20%+ Sell-Off Great News for Patient Investors

20%+ Sell-Off Great News for Patient Investors

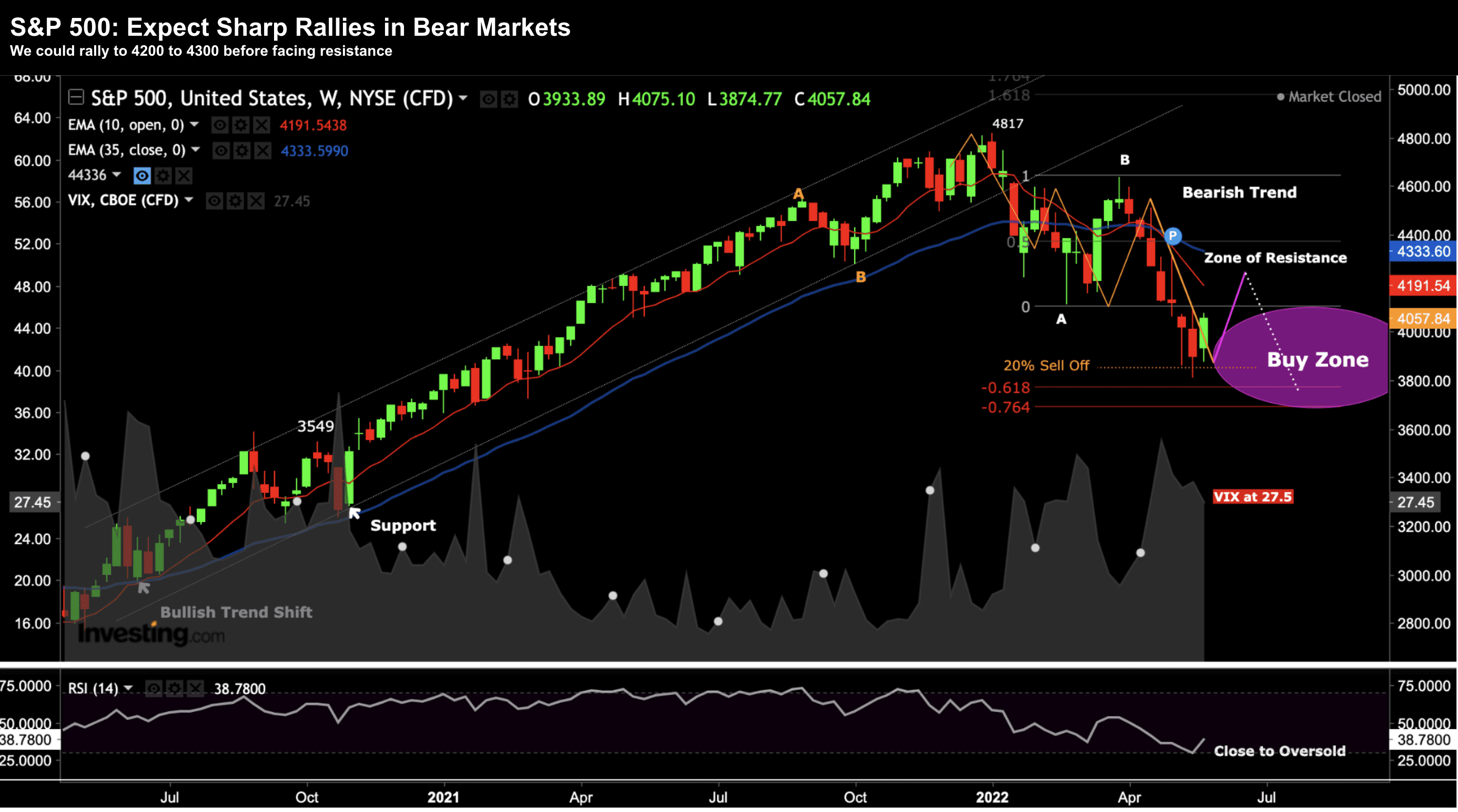

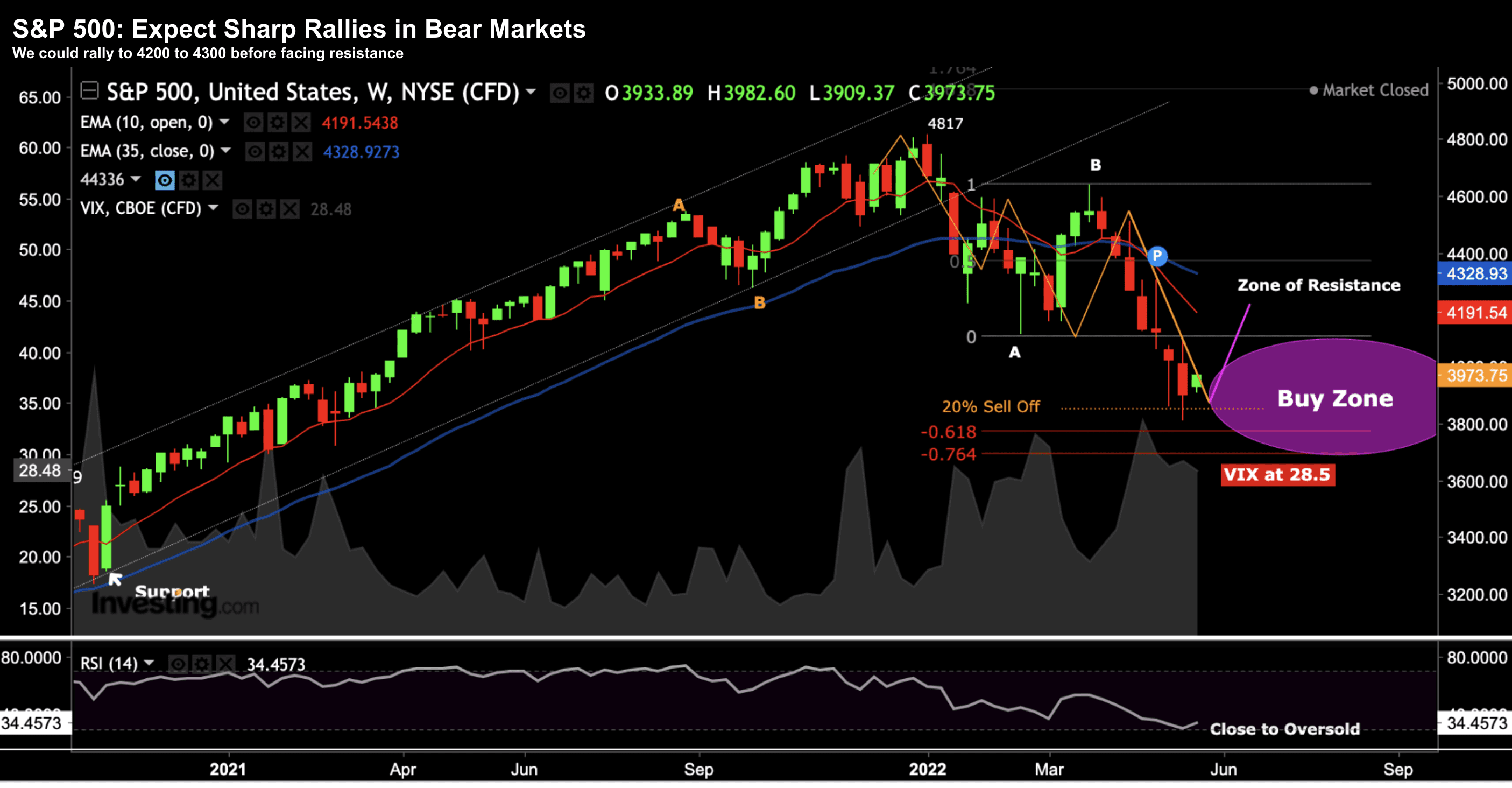

