A Very Narrow Market

A Very Narrow Market

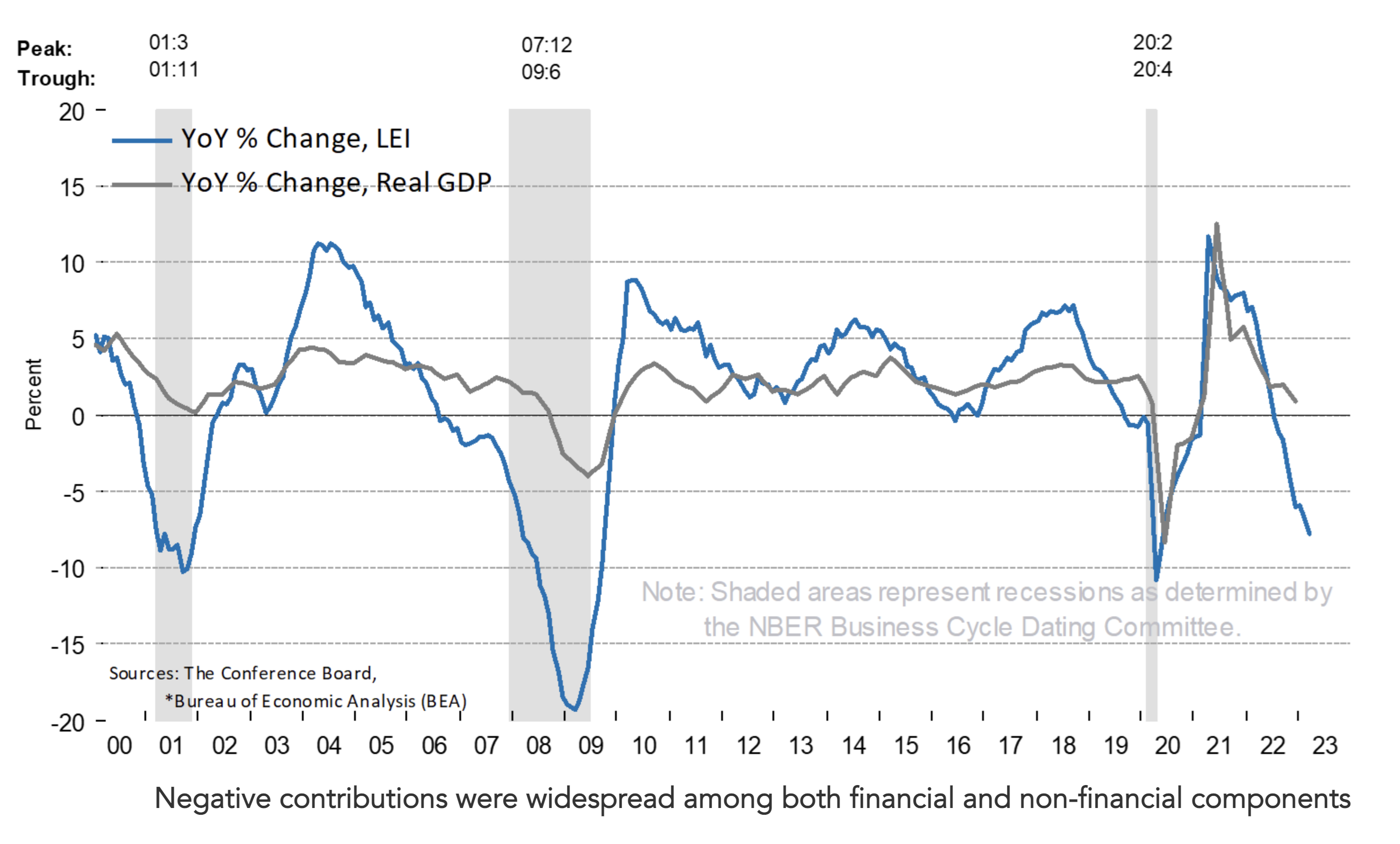

Last week all eyes were on large cap tech earnings. They delivered a mixed bag... but on the whole 'better than feared'. Q1 earnings didn't fall off a cliff. Single digit growth (top and bottom line) was largely cheered - which highlights how low expectations were. Next week eyes turn to the Fed. The market has priced in a 25 bps hike for May - but will it be a 'dovish' hike - where they offer language to suggest a pause in June? Or will they say "there's more work to do"?