The Risk/Reward for Equities

The Risk/Reward for Equities

What's the risk/reward equation for equities? My view - the downside risks still outweigh the upside opposite a host of reasons. Let's explore...

The Risk/Reward for Equities

The Risk/Reward for EquitiesWhat's the risk/reward equation for equities? My view - the downside risks still outweigh the upside opposite a host of reasons. Let's explore...

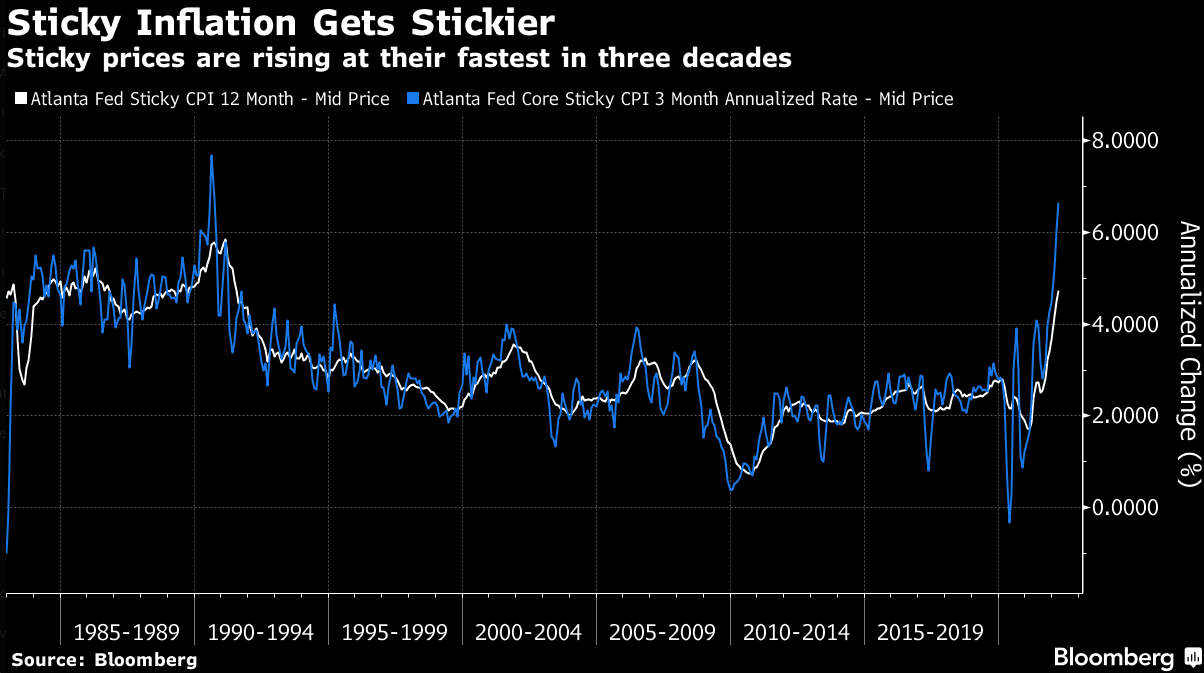

Core PCE Rises 4.9%… But Is it Peaking?

Core PCE Rises 4.9%… But Is it Peaking?Is inflation peaking? If we knew the answer to that question - markets would be in a very different place.

The problem is - we cannot know for sure. However, there are positive developments...

