Fed: Don’t Expect Rate Cuts

Fed: Don’t Expect Rate Cuts

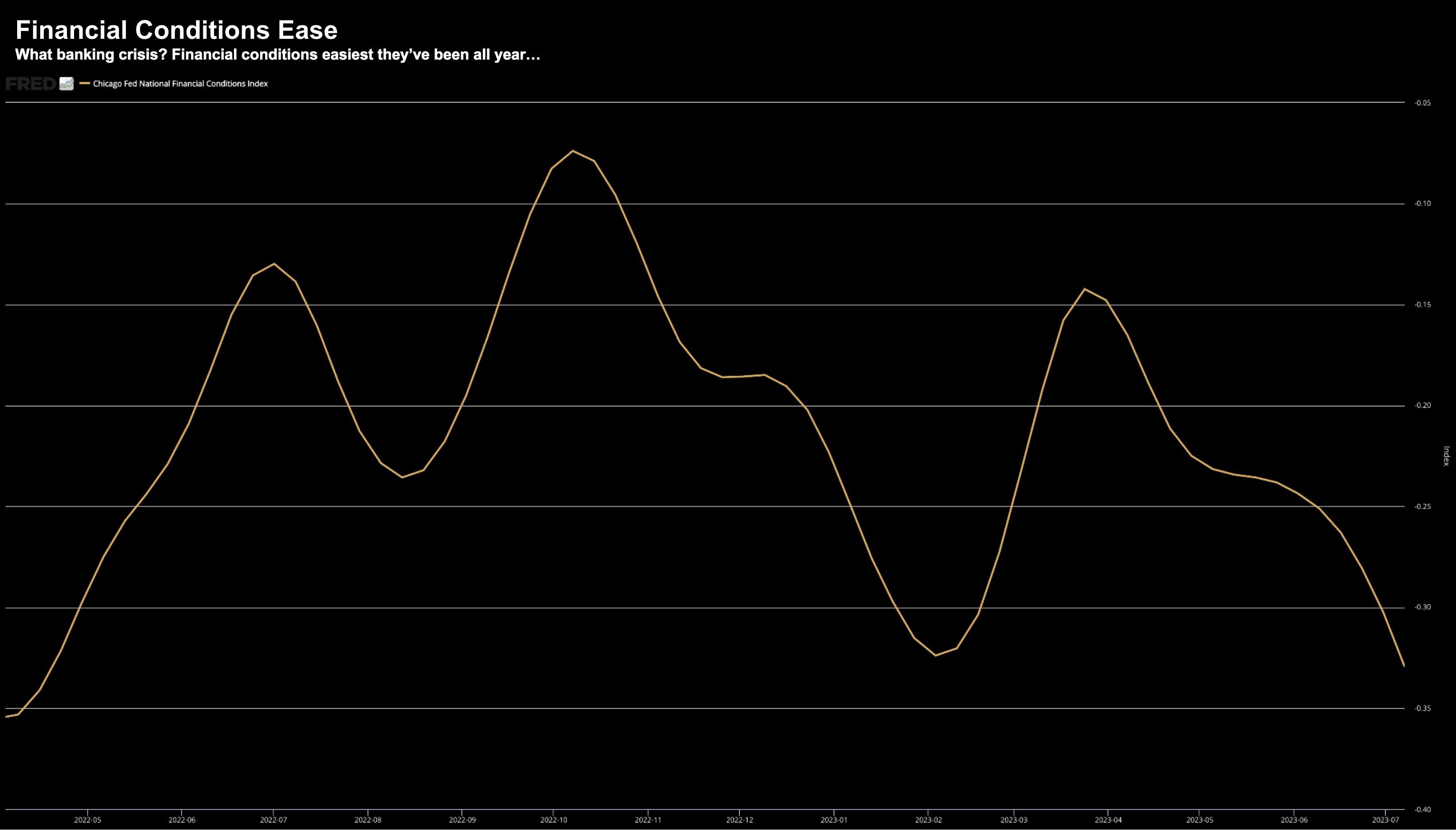

