Recession: The ‘Cost’ of Unwanted Inflation

Recession: The ‘Cost’ of Unwanted Inflation

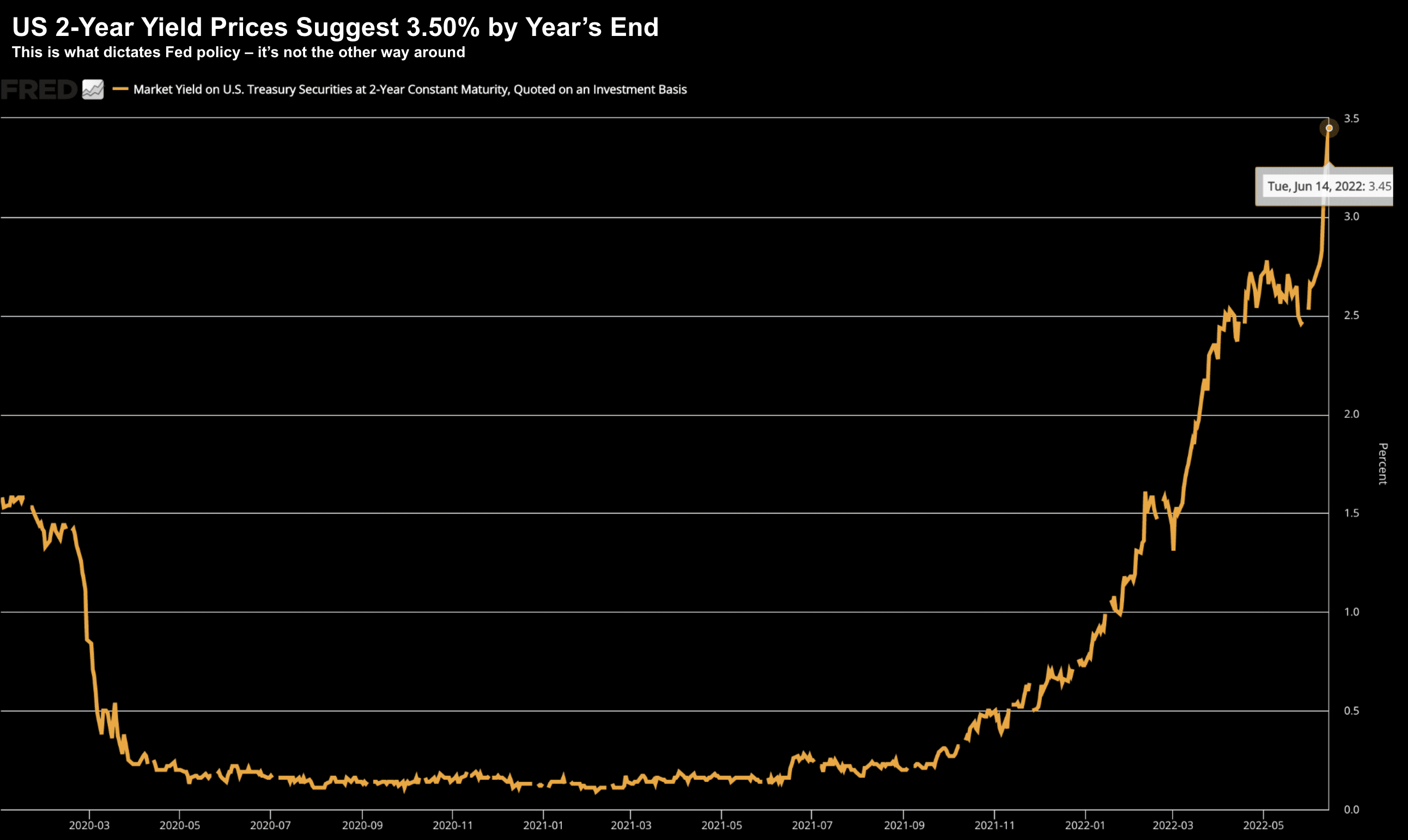