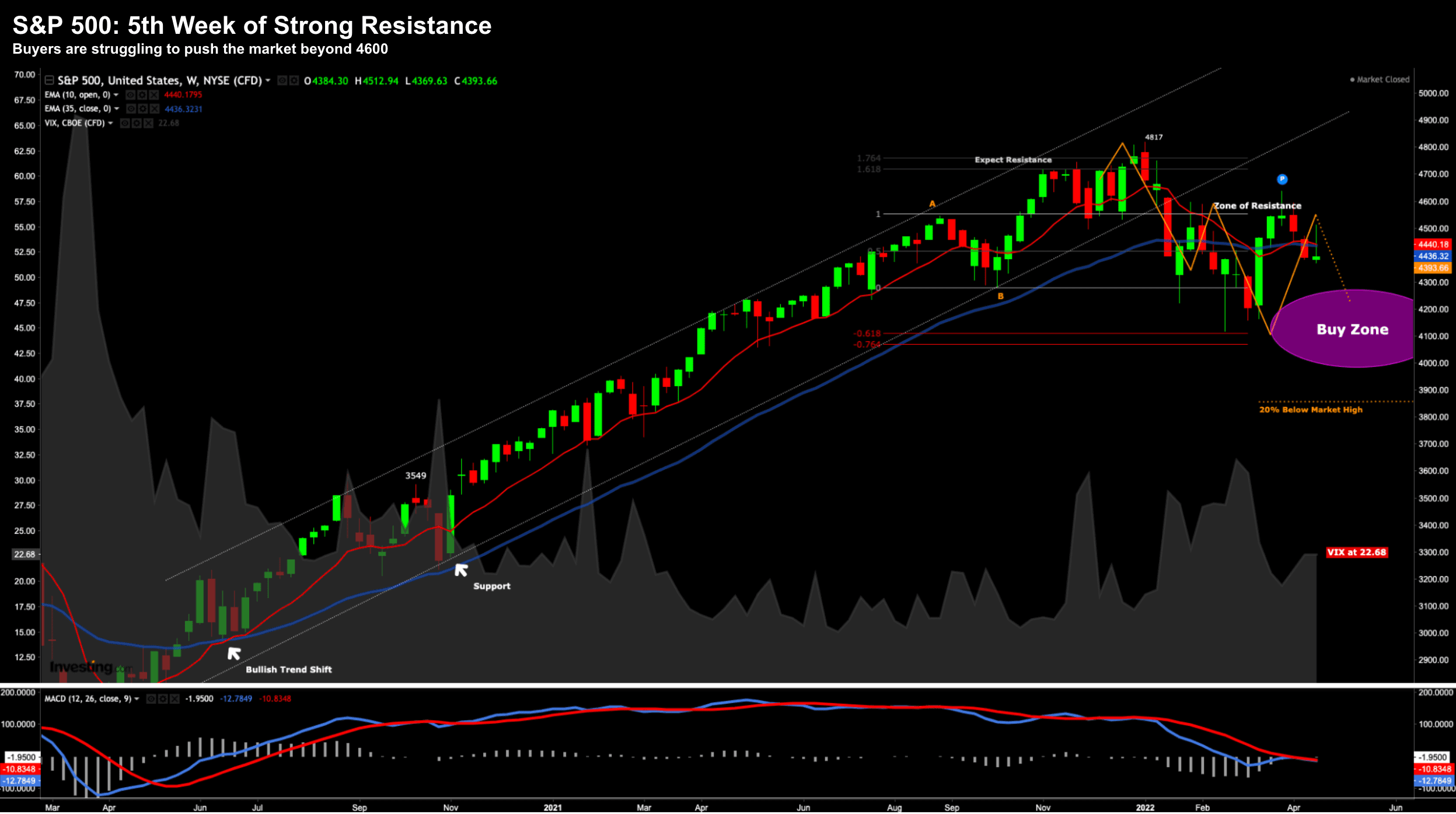

Why The “Fed Put” is a Lot Lower

Why The “Fed Put” is a Lot LowerForget about a Fed Put at 3800 - I think it's a lot lower. Fundamentally and technically I construct a case where the S&P 500 could easily trade 3500 this year. And if so - I would be a strong buyer for the long-term.