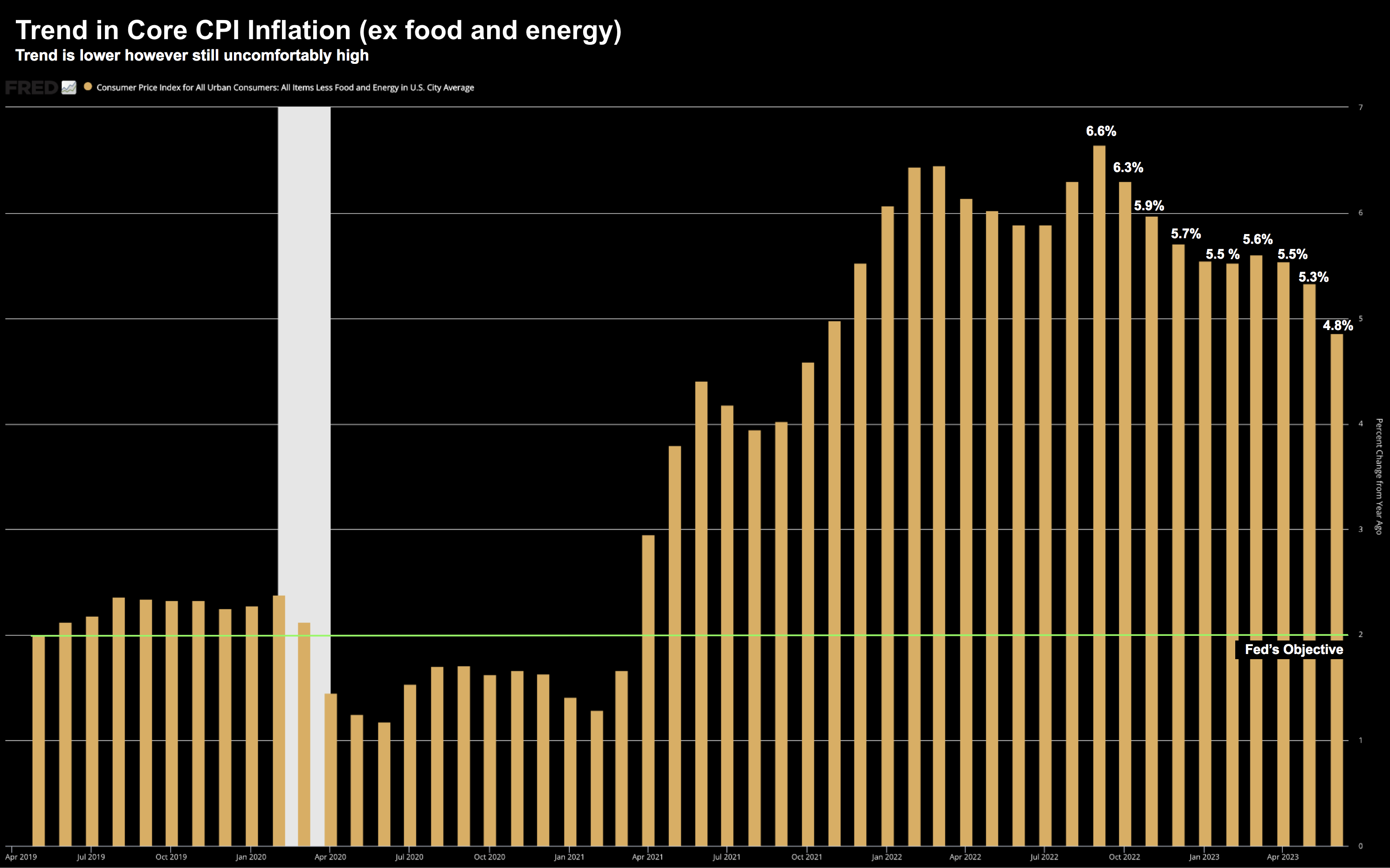

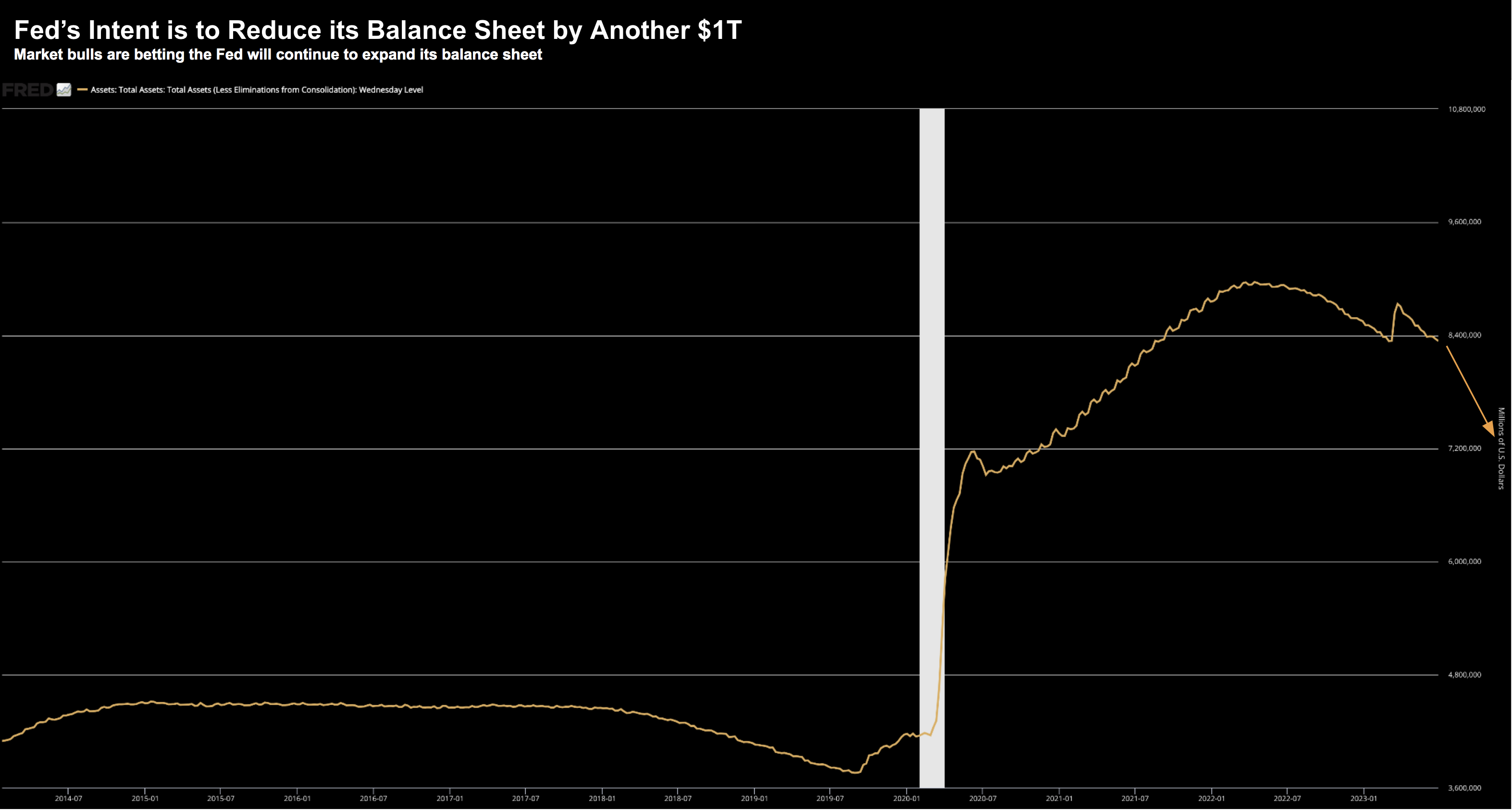

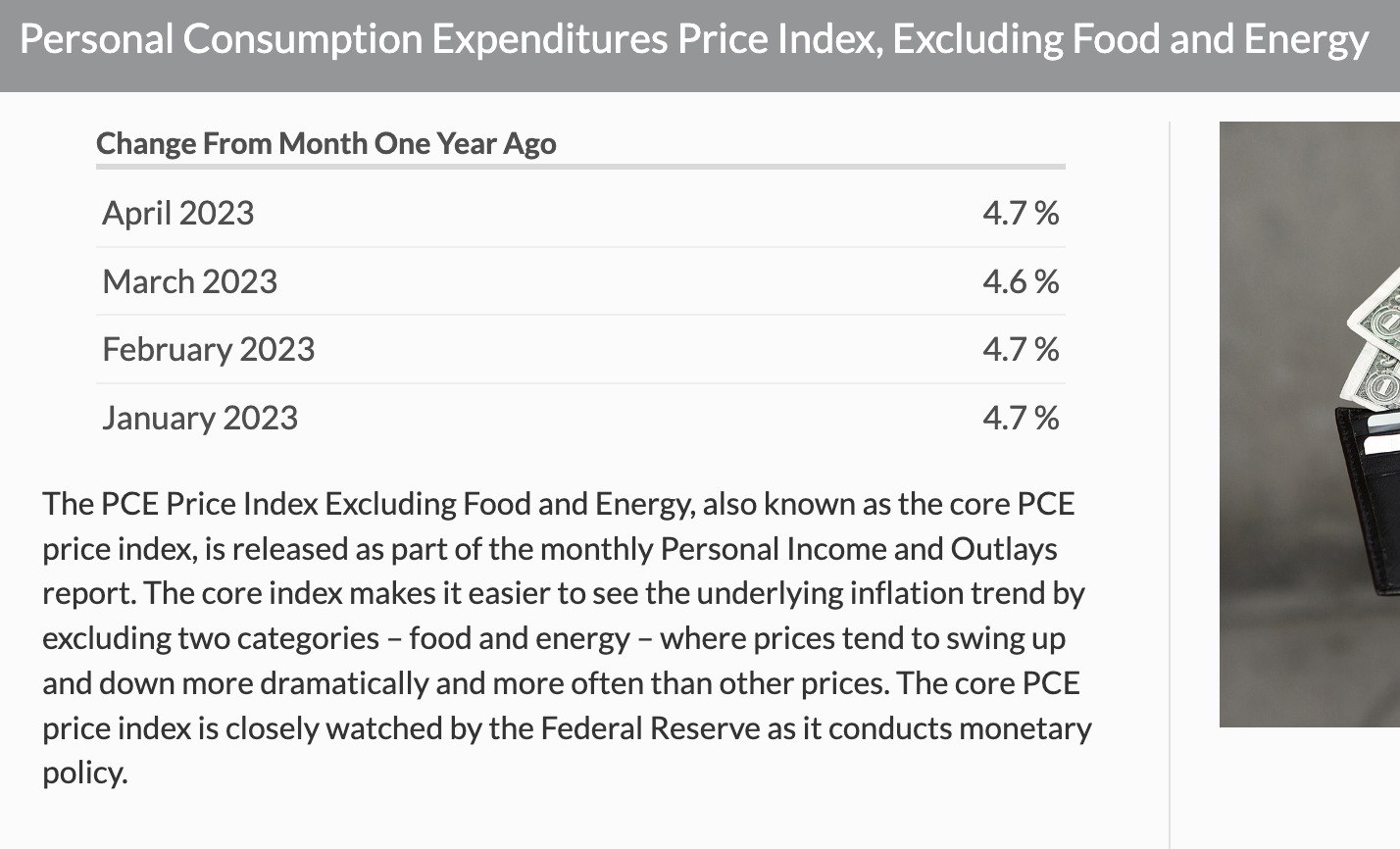

