My Hypothesis into Year End

My Hypothesis into Year End

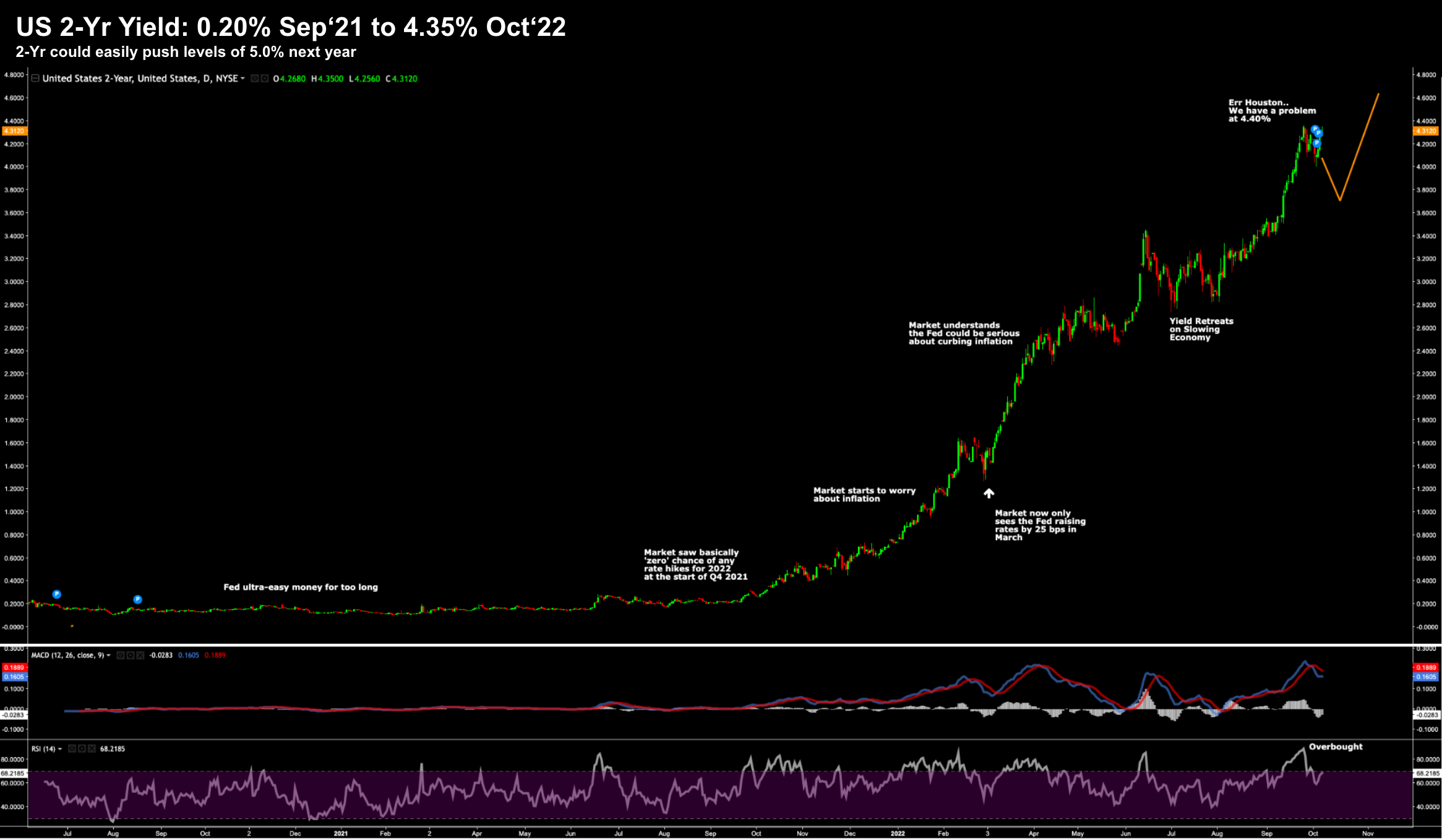

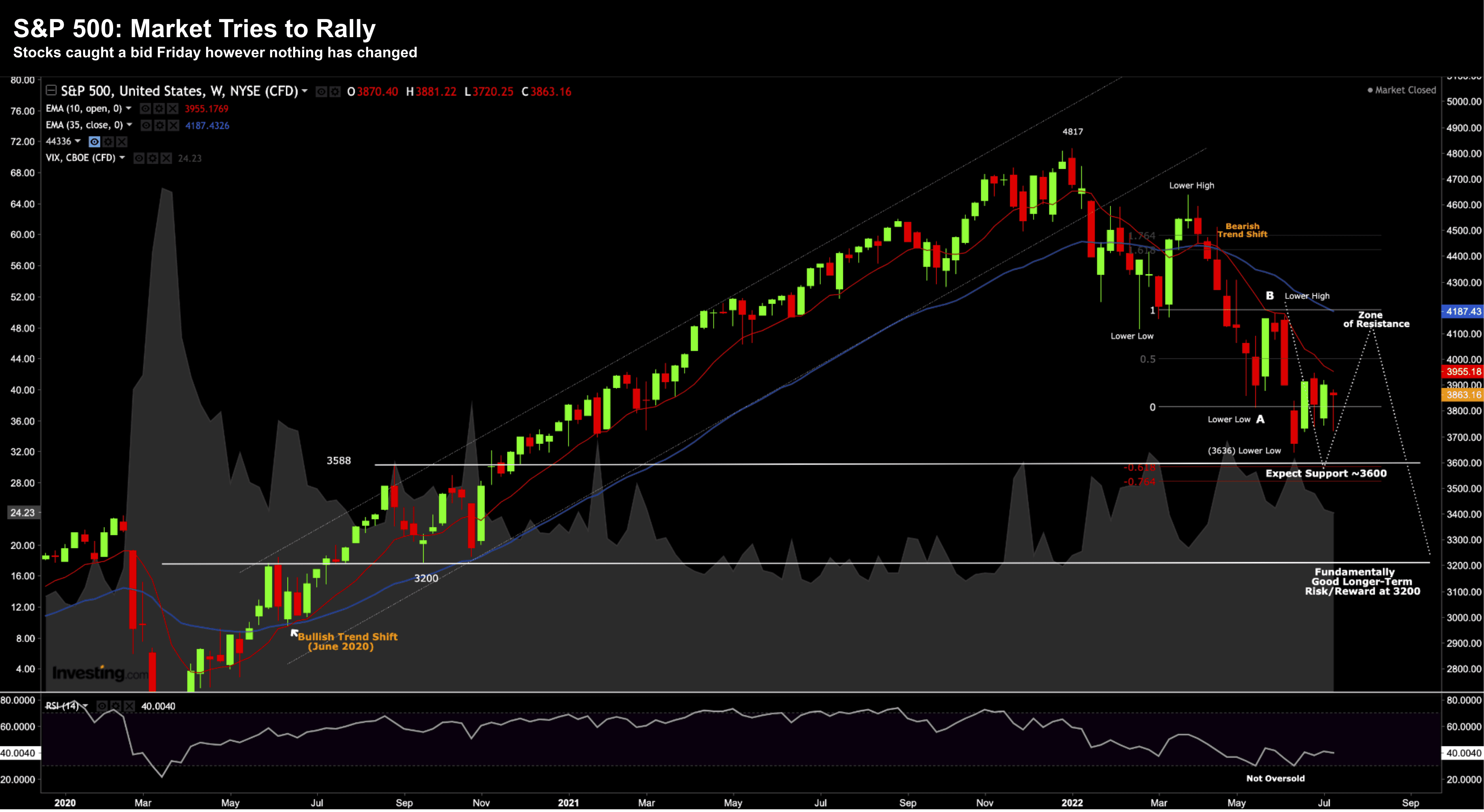