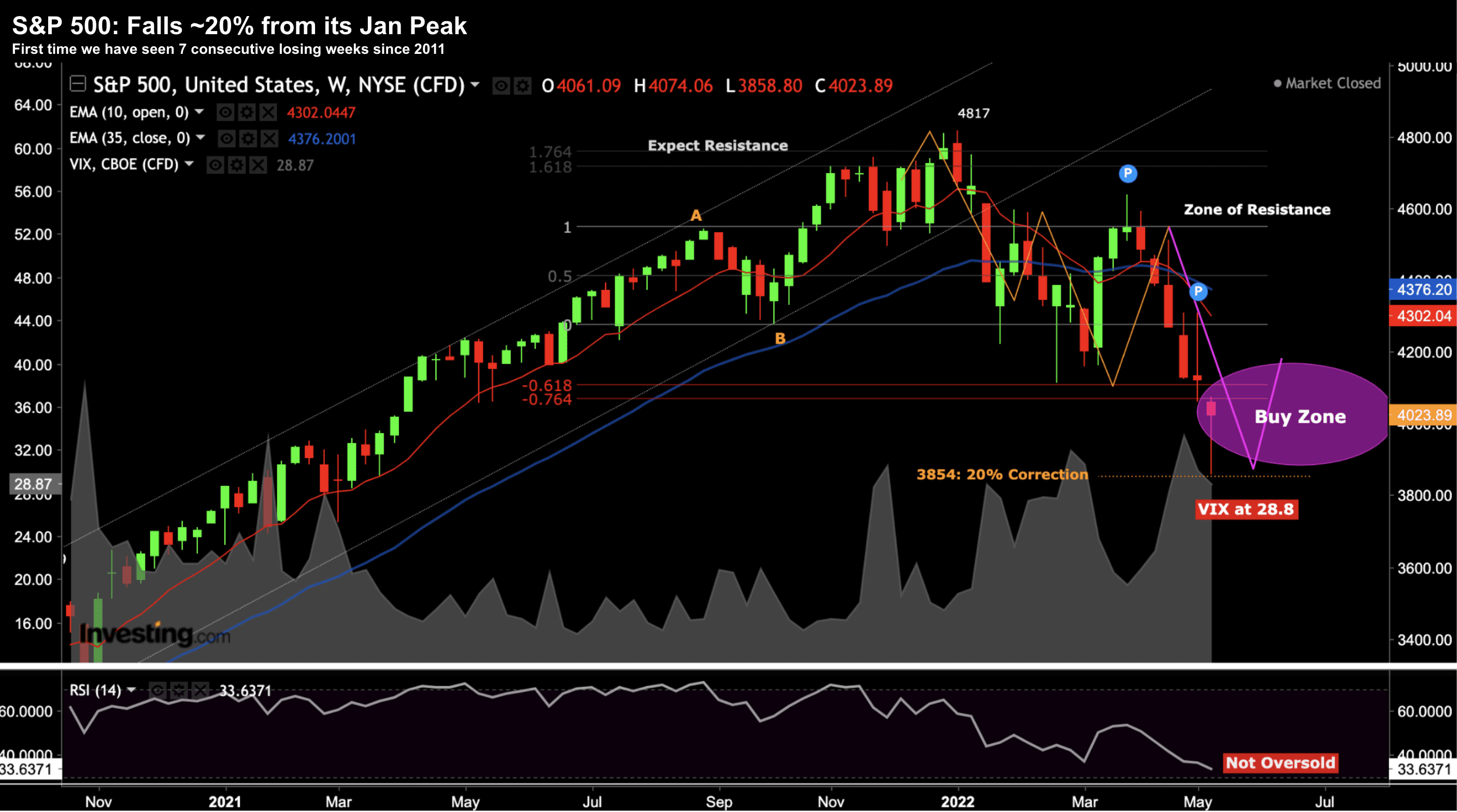

Bear Market Rally… For Now

Bear Market Rally… For NowThe S&P 500 has lost ground 7 weeks in a row. We have not seen that since 2011. At its low - we are 20% off the high. Is this the bottom? I don't think so. Whilst I expect a near-term rally - lower lows are possible this year.

