Buffett’s Letter: Time Not to be Greedy

Buffett’s Letter: Time Not to be Greedy

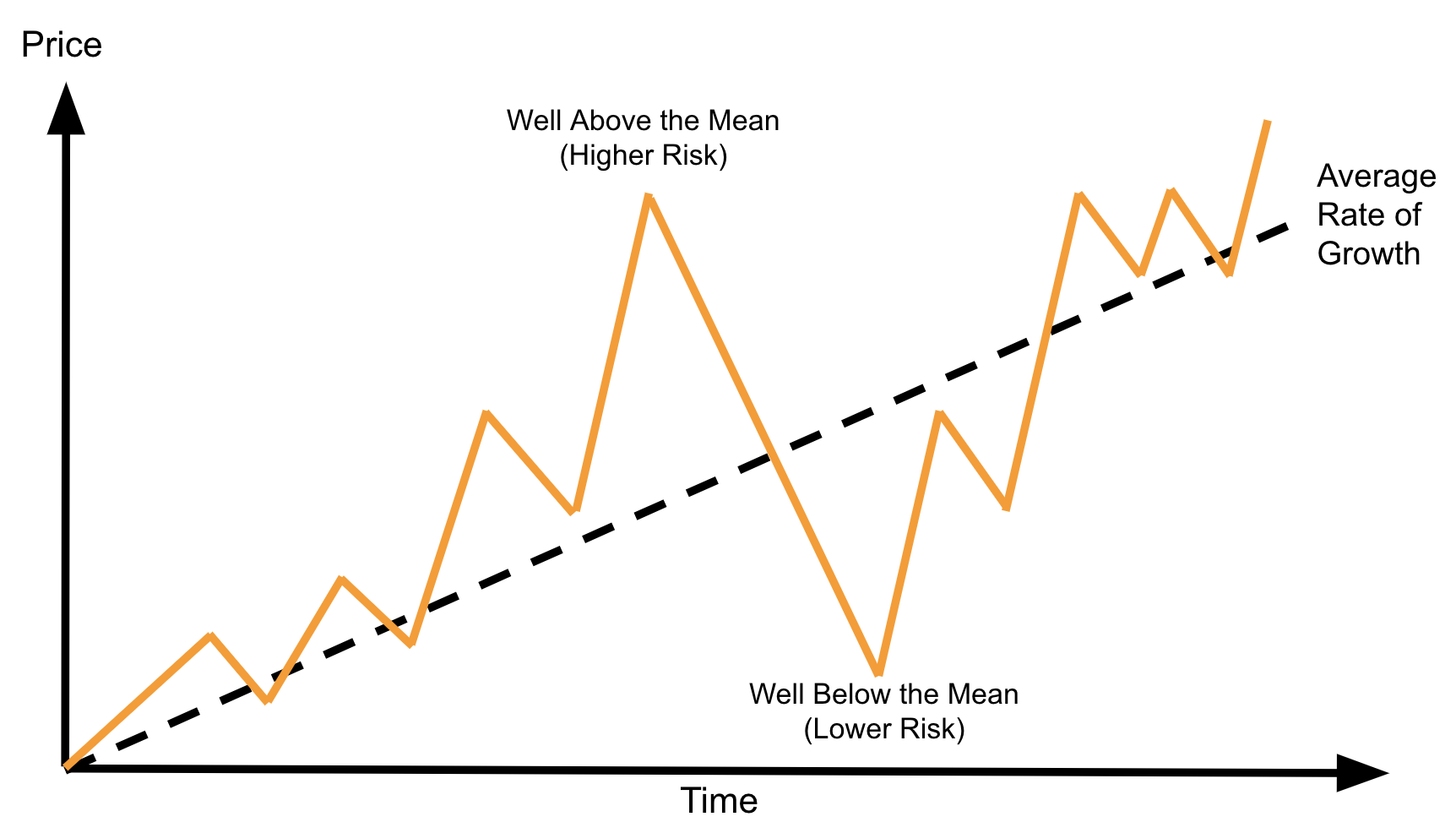

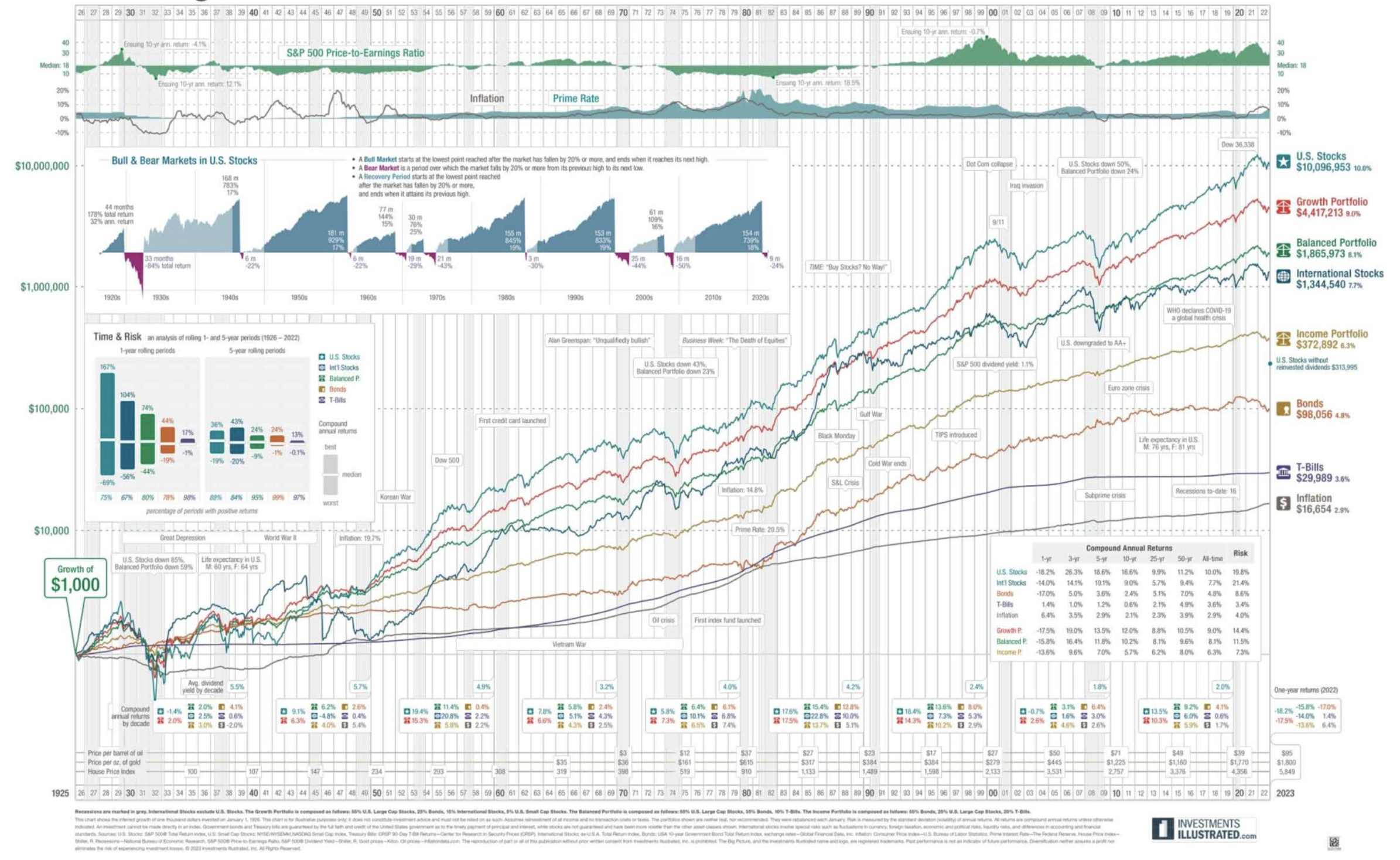

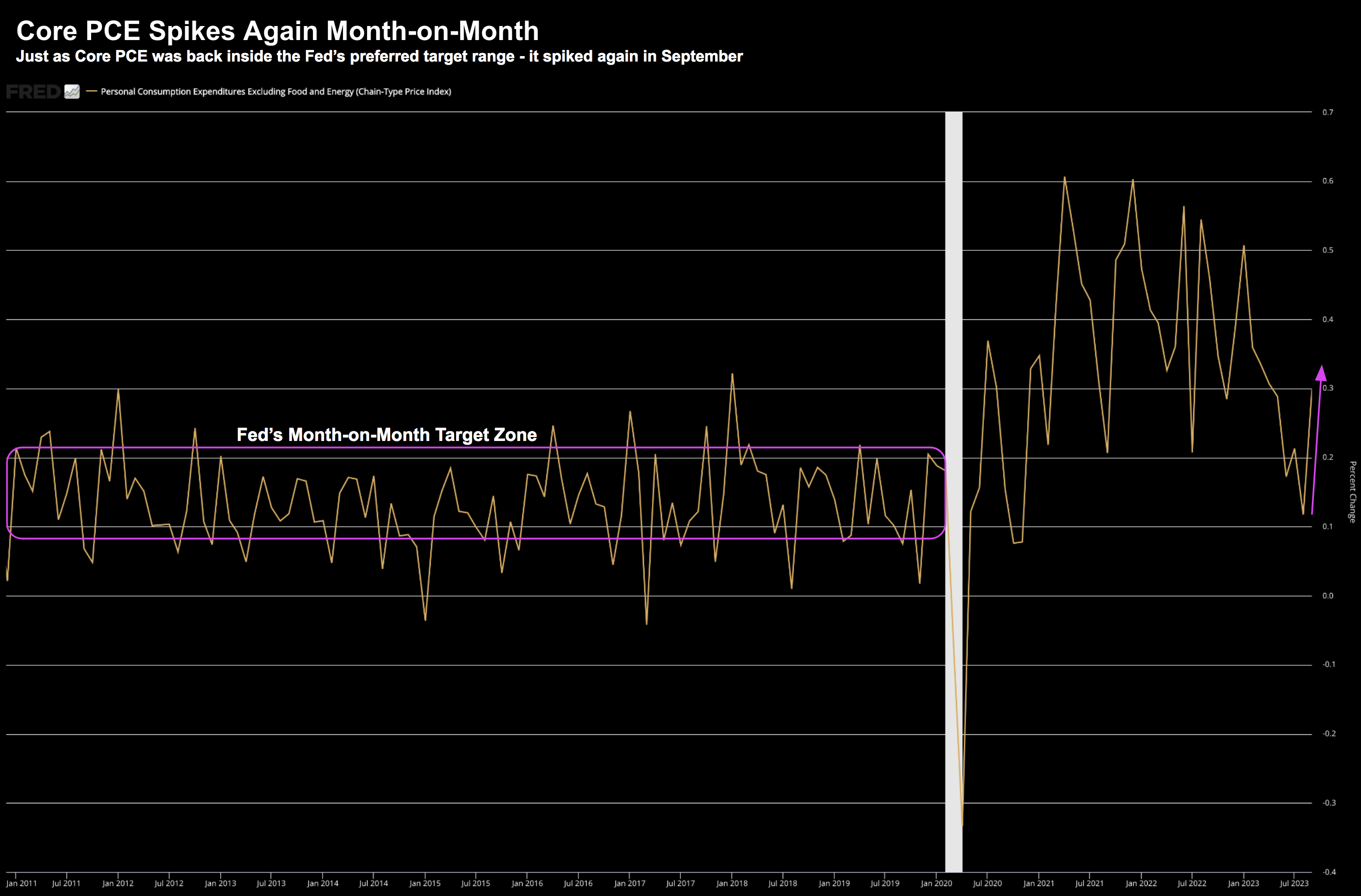

If we needed confirmation the market isn't cheap - the Oracle of Omaha told us as much in his annual letter to shareholders. He sits on a record amount of cash - over $167B. But he is no hurry to overpay. Buffett's letter is compulsory reading for anyone who is serious about investment. It's filled with timeliness insights from the mind of one of the world's greatest investors (arguably the greatest). For example, very few (if any?) have averaged a CAGR of 19.8% for 58 years (see page 17) vs the S&P 500 10.2%