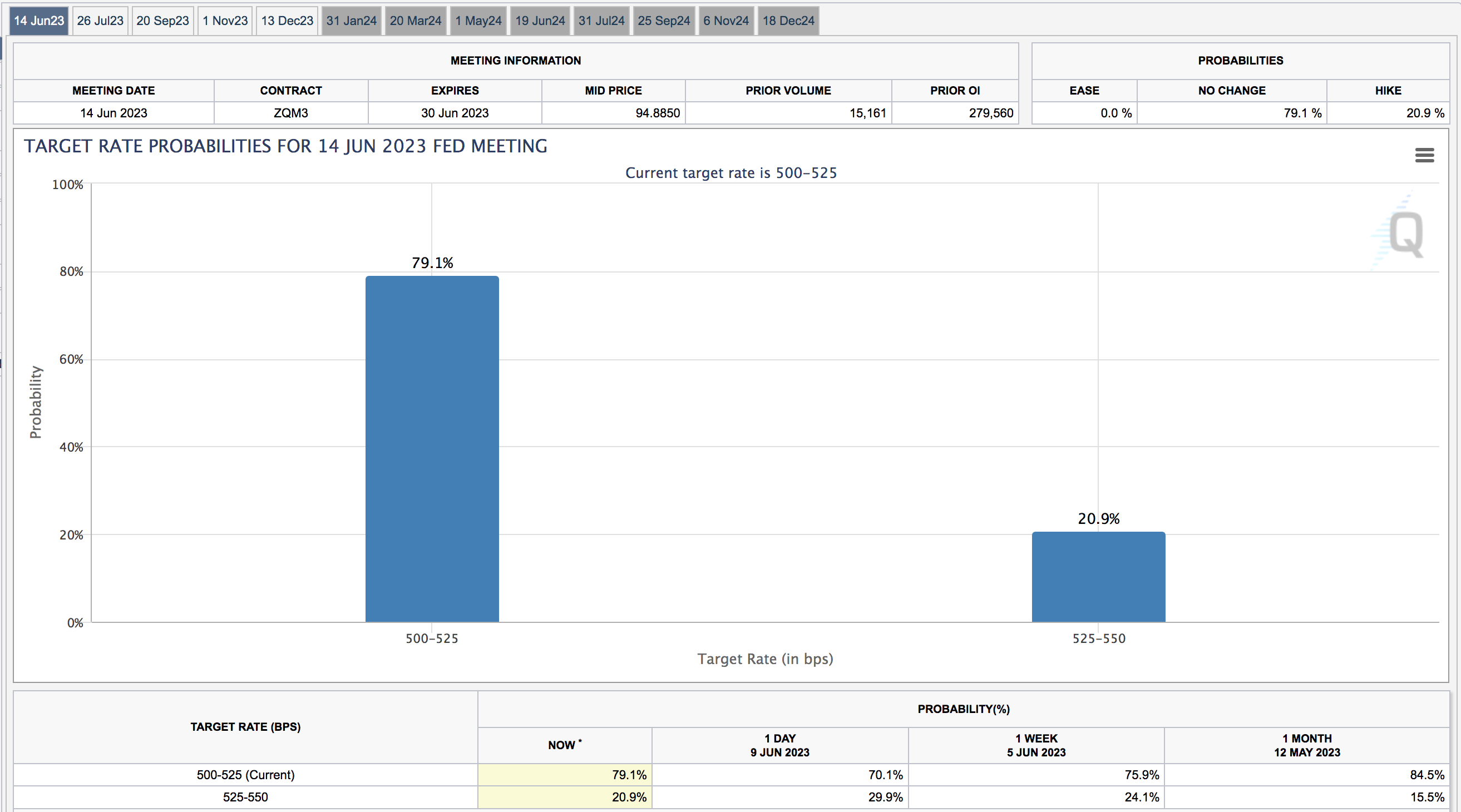

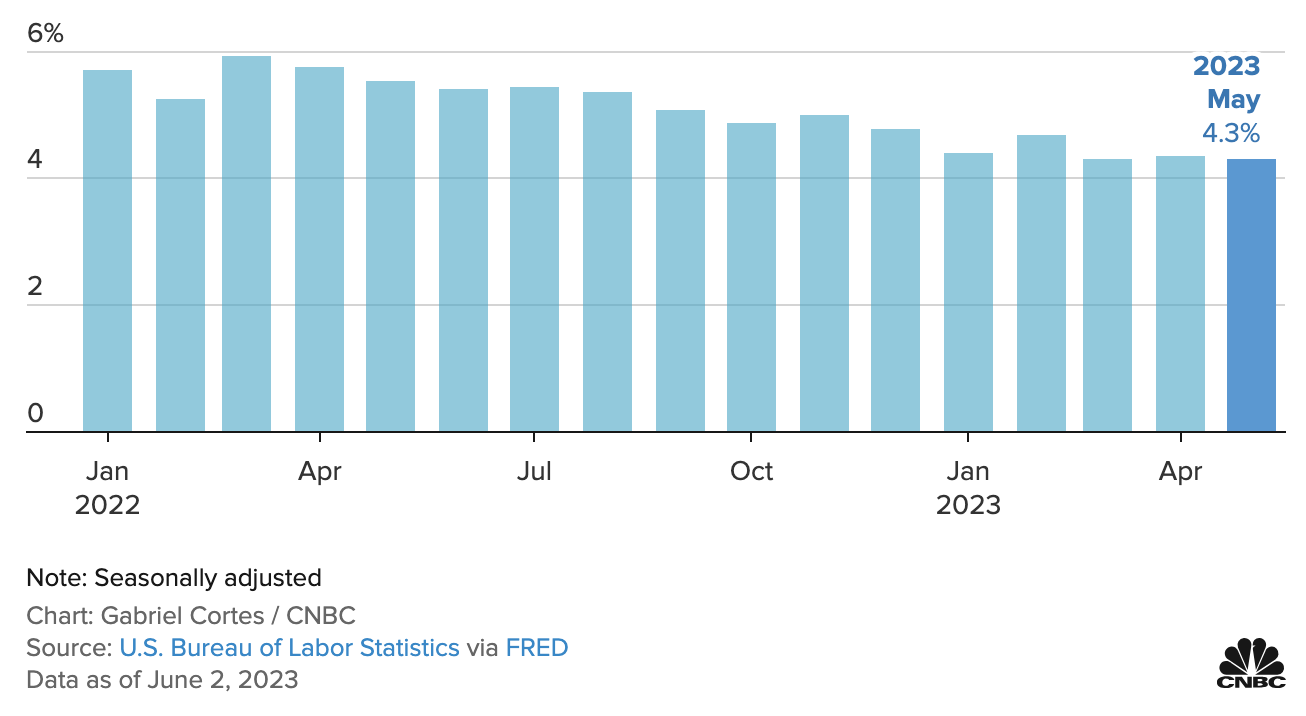

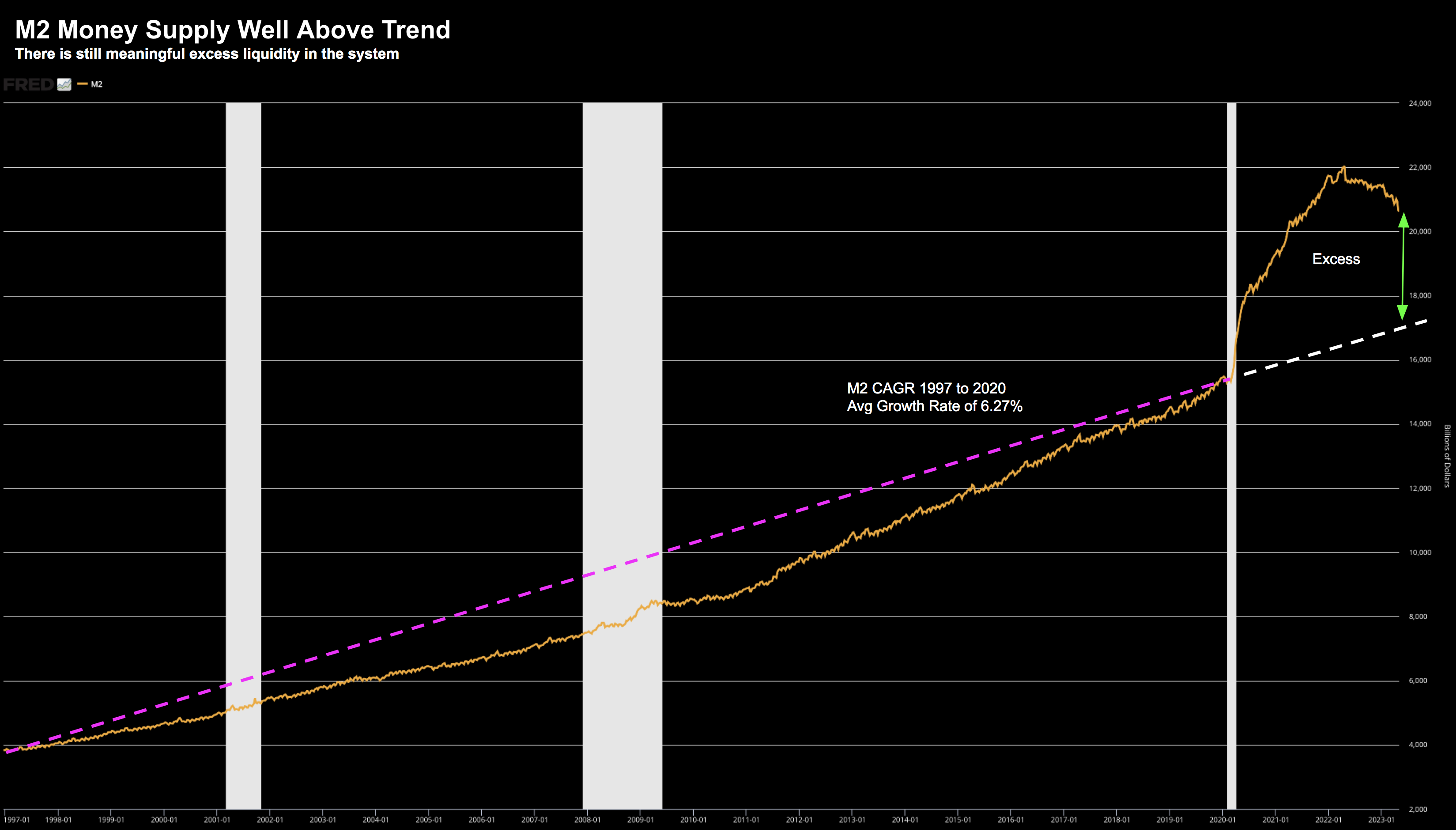