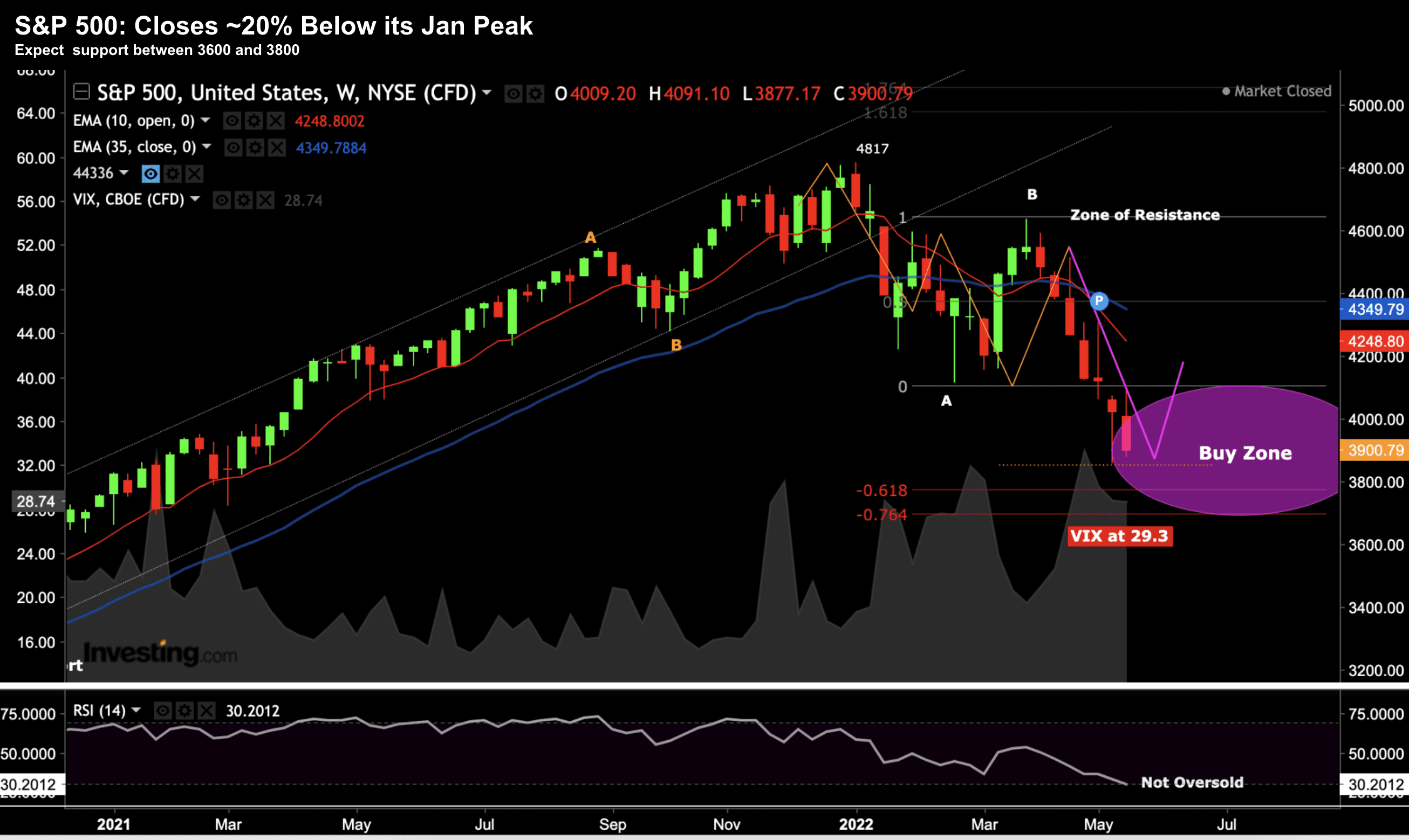

Tech Pummeled… But “Fear Index” Still Low

Tech Pummeled… But “Fear Index” Still LowIn three sessions - we've seen over $1 Trillion of market cap wiped off mega-cap tech names. And whilst we're closer to a bottom - where valuations of some companies are attractive - there's likely more downside yet.

