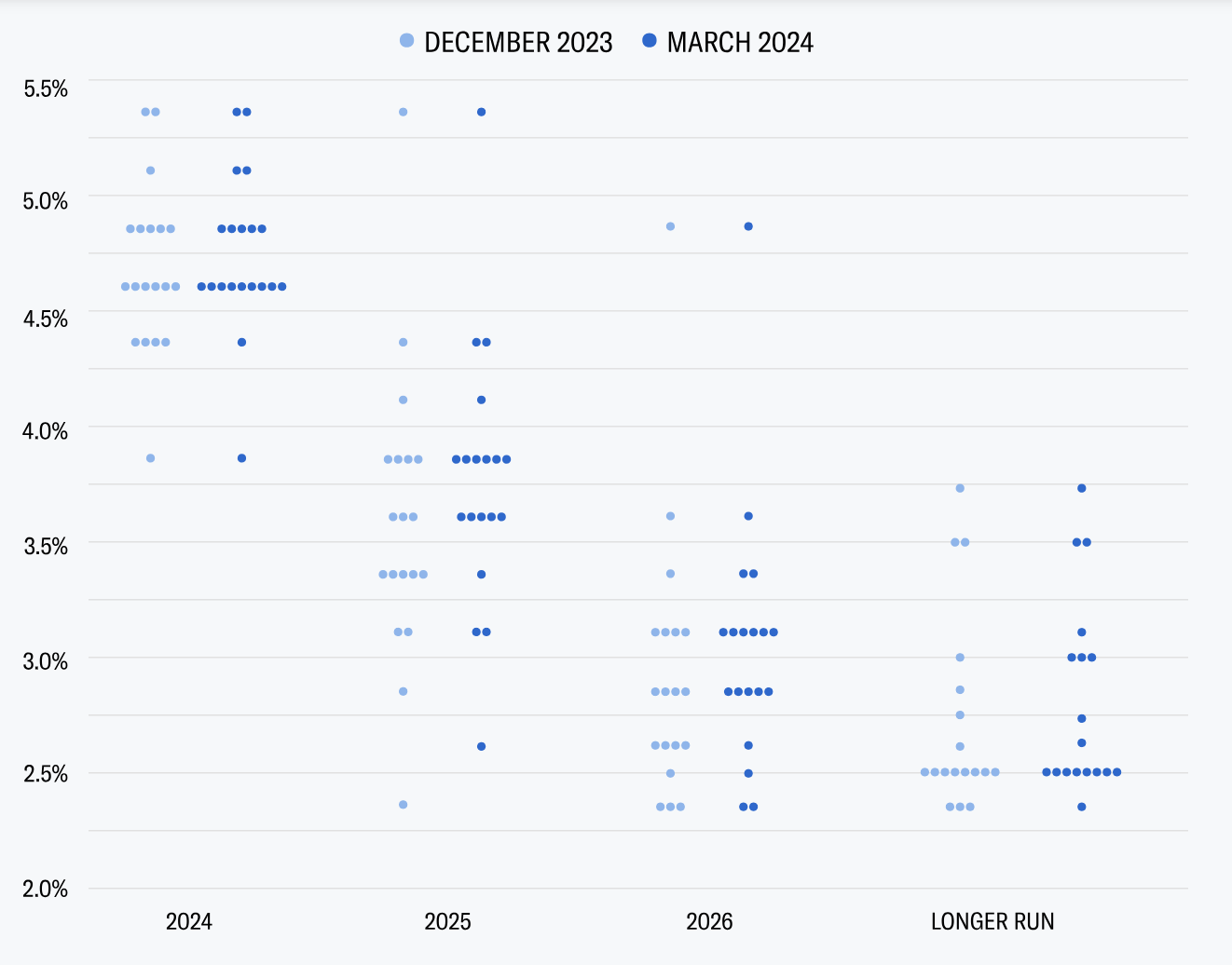

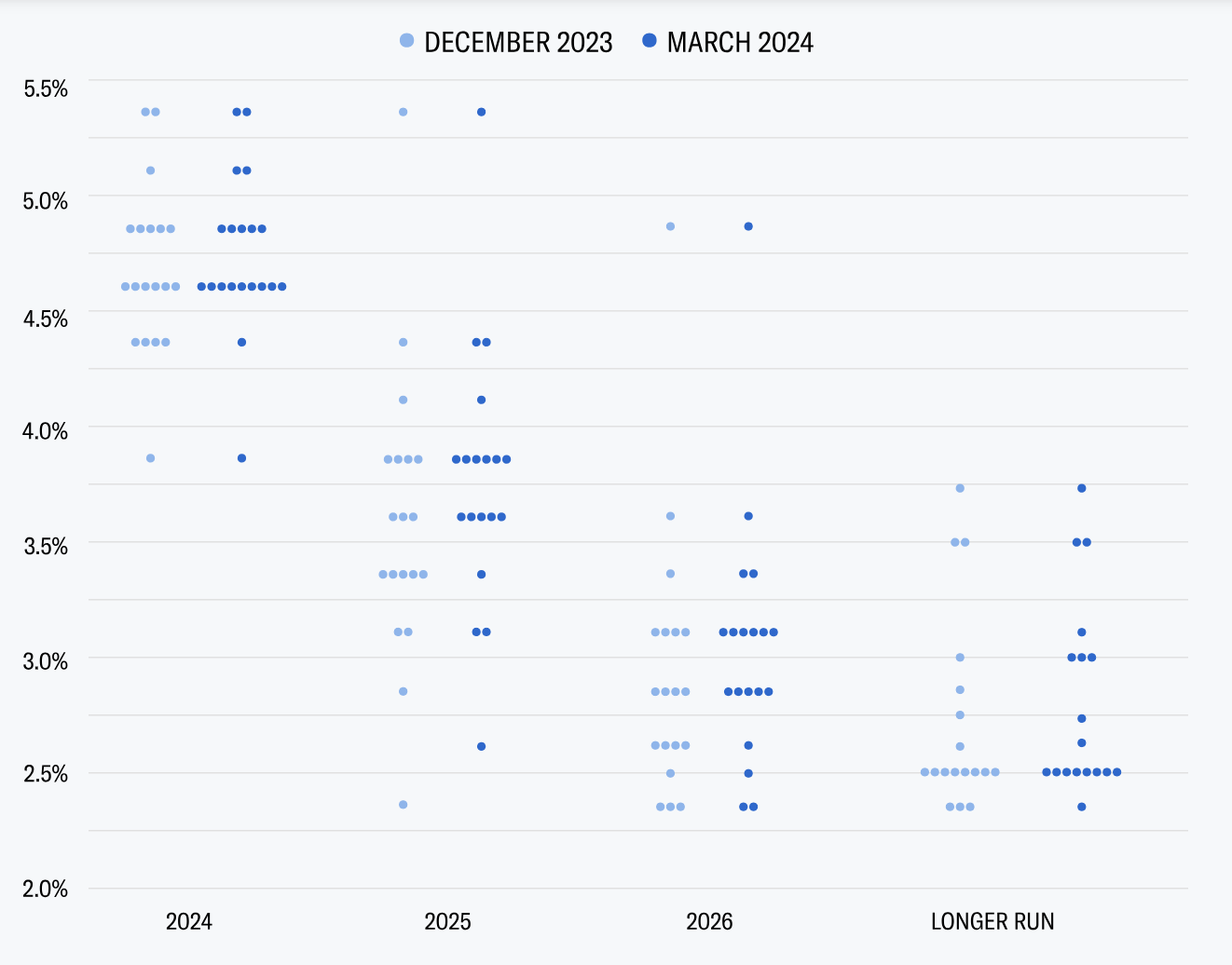

Rate Cut Hopes for 2024 Start to Fade

Rate Cut Hopes for 2024 Start to Fade

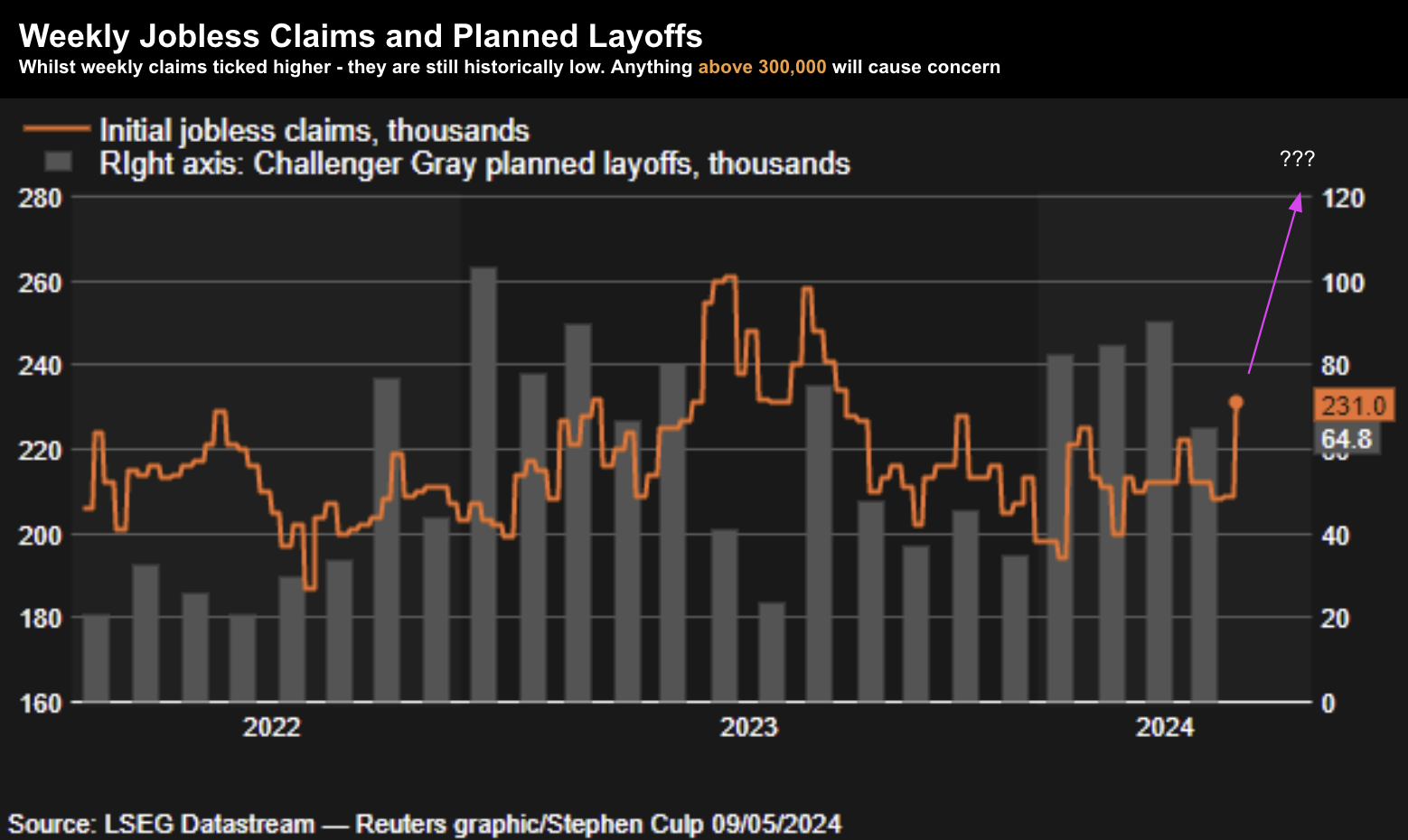

