Market Sweats Trump Tweets Over Powell

Market Sweats Trump Tweets Over Powell

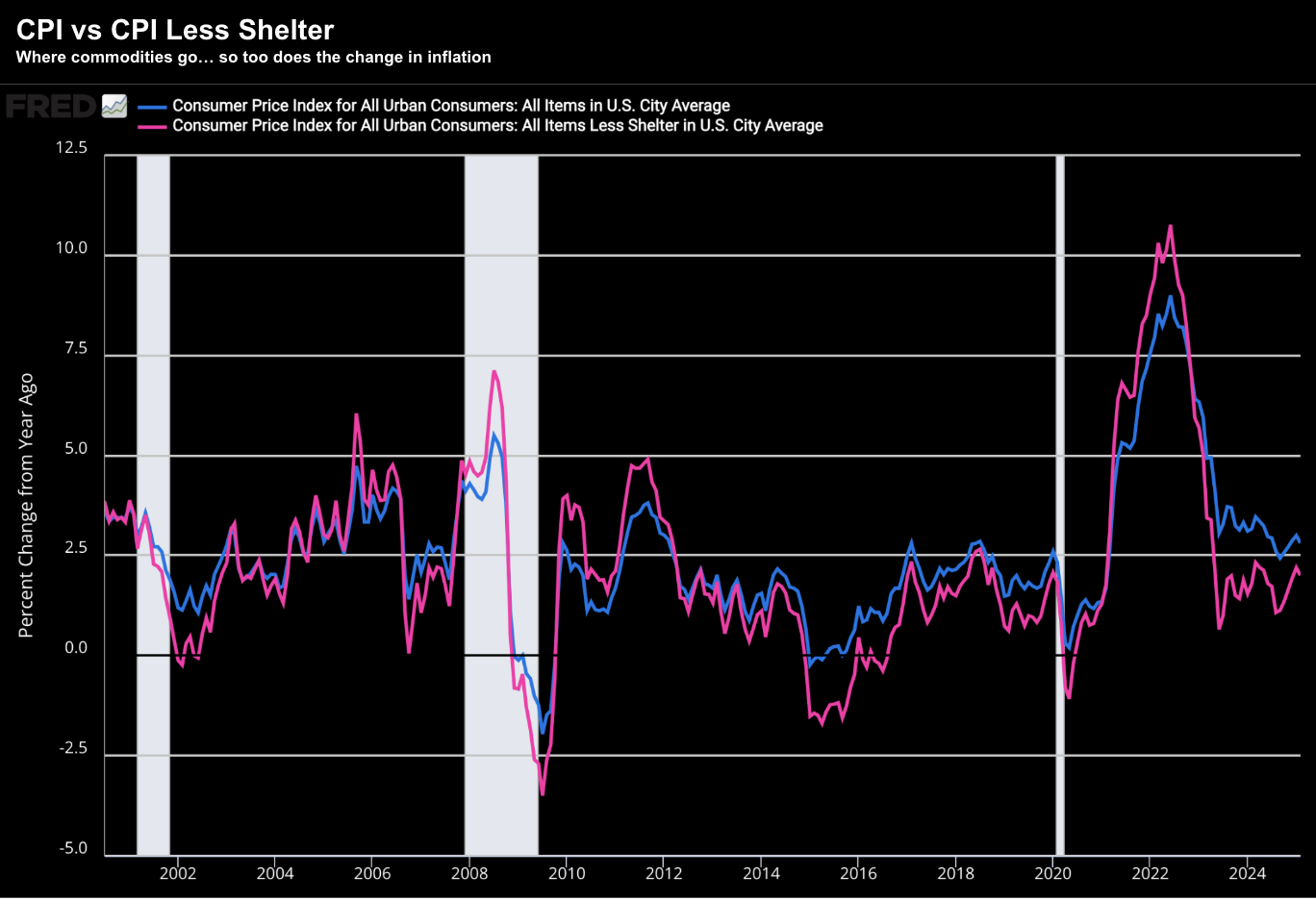

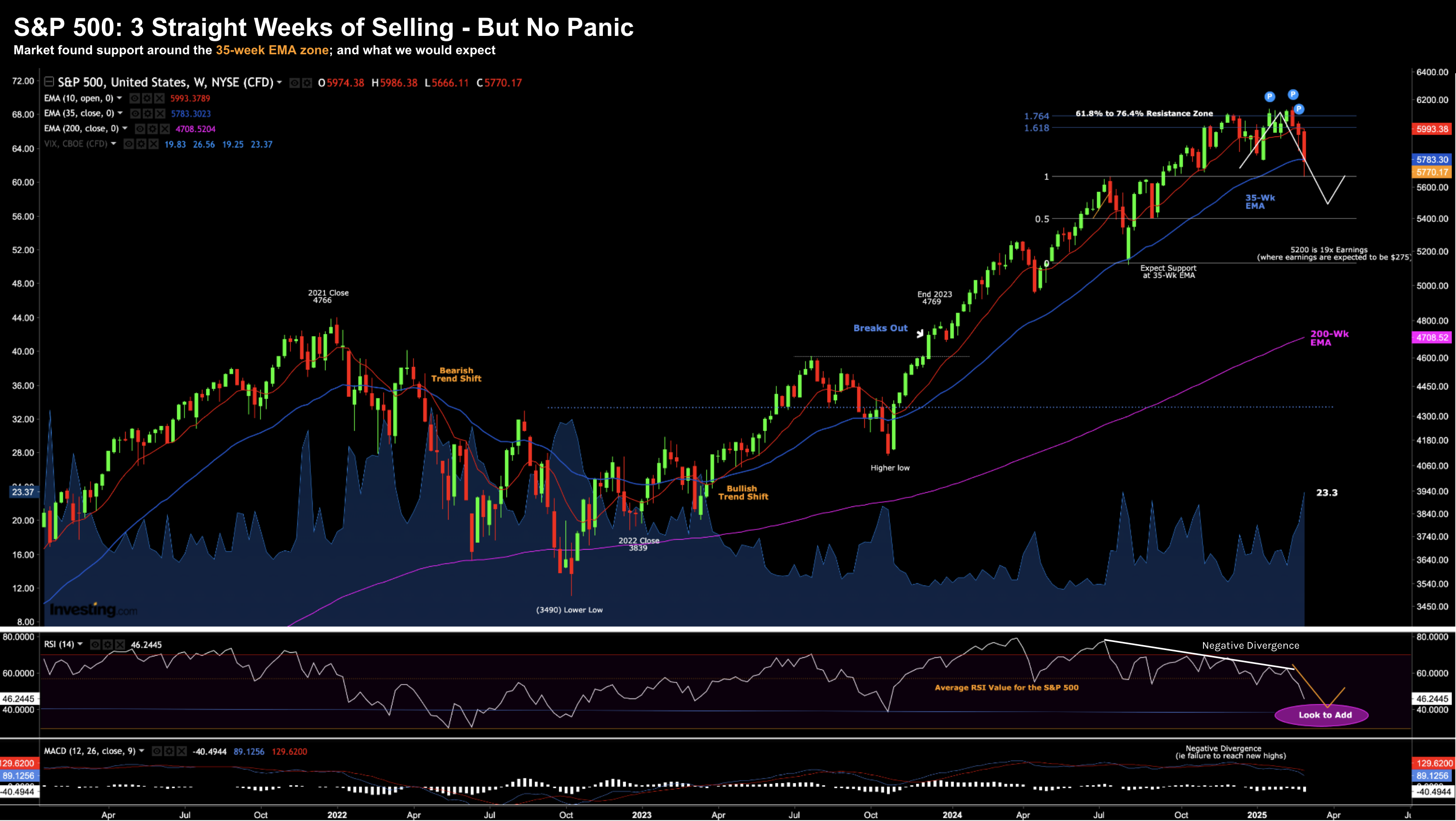

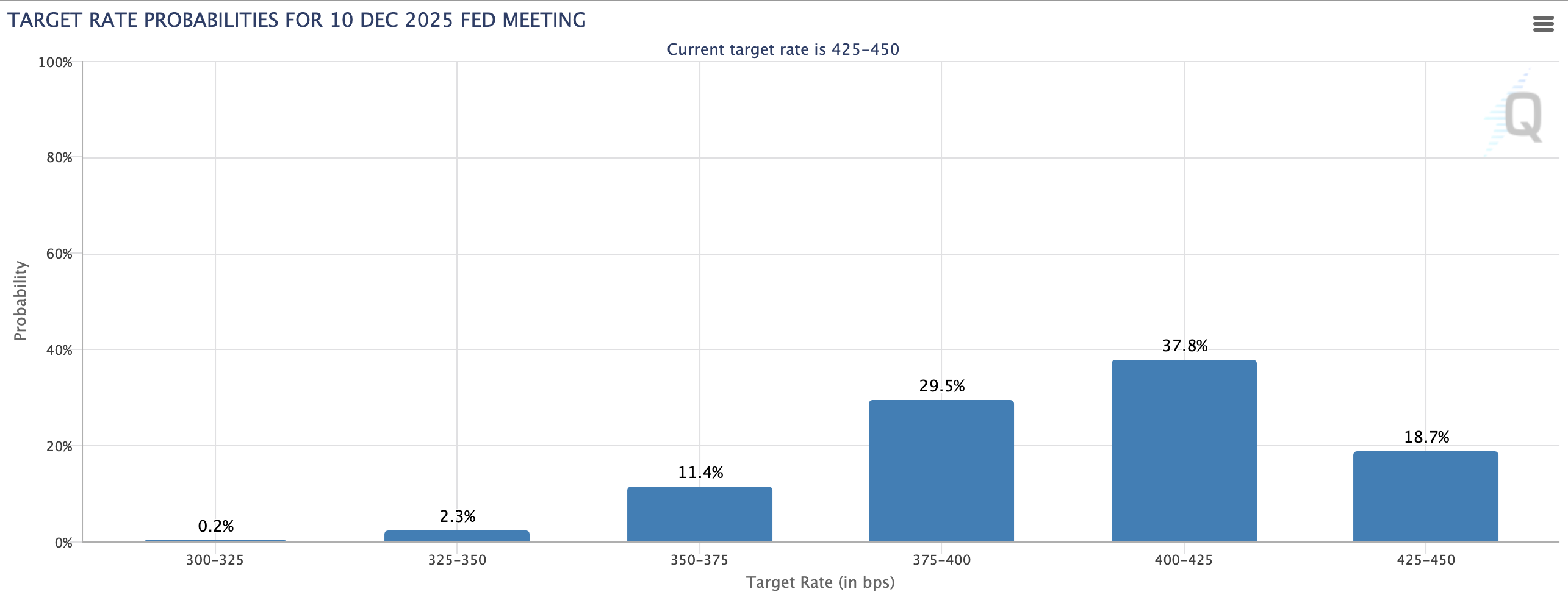

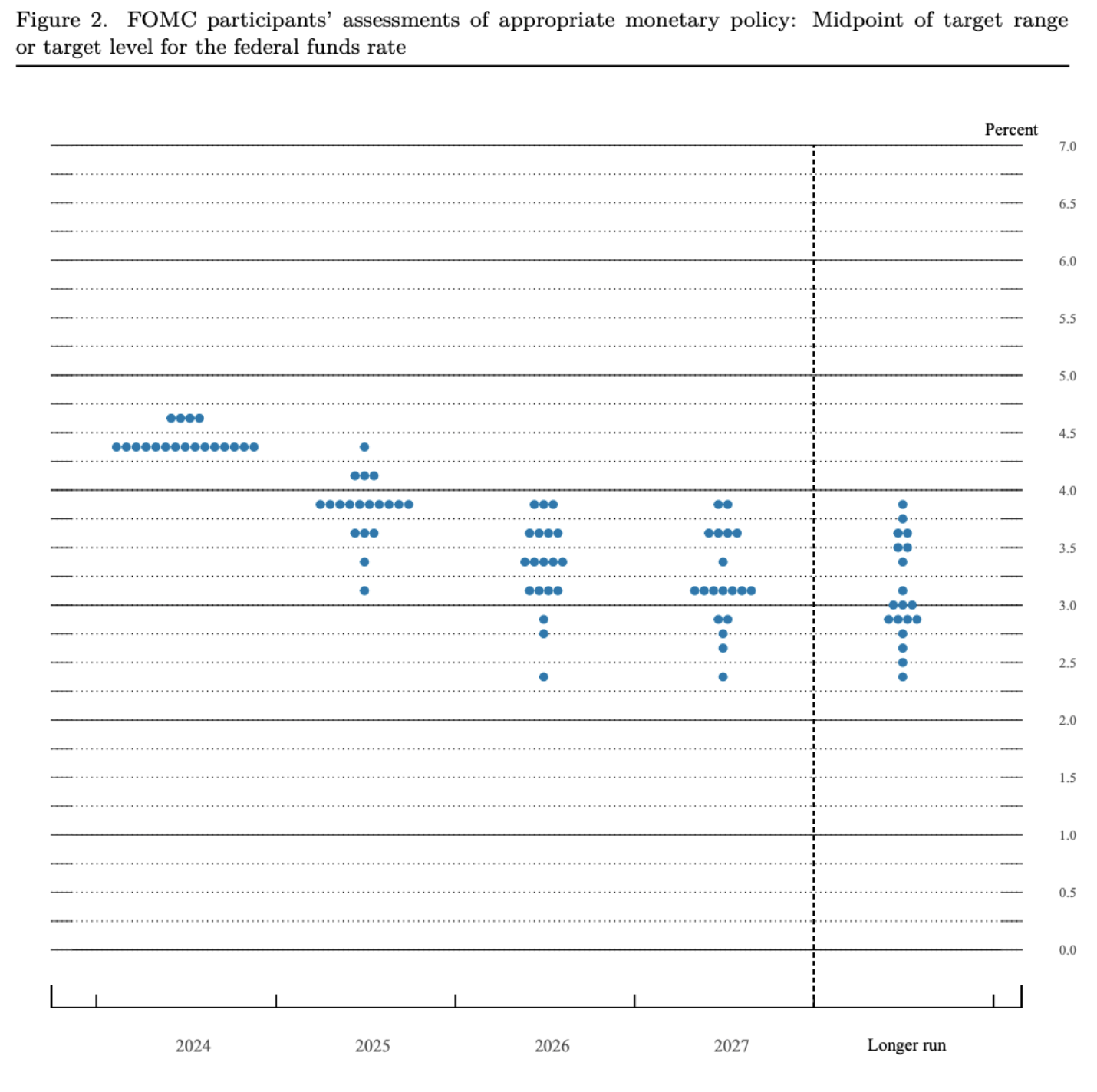

What matters more to the market: (a) a Trump tweet on any potential trade deal; or (b) Jay Powell's statement on monetary policy? If you ask me it's the former. Today's statement from the Fed was almost a non-event for the market. Powell maintained rates in the 4.25% to 4.50% target range (which was expected). However he told the market that the risk of "higher unemployment and higher inflation" have risen since their last meeting. That's problematic...