Risk On? Or Classic Bear Trap?

Risk On? Or Classic Bear Trap?

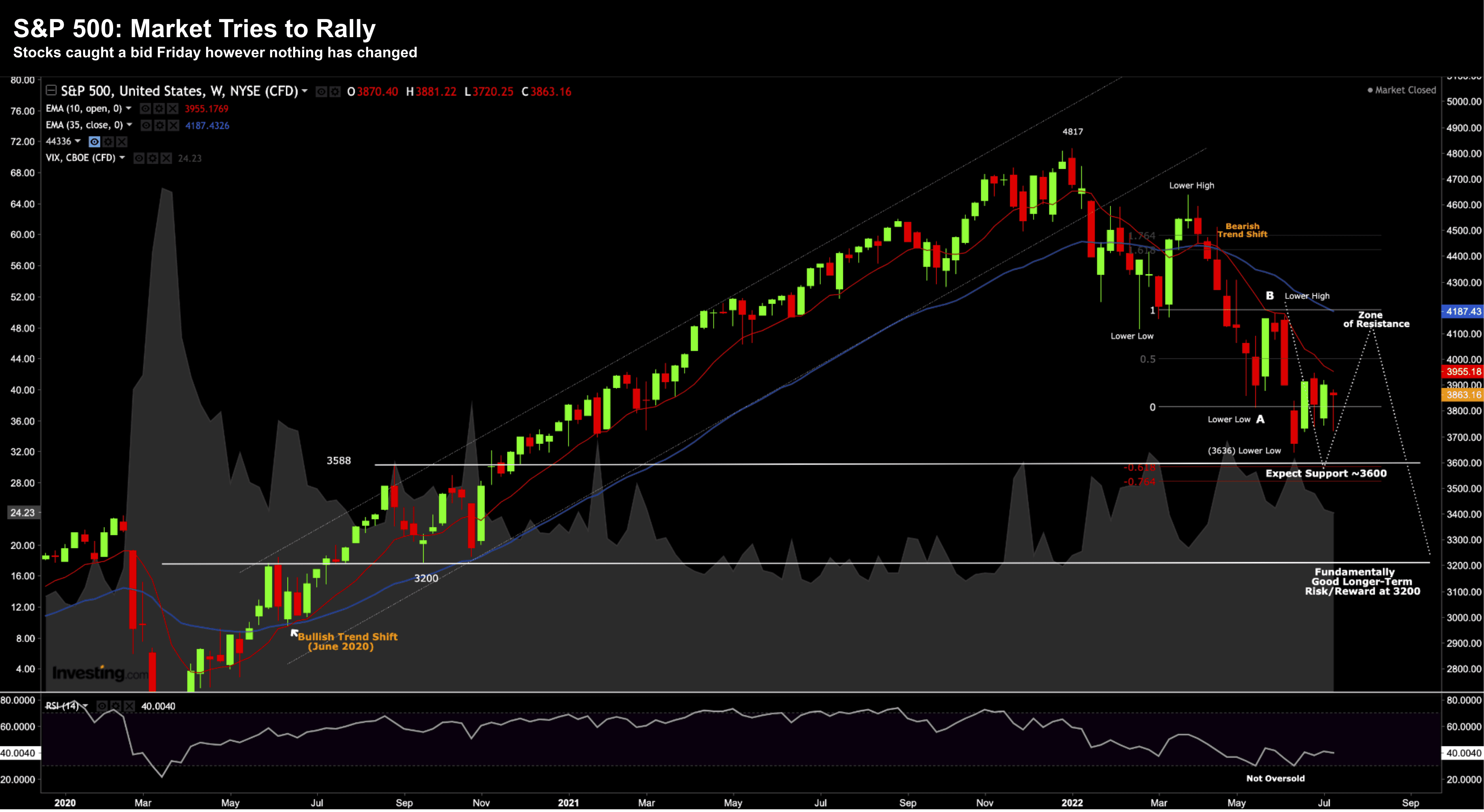