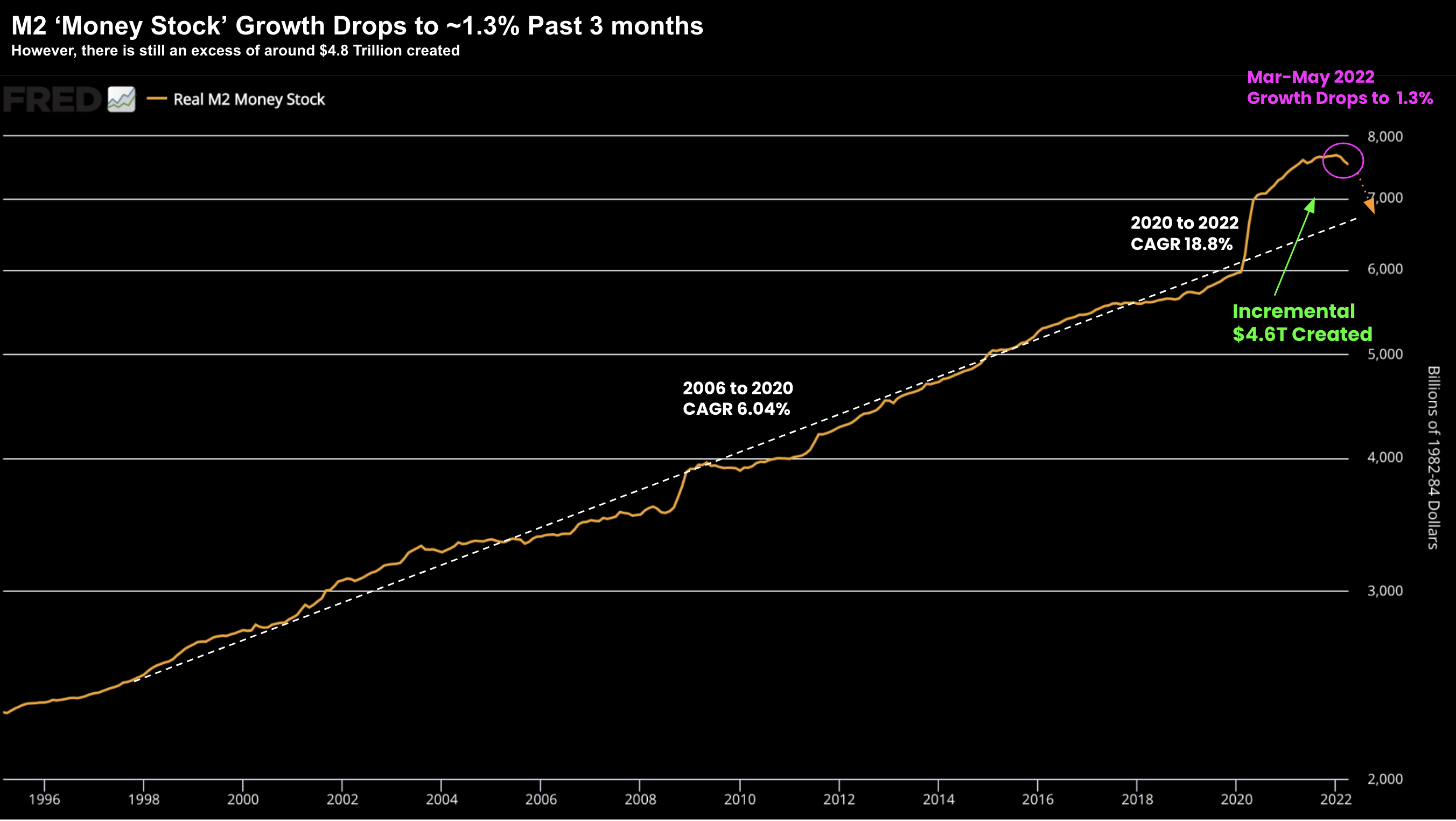

M2 Money Supply Still Far Too High

M2 Money Supply Still Far Too High Heading into the Fed decision - some feared we could see a 75 basis point rise. However, Jay Powell soon put those fears to rest. But the relief didn't last long... the 10-year treasury ripped above 3% as the market digested what a combination of (far) higher nominal rates.

12 Stocks to Own on any “Panic Selling”

12 Stocks to Own on any “Panic Selling”If you are investing today - you need to remain extremely selective with stocks. Look at the decimation in names like Facebook and Netflix. This post offers my checklist when selecting a stock....

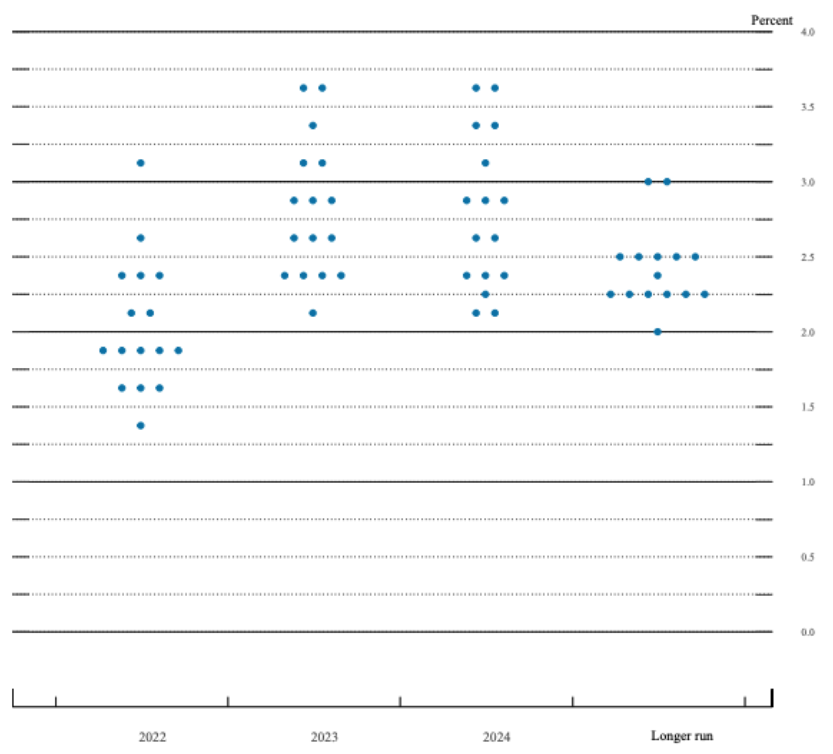

Bullard: “50’s at Every Meeting”

Bullard: “50’s at Every Meeting”St. Louis Fed James Bullard threw more fuel on the 'interest rate fire' today - suggesting the nominal Fed funds rate needs to be at 3.50% by the end of the year. And if he had his way - that would roughly be 100 basis points higher than what's currently shown on the Fed dot plot.

There’s Only One Way to Fix Inflation

There’s Only One Way to Fix InflationMore bad news on the inflation front today... this time with Producer Prices. The producer price index (PPPI) - which measures prices paid by wholesalers - was up 11.2% from a year ago - a fresh record. This is especially bad news as it's a precursor to what to expect with consumer inflation. In other words, higher prices are typically passed on.

