Real PCE: “Robust” Economy or Signs of Rust?

Real PCE: “Robust” Economy or Signs of Rust?

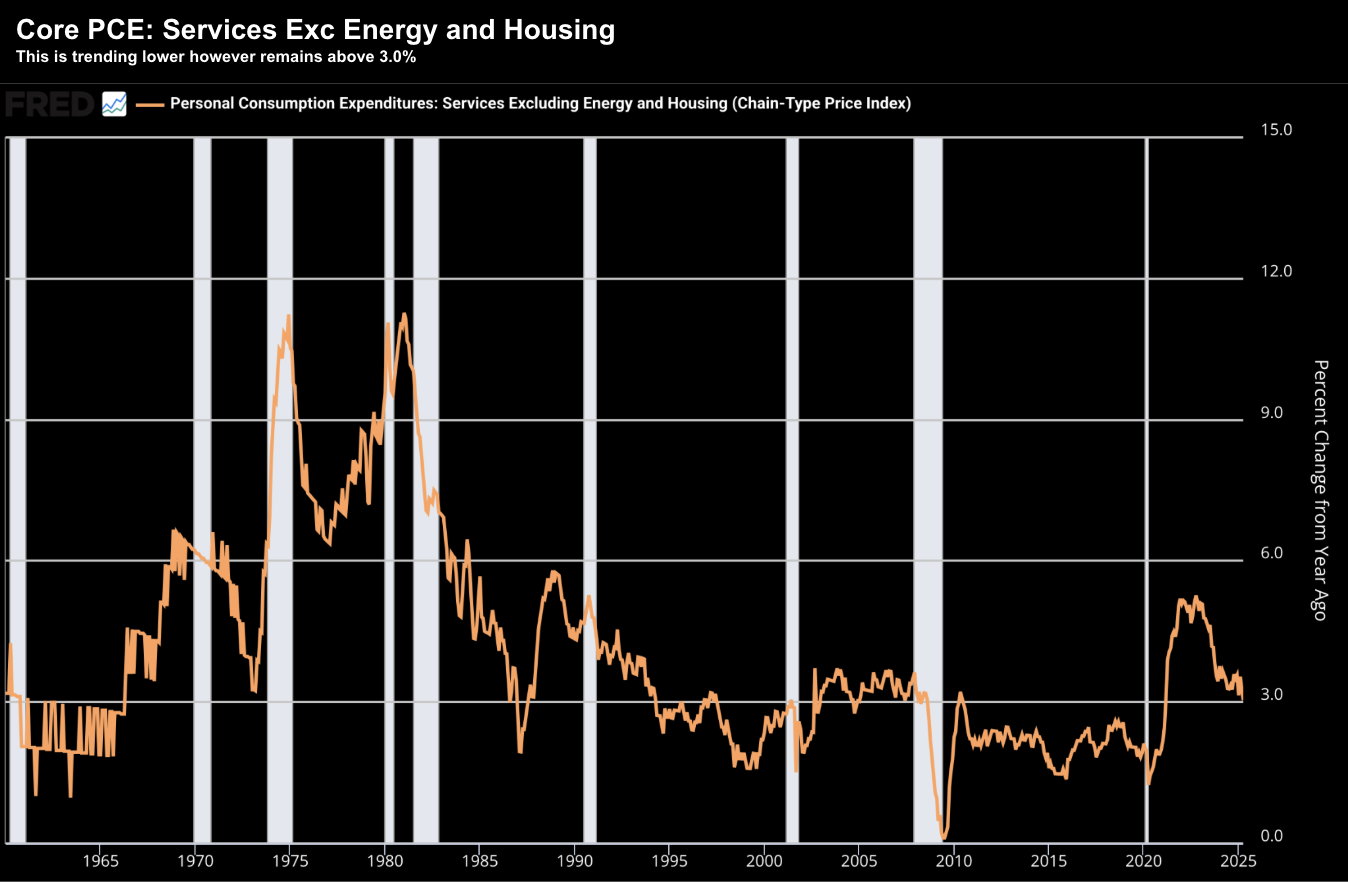

