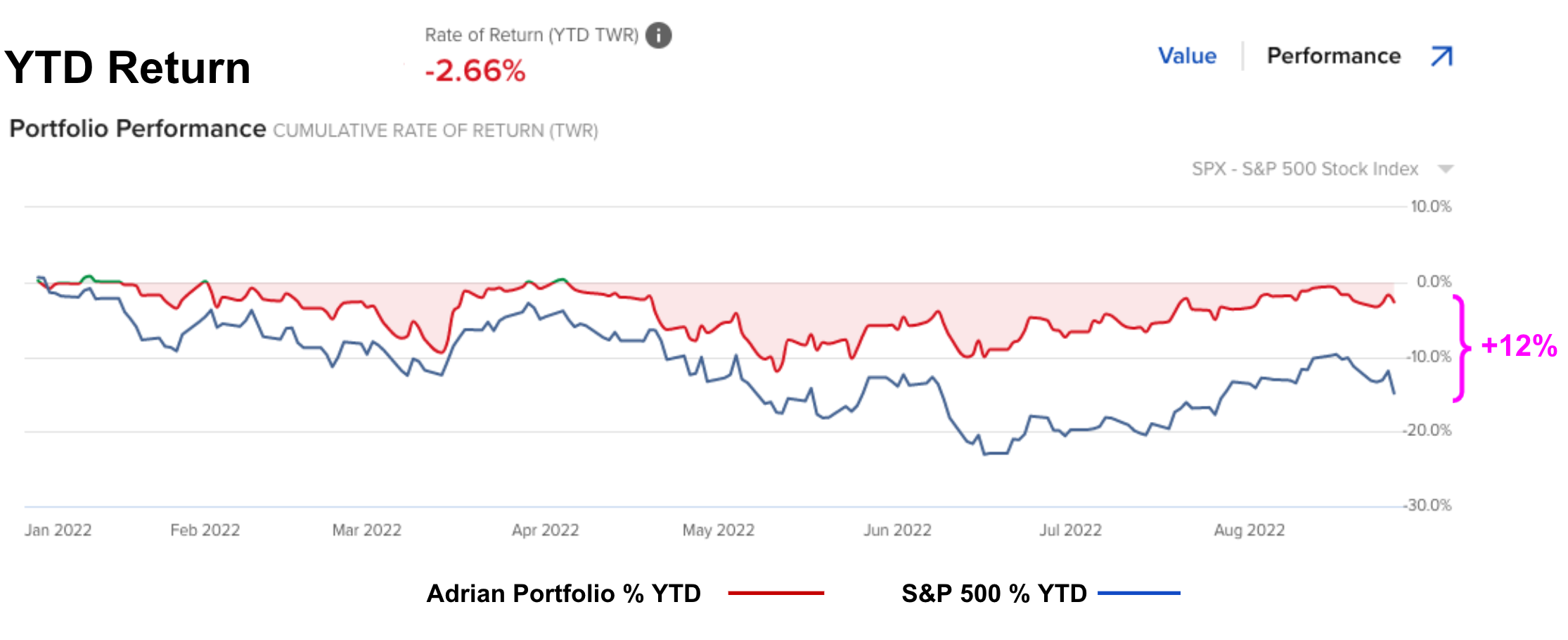

Things Starting to Look a Little Better

Things Starting to Look a Little Better

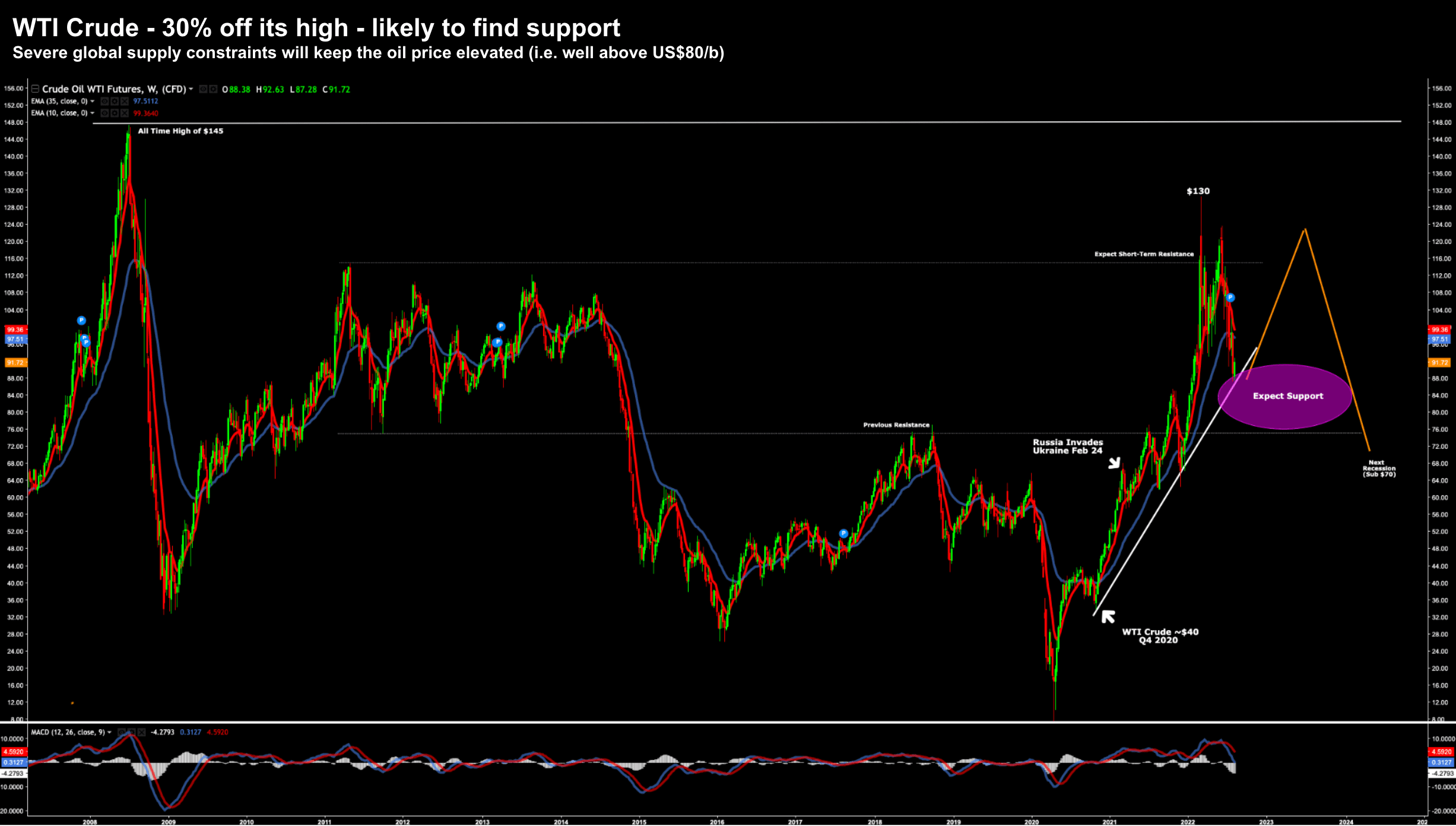