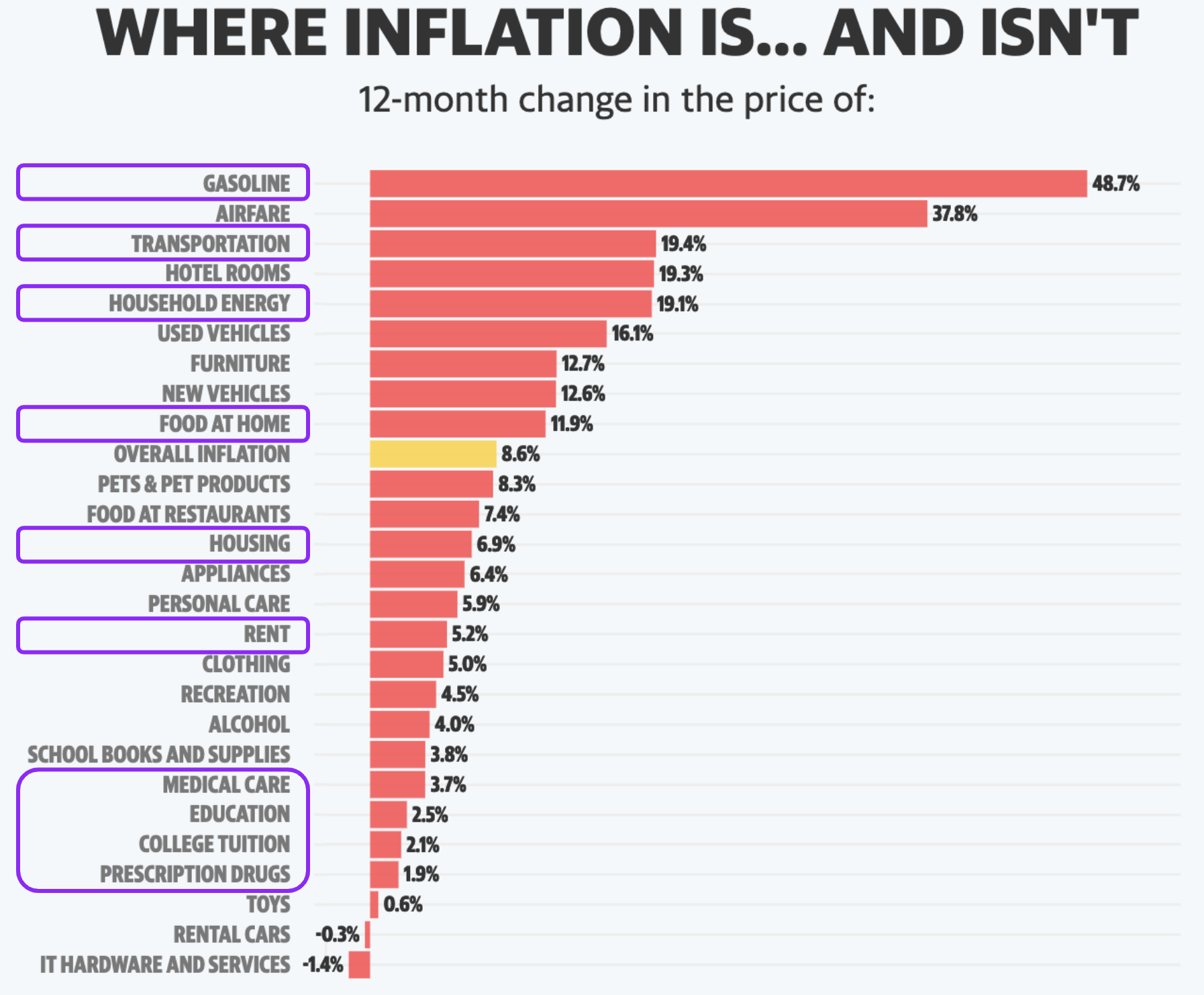

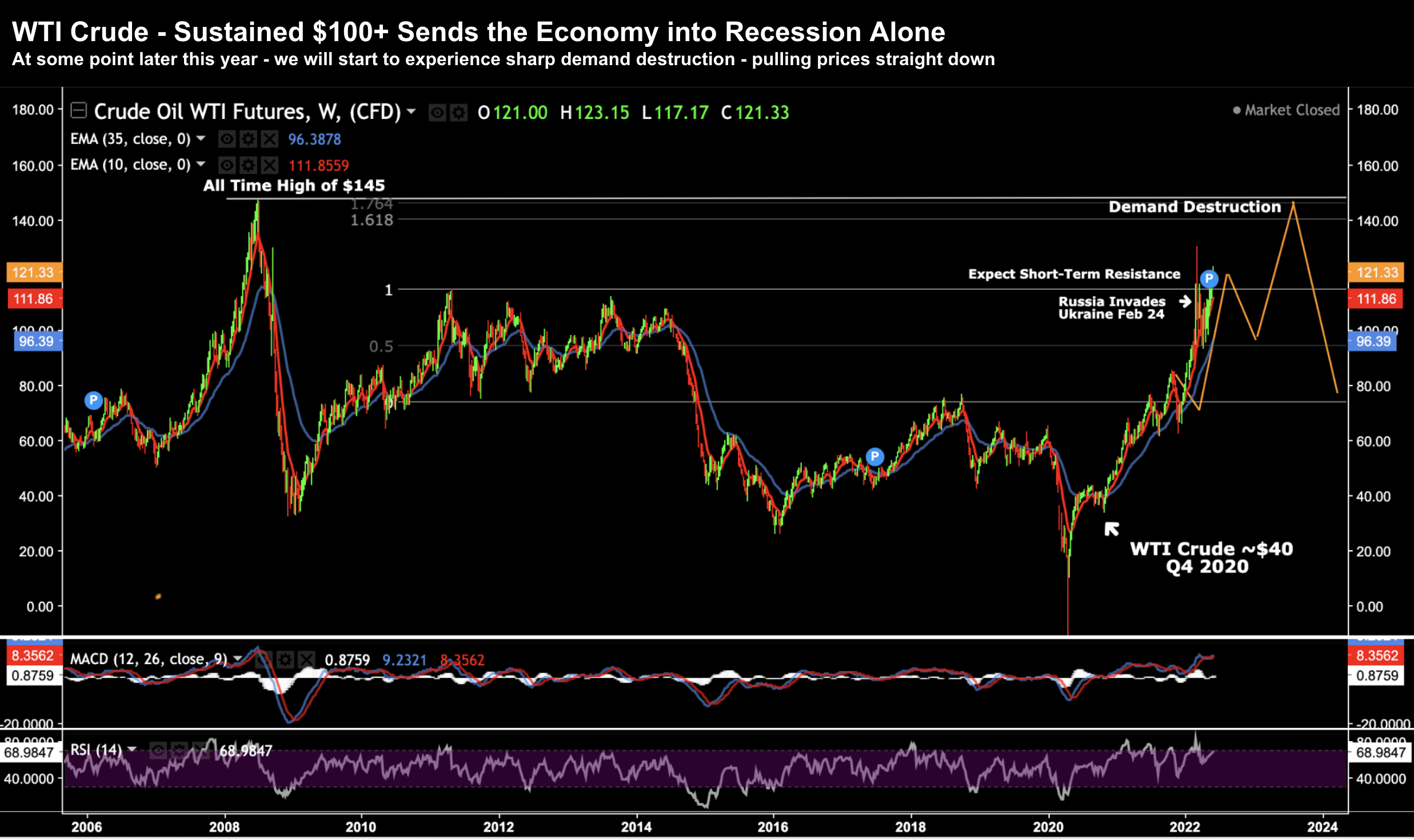

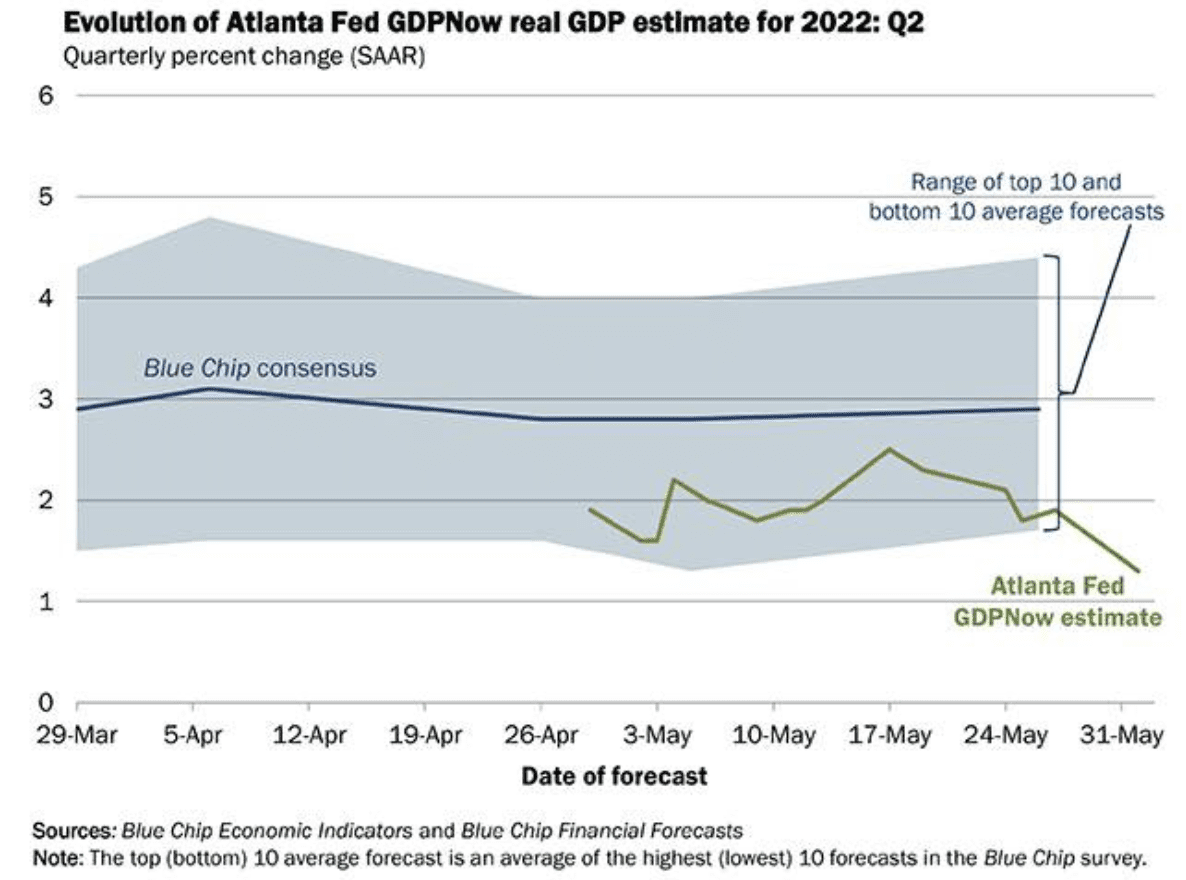

