Time to be Greedy or Fearful?

Time to be Greedy or Fearful?

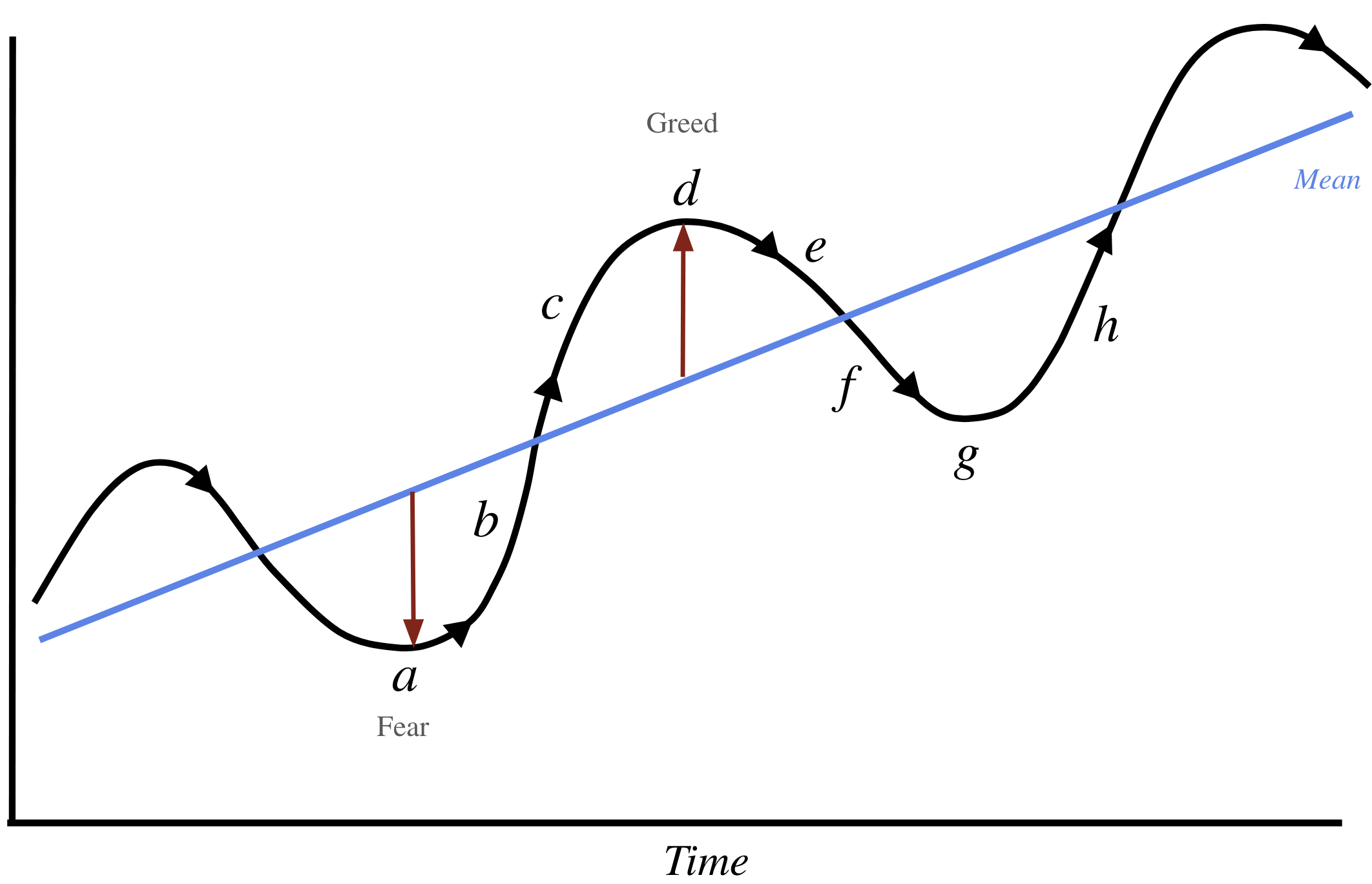

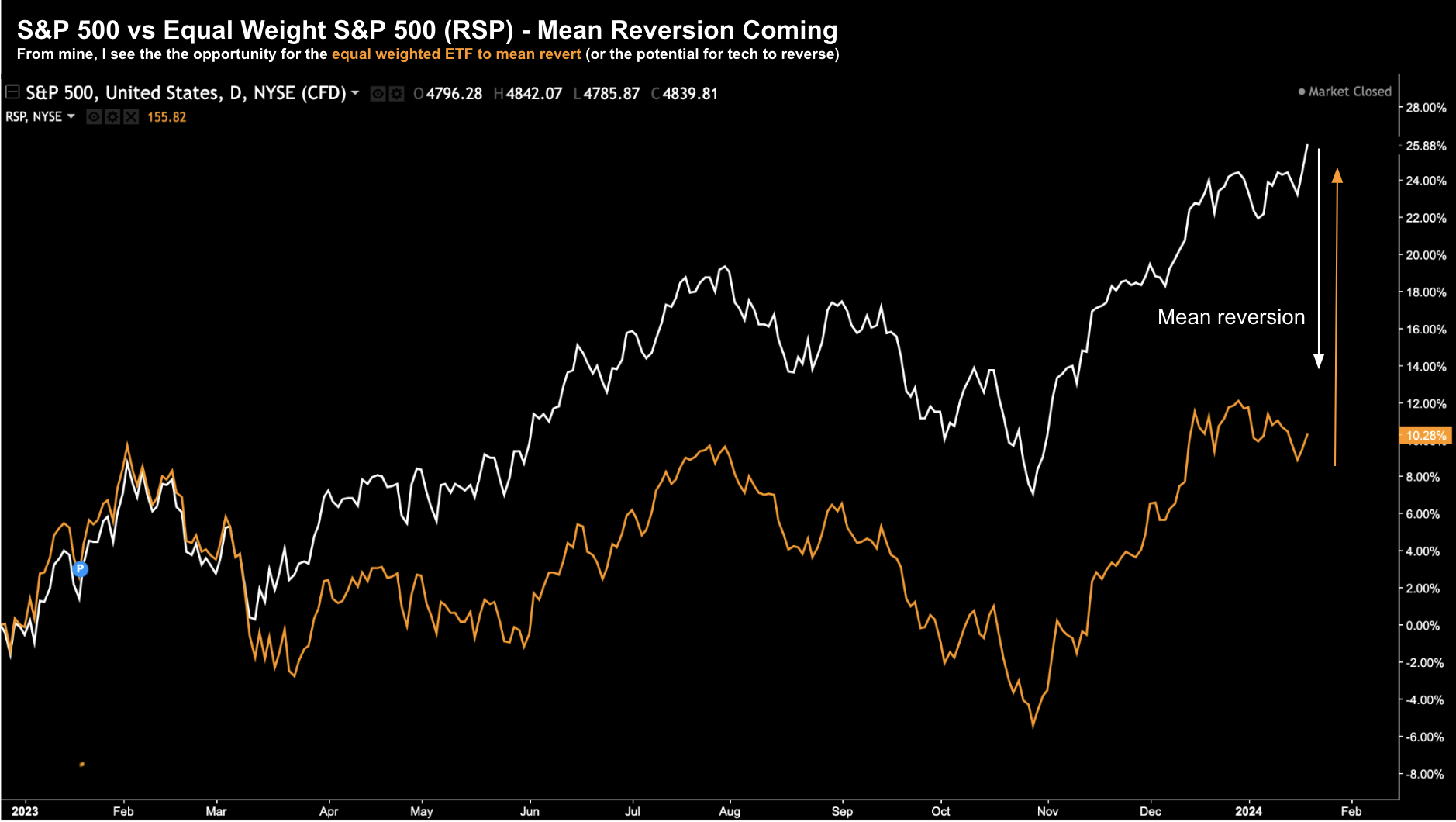

Warren Buffett is famous for saying "be fearful when others are greedy; and be greedy when they are fearful". Today the Oracle of Omaha sits on a record $325B in cash - a record for Buffett - and over 30% of his entire portfolio. Investor enthusiasm today is wildly optimistic about future growth and earnings post the election result. And whilst surging prices are a sign of confidence - markets are also notoriously fickle...