Market Confident on Imminent Rate Cuts Despite Inflation Print

Market Confident on Imminent Rate Cuts Despite Inflation Print

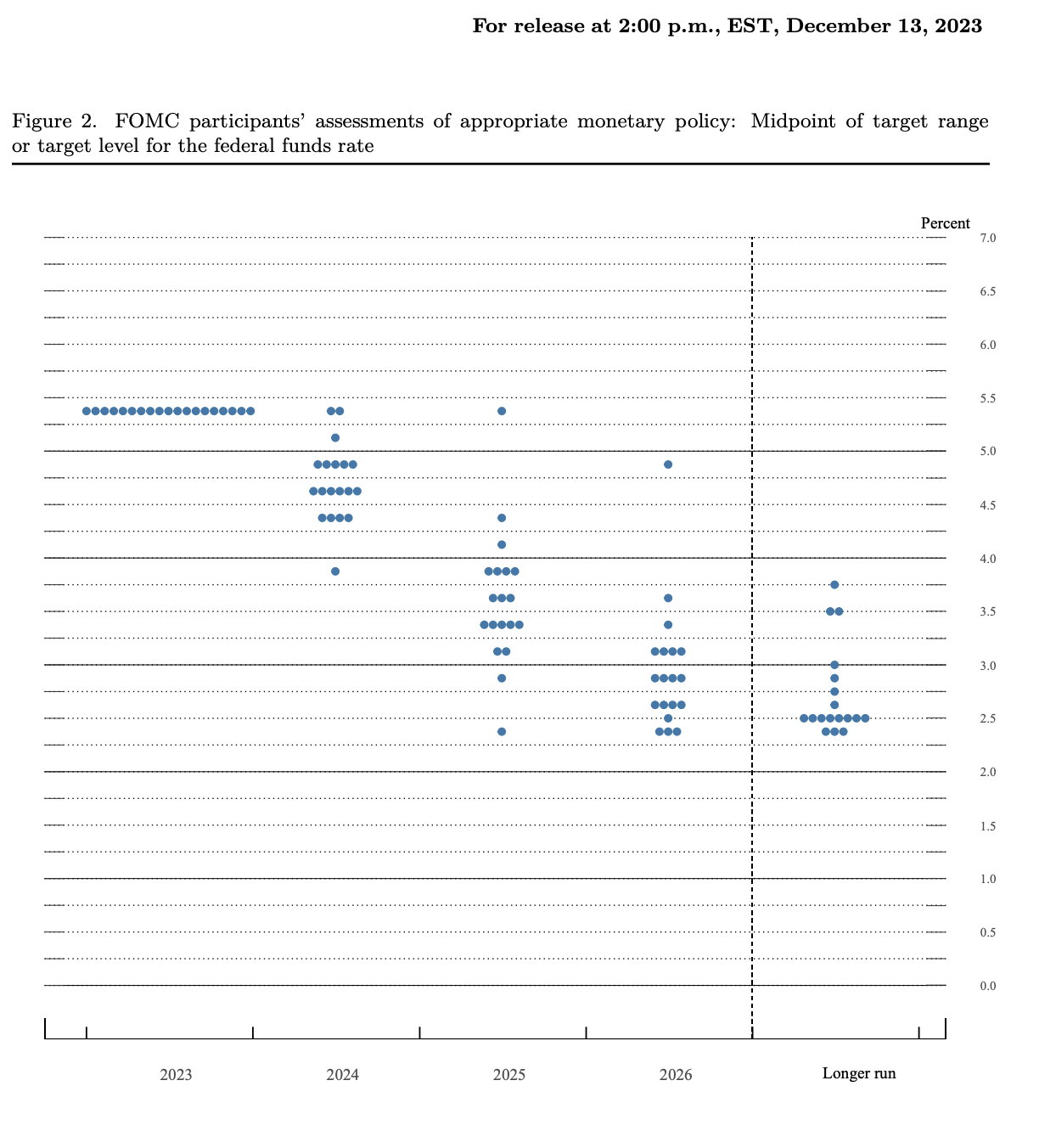

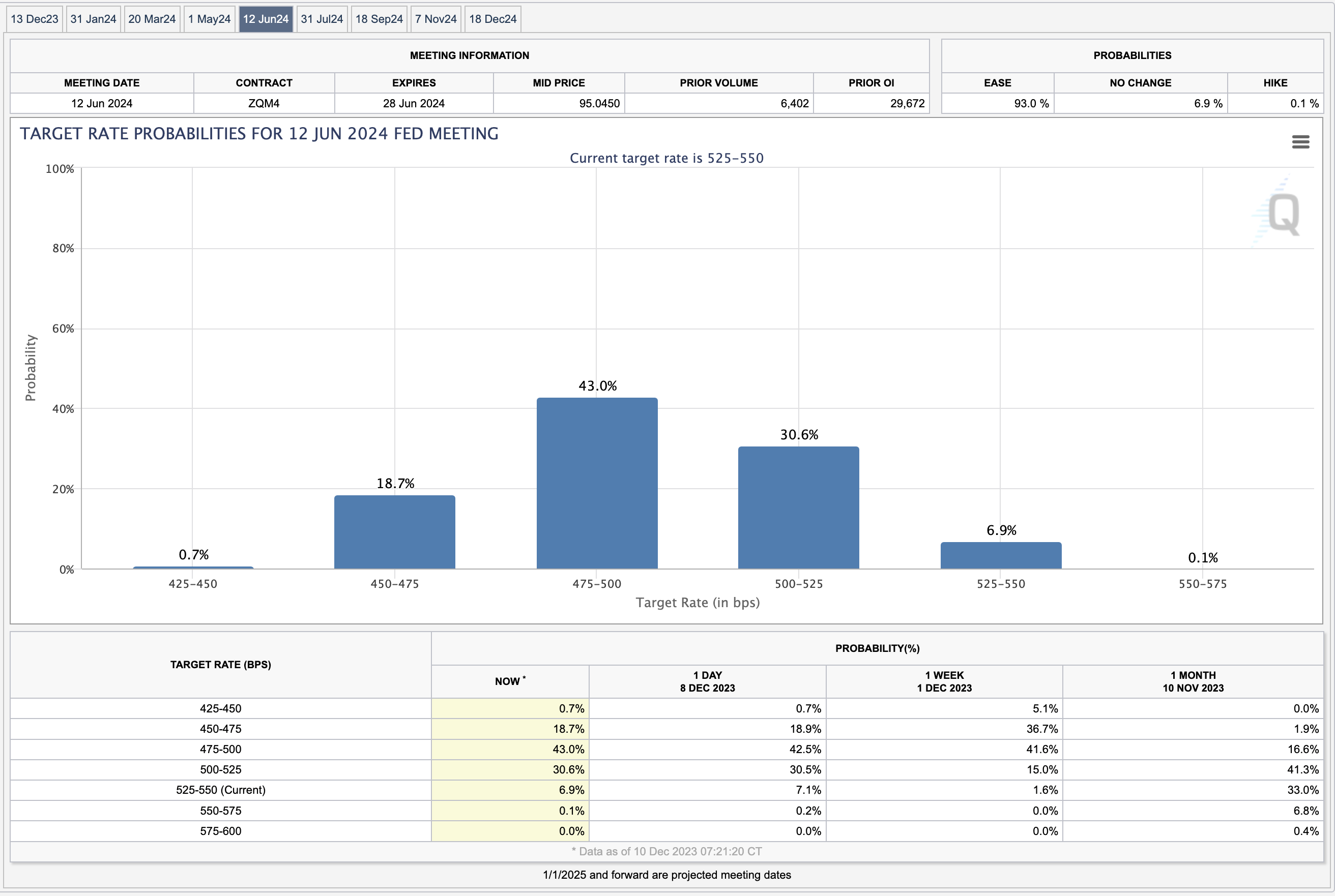

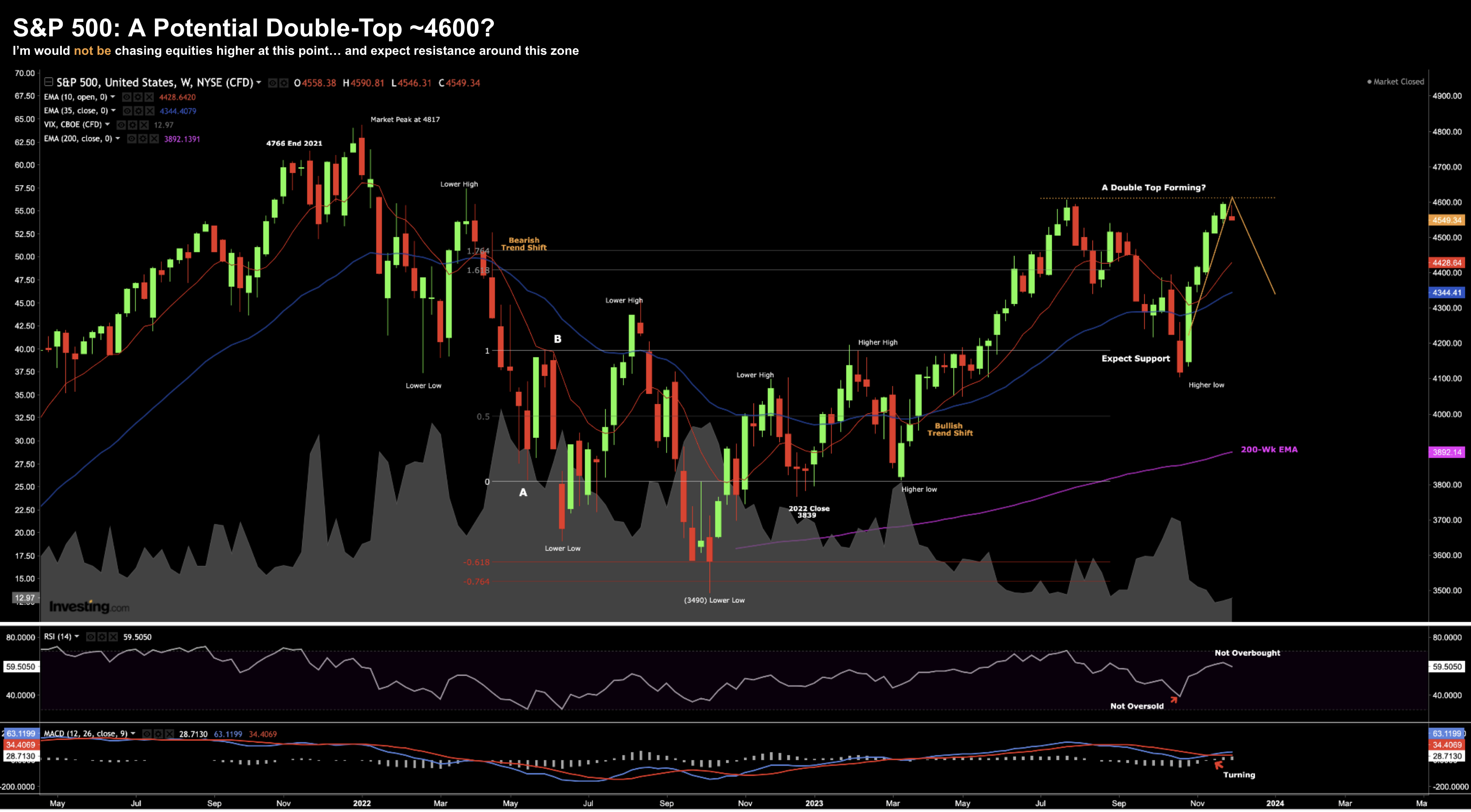

