A Foolish Forecast

A Foolish Forecast

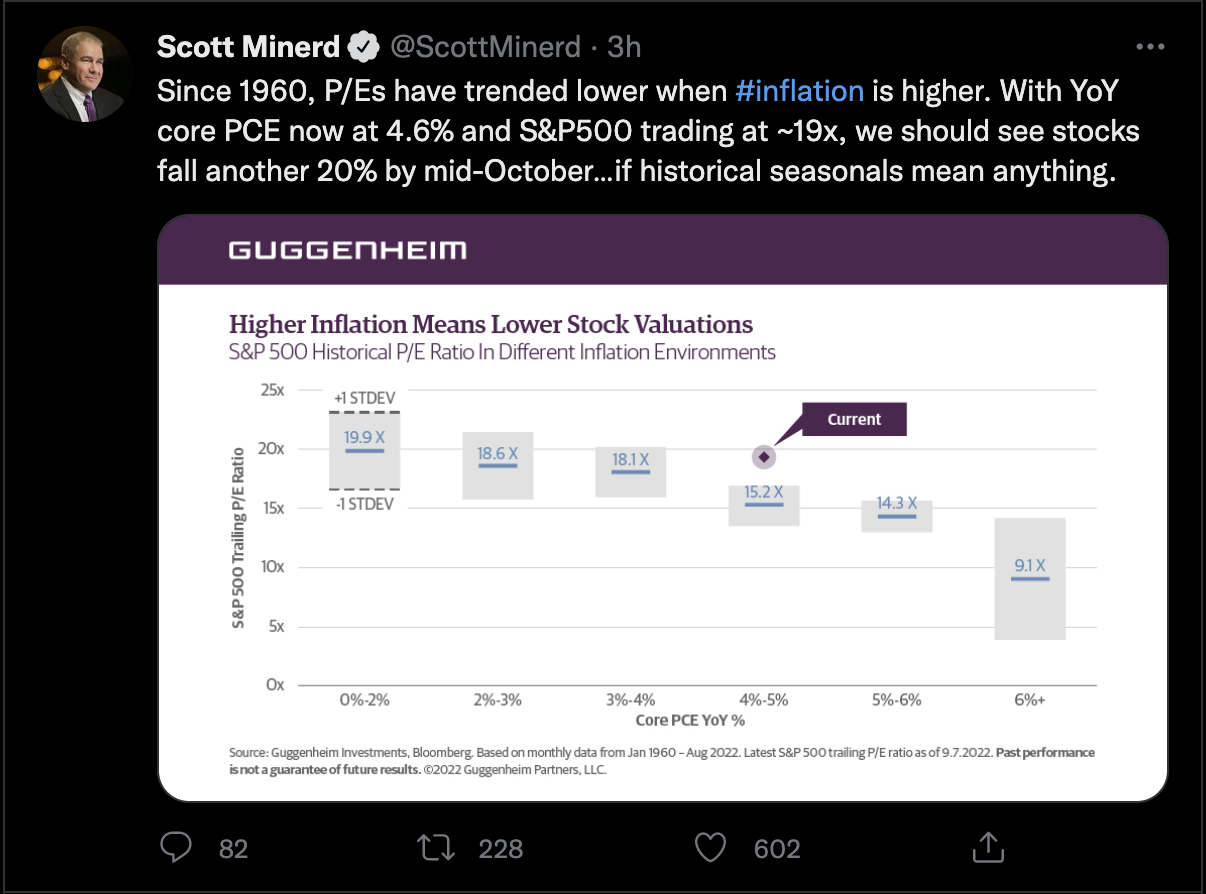

The business of forecasting is very difficult... what I think is a fool's errand. But when it comes to forecasting the economics of 330M people - their behaviour - and the specific impact on stock prices - it's near impossible.