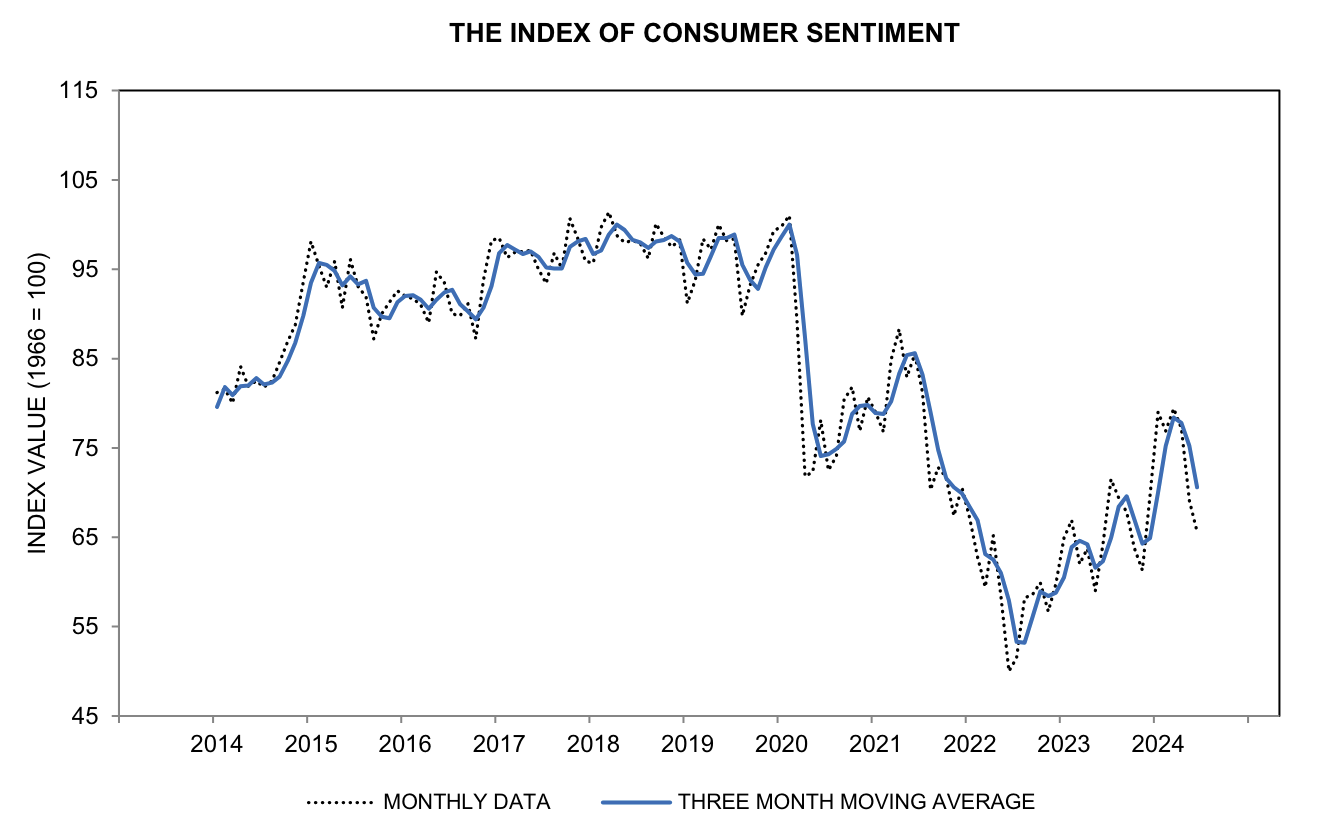

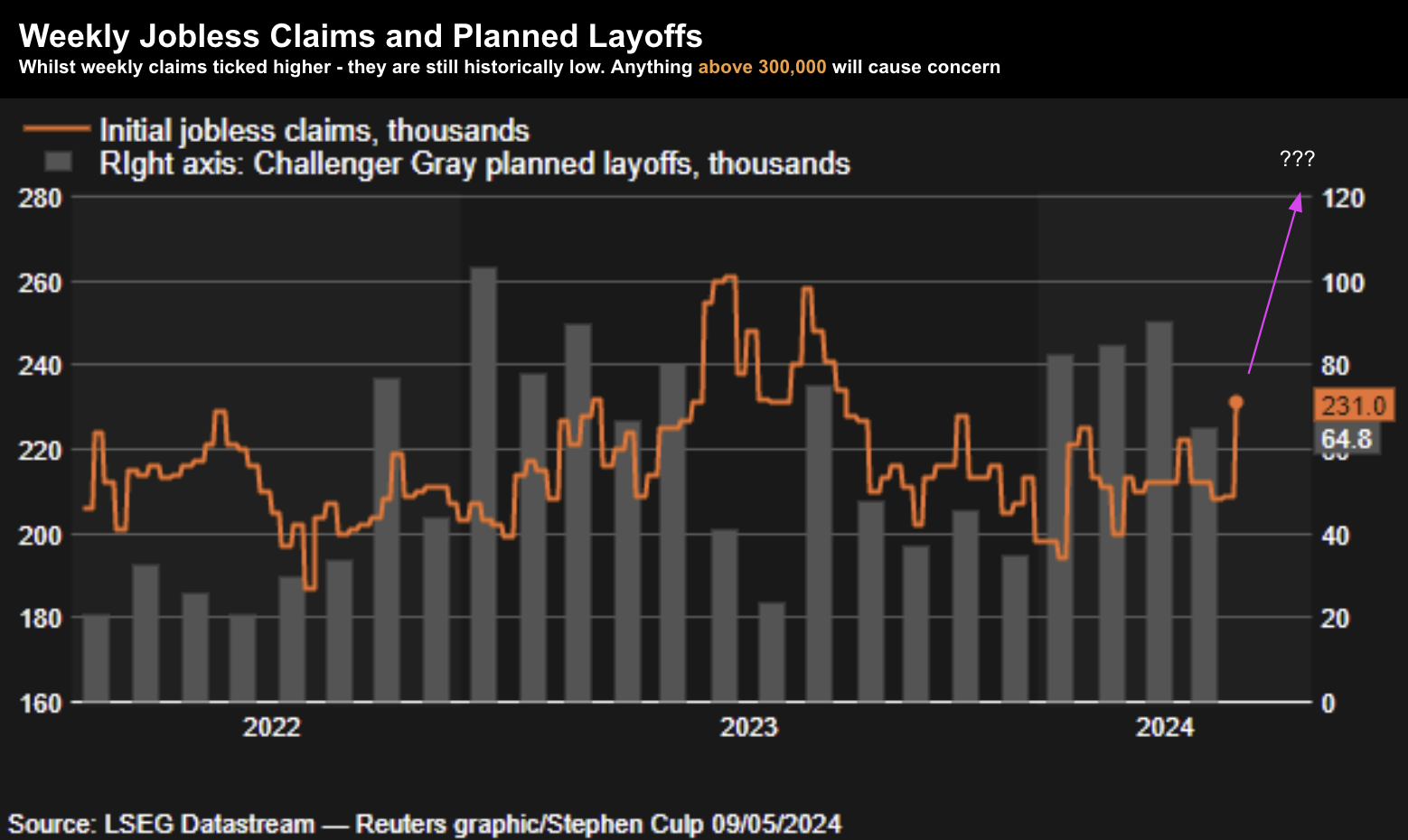

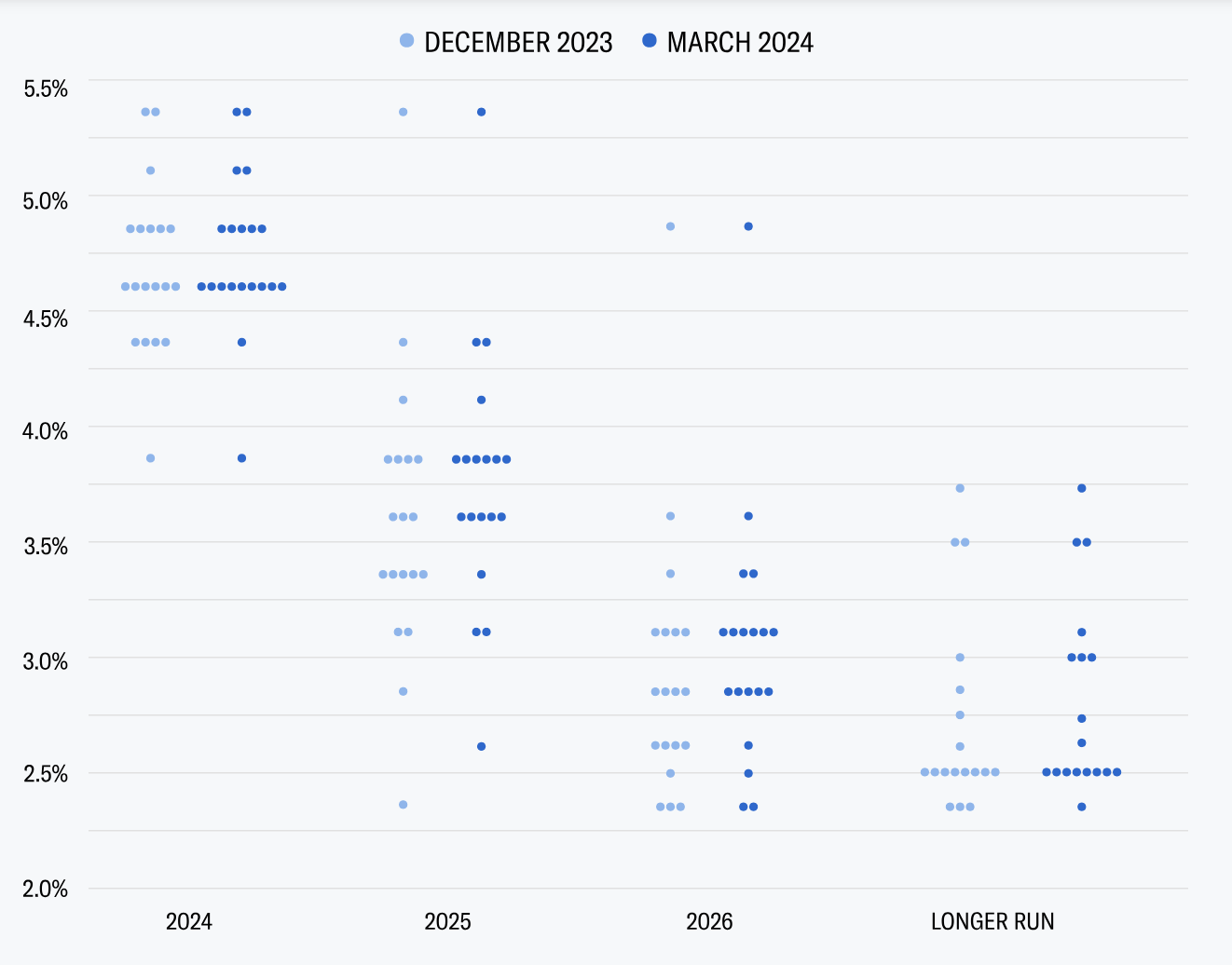

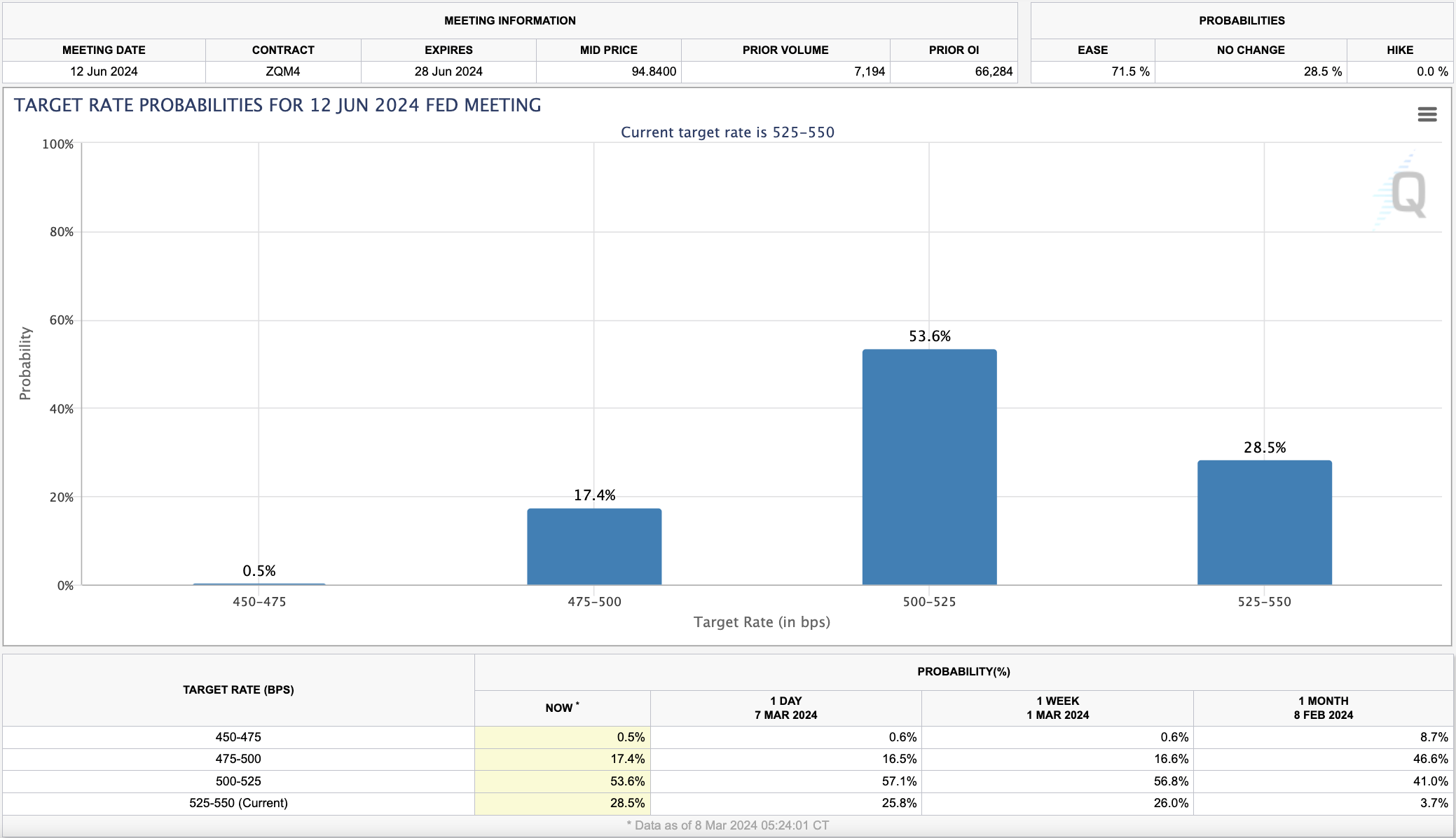

