What Just Happened?

What Just Happened?

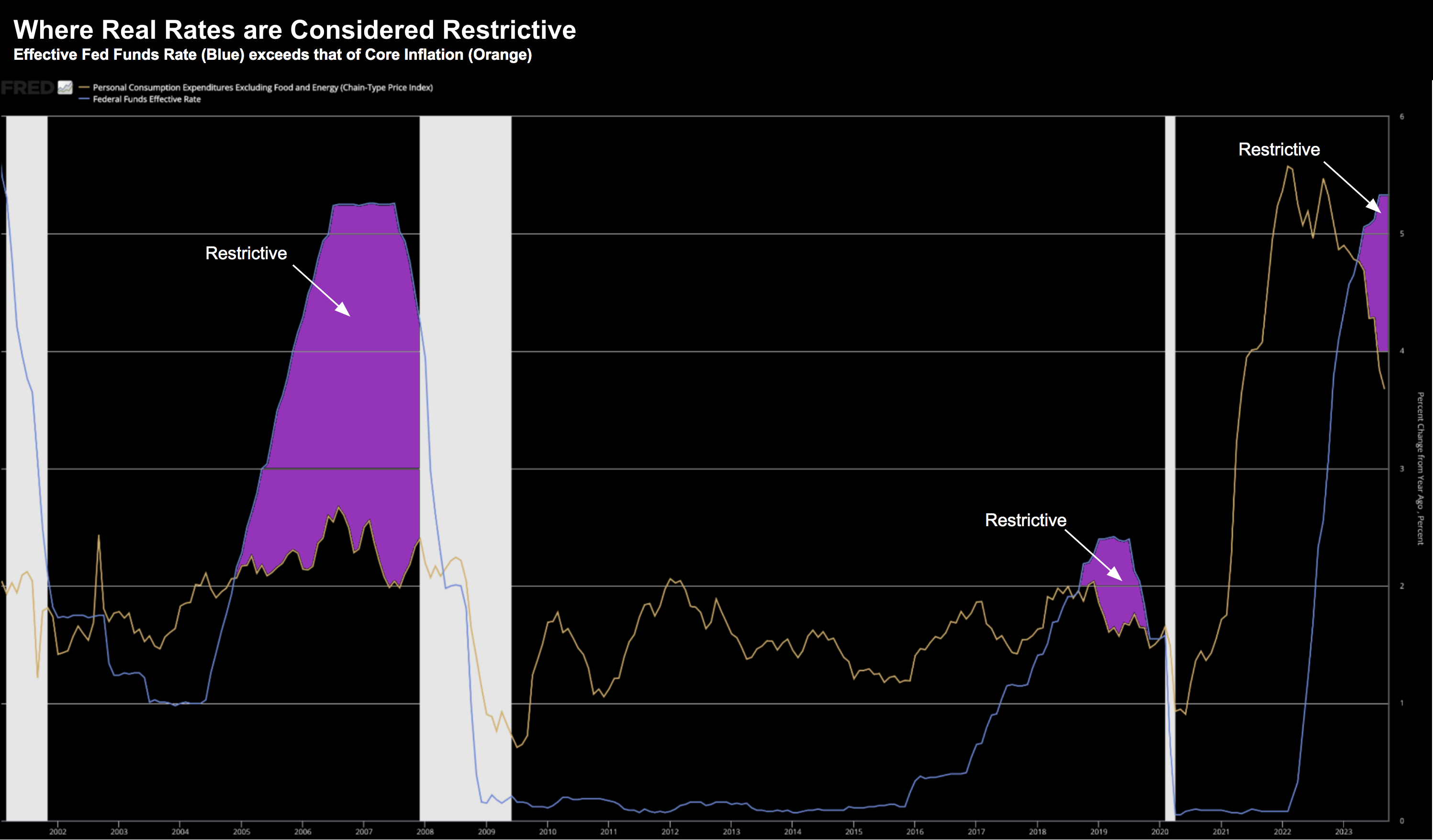

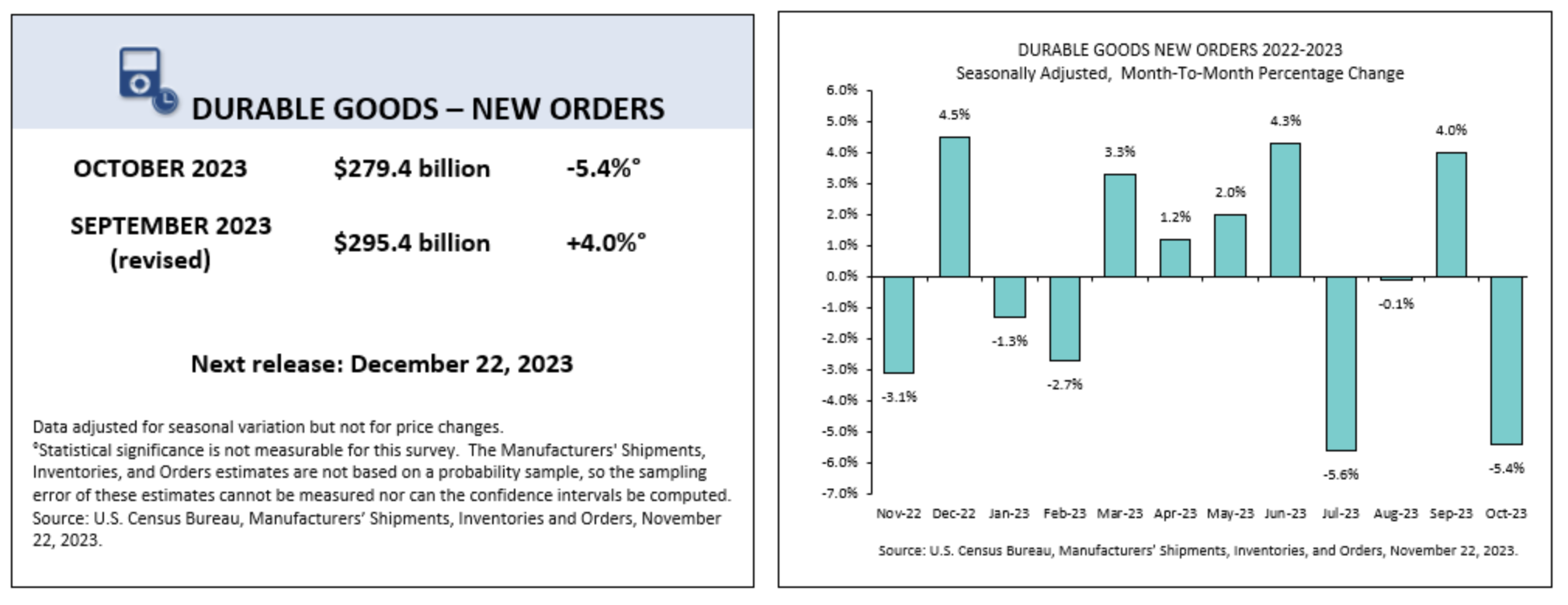

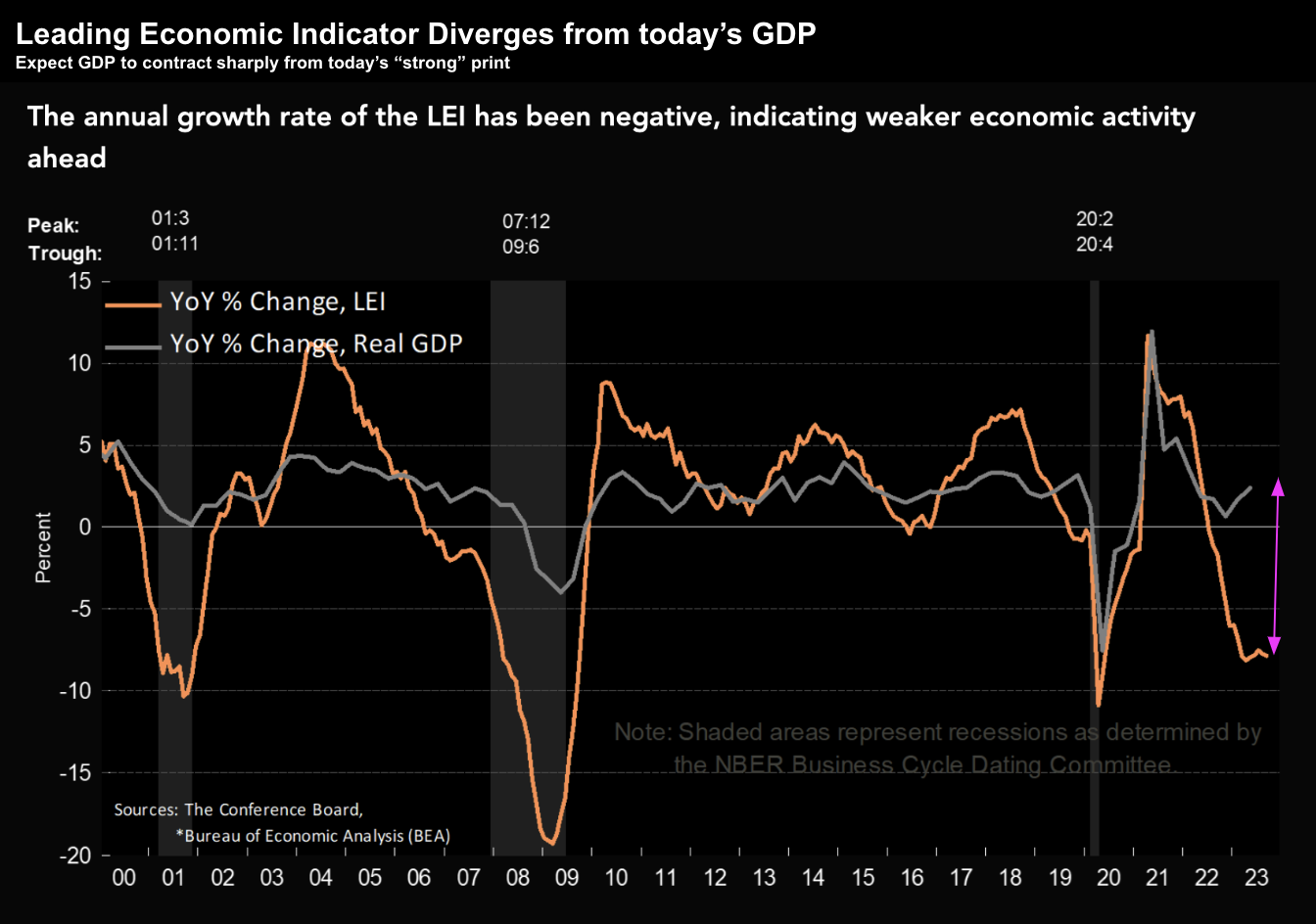