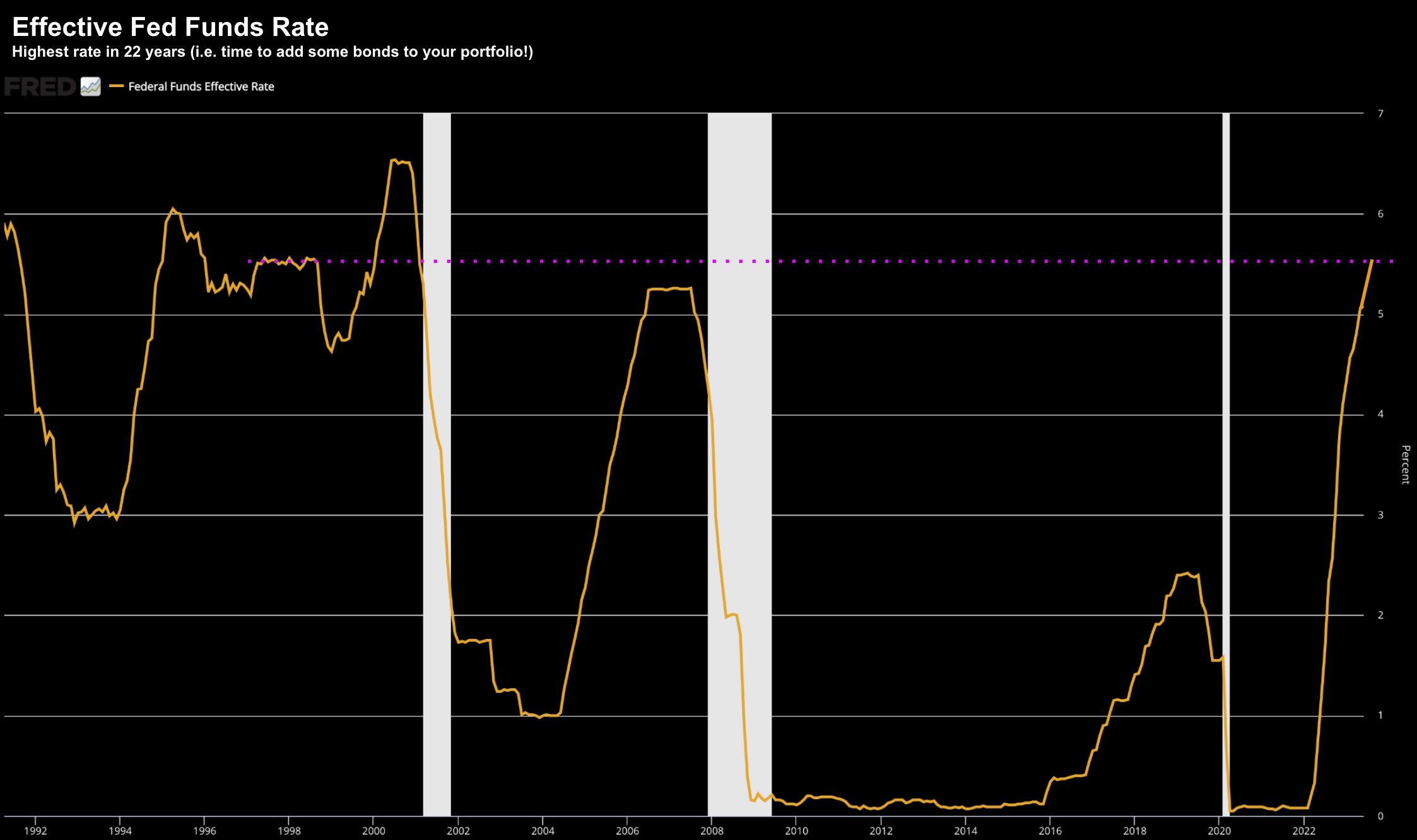

If nothing else, I took one thing away from this week's Fed decision: don't expect rate cuts anytime soon. The market had priced in a 25 bps rate increase - with the Fed flagging it well in advance. And the Fed didn't disappoint. But what they were hoping for was more of "dovish hike" It wasn't coming... Powell is keeping things tight-lip. And he has good reason to... he (like the market) simply doesn't know what lies ahead. And whilst things appear to be trending in the right direction - it's far too premature to call a victory over unwanted inflation