The $10+ Trillion Question

The $10+ Trillion Question

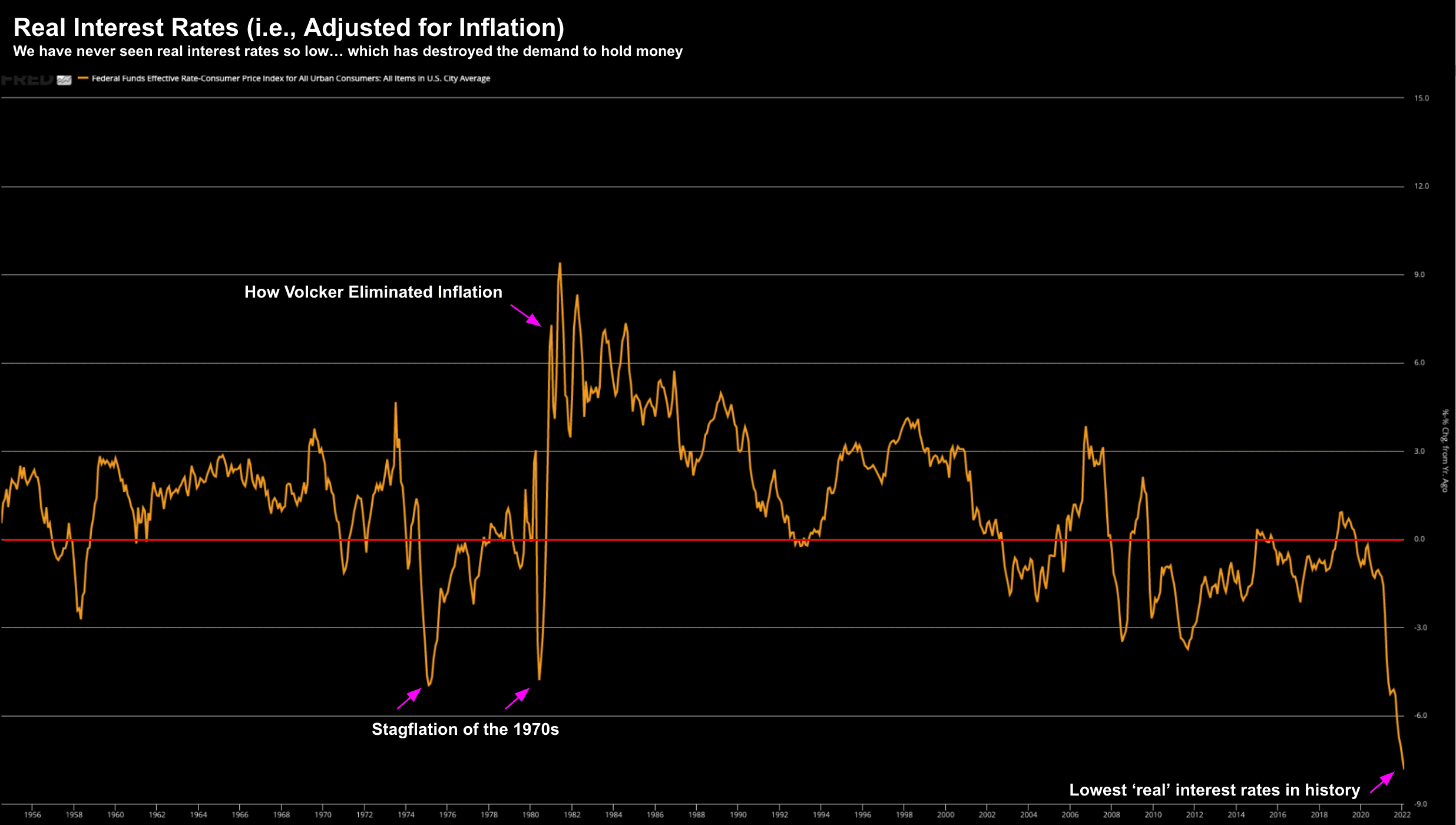

The biggest thing we've learned this week (which investors should pay attention to) is what Vice Chair Lael Brainard had to say on aggressive monetary policy (specifically QT). She is largely in favour of ultra-low rates and money printing.... and was Senator Warren's pick for Powell's role. However, now Brainard has conceded we have a problem.