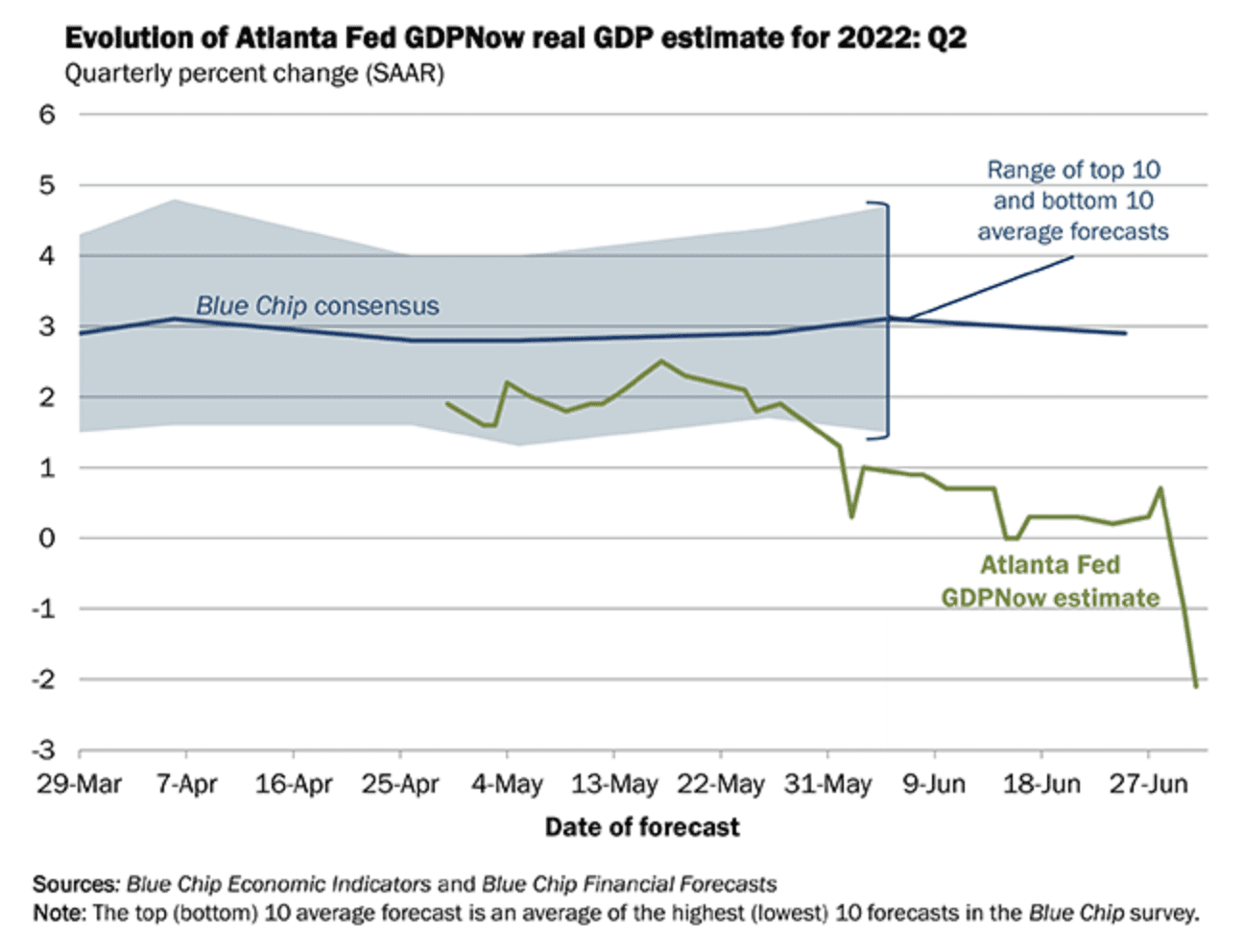

Today the Fed reminded us they have one objective (and only one): to bring inflation back to its target level of 2.0%. However, the unspoken narrative was sacrifices will need to be made (i.e. expect a recession)