Equity Risk Premium Isn’t There

Equity Risk Premium Isn’t There

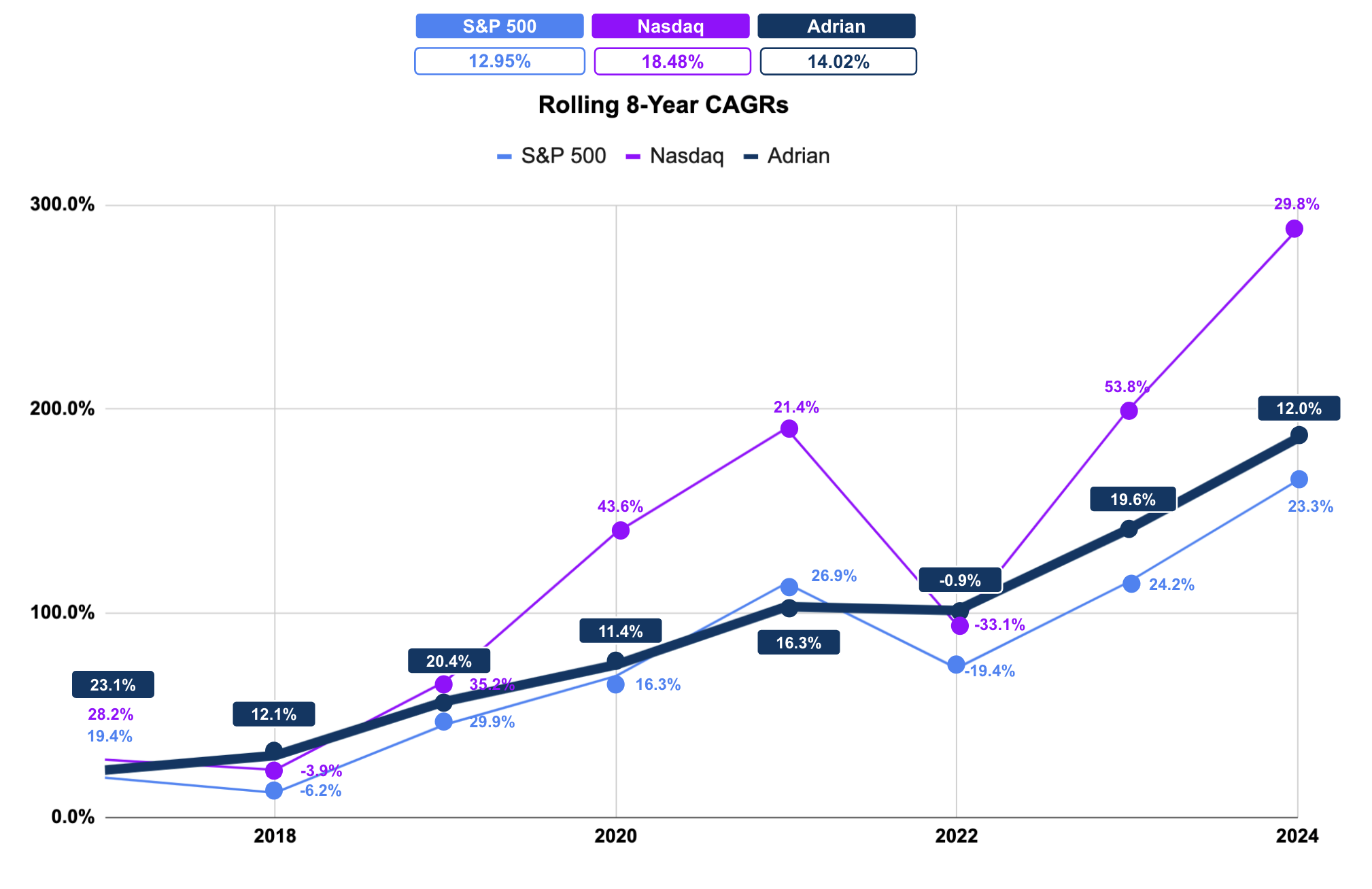

The S&P continues its impressive six week rally - up over 22% from its early April low of 4,835. At 5,916 - this represents a forward price to earnings (PE) ratio of ~22x - with earnings per share (EPS) expected to be ~ $270 this year. If we take the inverse of 22x - that gives us the market's earnings yield; i.e., 4.56%. The question whether 4.56% represents a good risk/reward? There's an easy way to answer that... let's explore.