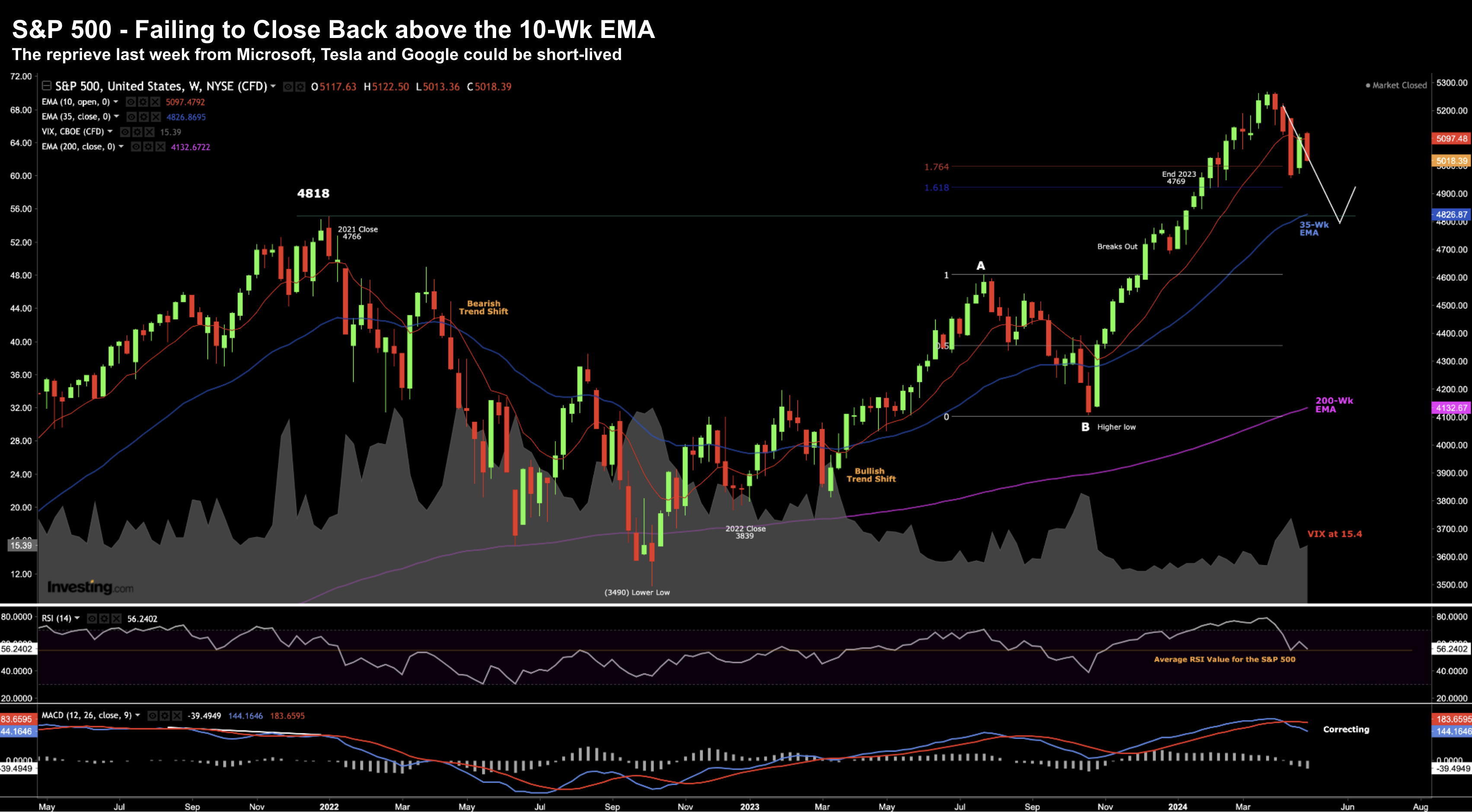

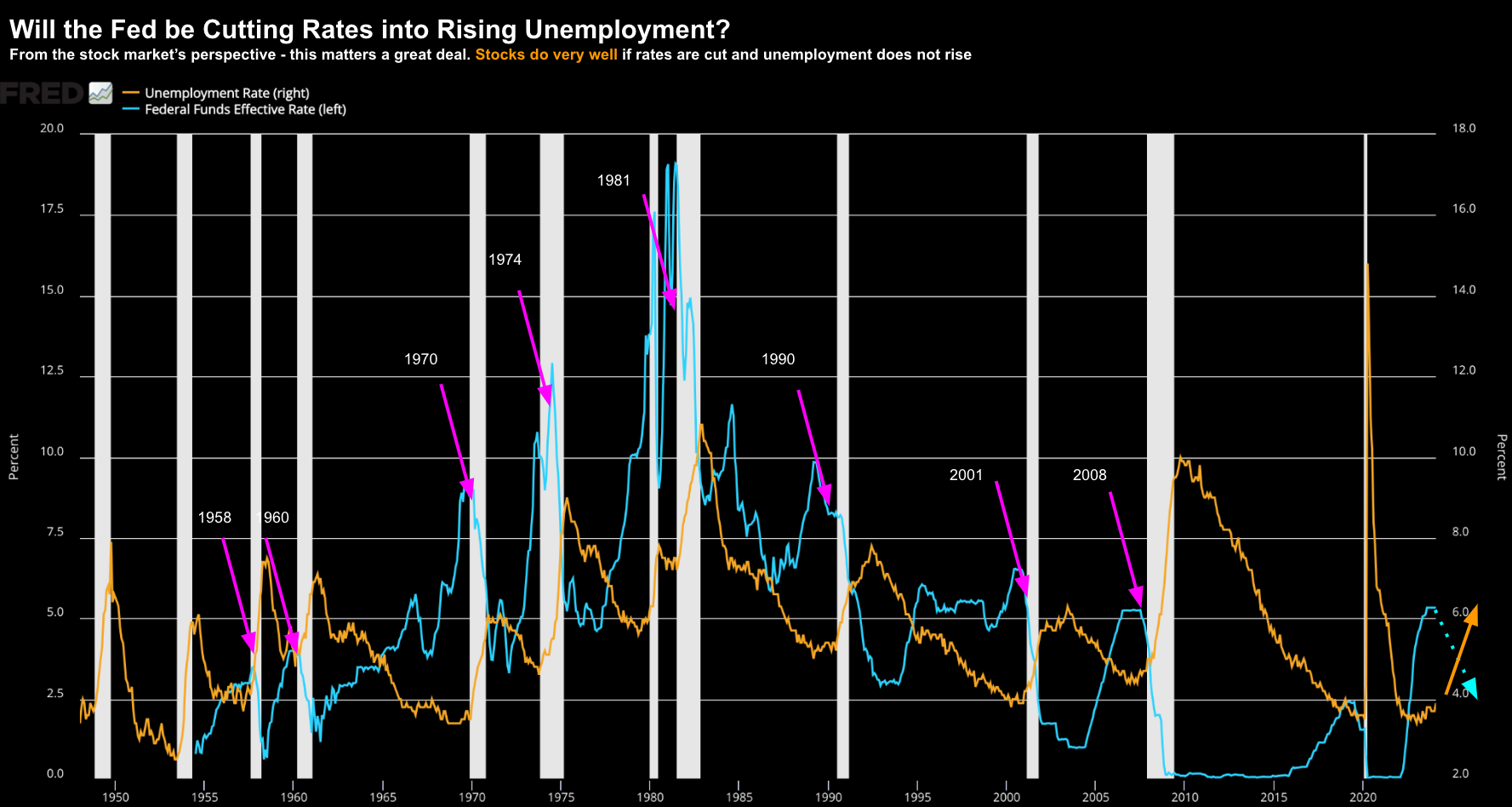

Just as market participants were starting to get hopeful rate cuts could be coming - that door was slammed shut. Yields surged opposite a stronger-than-expected monthly payrolls number. Heading into the print - the market was looking for softness in the labor market - with maybe 190K jobs added. Recent data had suggested jobs were slowing - paving the way for the Fed to cut rates as early as July (with a 70% chance assigned to September). As it turns out, monthly job gains were said to be 272,000. That said, there are some ambiguities with the report - with the unemployment rate jumping to 4.0%. Is Sahm's Rule about to trigger in the coming months?