The Folly of Forecasting

The Folly of Forecasting

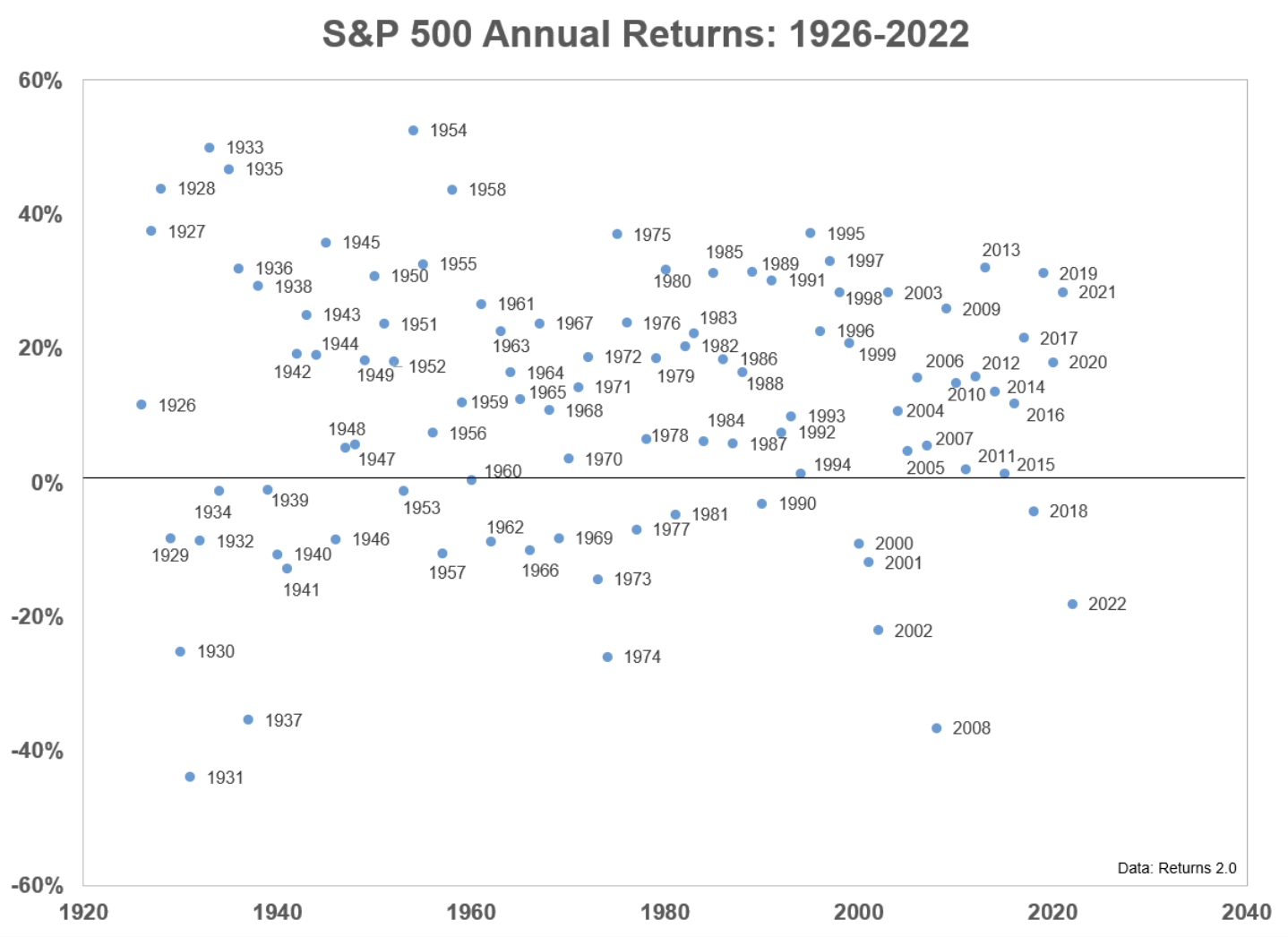

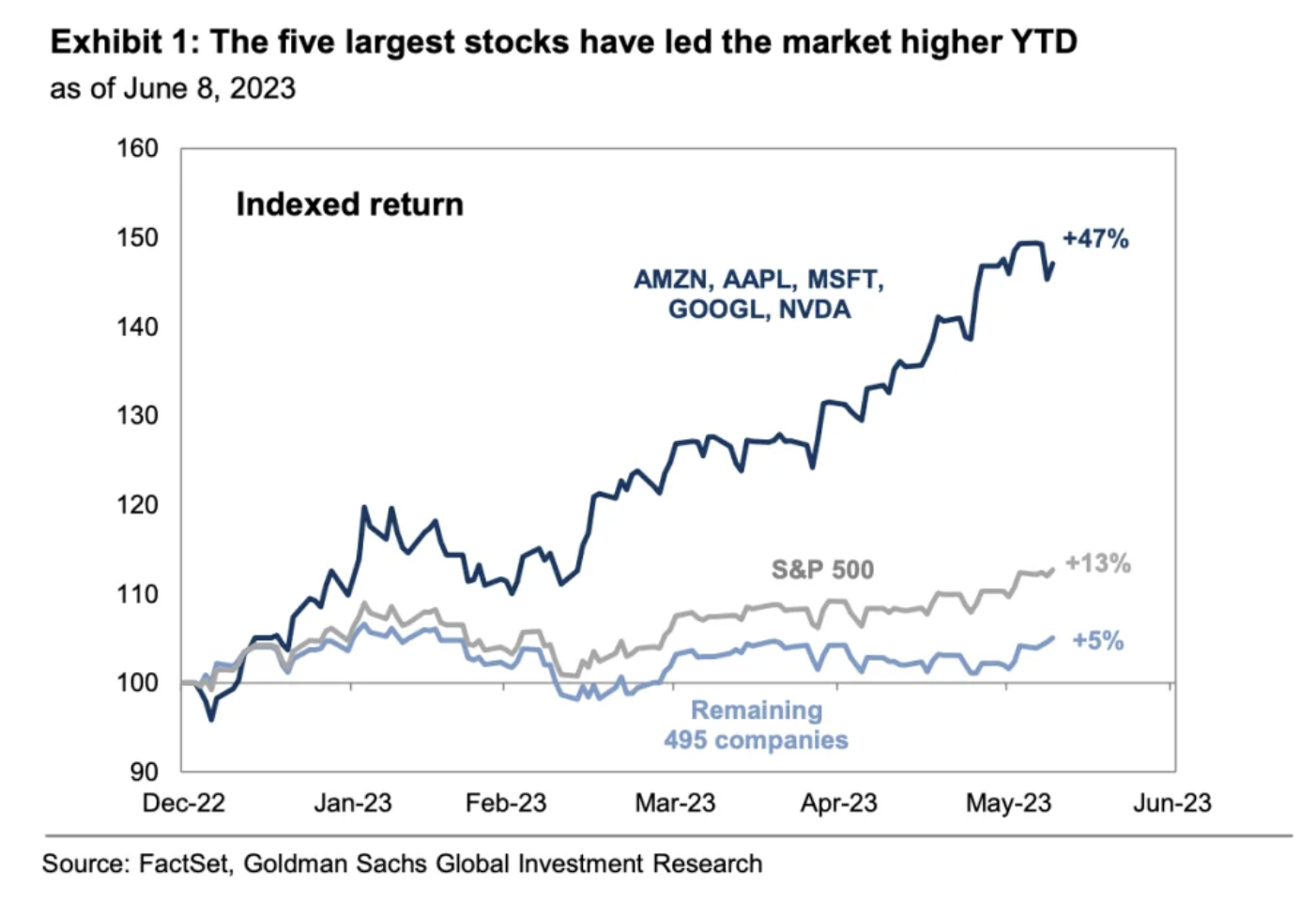

