In Warsh We Trust

In Warsh We Trust

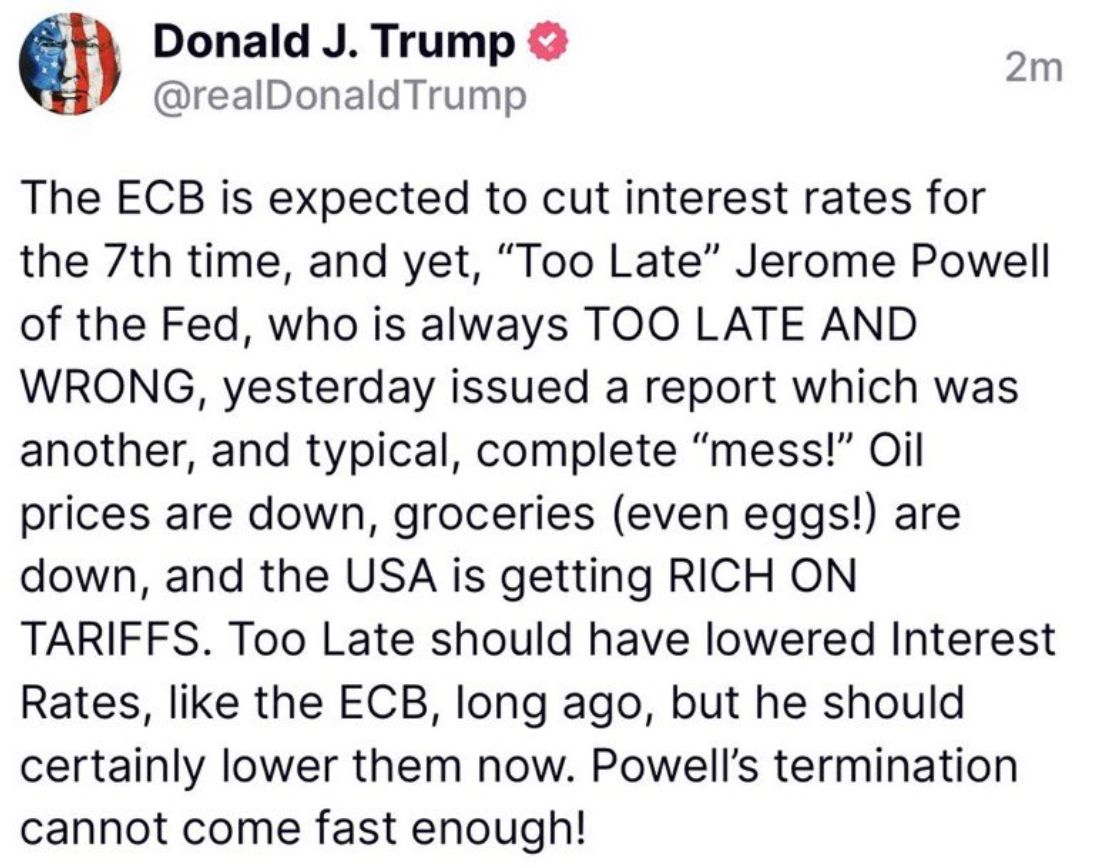

Trust is the invisible architecture of the global financial system. When central bank independence is questioned or fiscal discipline slips, markets don't just adjust—they convulse. While Kevin Warsh’s nomination as Fed Chair provides a stabilizing institutional anchor, it doesn't end the "debasement trade." With gold and silver undergoing a violent but necessary reset, investors must distinguish between technical profit-taking and the long-term diversification away from dollar-centric reserves. In modern macro, it’s always a matter of trust.