Fear & Greed

Fear & Greed

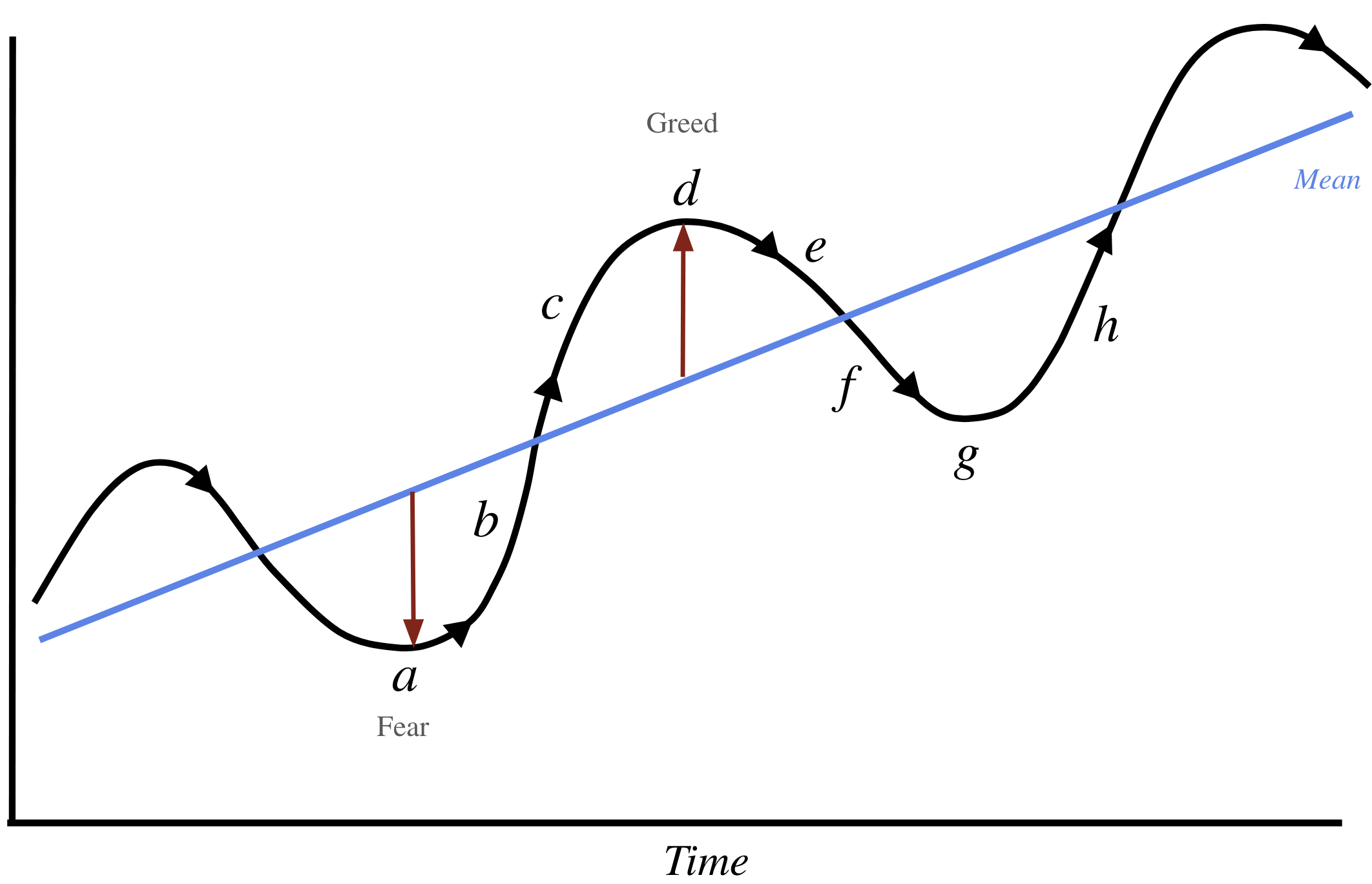

Wall St. is driven by just two emotions: fear and greed. Pending on the degree to which you succumb to these emotions - it will have a profound impact on your bottom line. All too often, most investors will do two things: (i) buy when there is market greed; and (ii) sell when there is fear. It's the opposite of what you should do. However, this is something you need to master if you are to be successful in the game of asset speculation.