Investor’s (Valid) Capex Concerns w/AI

Investor’s (Valid) Capex Concerns w/AI

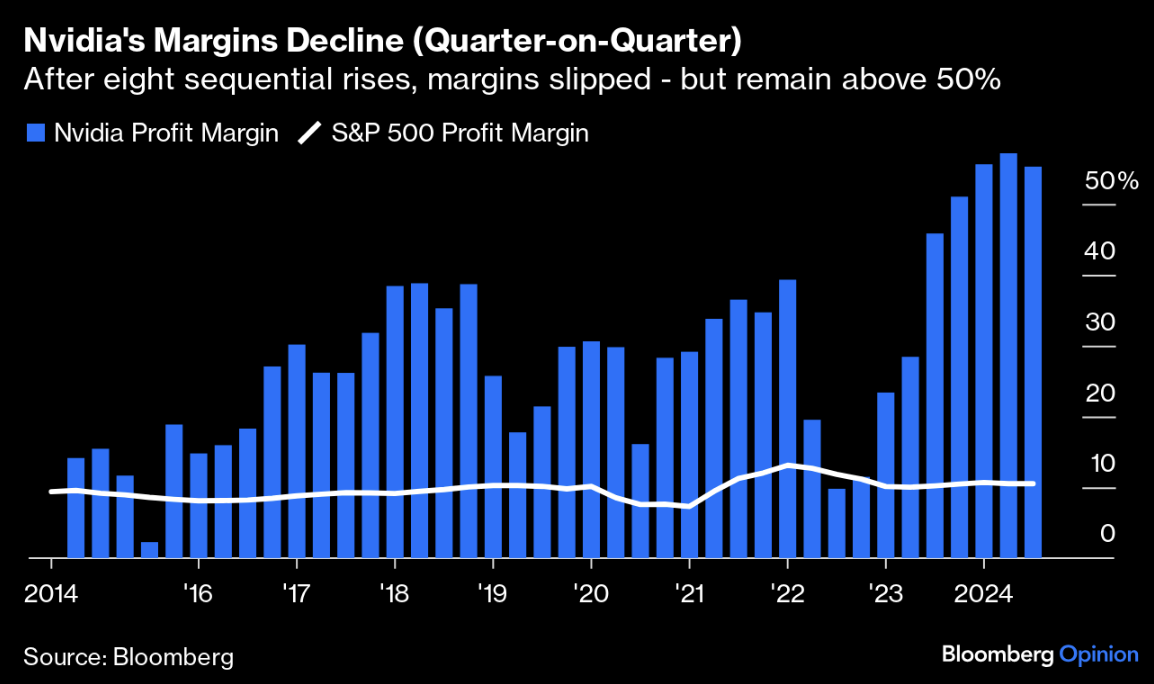

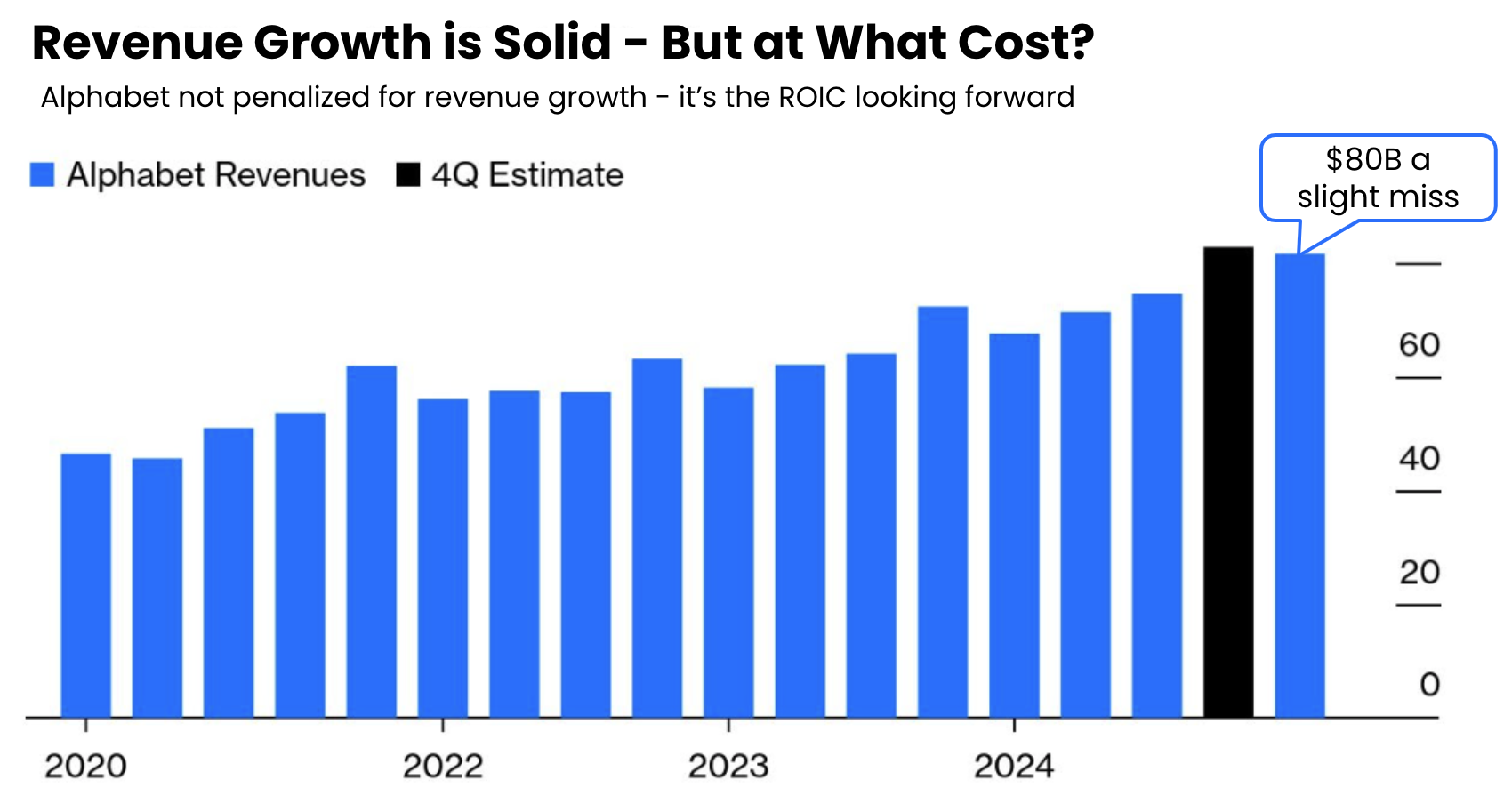

Large-cap tech's planned capex for 2025 is worrying investors. What will be the return on that capital? Never before have these companies made such large bets. Before DeepSeek, it was assumed the tech giants - with their deep pockets and almost limitless resources - would enjoy a wide moat in the AI arena. And from there, that justified the high valuation multiples. Not now. DeepSeek’s arrival challenges those long held assumptions (and valuations).