Powell Delivers a Blunt Message

Powell Delivers a Blunt Message

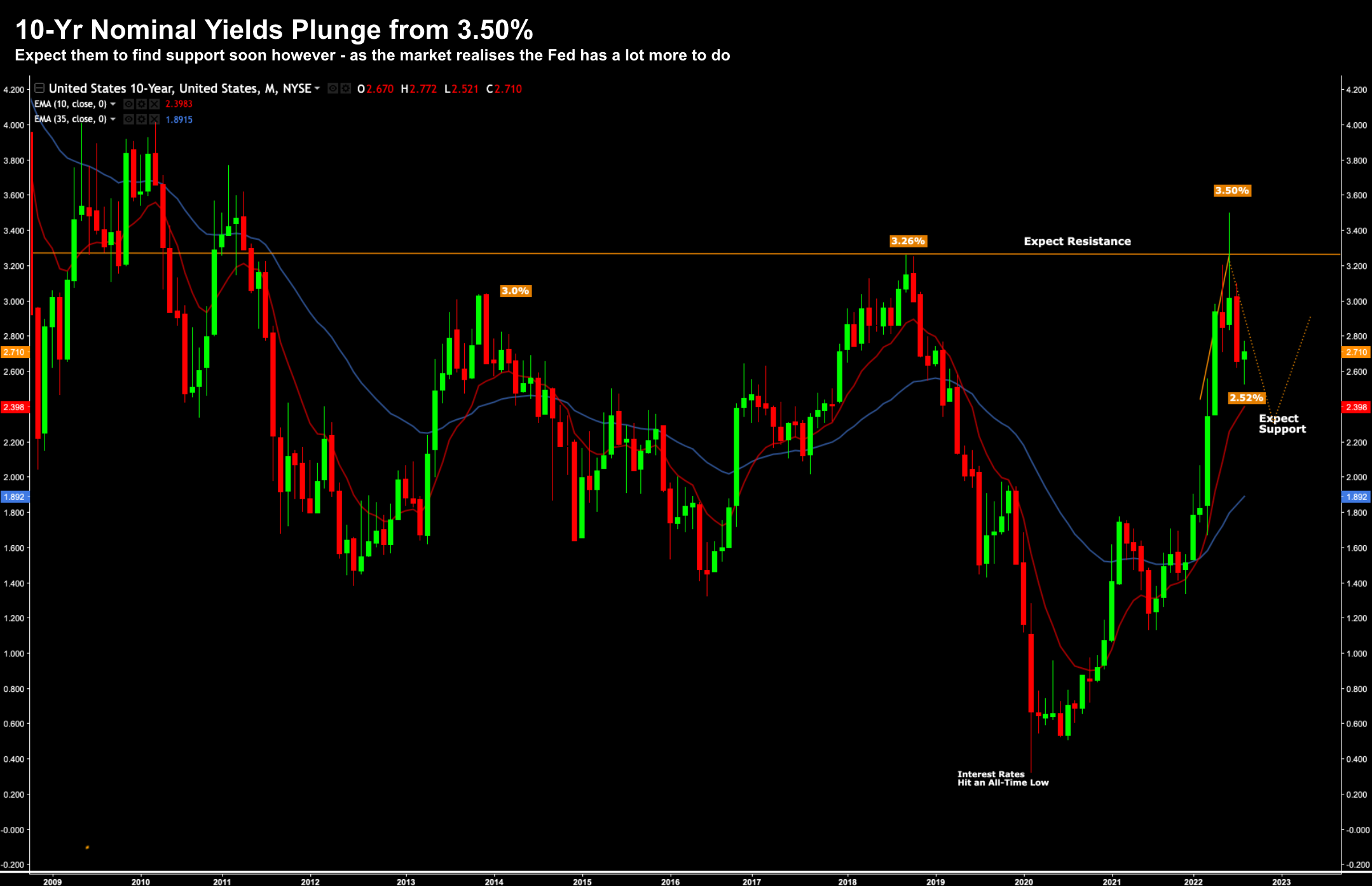

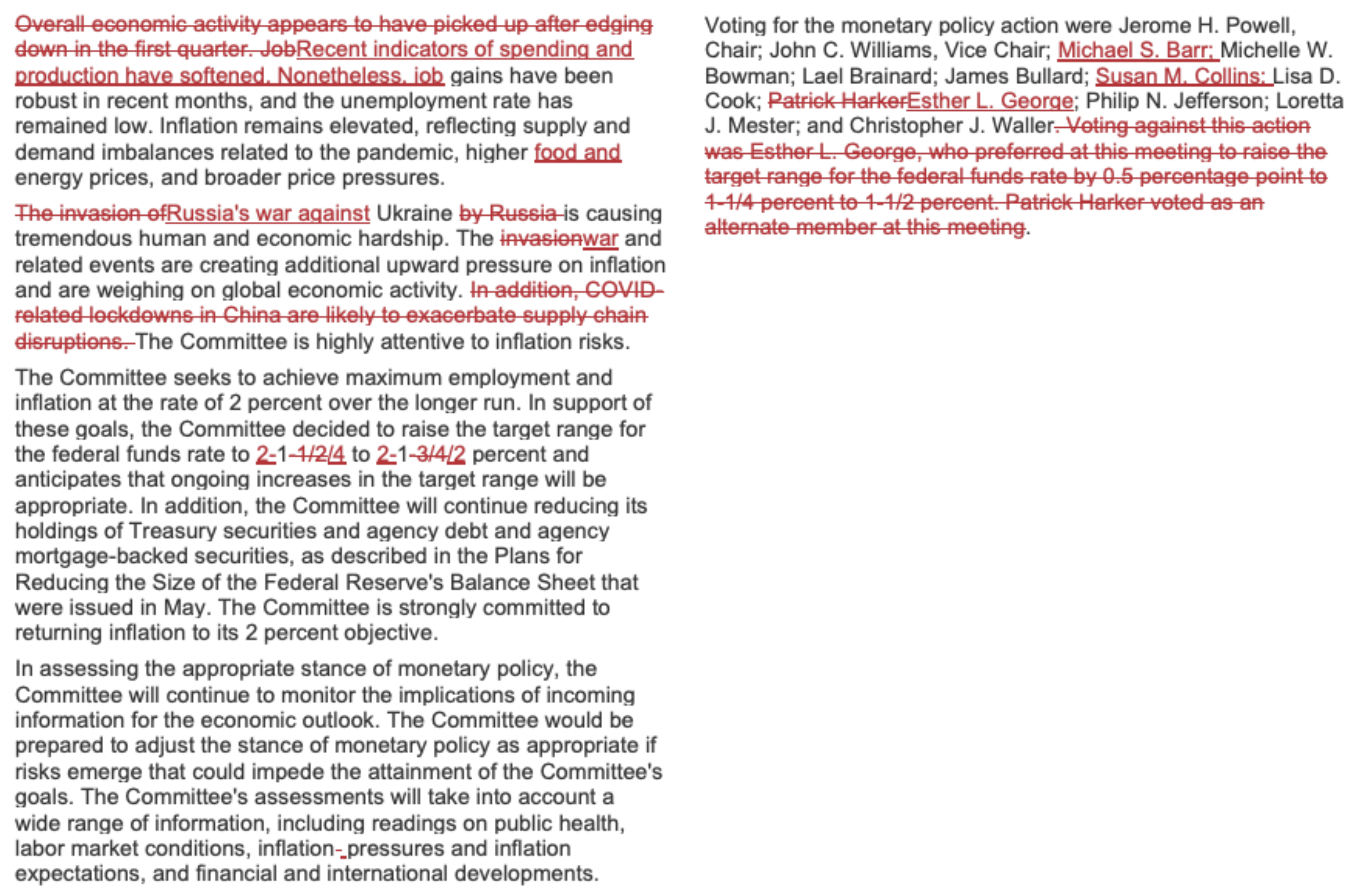