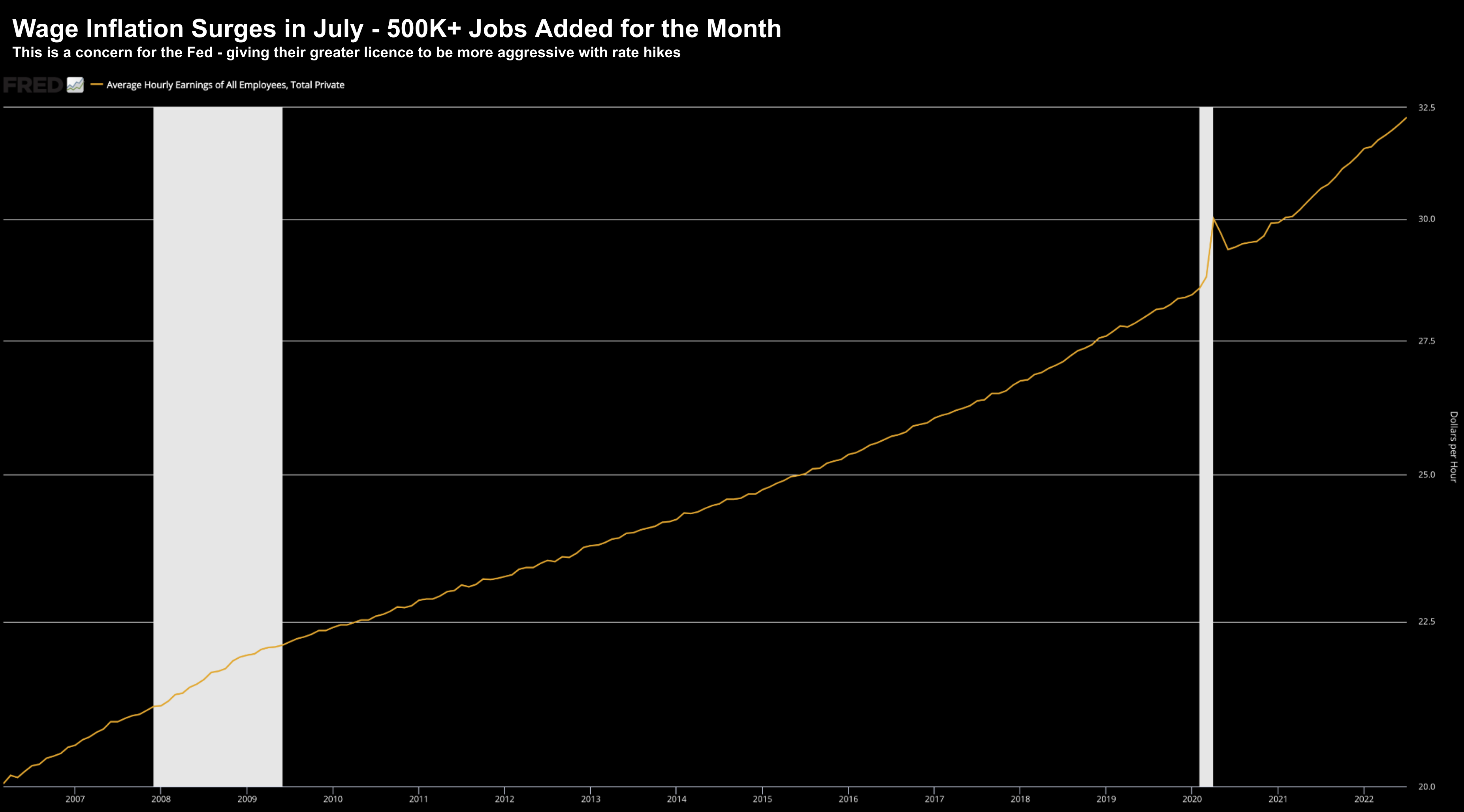

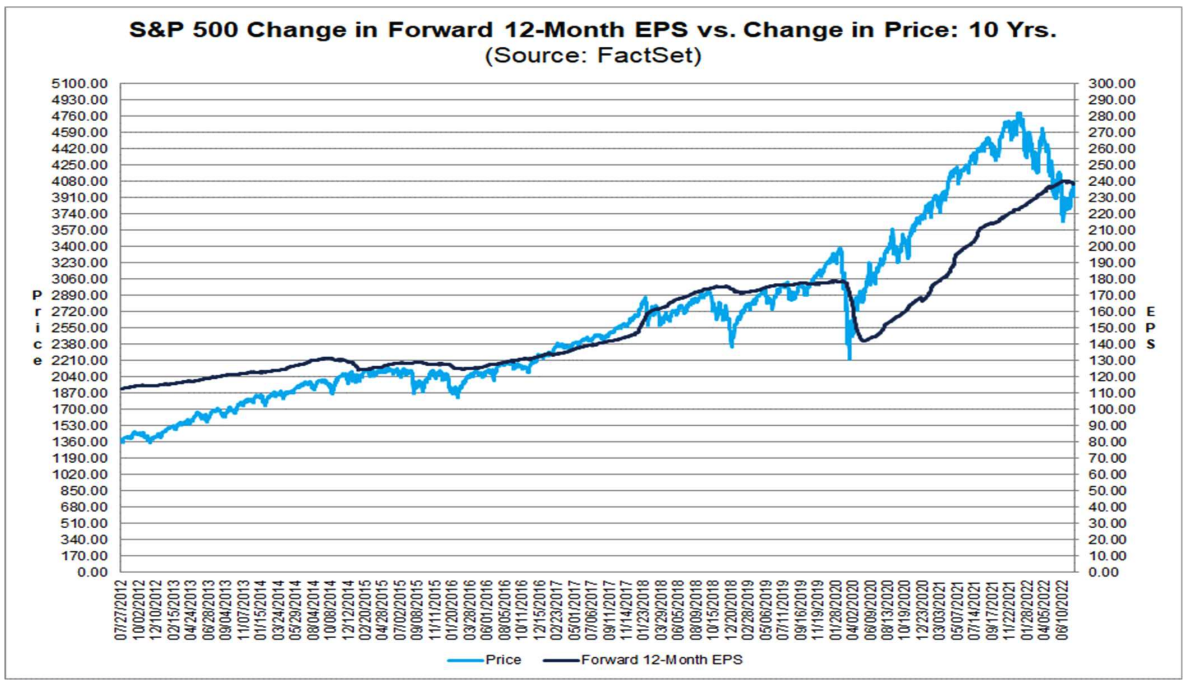

Markets are slowly but surely starting to look better. Yes - they are 25% off their highs - but that's a healthy development. The way we make money is buying well. And with a little patience - we hope they go lower. My S&P500 target remains around 3200...