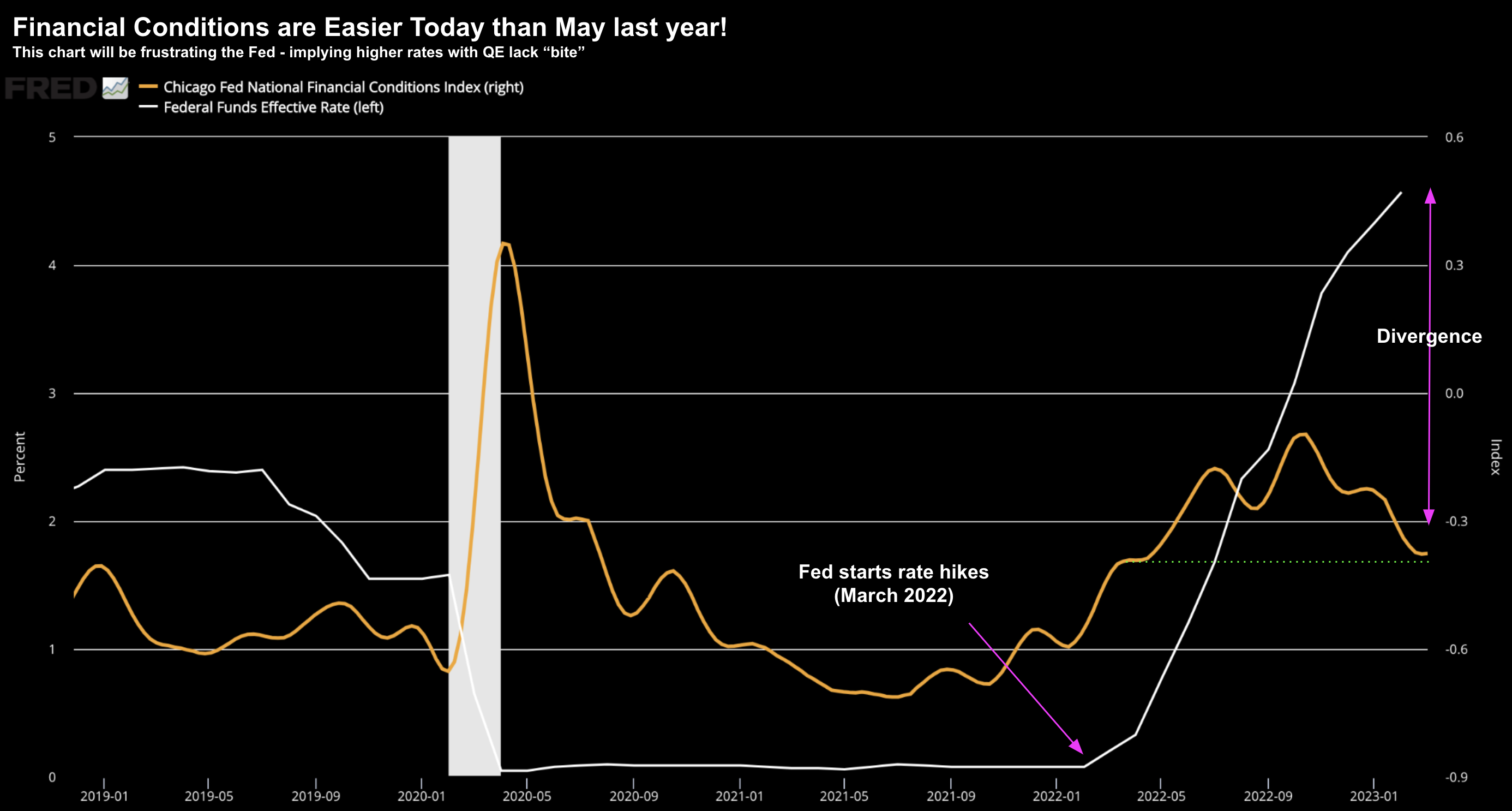

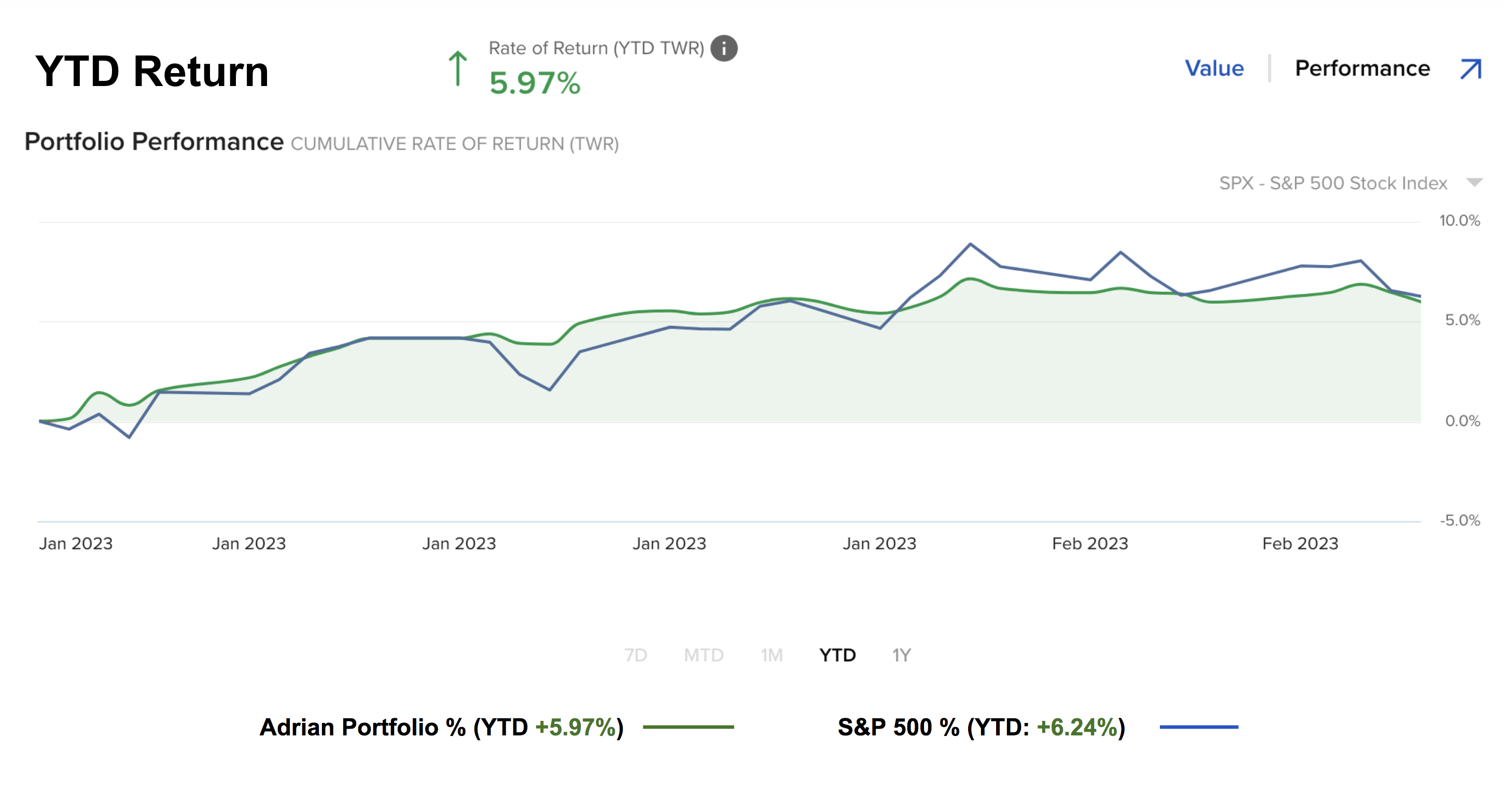

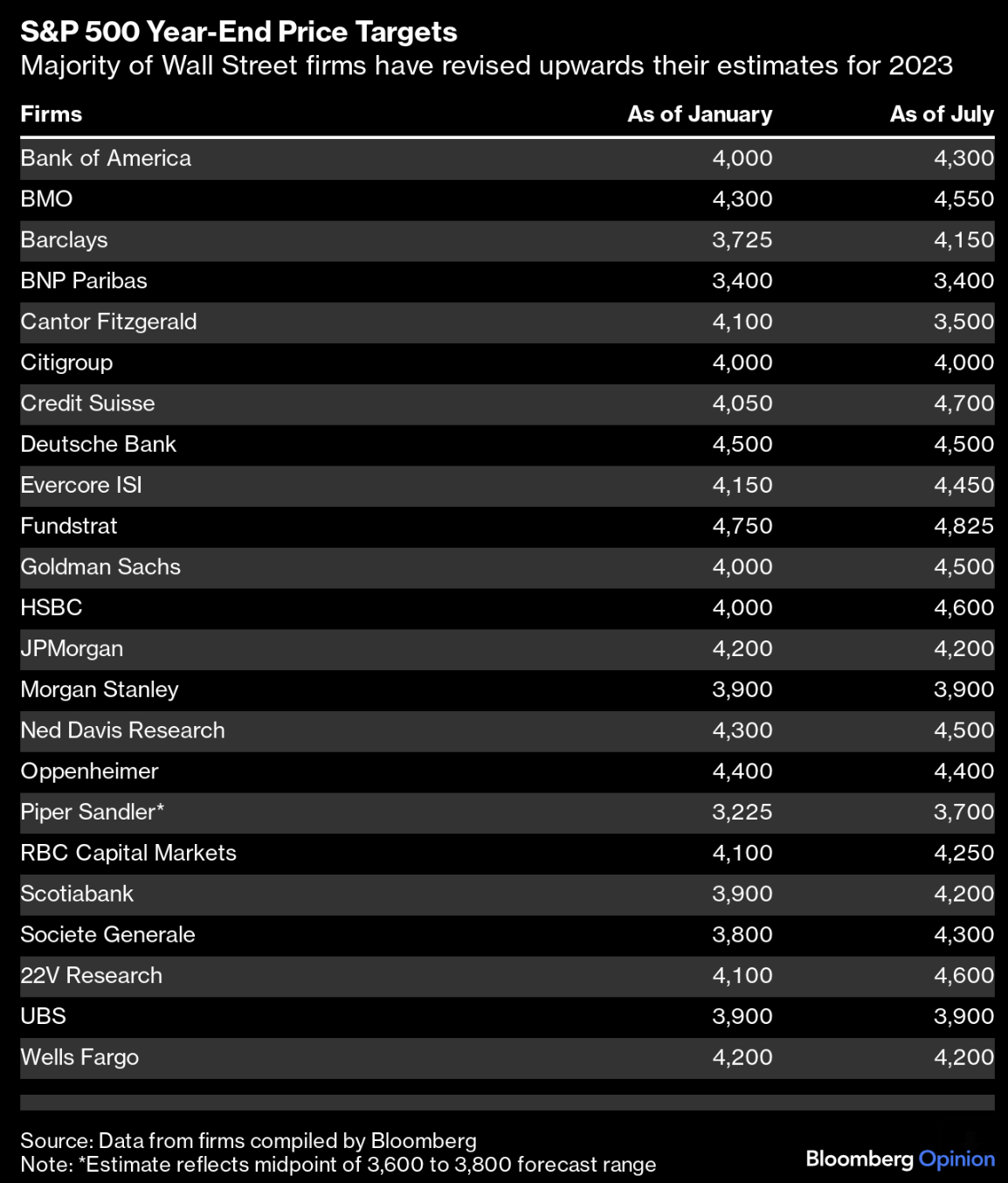

July 24 this year the S&P 500 traded around 4600. At the time, gains were almost 20% for the year. The bulls had all the momentum and analysts were ratcheting up their end of year forecasts. Some felt 20% YTD gains were not enough - calling for even greater upside. What happened? Stocks corrected around 10% offering investors a better opportunity. The game of near-term forecasting is a fool's errand...