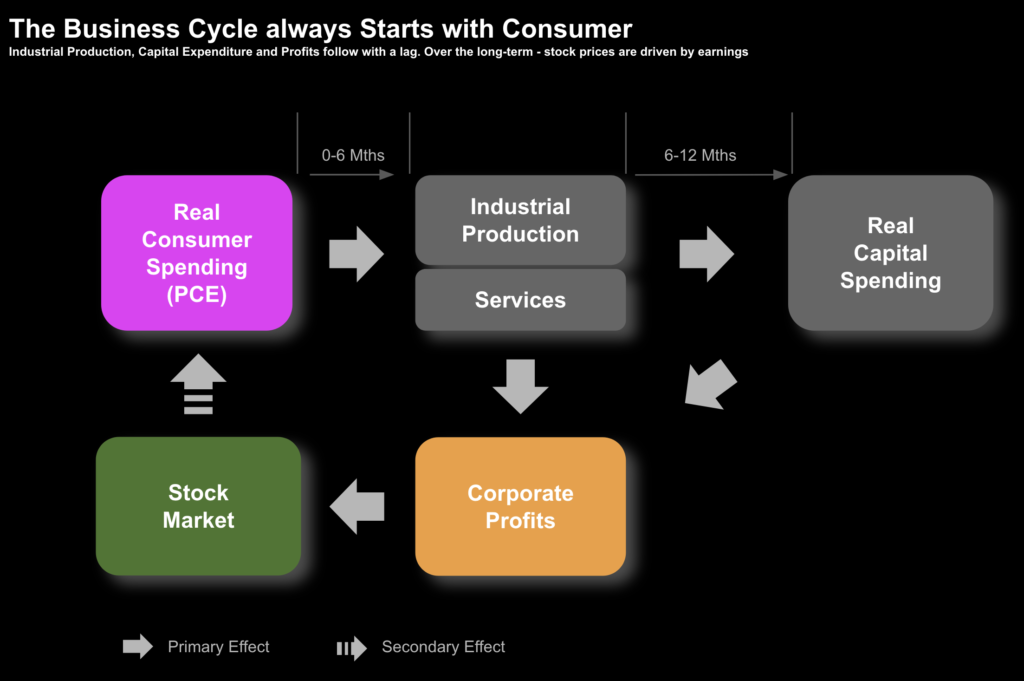

Headline indicators suggest economic resilience, but underlying data reveals structural cracks. While personal consumption remains high, it is increasingly fueled by government transfers rather than private wages. With real spending outpacing income and pending home sales plunging 9.3%, Real PCE serves as a critical leading indicator of an approaching market downturn