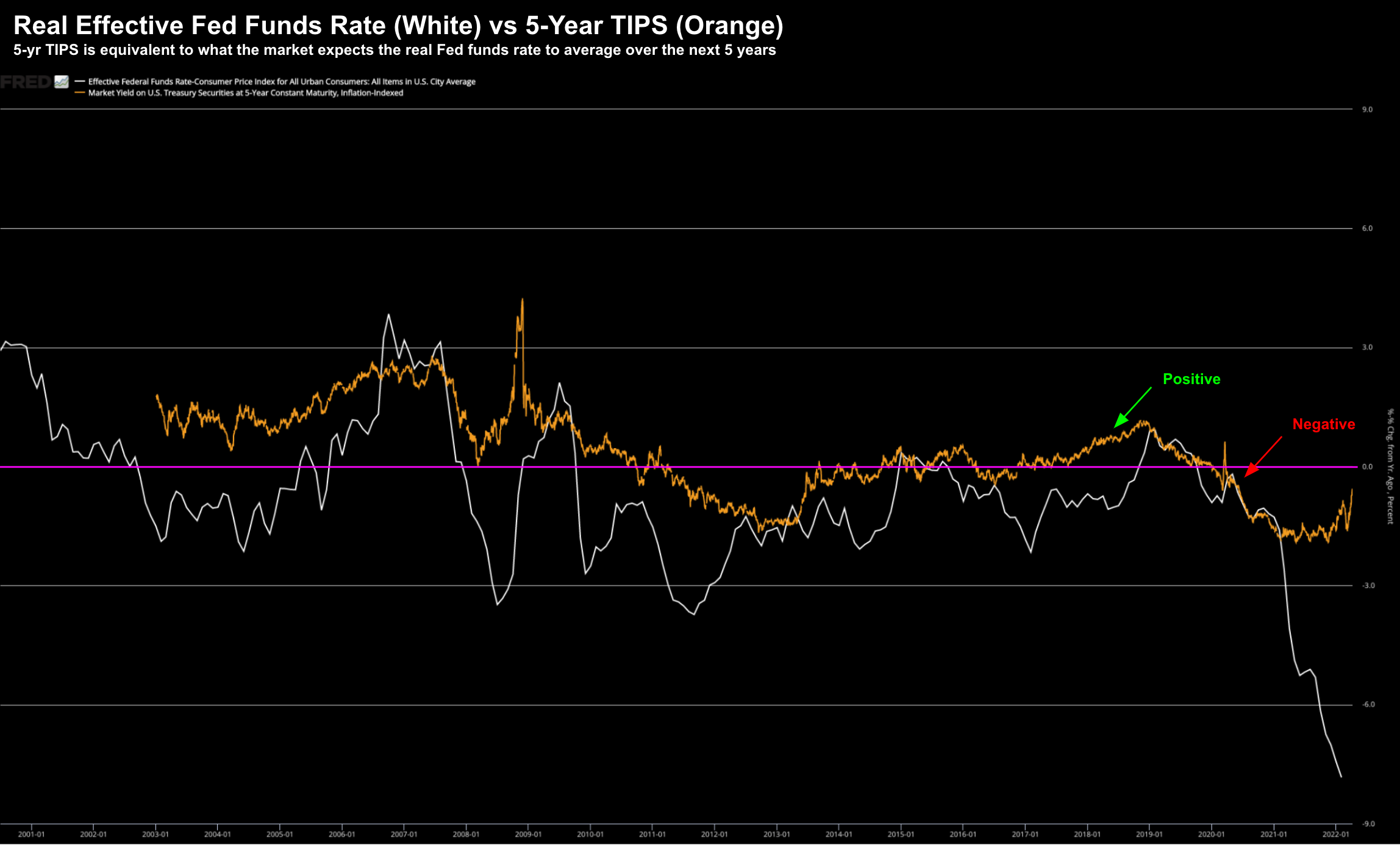

Real Yields Suggest No Recession in 2022

Real Yields Suggest No Recession in 2022Over the past fifty years, the inversion of the 2-year / 10-year yield curve (aka '2-10') has predicted every recession. Given its reliable predictive power - its recent inversion consumes financial media. There's just one problem: It's lousy at timing.