“Heads I Win and Tails You Lose”

“Heads I Win and Tails You Lose”

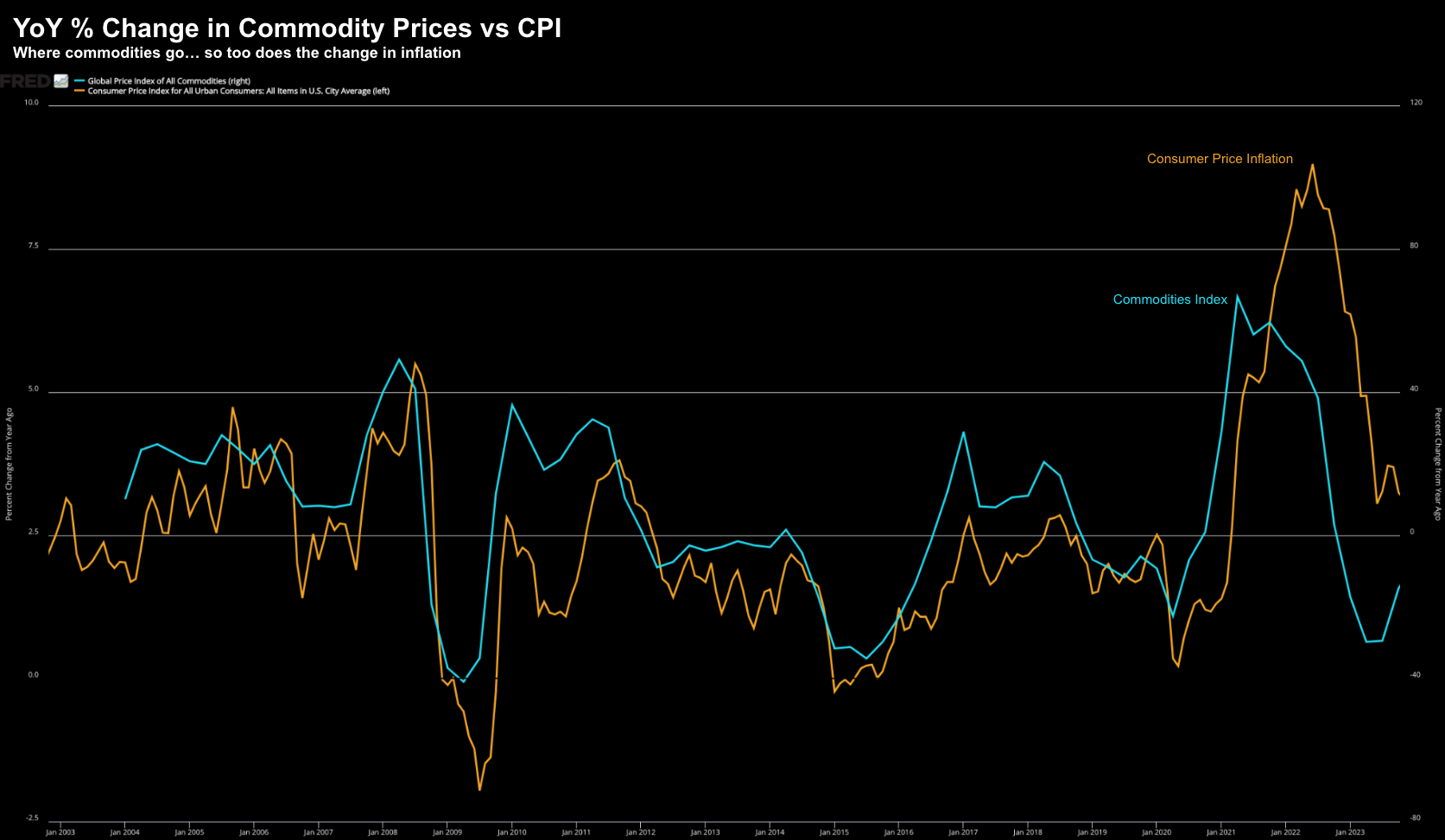

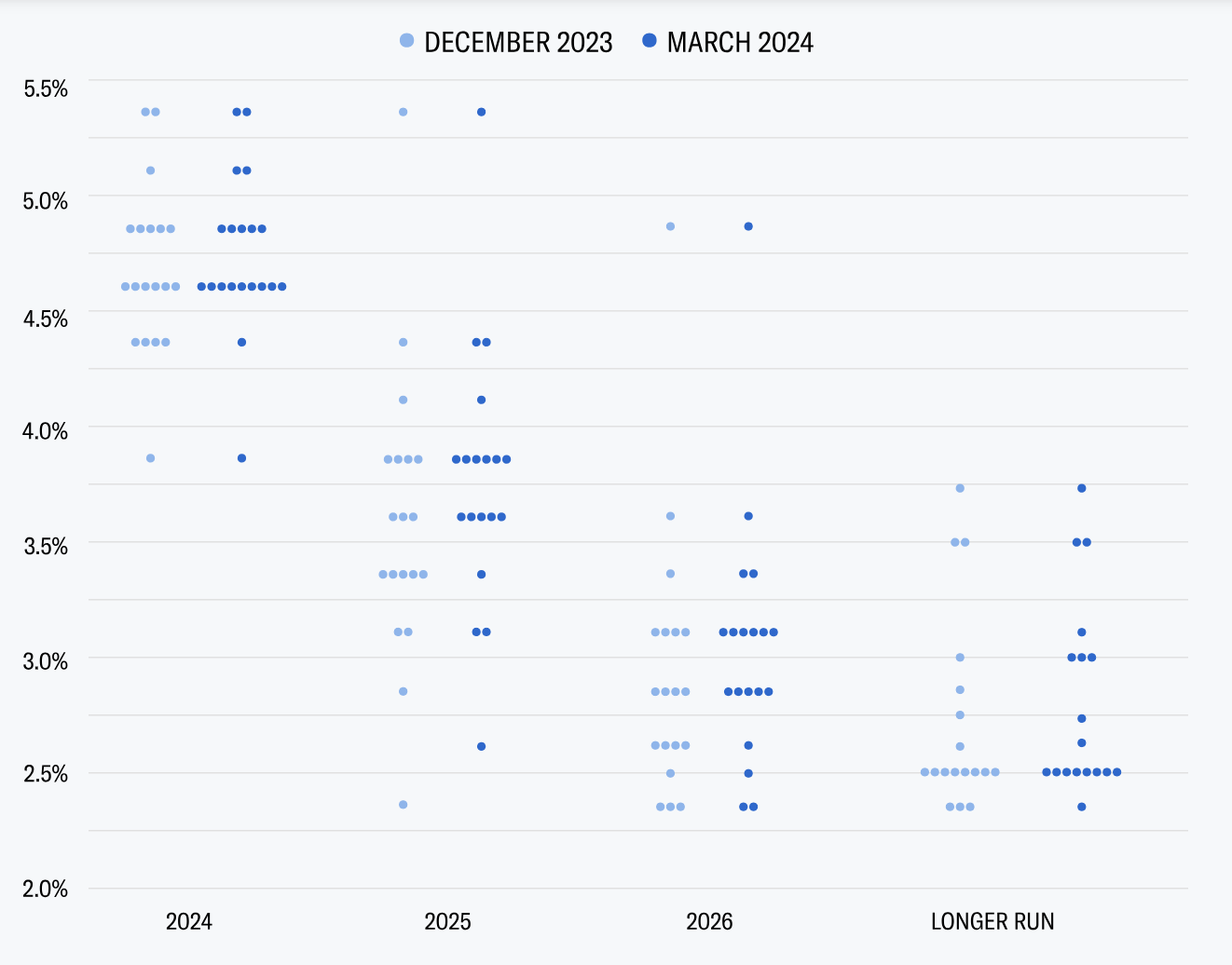

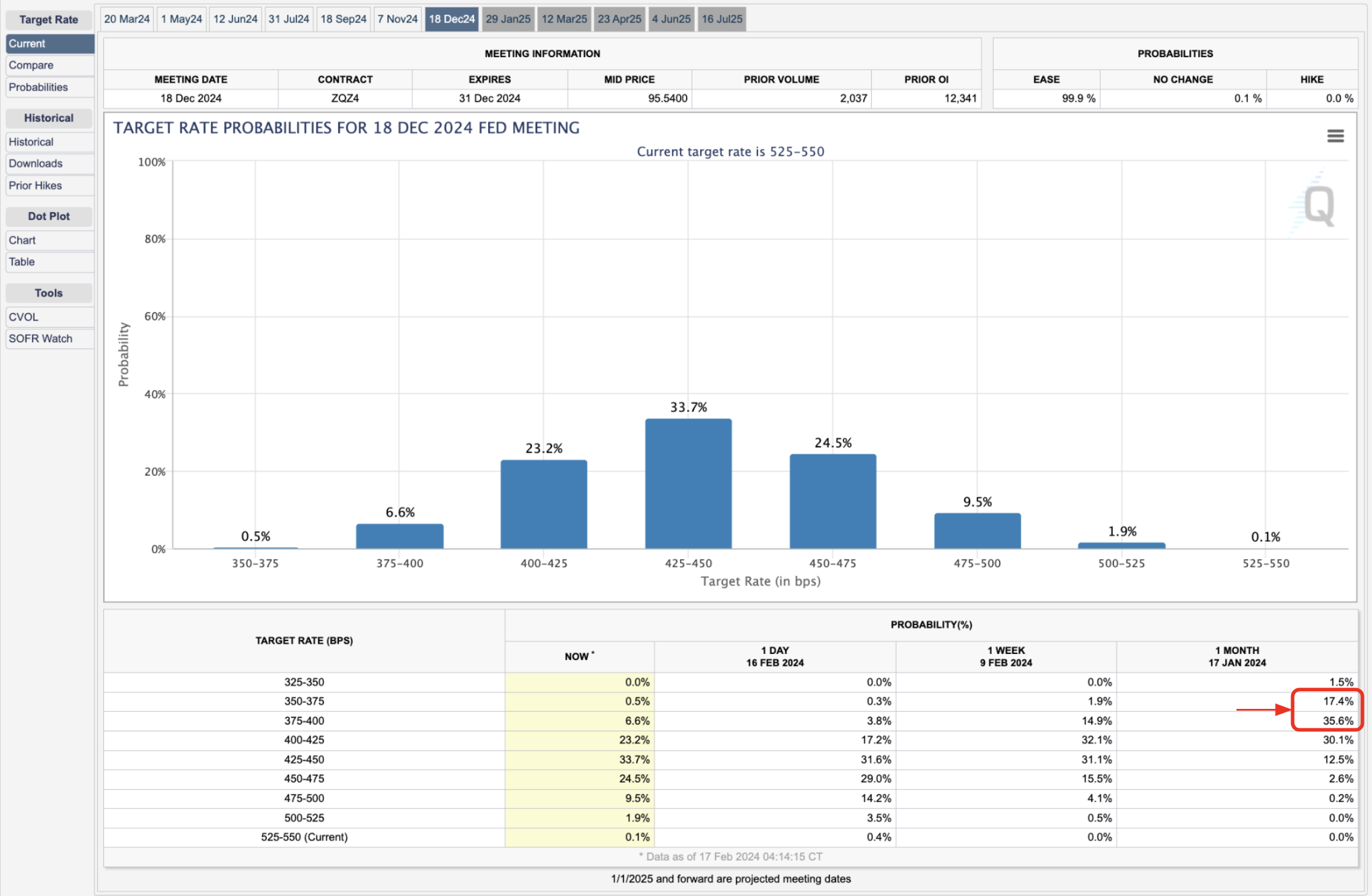

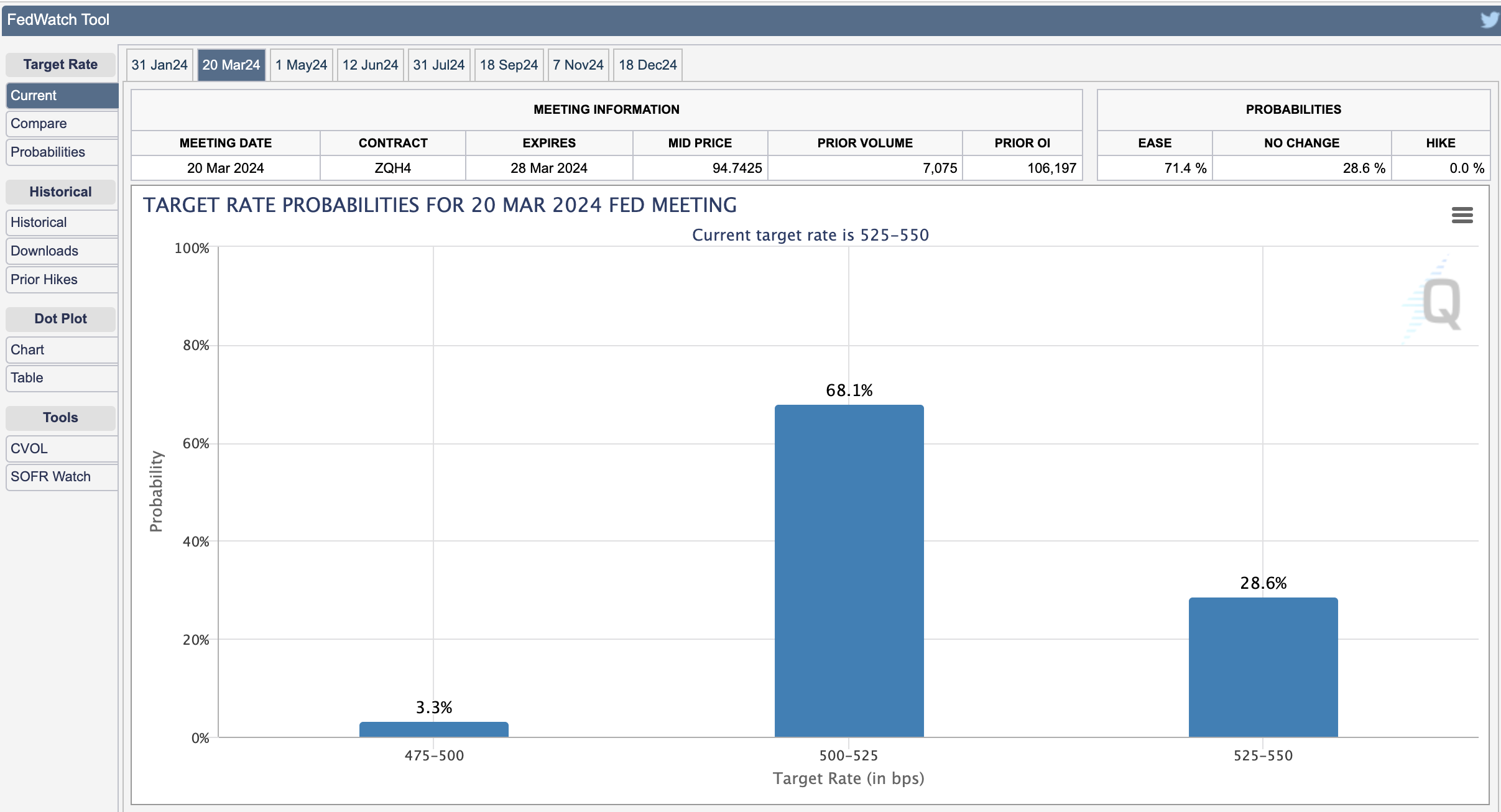

