Jamie Dimon: “This is Serious”

Jamie Dimon: “This is Serious”

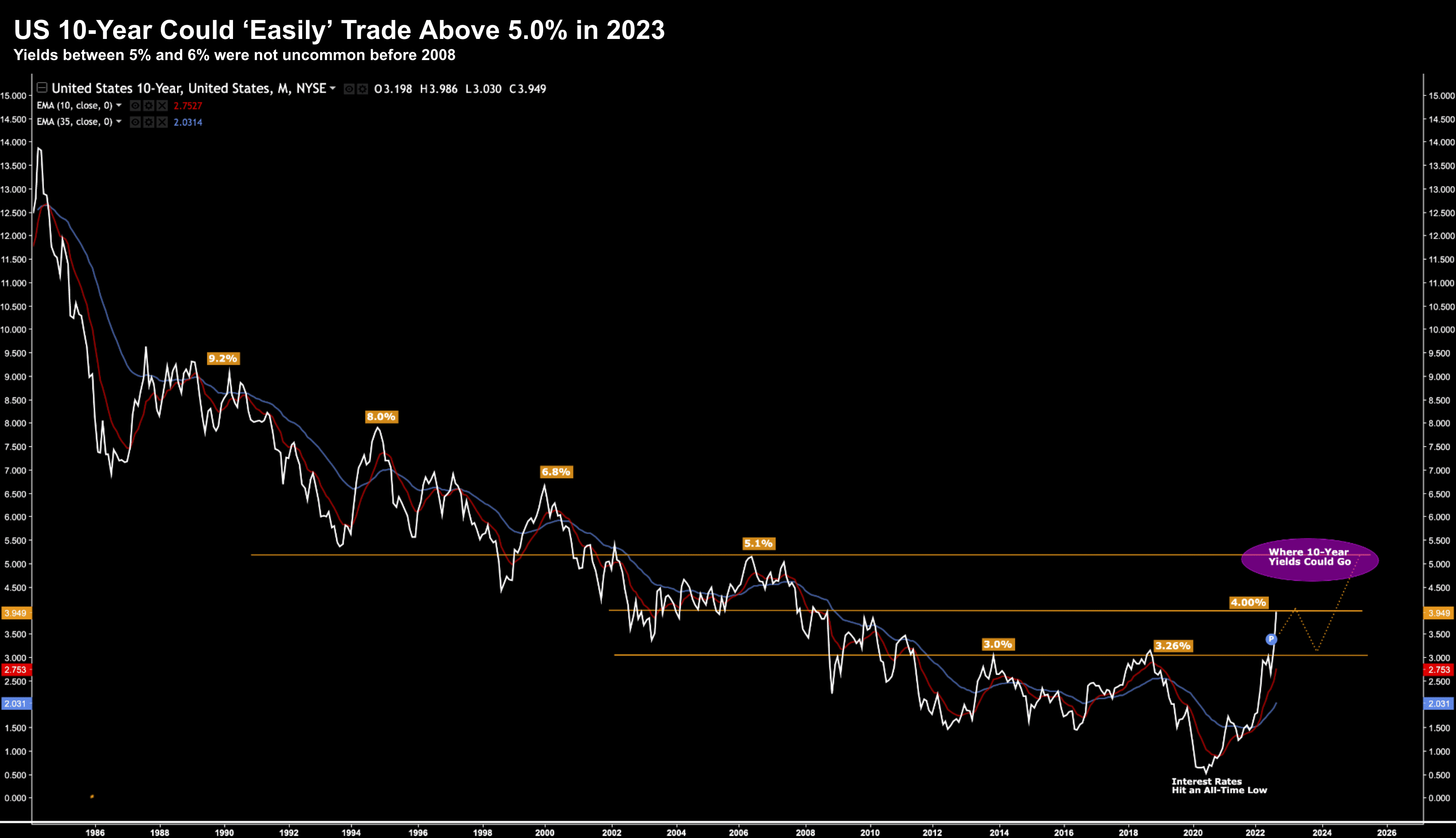

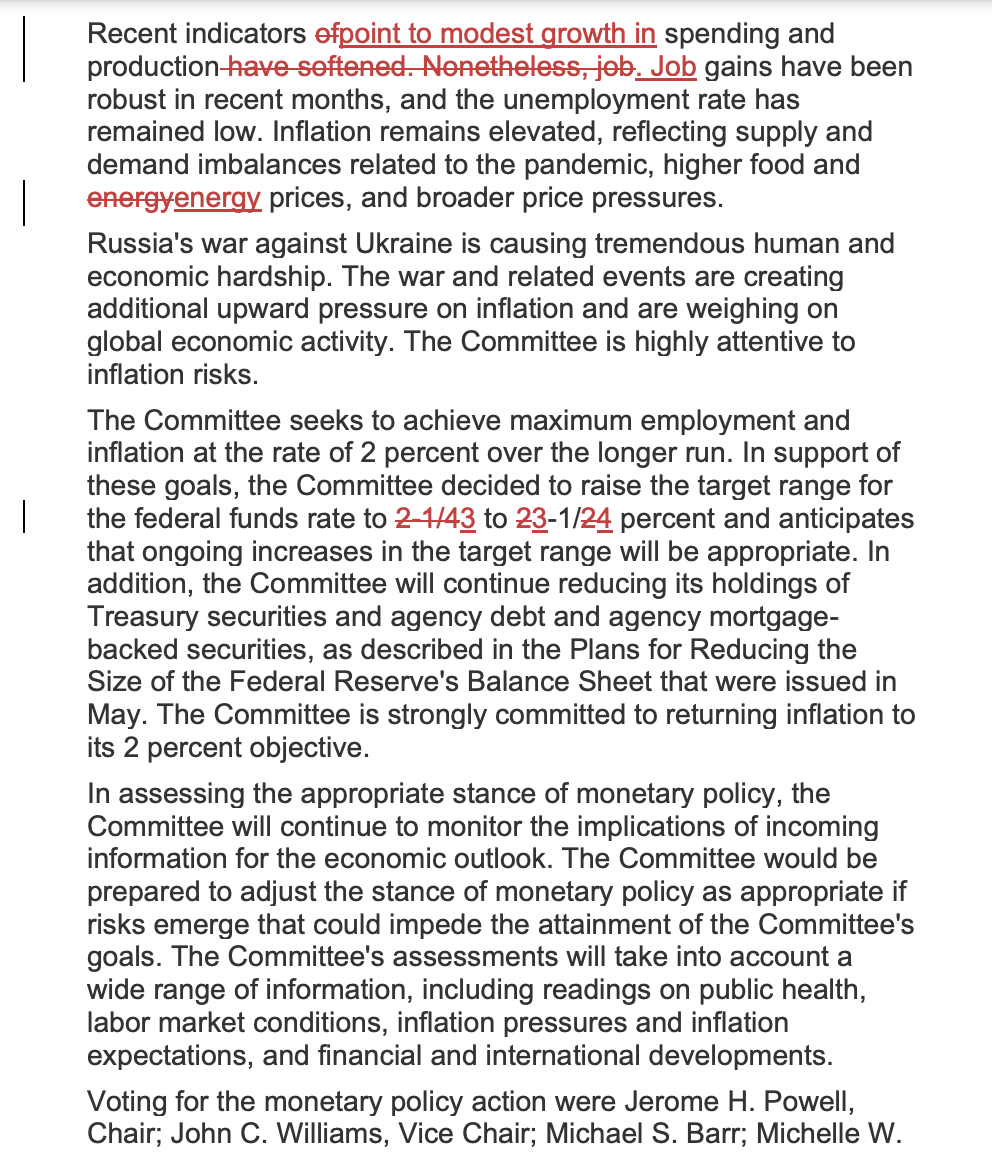

