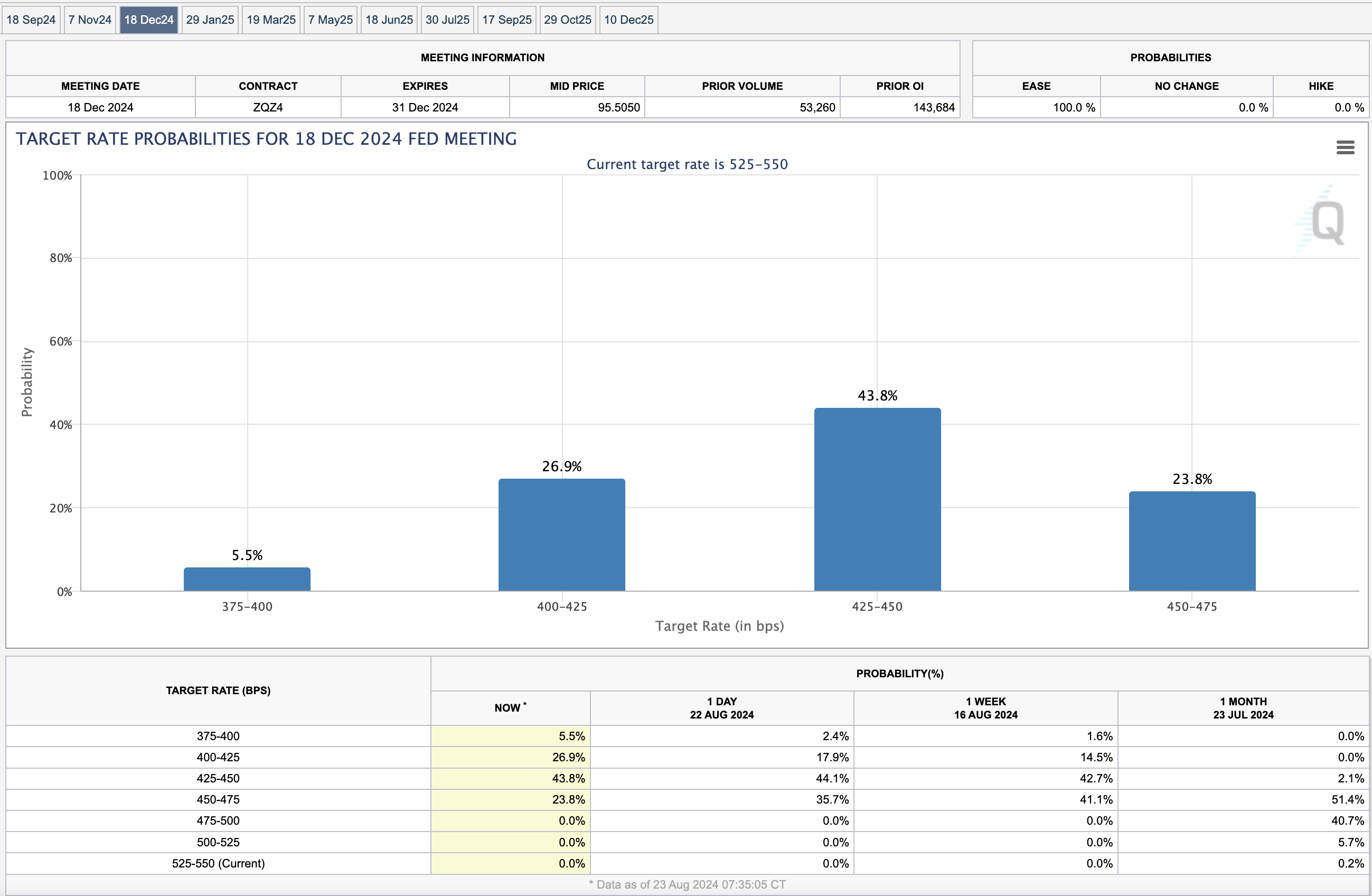

Don’t Bet on 50 Bps for Sept.

Don’t Bet on 50 Bps for Sept.