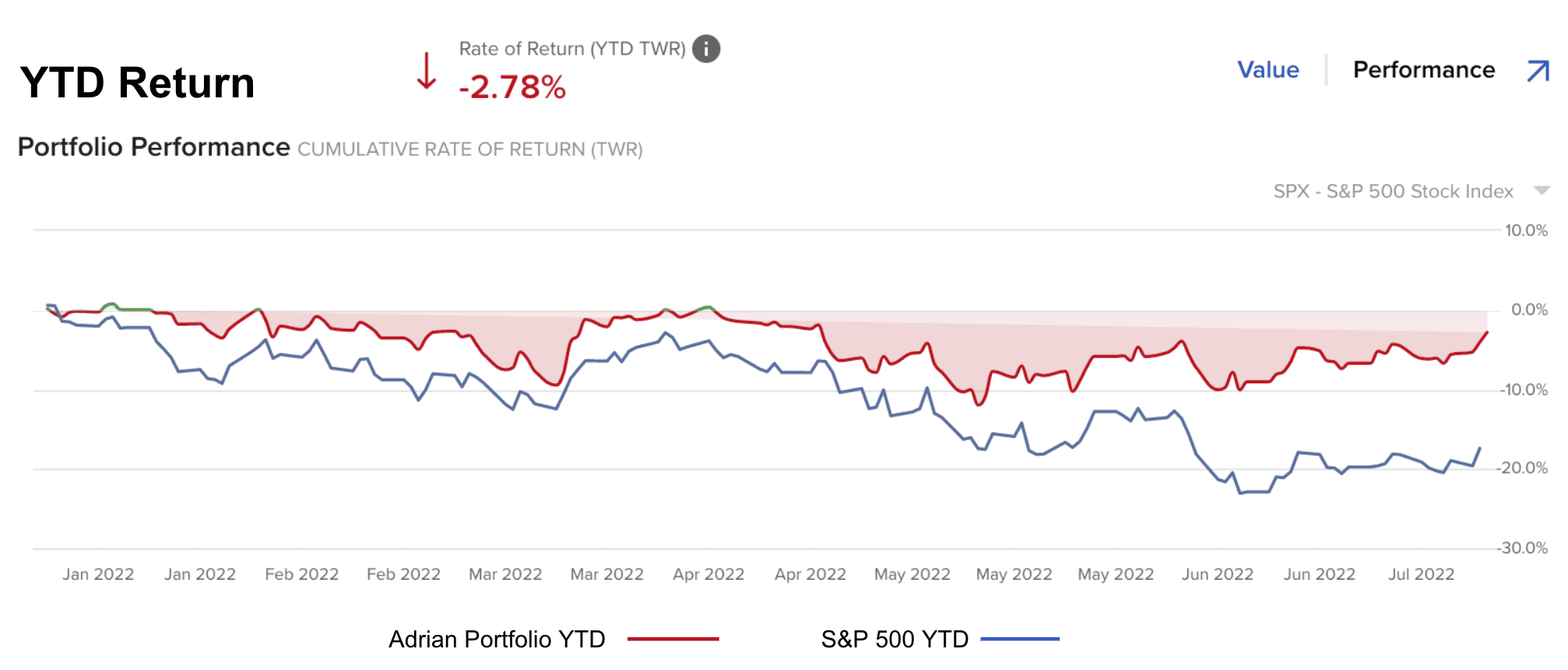

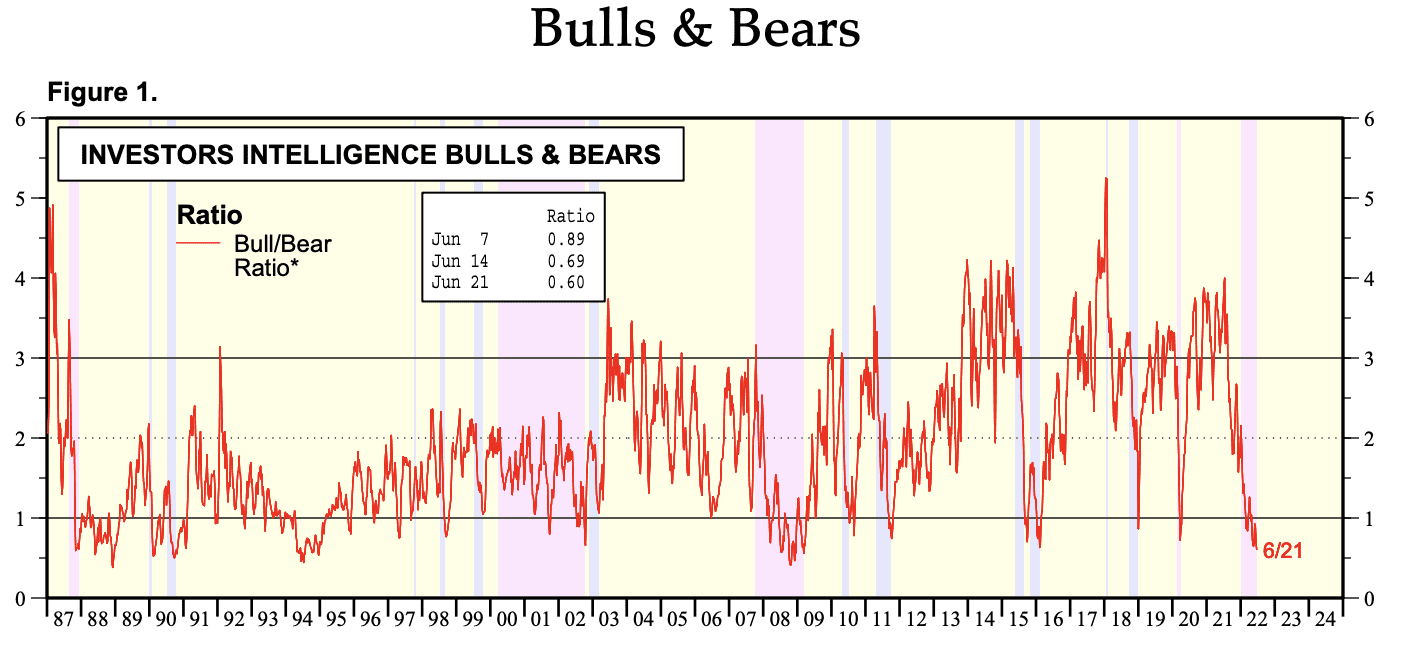

I have four key hypothesis into how I am positioned for year end: (i) 2023 will bring a recession; (ii) earnings will contract; (iii) multiples will compress; and (iv) it's premature to think about fighting the Fed. Let's explore...