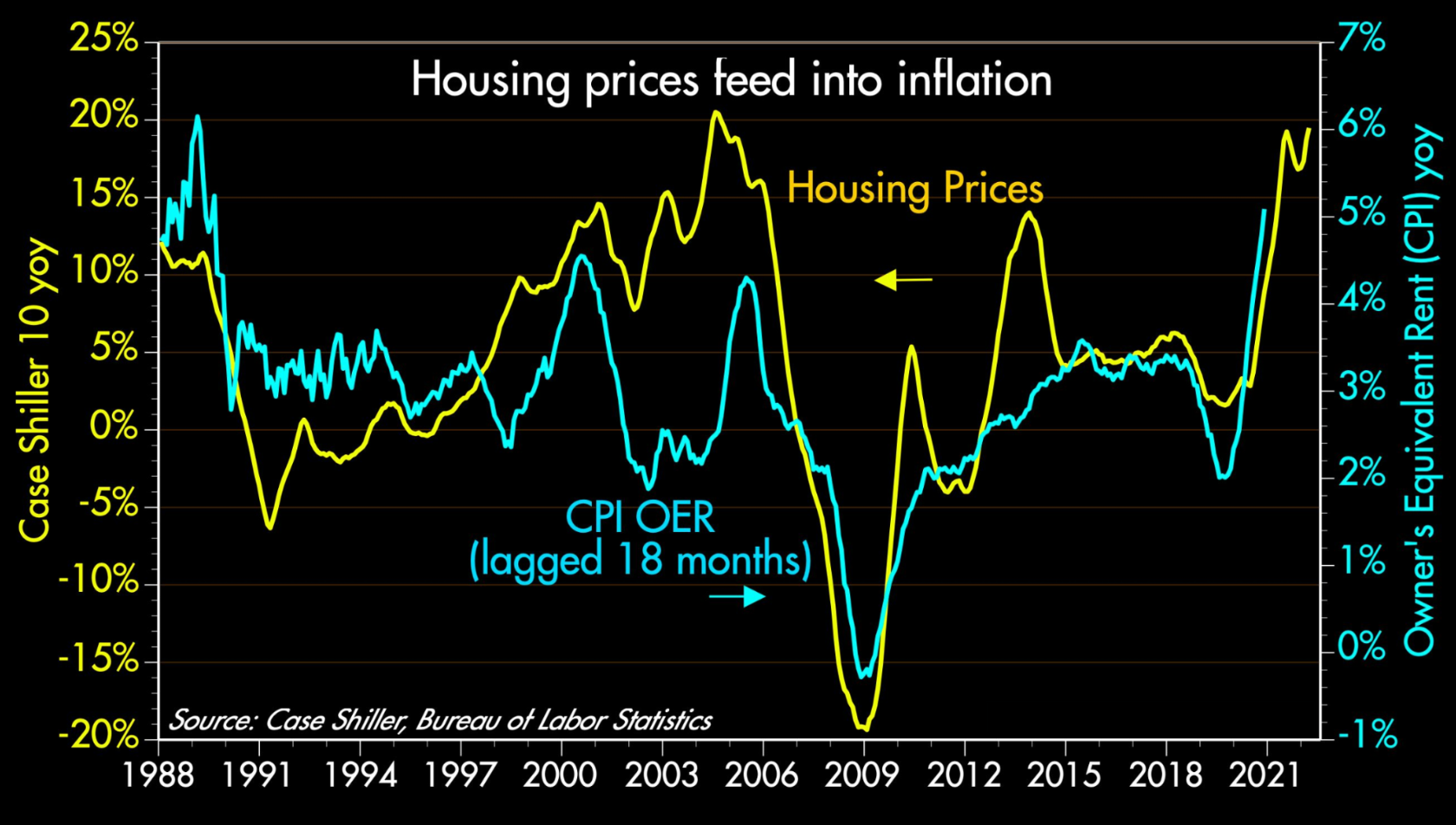

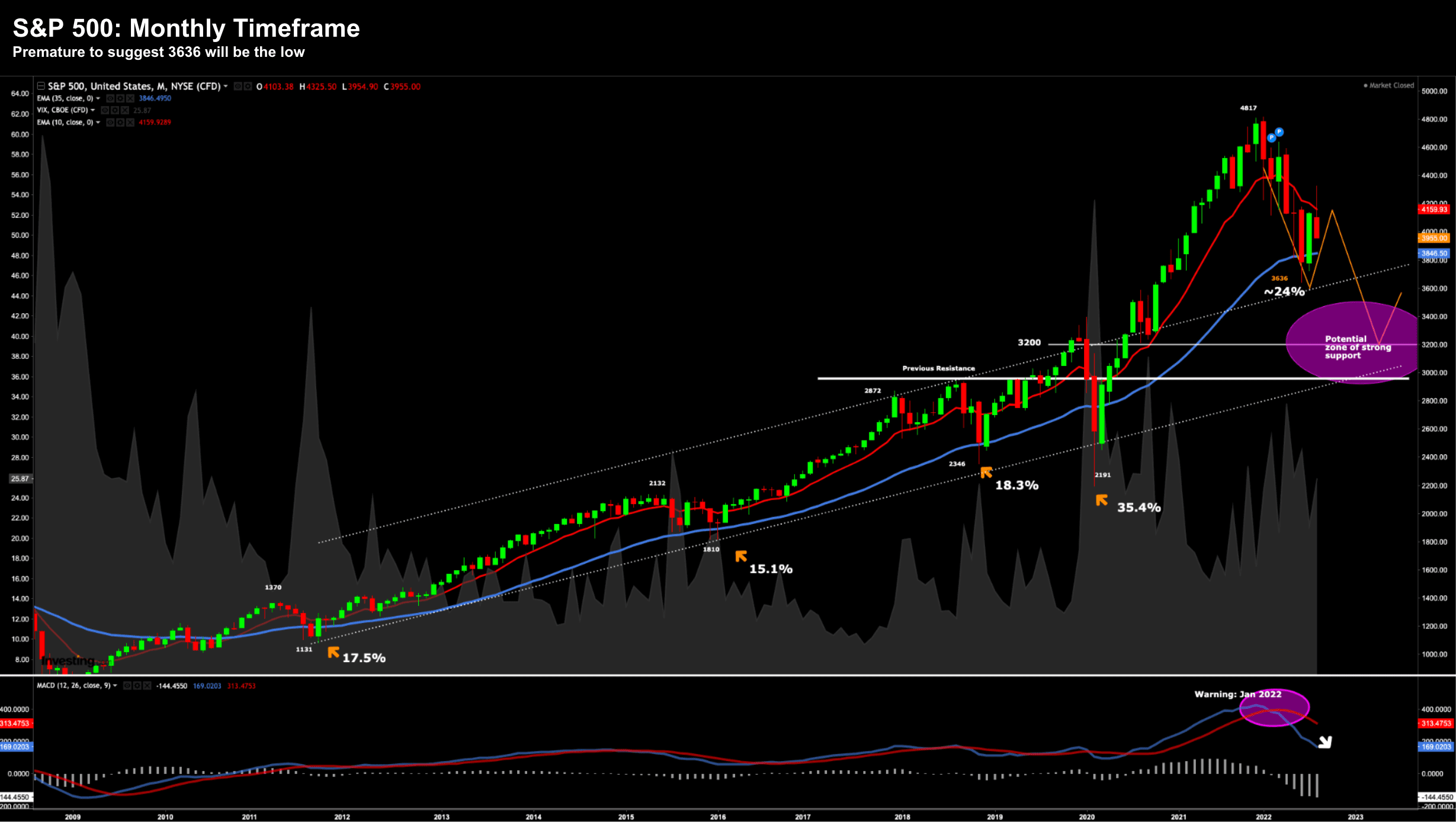