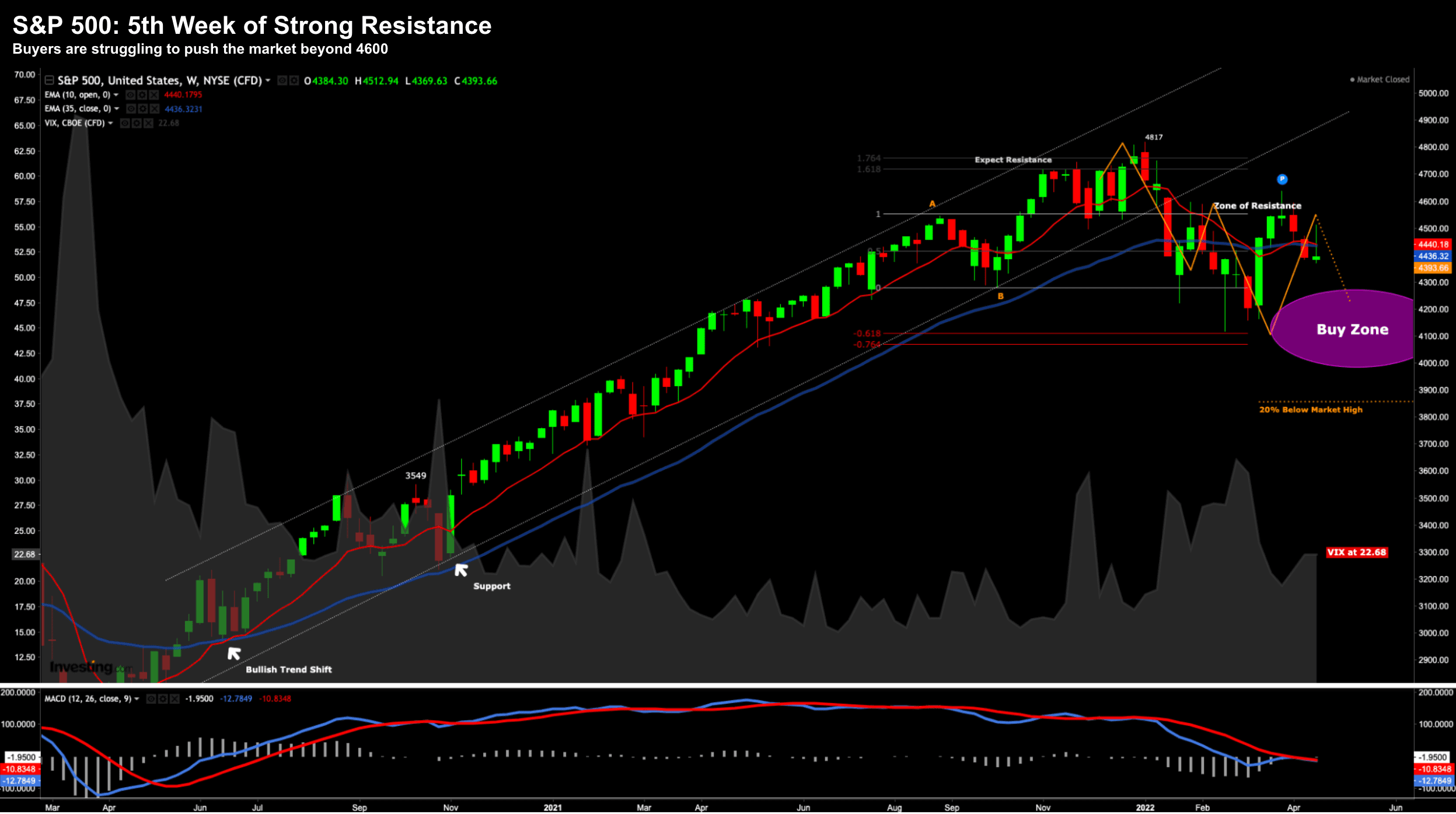

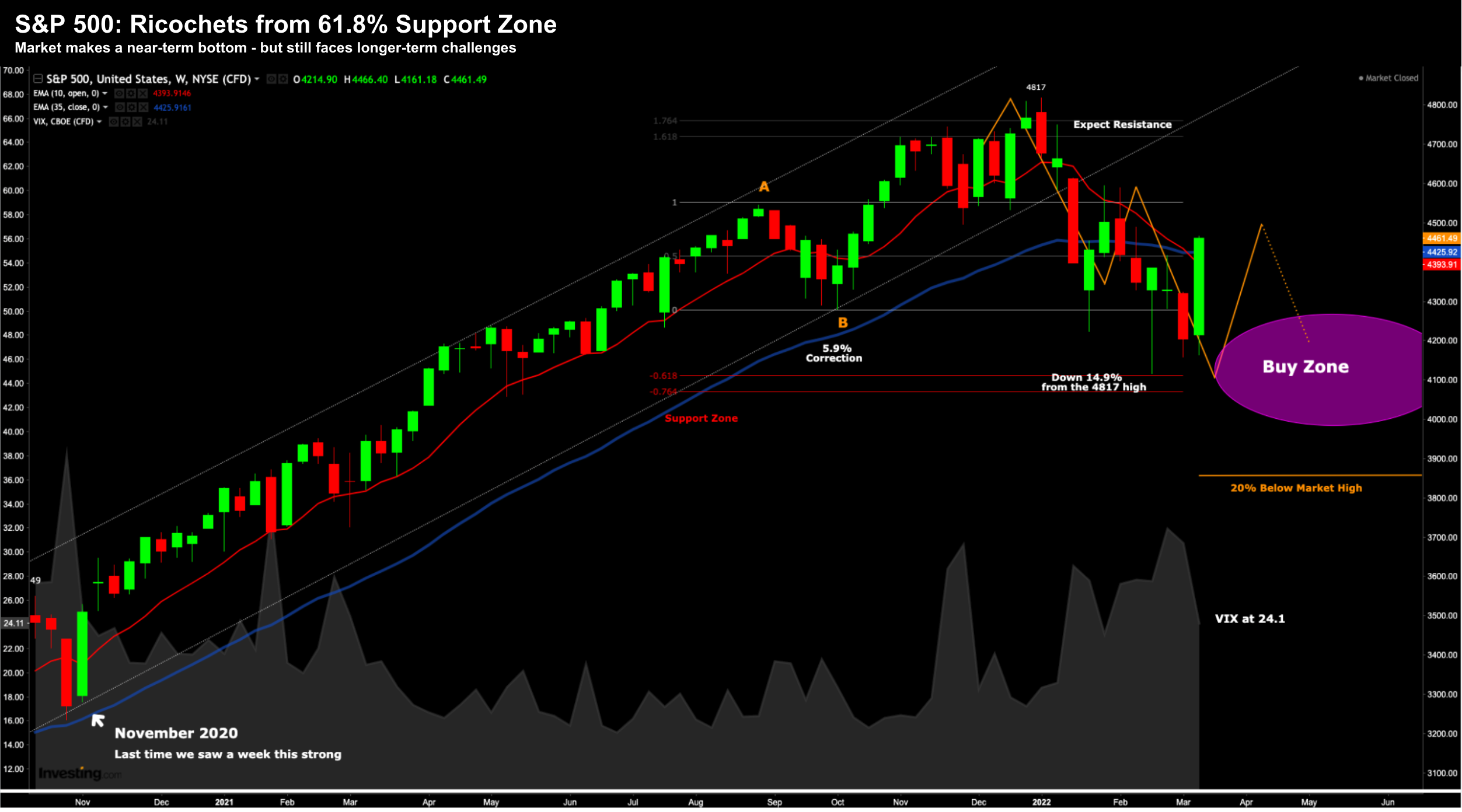

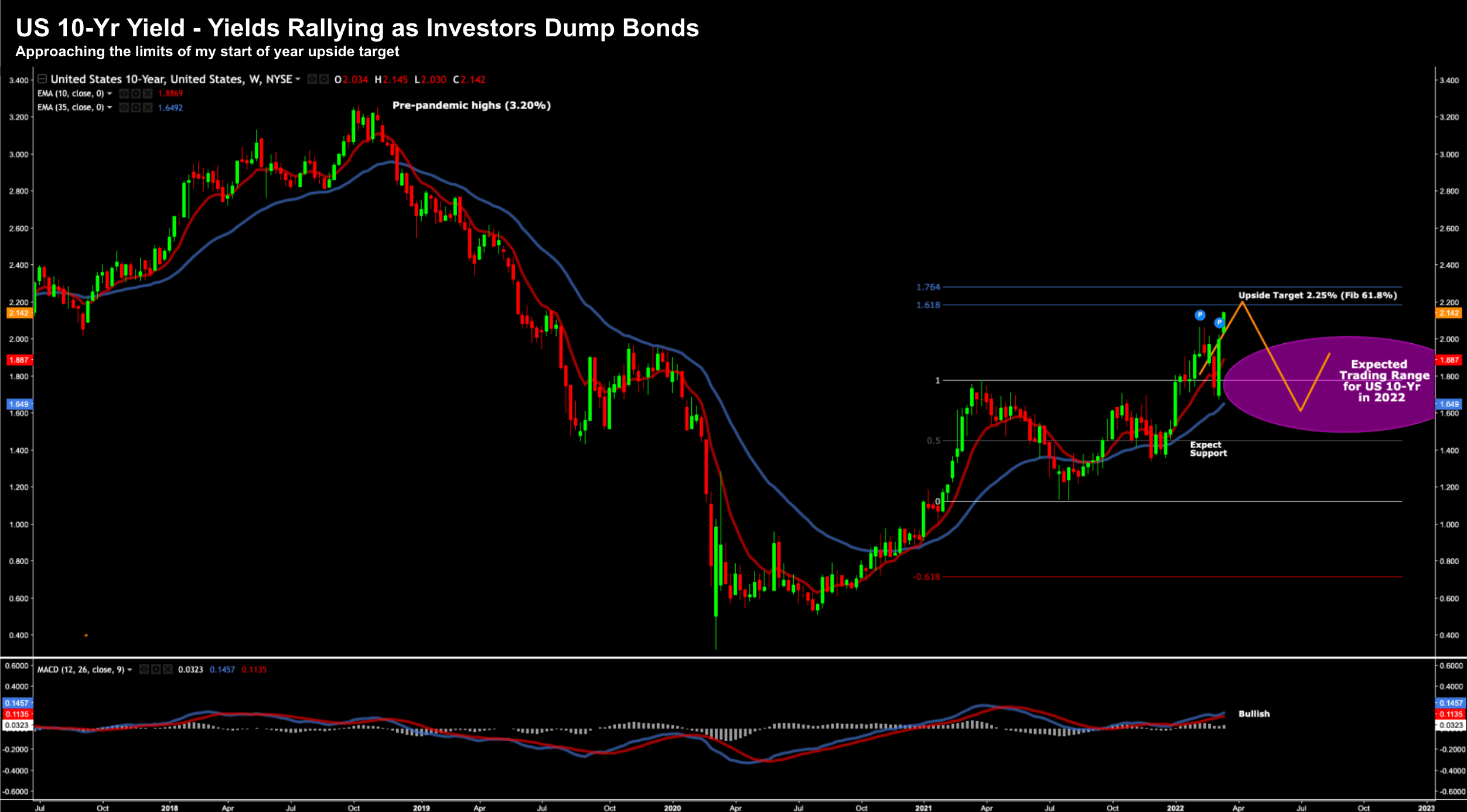

A 20%+ sell off isn't a time to worry... quite the opposite... it's a time to get excited and to sharpen your pencils. The Fed is about to gift us a once-in-a-decade buying opportunity...