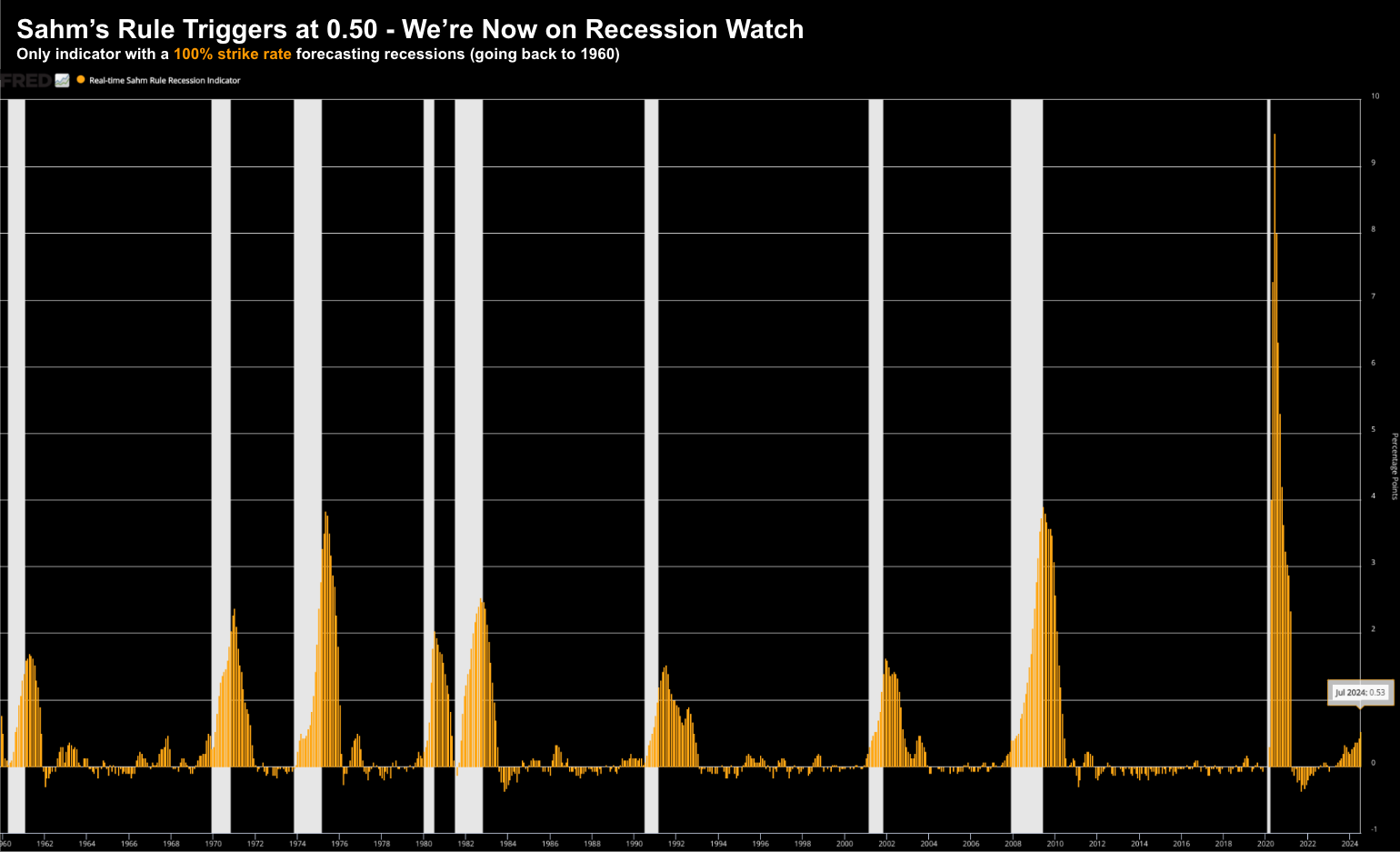

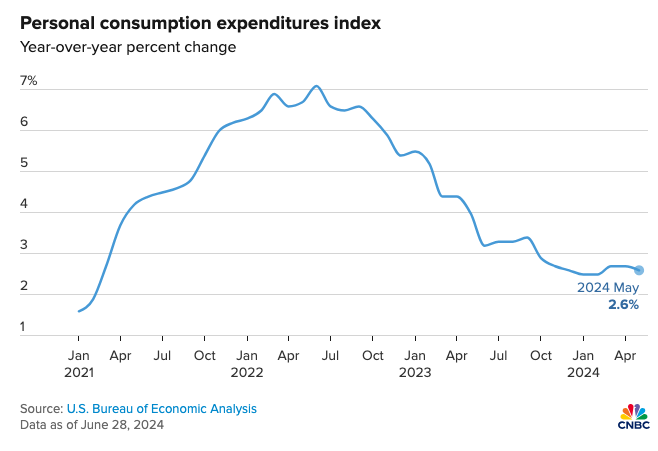

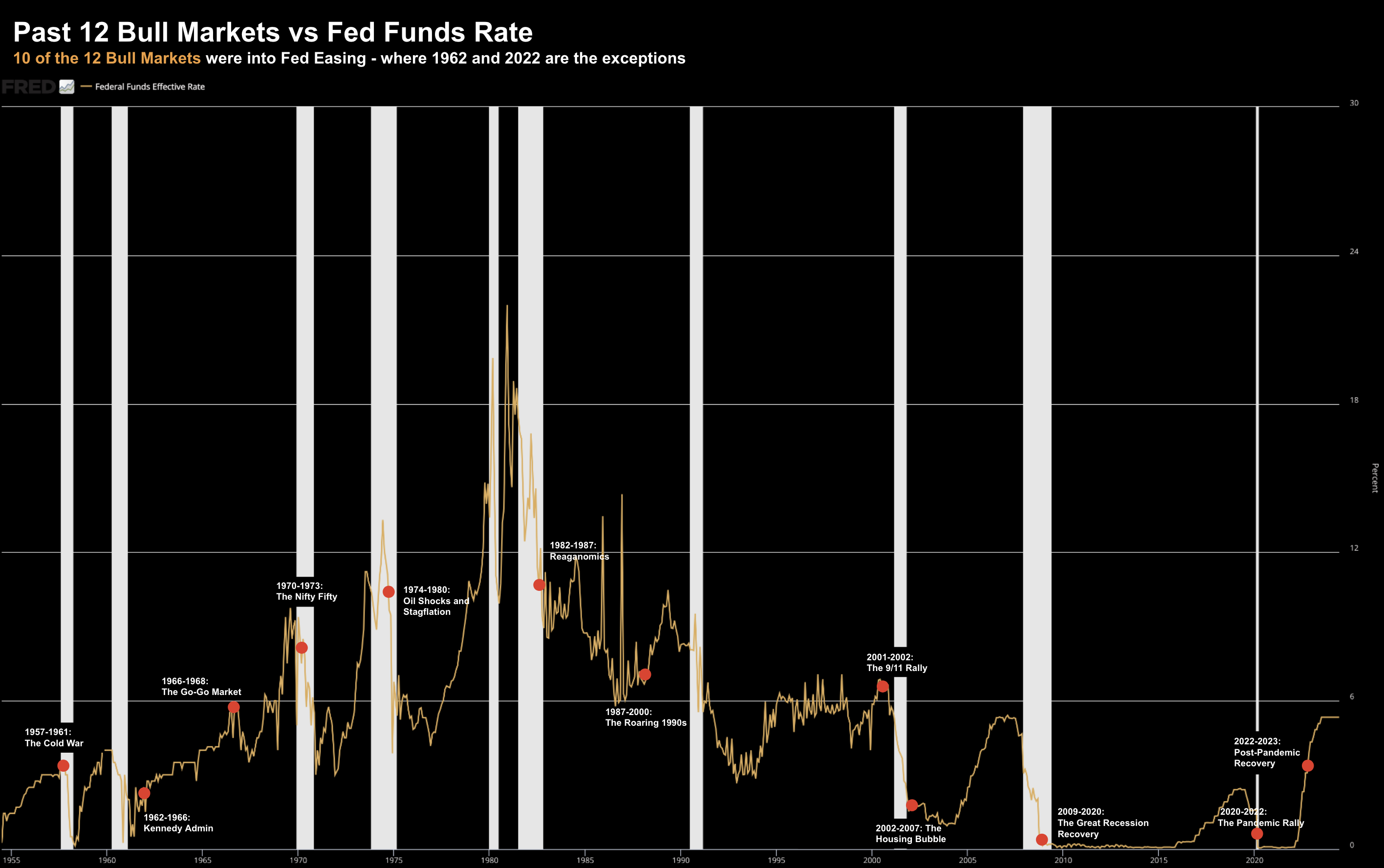

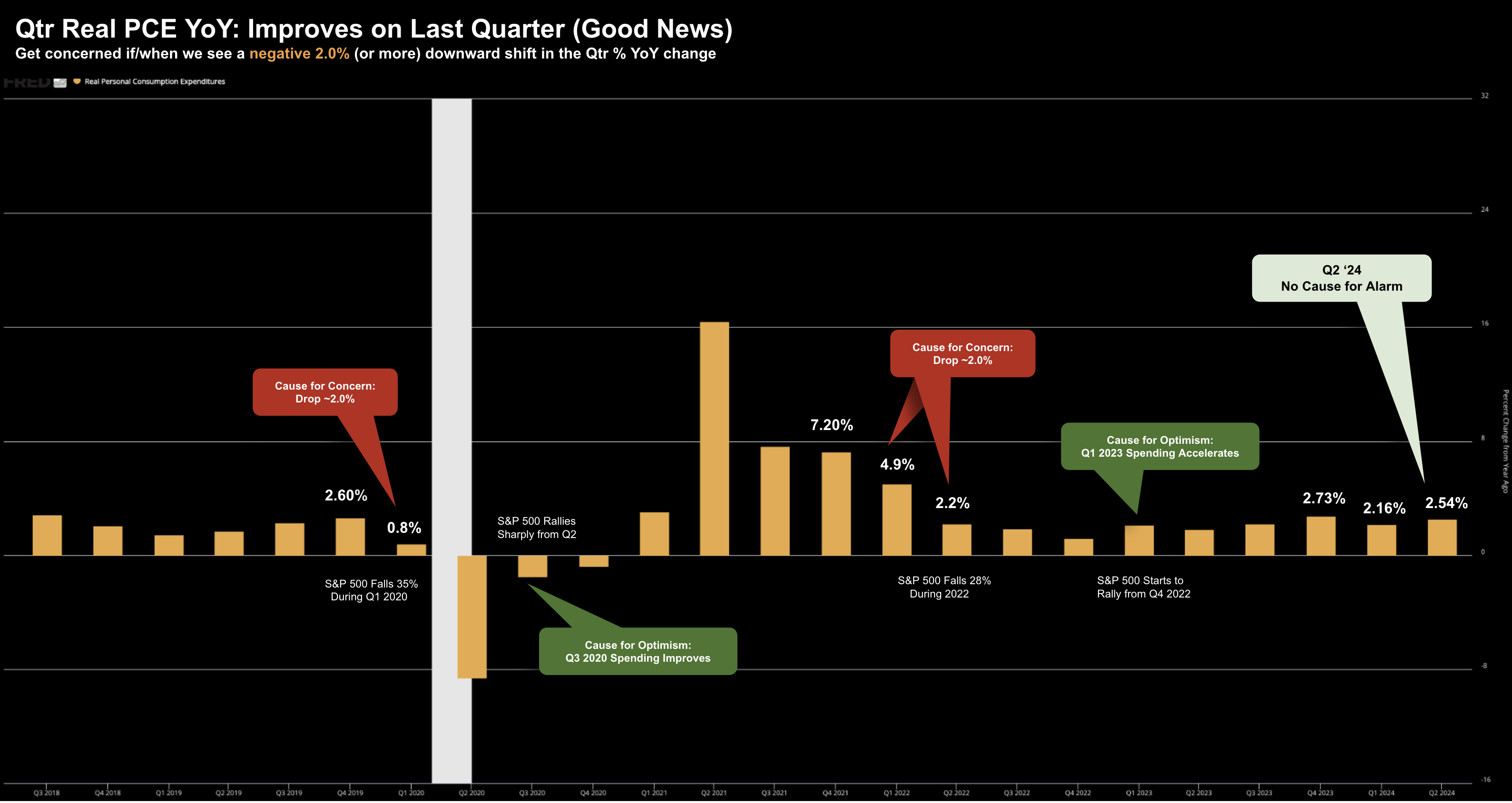

Do we have a 'good, solid' economy or one that's at risk of a recession? Is the employment market robust or one that's slowing sharply? Should the Fed cut 50 basis points or 25? And if 50... why? These are not easy questions to answer - as you can make the case either way (pending your lens). Regardless, the popular narrative is one favoring a soft-landing. Jay Powell echoed this sentiment with a victory lap at Jackson Hole. Former Fed Chair Janet Yellen supported this thesis over the weekend...