Two Reasons the Fed Could Cut Rates

Two Reasons the Fed Could Cut Rates

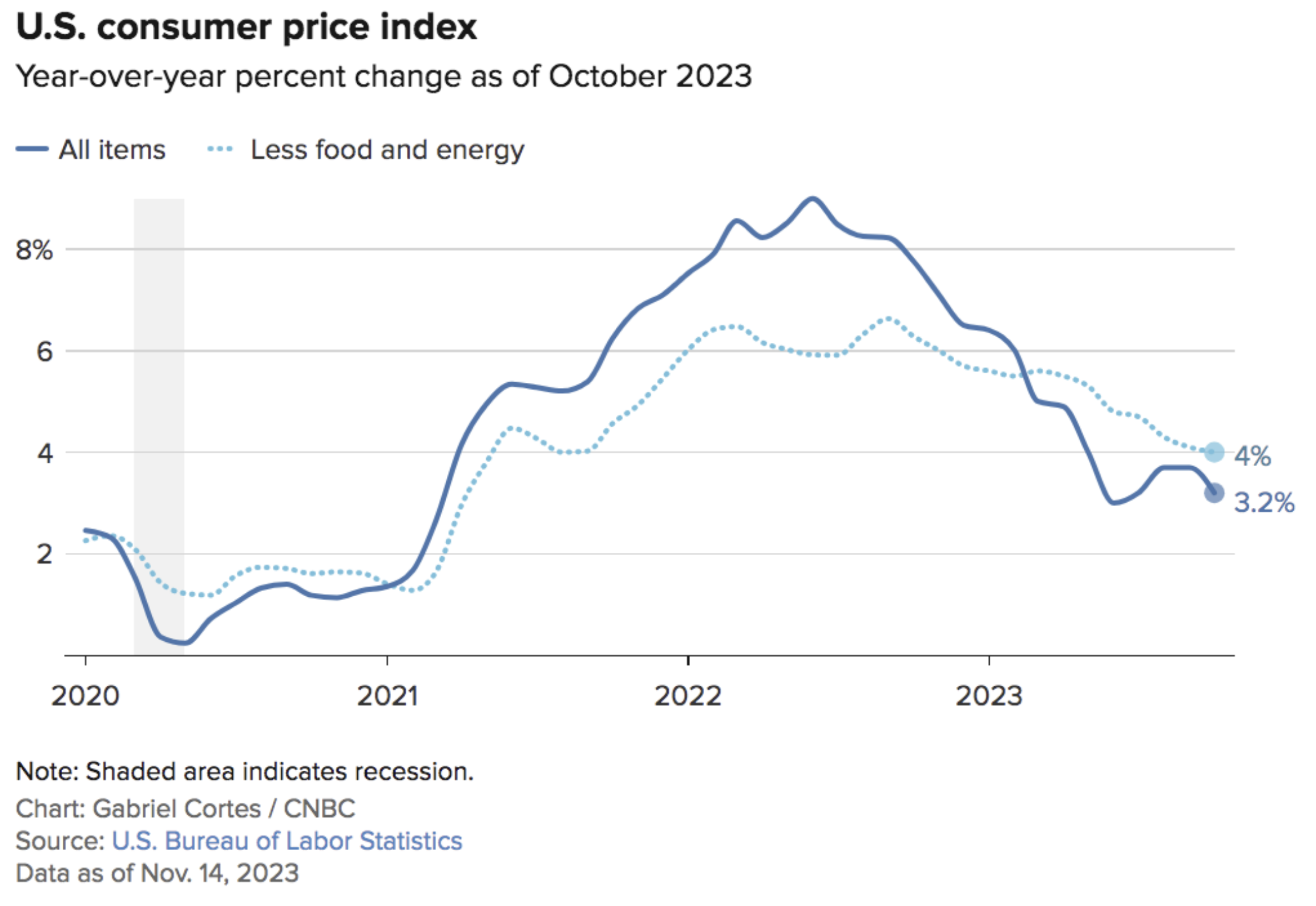

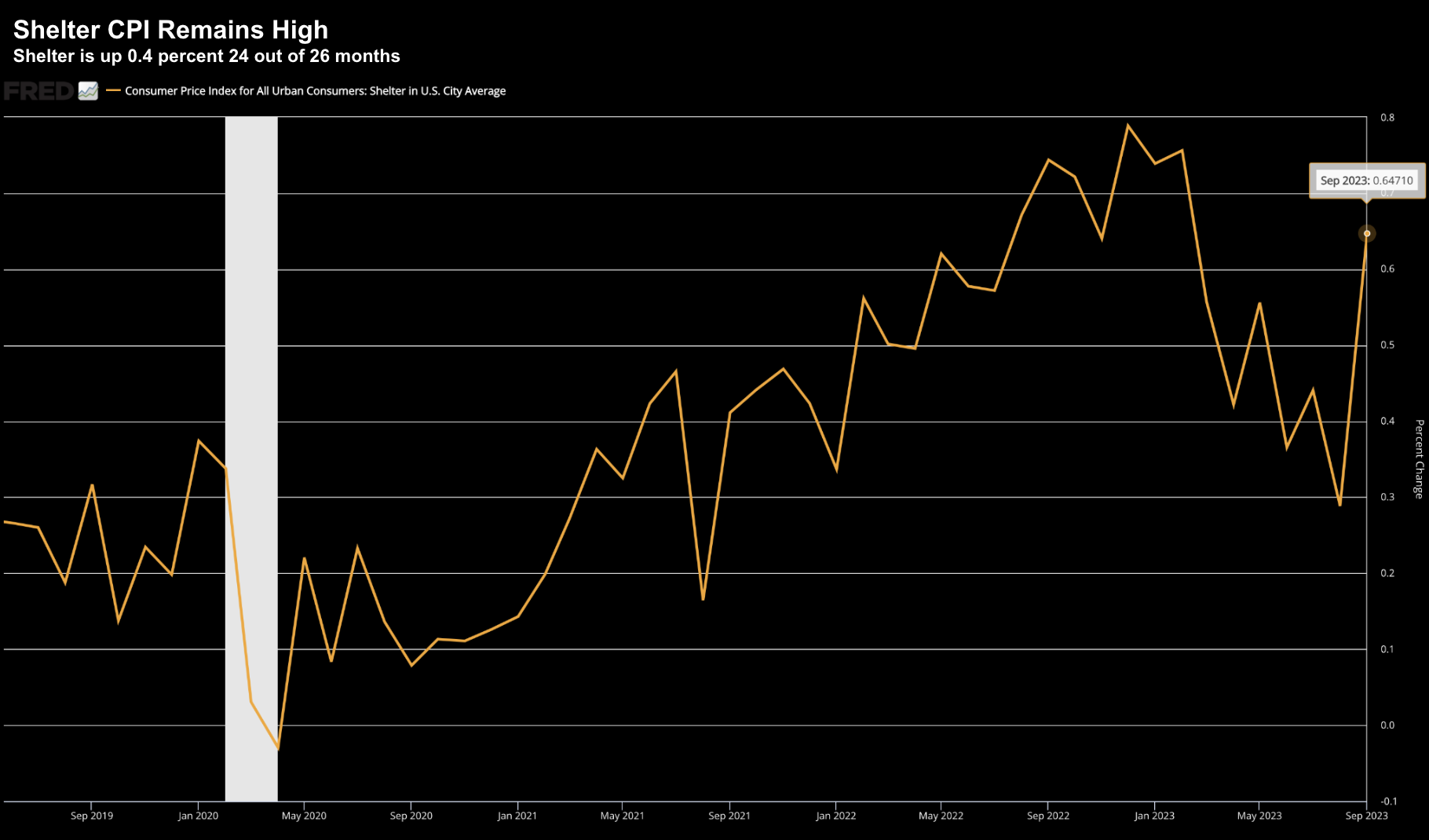