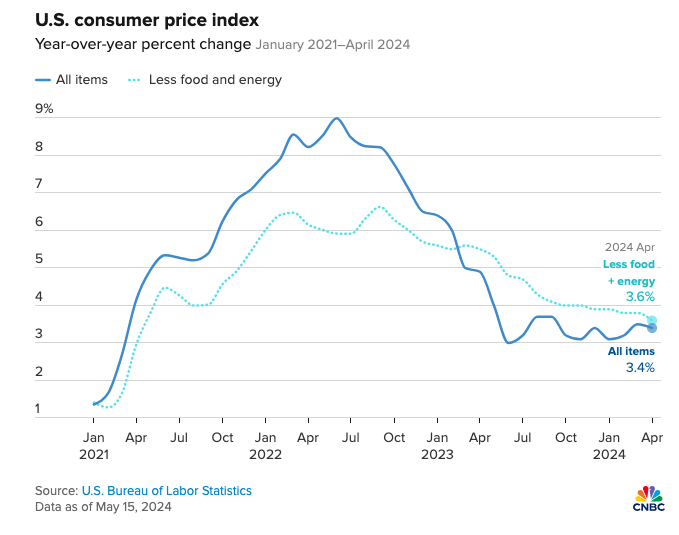

After almost three decades at this game - something you learn is not to fight the tape. Trade against momentum at your own peril. Consider the news today... it was both bad and good. I will start with the (perceived) 'good'. The Consumer Price Index (CPI) was slightly cooler than expected. And whilst it's still a long way above the Fed's target of 2.0% - the market was thrilled it was only up 0.3% MoM and 3.4% YoY. Bond yields plunged and stocks ripped. Sure... 3.4% isn't great... but that's Main Street's problem... Wall Street doesn't care. However, the bad news was retail sales plunged. But wait a minute - that's also "good news" - as it could mean a more accommodative Fed. Heads I win and tails you lose.