‘INVESTCON 5’ – Trim Growth and Get Defensive

‘INVESTCON 5’ – Trim Growth and Get Defensive

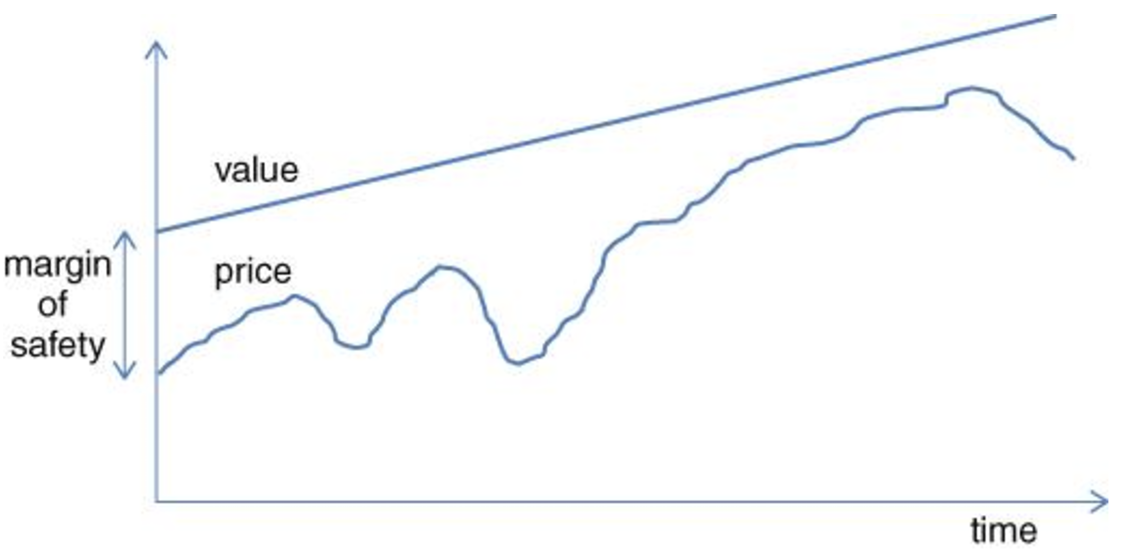

Howard Marks reminds us, true success lies in understanding the critical difference between price and value. Price is what you pay for an asset—a number driven by market sentiment, optimism, and fear. Value, on the other hand, is what you get—an asset's inherent worth based on its ability to generate future cash flows. While markets may act as a voting machine in the short term, pushing prices to extremes, they behave like a weighing machine over the long run, eventually reflecting true value. By focusing on value over price, investors can avoid costly mistakes.