Consumer Confidence Drops as Delinquencies Continue to Rise

Consumer Confidence Drops as Delinquencies Continue to Rise

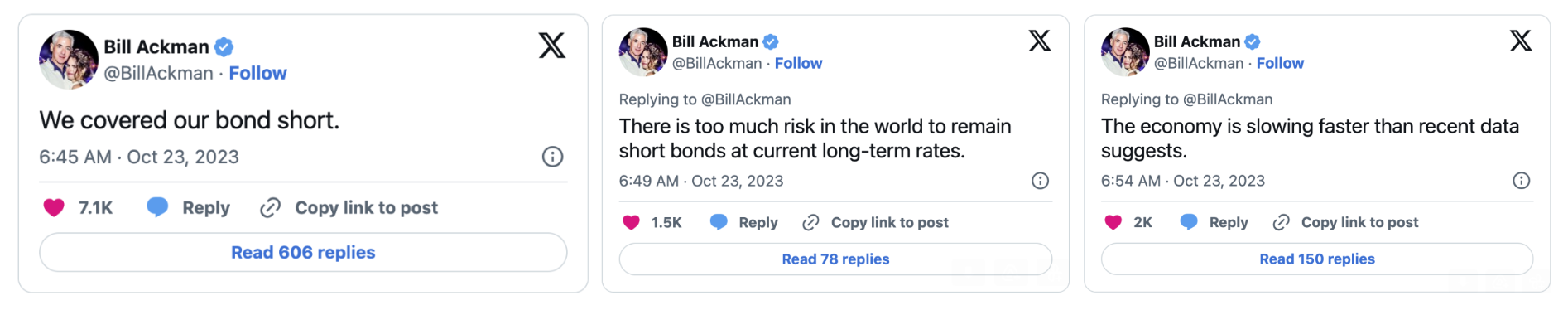

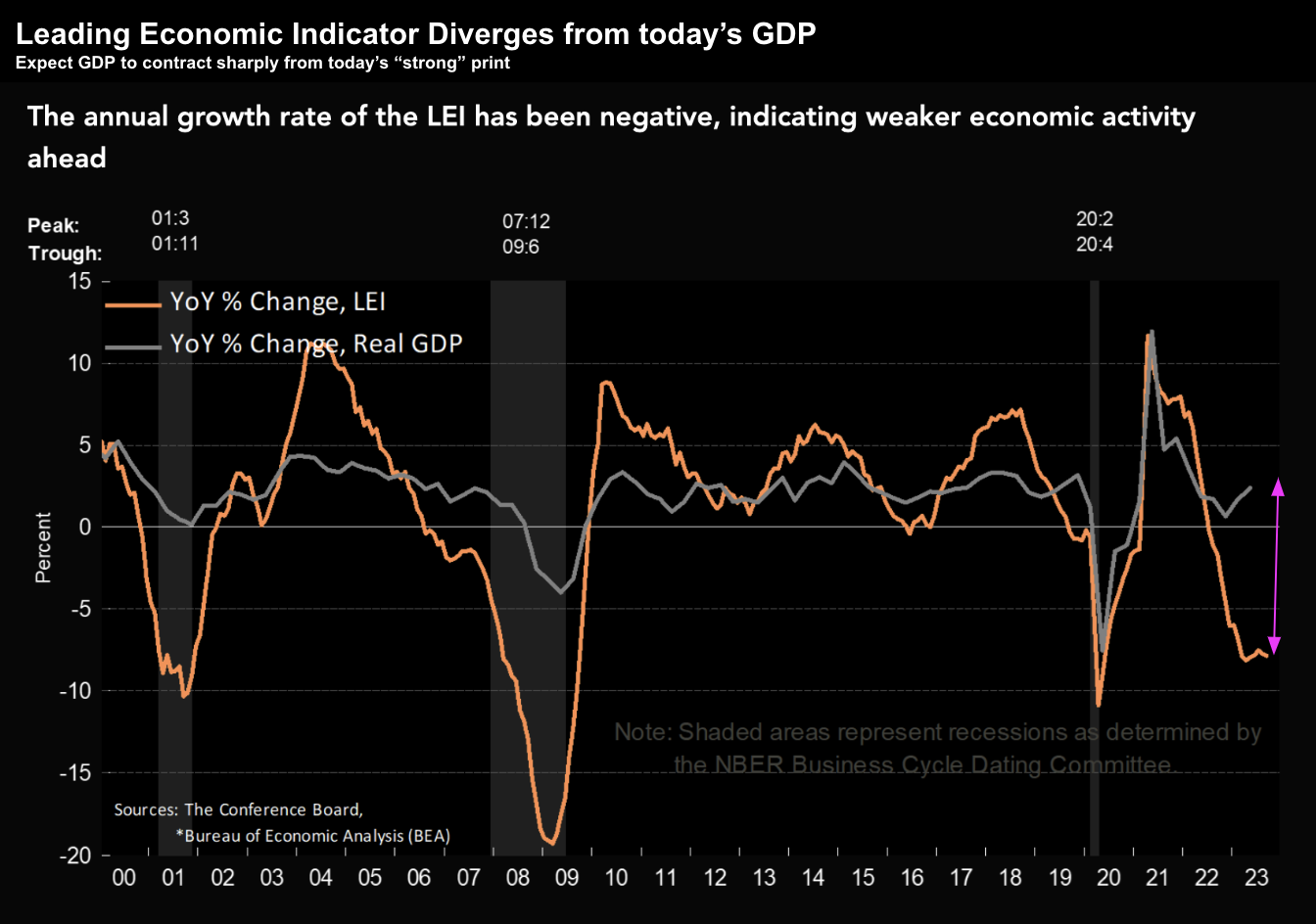

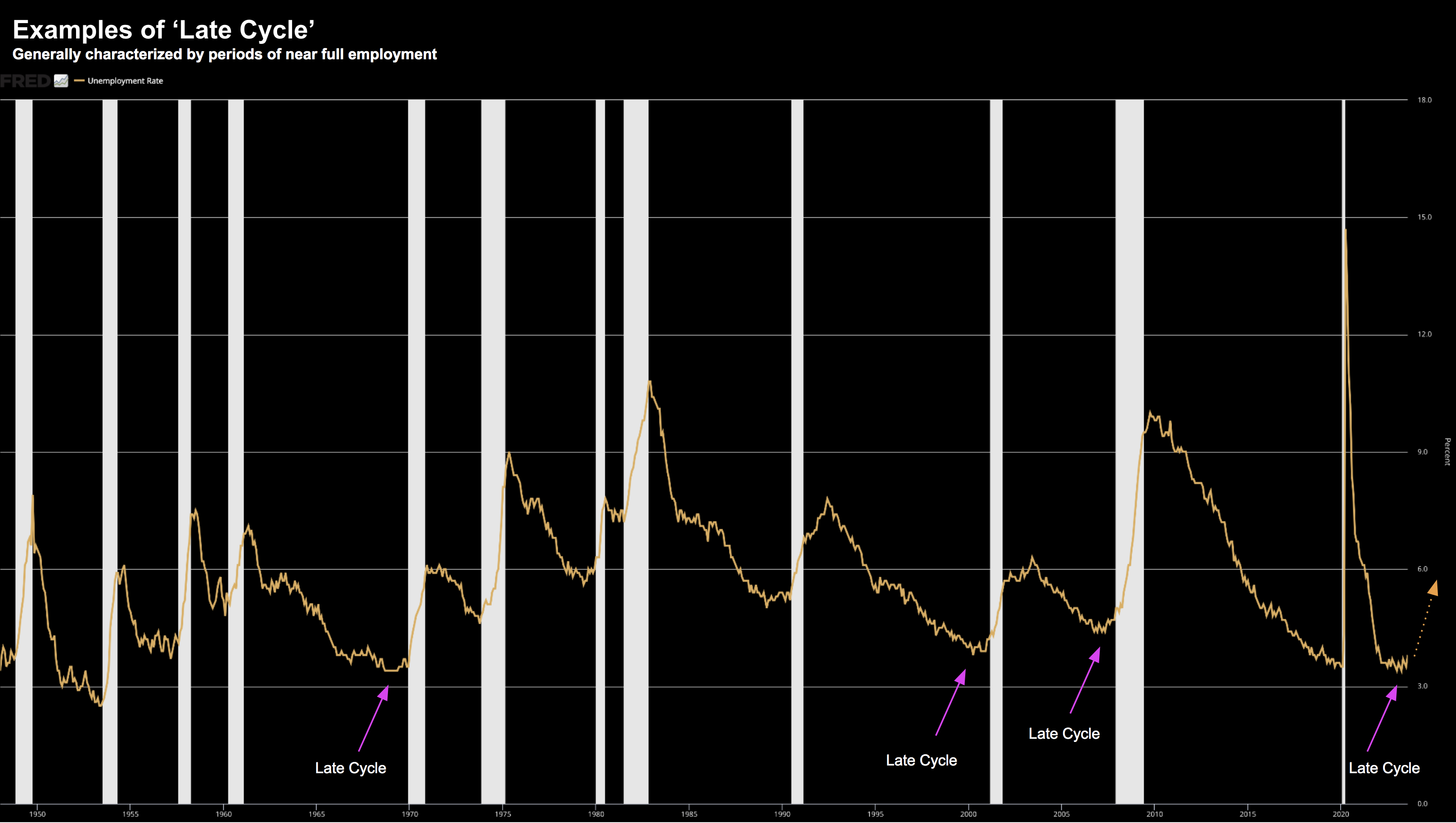

Warren Buffett expressed caution around overpaying in his most recent letter. Jamie Dimon - JP Morgan CEO - said today there's a 50% chance of recession - with a soft landing slim. News of falling consumer confidence and rising credit delinquencies also hit the tape today. This begs a question: is the consumer in 2024 stronger than what we saw in 2023? My guess is no.