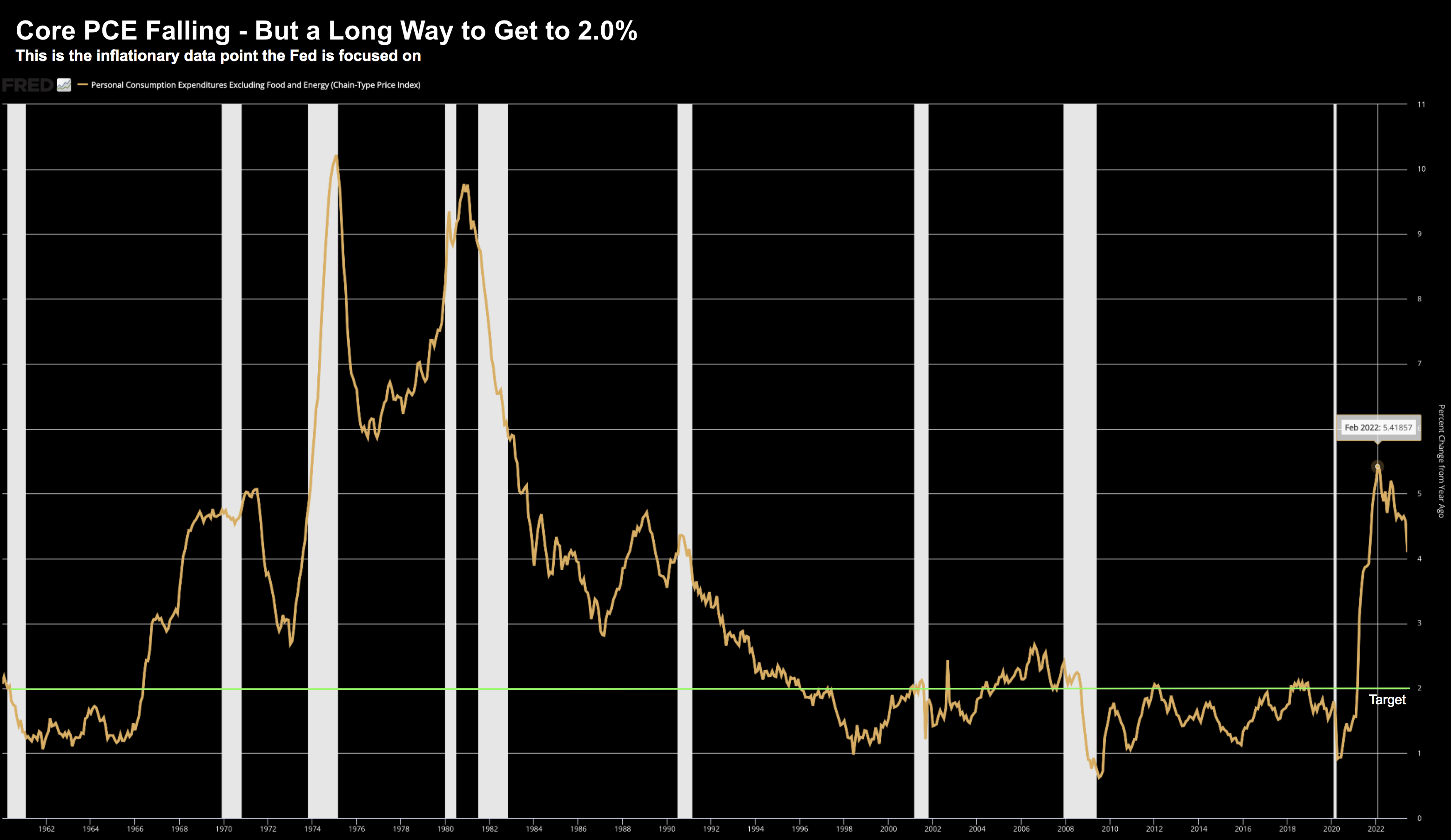

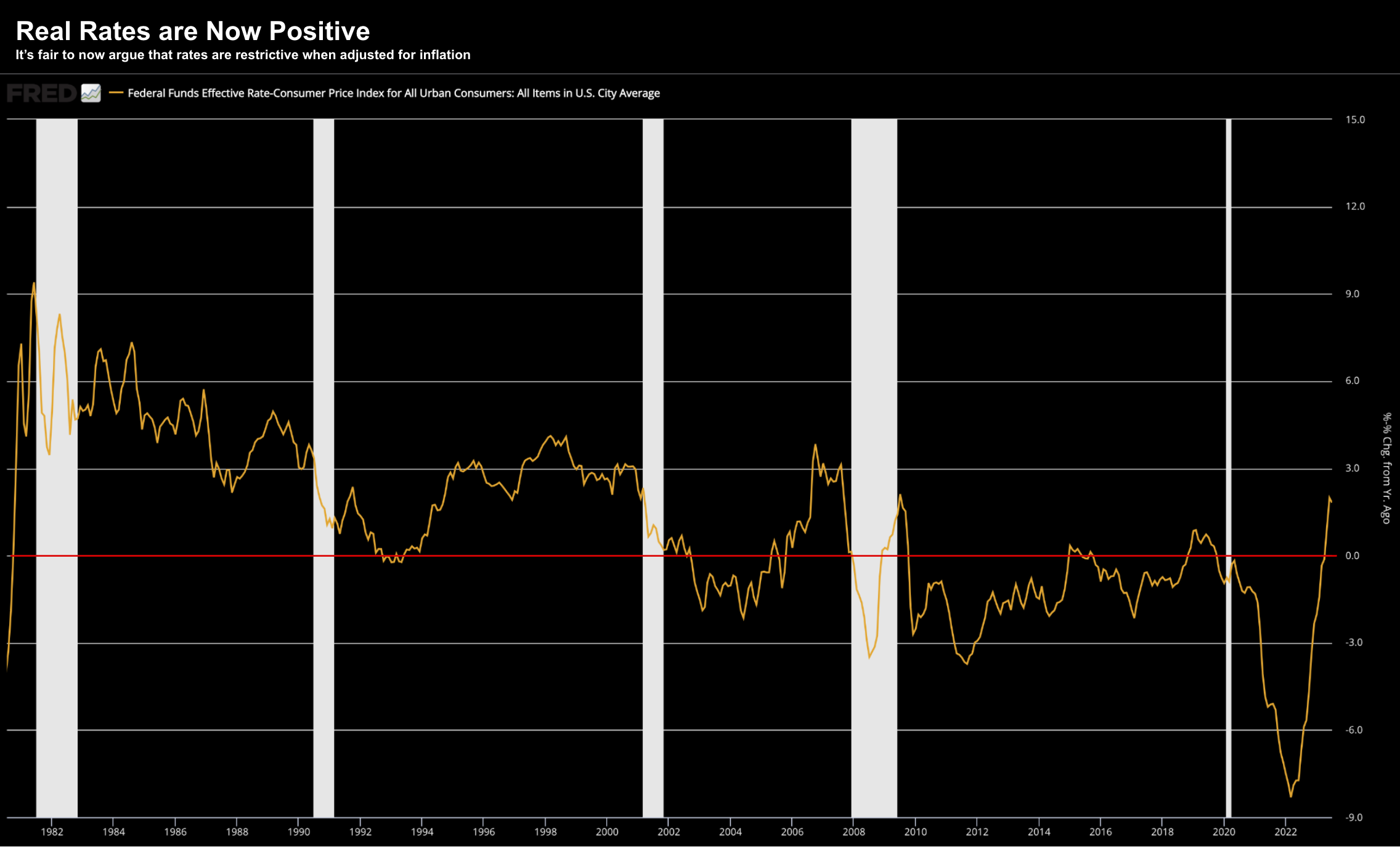

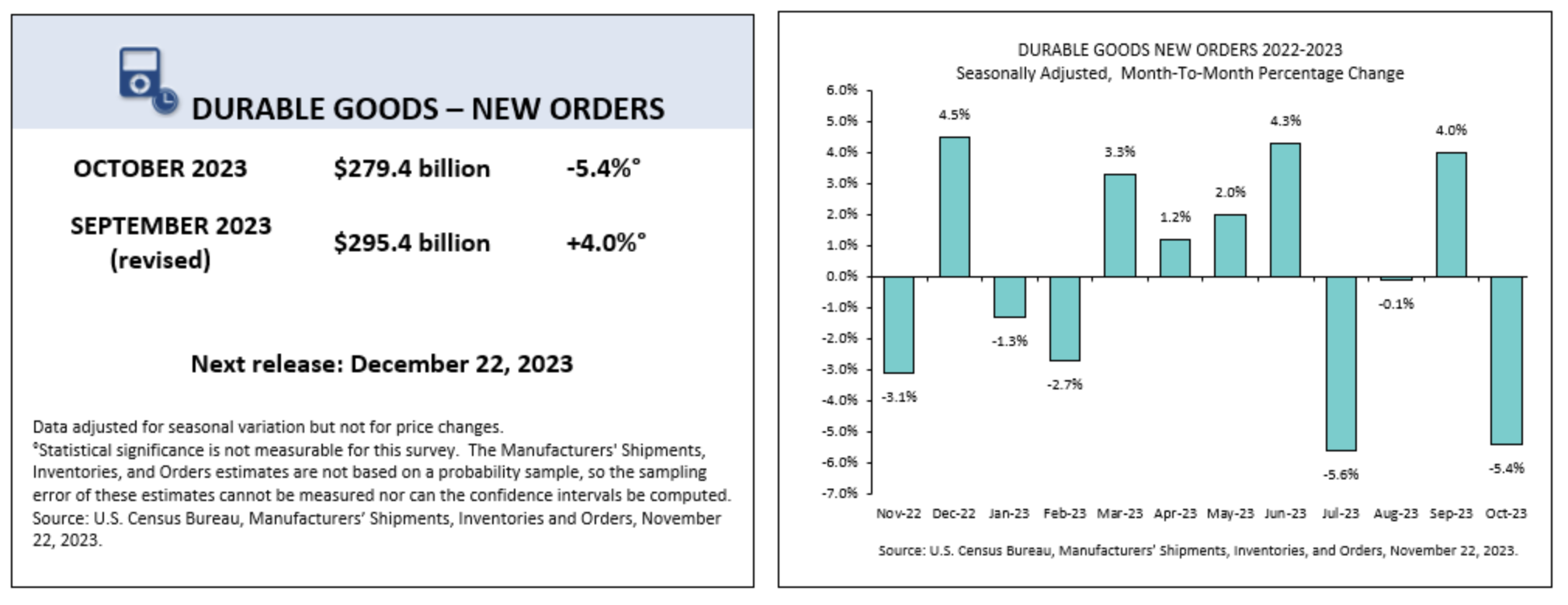

The latest set of economic numbers support a 'goldilocks' scenario for stocks. For example, durable goods orders continue to fall (a positive for inflation); and employment remains robust (a positive for growth). The question is what could cause the Fed to cut rates mid next year (given this is what is priced in)? I will offer two reasons... both of which I think are unlikely before June.