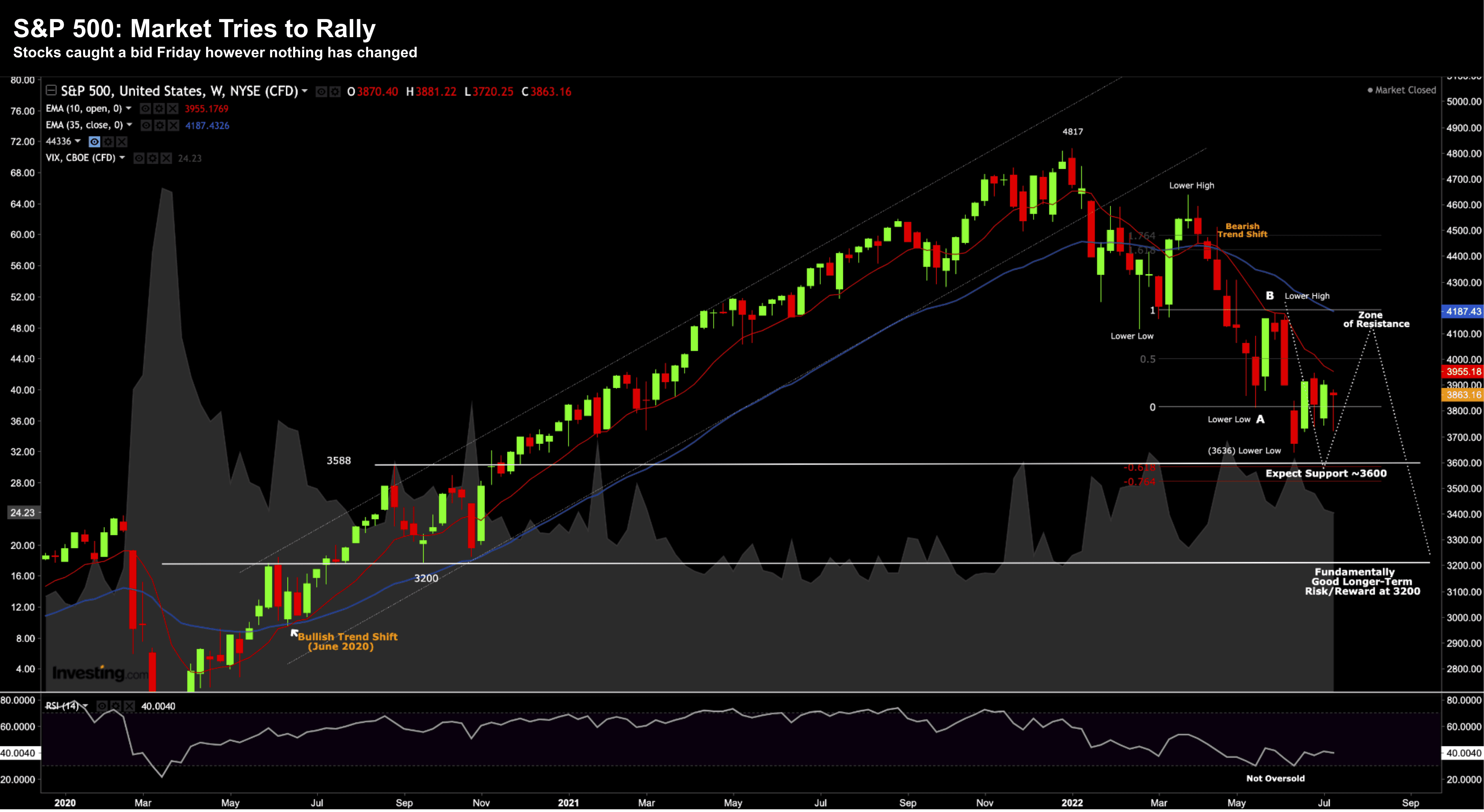

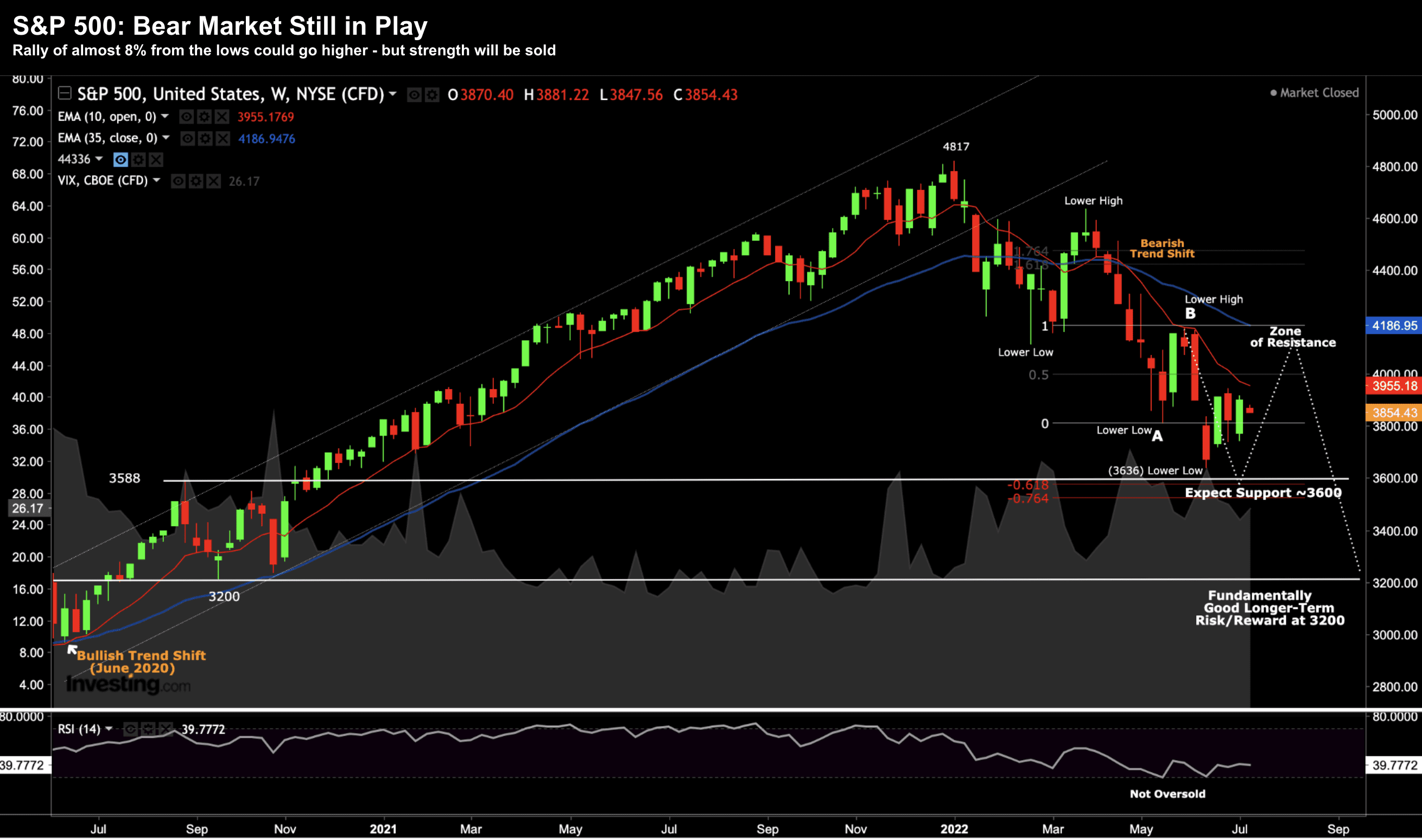

The S&P 500 is up 14% from its June lows. But from mine, this is still a bear market rally. The Fed is far from done.