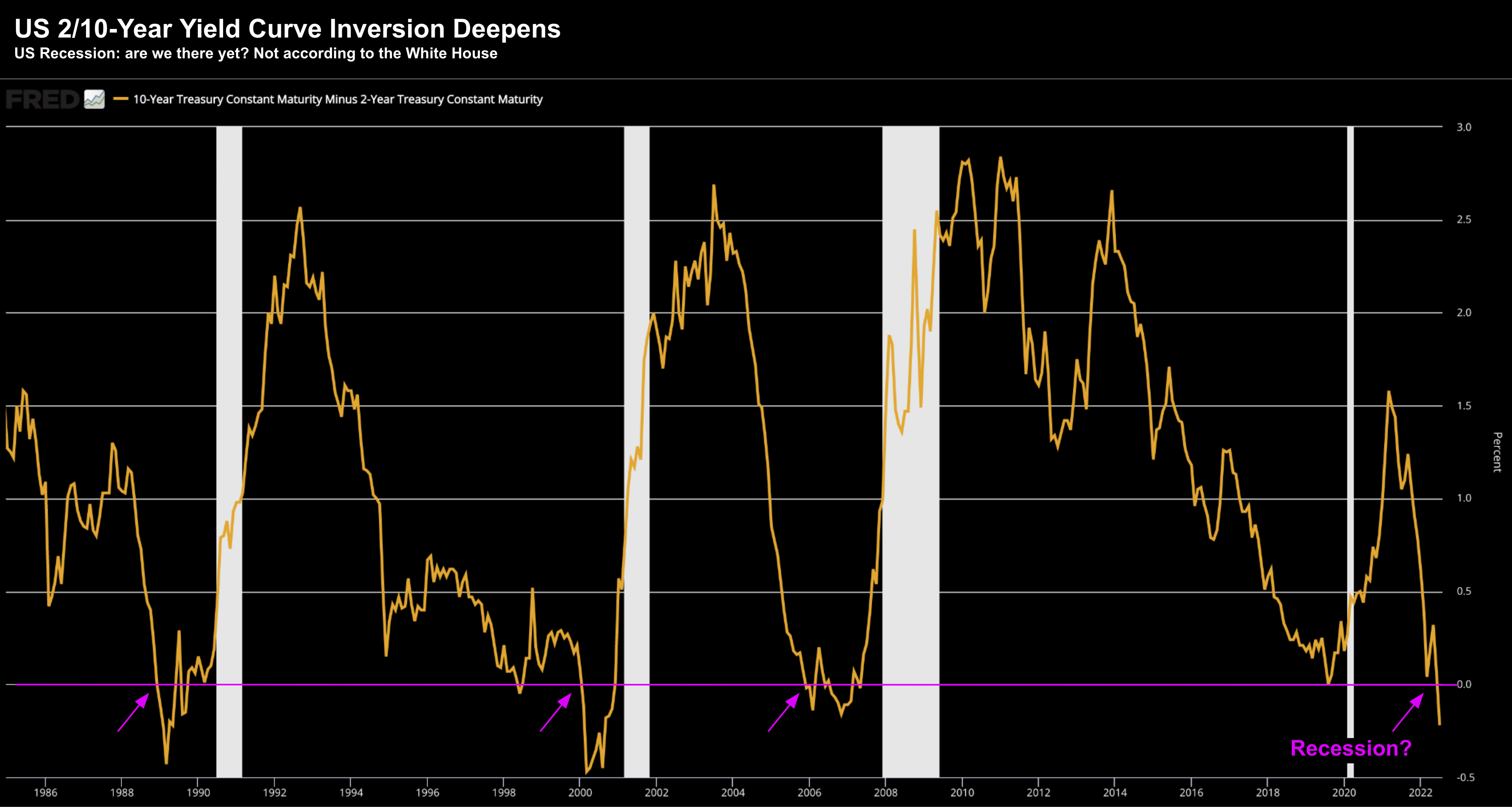

If it wasn't already clear - it is now. Interest rates are going sharply higher and for longer. Powell's 8-minute Jackson Hole speech was carefully scripted - using words like "pain" to prepare the market for what lies ahead.