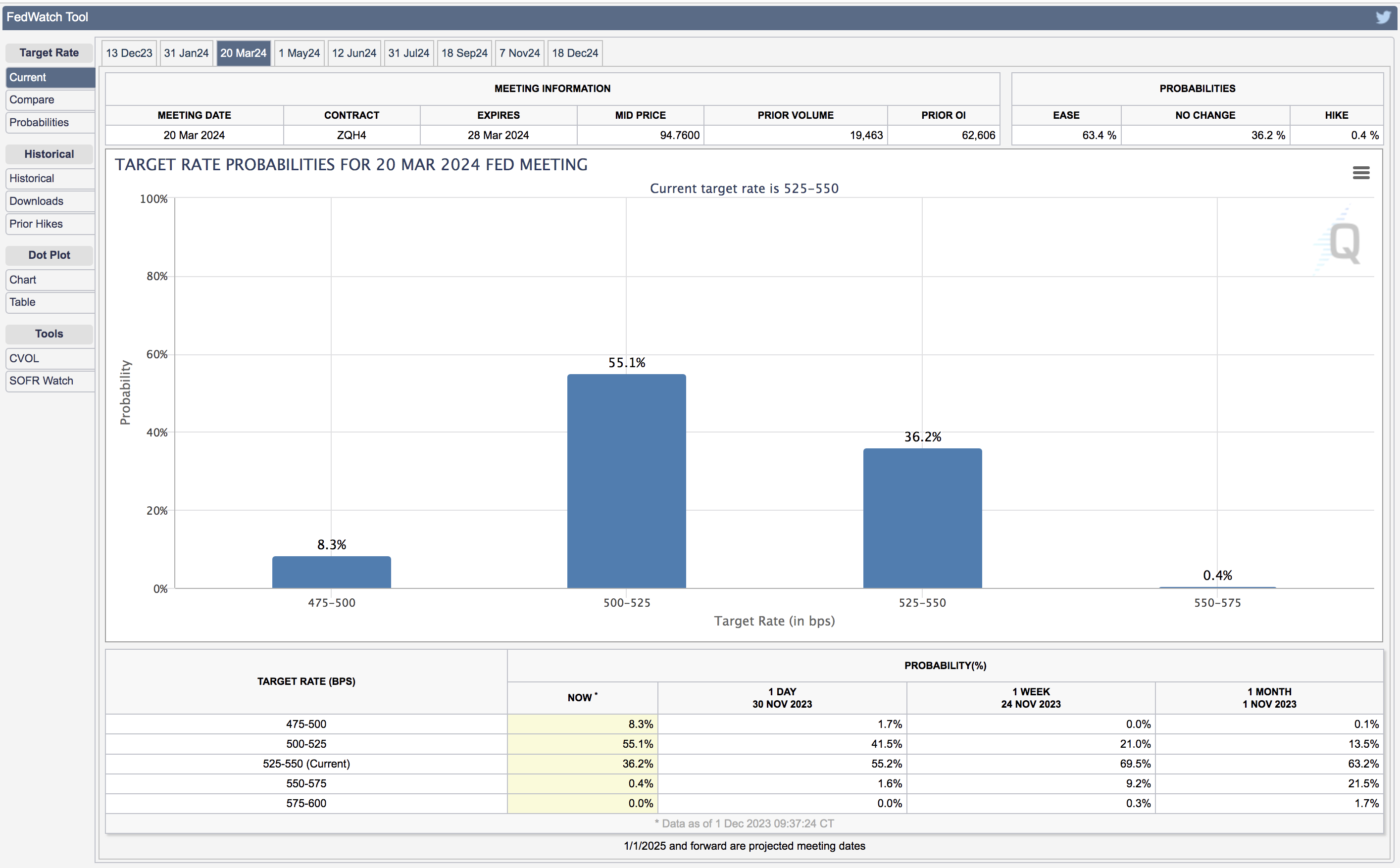

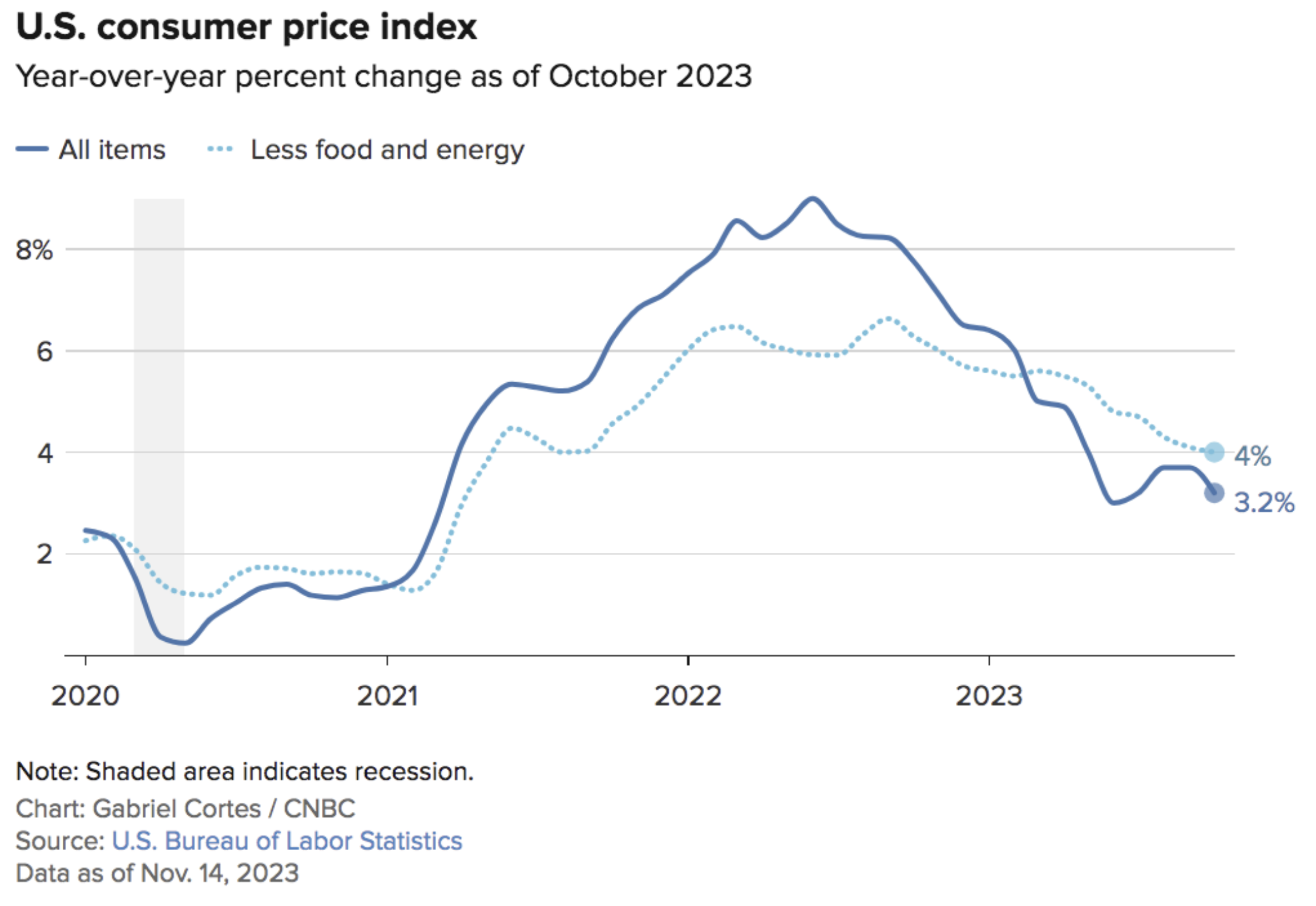

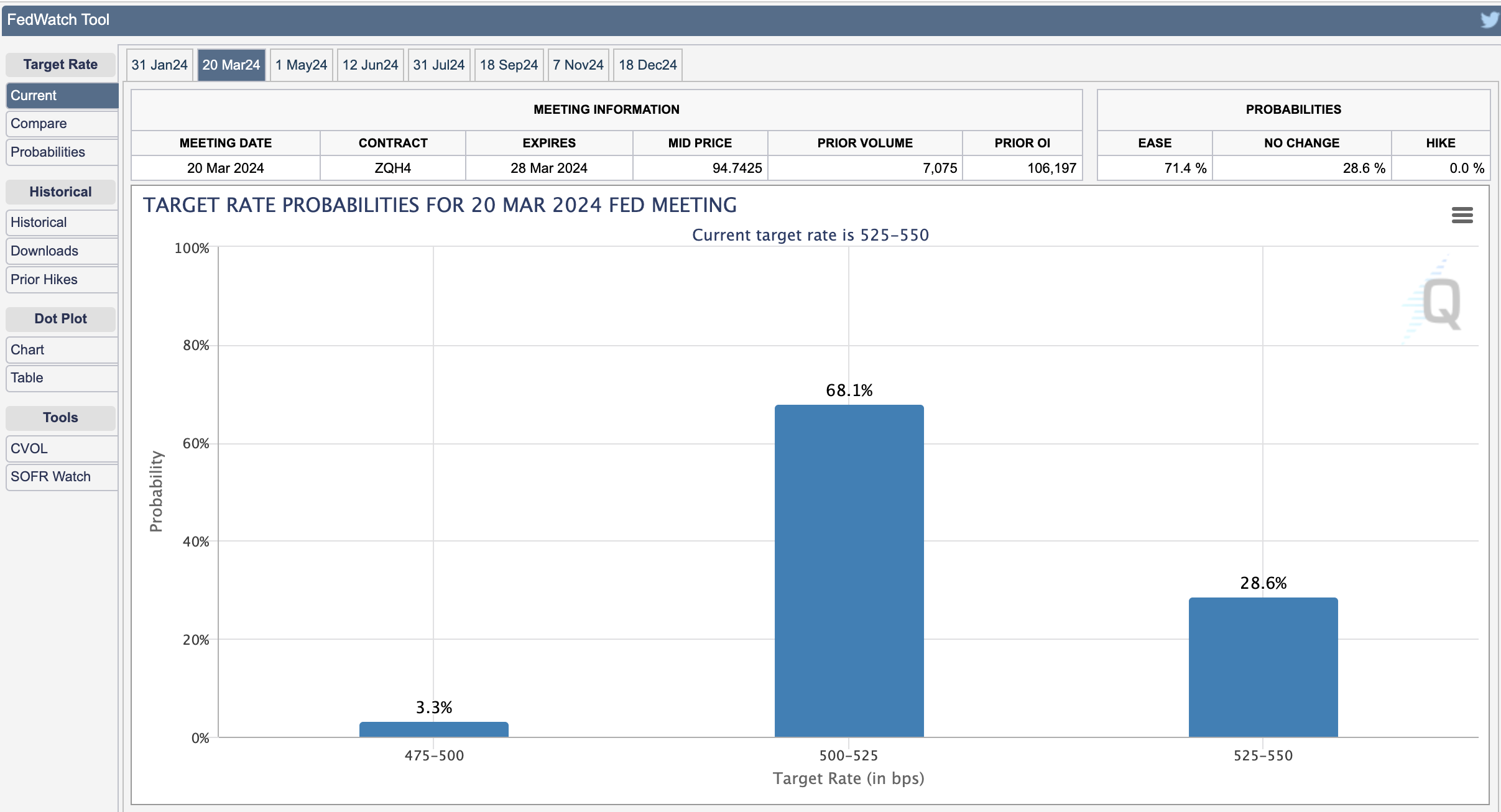

Today we received the final monthly inflation report for 2023 - ahead of the Fed's next policy meeting Jan 30-31. Markets were expecting very good news... but did they get it? On the surface, both prints were slightly higher than expected. However, we saw a mostly muted reaction in both bond and equity markets. Bond yields fell - with the market maintaining its 68% expectation of a rate cut as early as March.