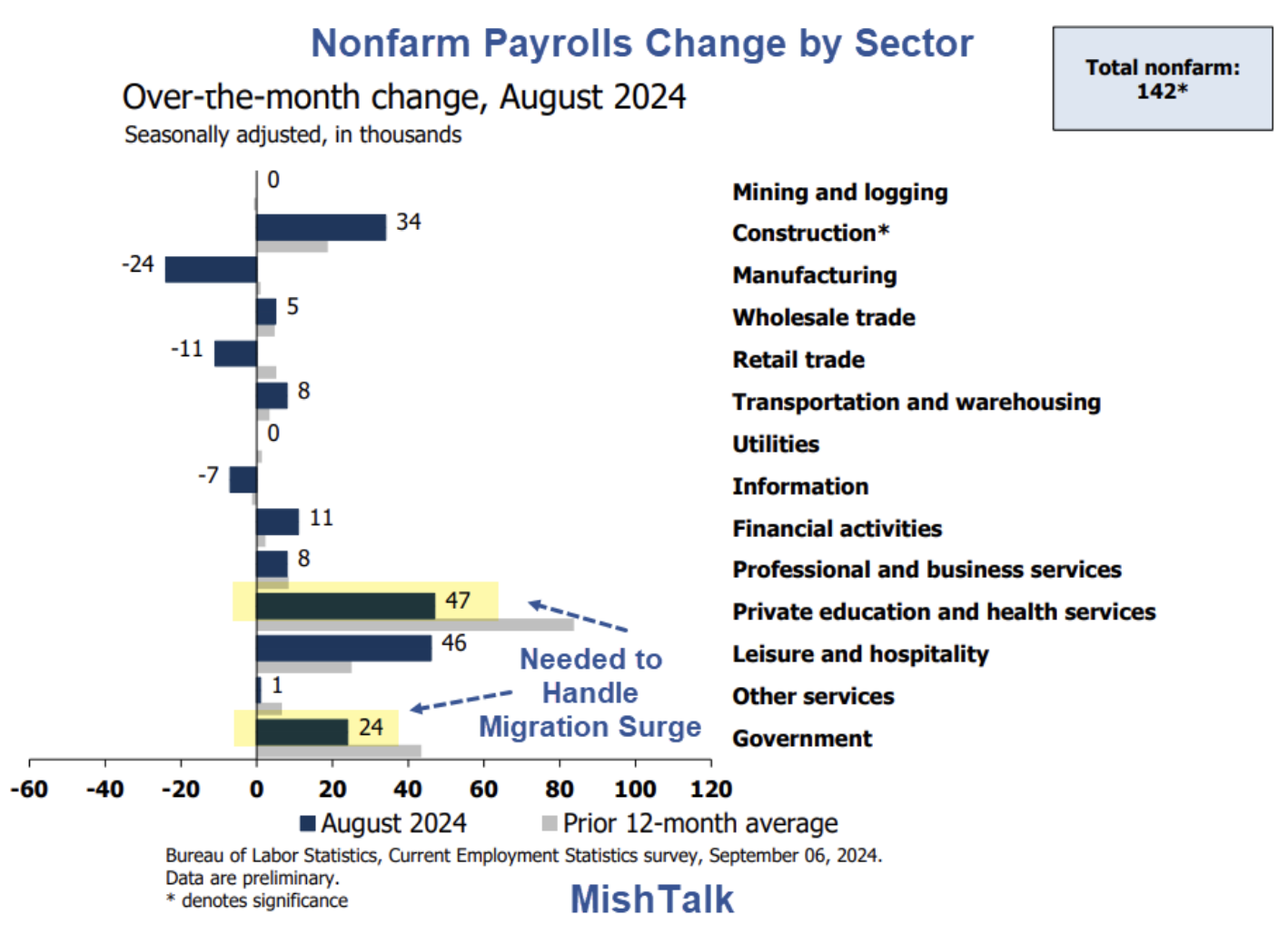

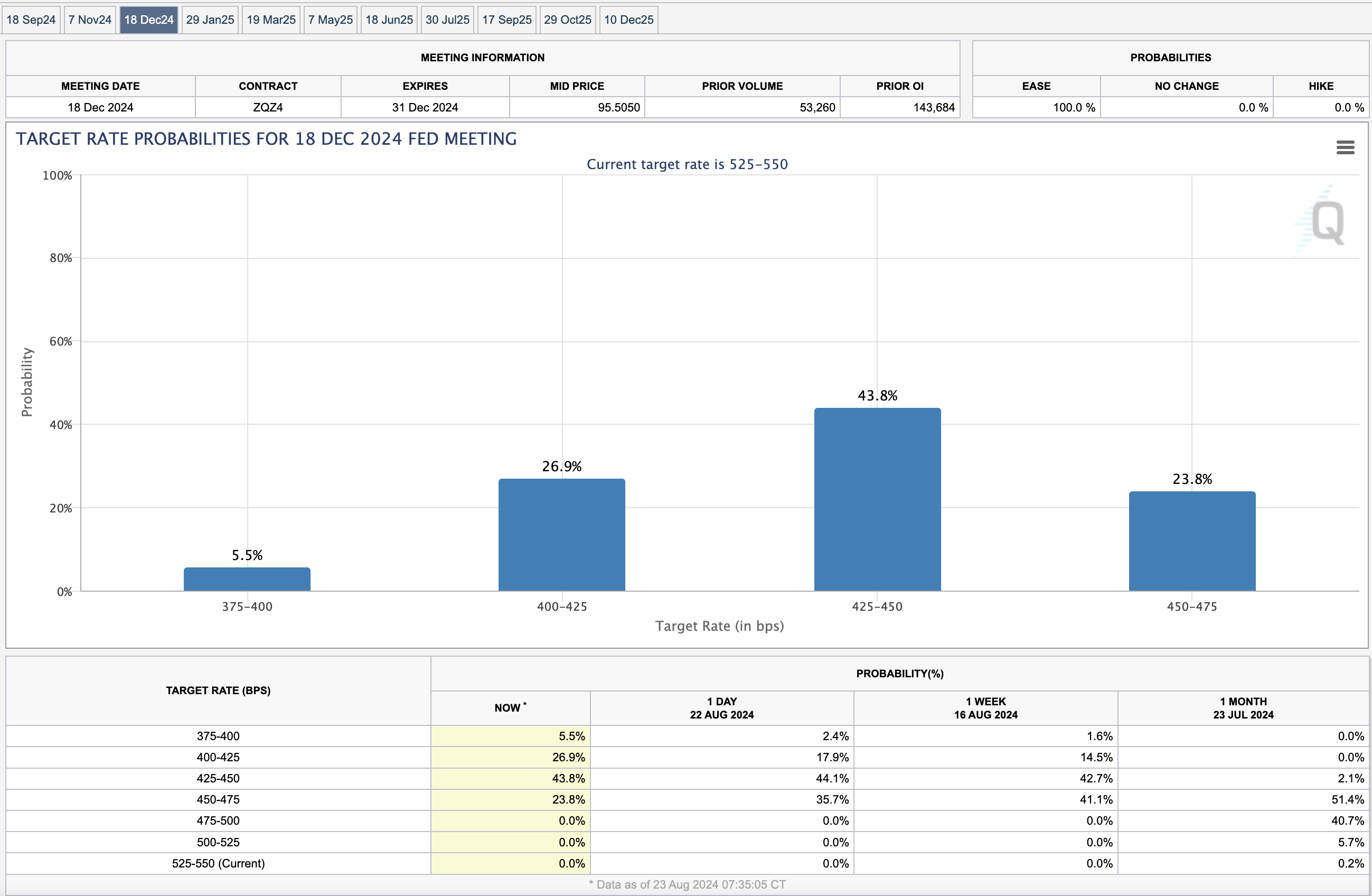

History shows that central bank easing cycles generally benefit stock markets. However, we should ask why central banks are cutting. If the Fede cuts rates to combat a slowing economy, the news may not be as positive as it seems. A weakening economy means lower corporate earnings and reduced consumer spending, which are ultimately negative for stock prices. Several bleak monthly jobs reports is evidence that the economy is struggling. But is just a soft patch or something worse? I suggest exercising caution - rate cuts are not always a positive.