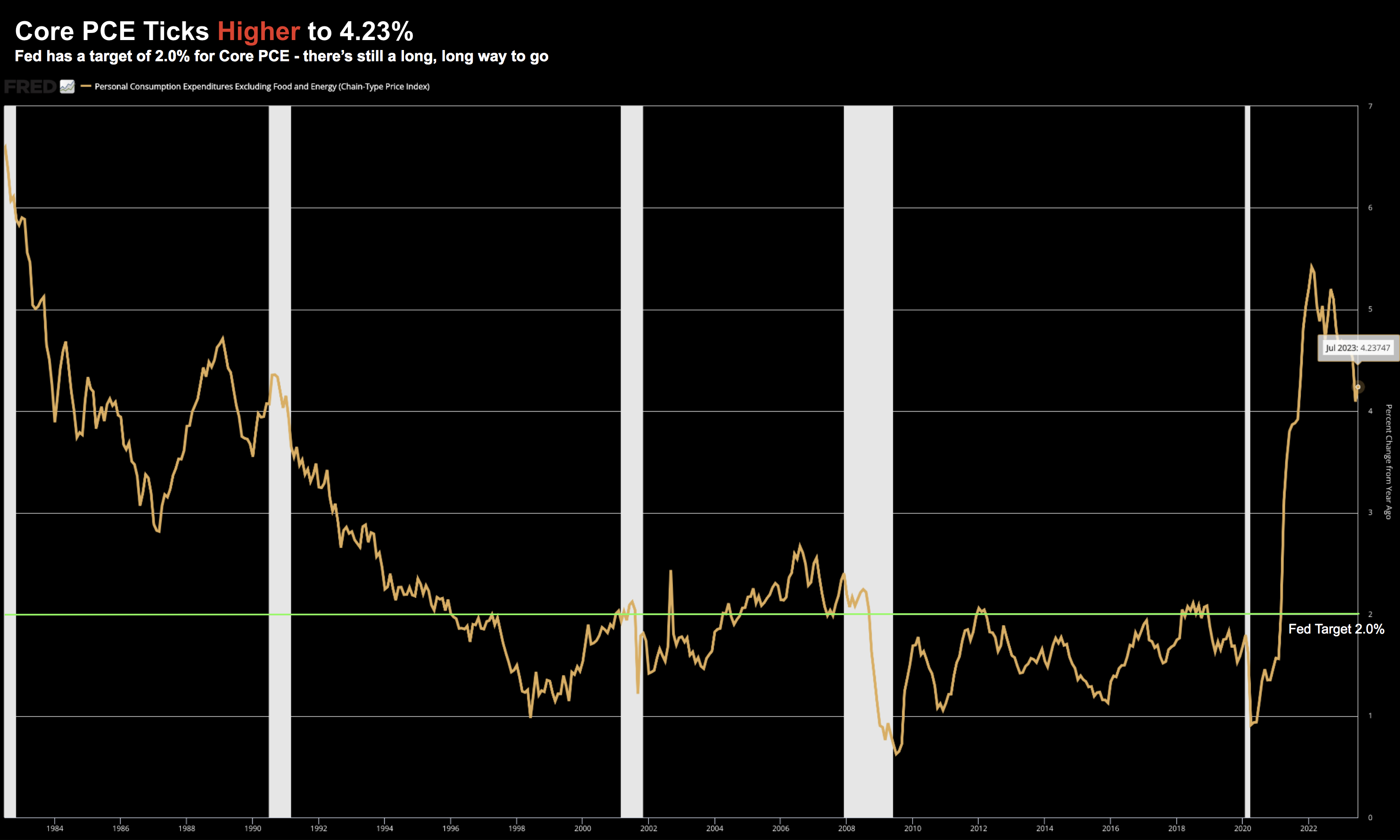

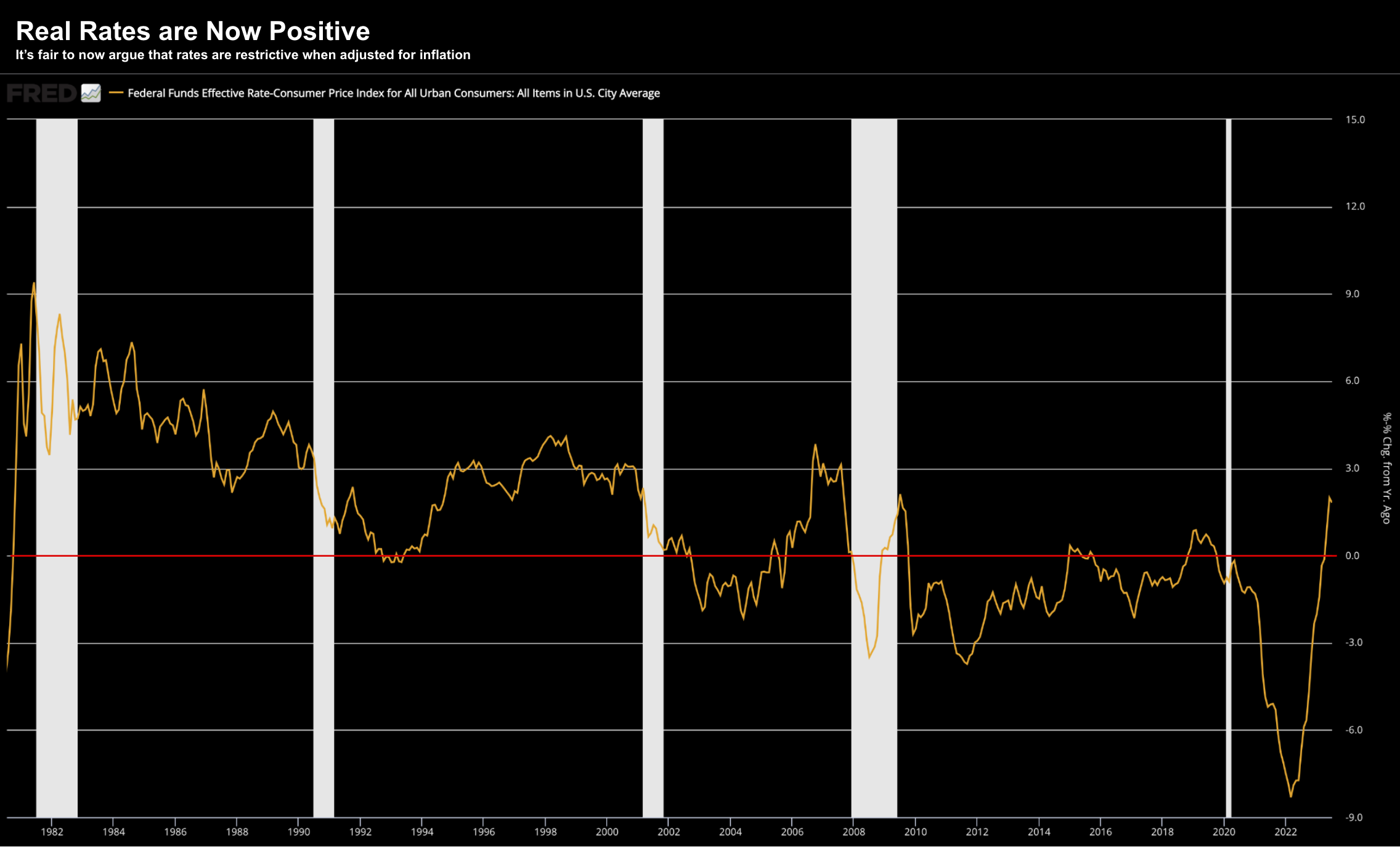

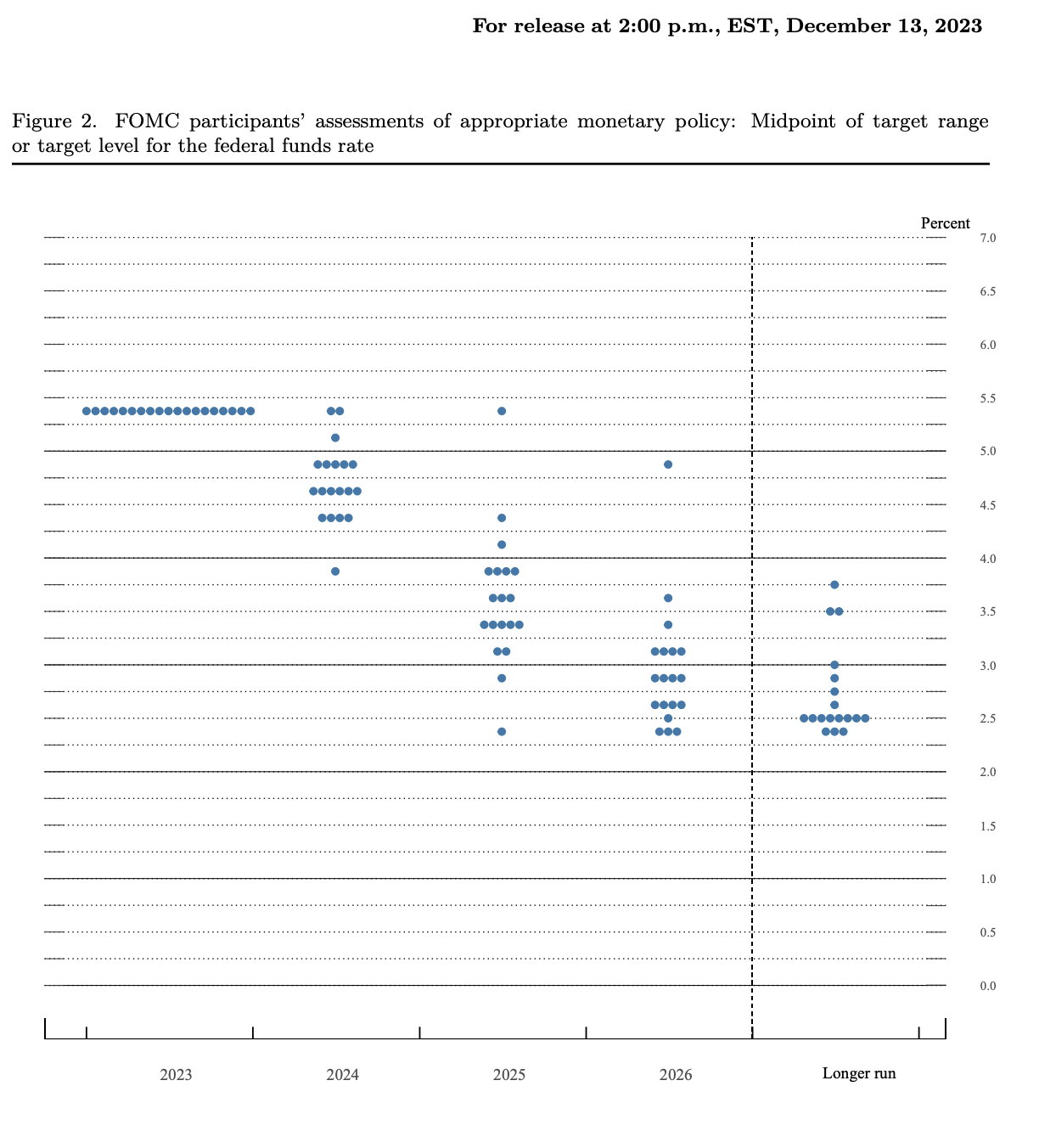

Only two weeks ago Fed Chair Powell said "the FOMC are not thinking about rate cuts". And it was premature to conclude with confidence they are at a sufficiently restrictive level. Well forget all that. Powell performed one of the more remarkable pivots ever seen from the Fed. He pivoted 180 degrees from his sentiment barely 14 days ago. Powell is now talking three rate cuts next year and the Fed have essentially "won the battle" over inflation. My take is the Fed is now more concerned about the business cycle; i.e., recession. There is a reason the Fed will cut - and that is the risk of dislocation in the economy (i.e., recession)