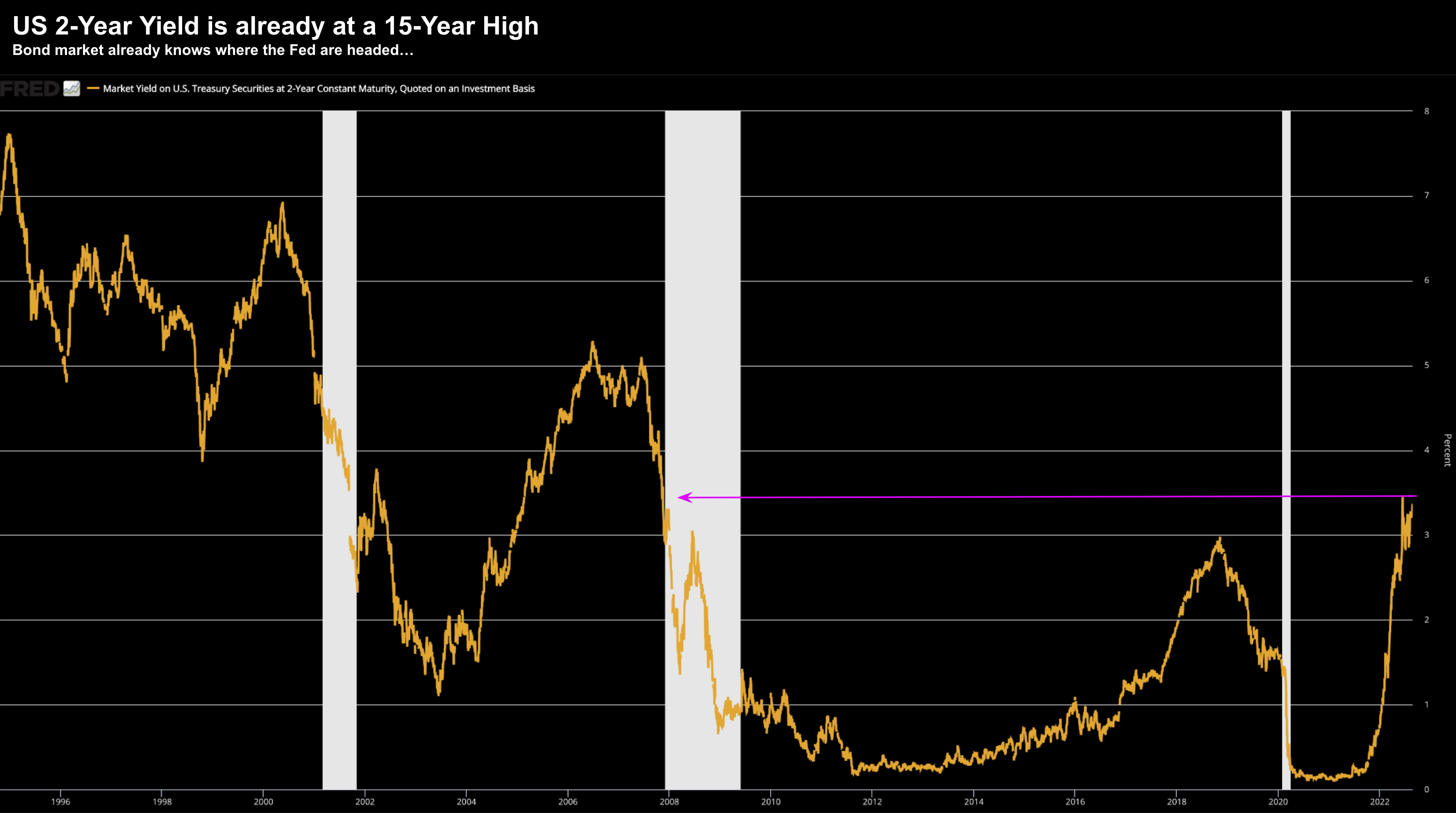

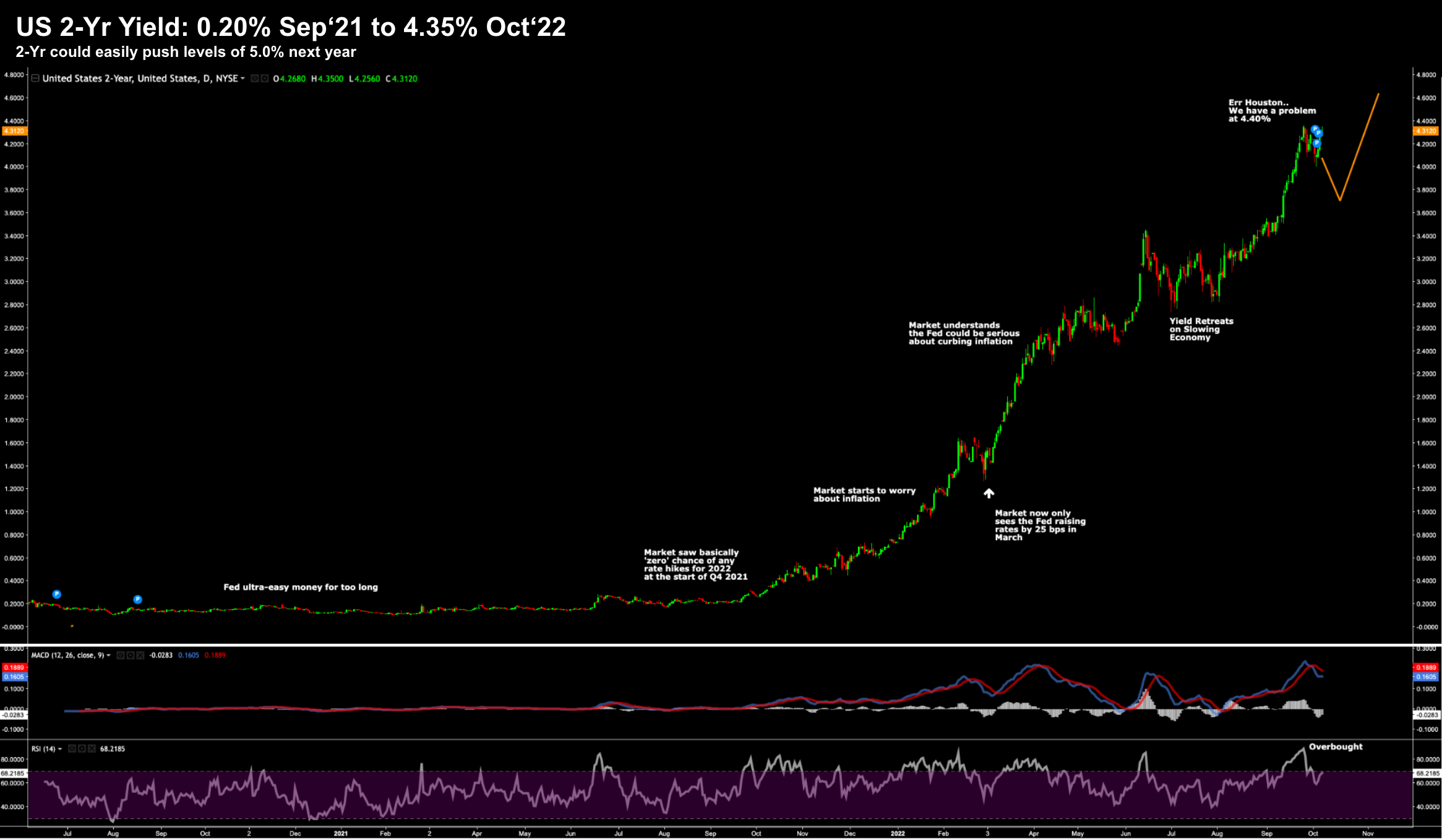

The CEO of the US' largest bank by assets - Jamie Dimon - has sent another warning. 'This is serious' he said... warning of perhaps up to 20% further downside and a recession in 2023...