Risk On? Or Classic Bear Trap?

Risk On? Or Classic Bear Trap?The S&P 500 is up 14% from its June lows. But from mine, this is still a bear market rally. The Fed is far from done.

Walmart Cuts Earnings b/w 11% – 13%

Walmart Cuts Earnings b/w 11% – 13%Add Walmart to the growing list of names slashing guidance. But this one is notable... especially given their read-through on the average consumer. What did we learn from the US' largest physical retailer.

Forget Snap… There’s a Much Bigger Picture

Forget Snap… There’s a Much Bigger PictureNext week we have the Fed (expected to raise 75 bps) and big-tech earnings. Both will move markets - but I give more weight to what we hear from Apple, Amazon, Google and Microsoft.

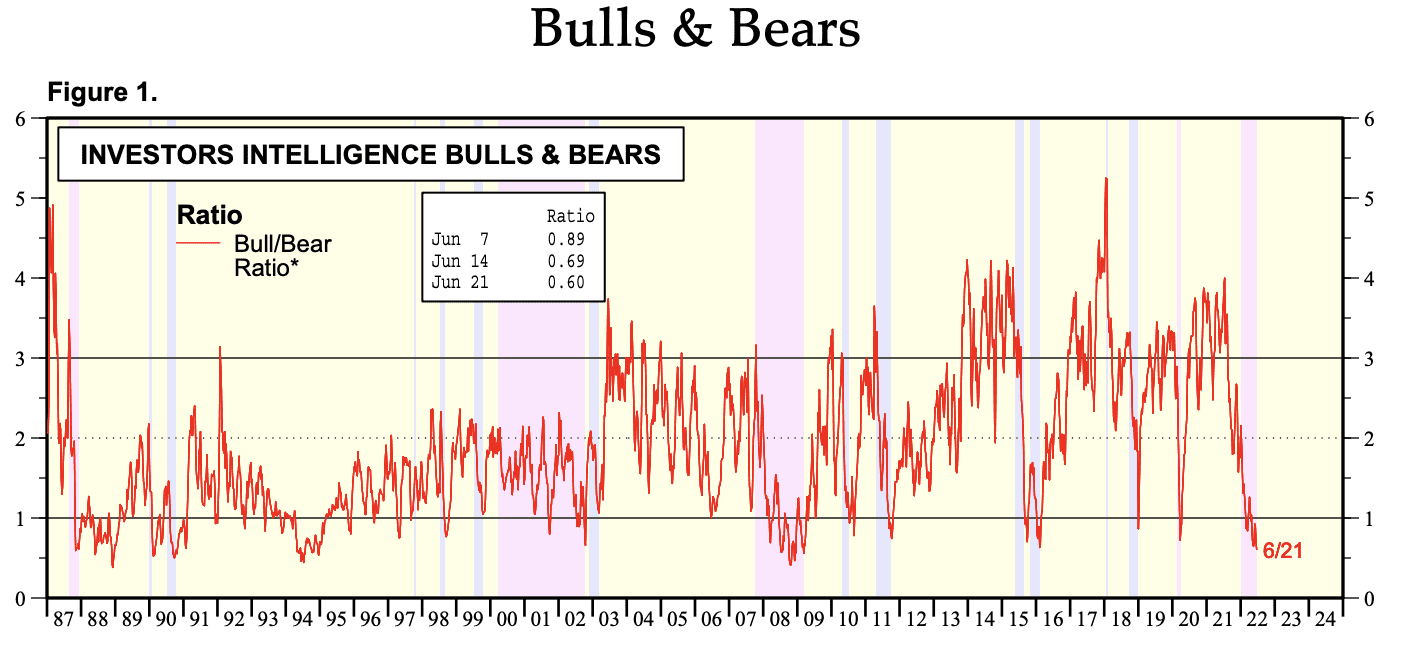

Bear Market Rally? Or ‘the’ Bottom for 2022?

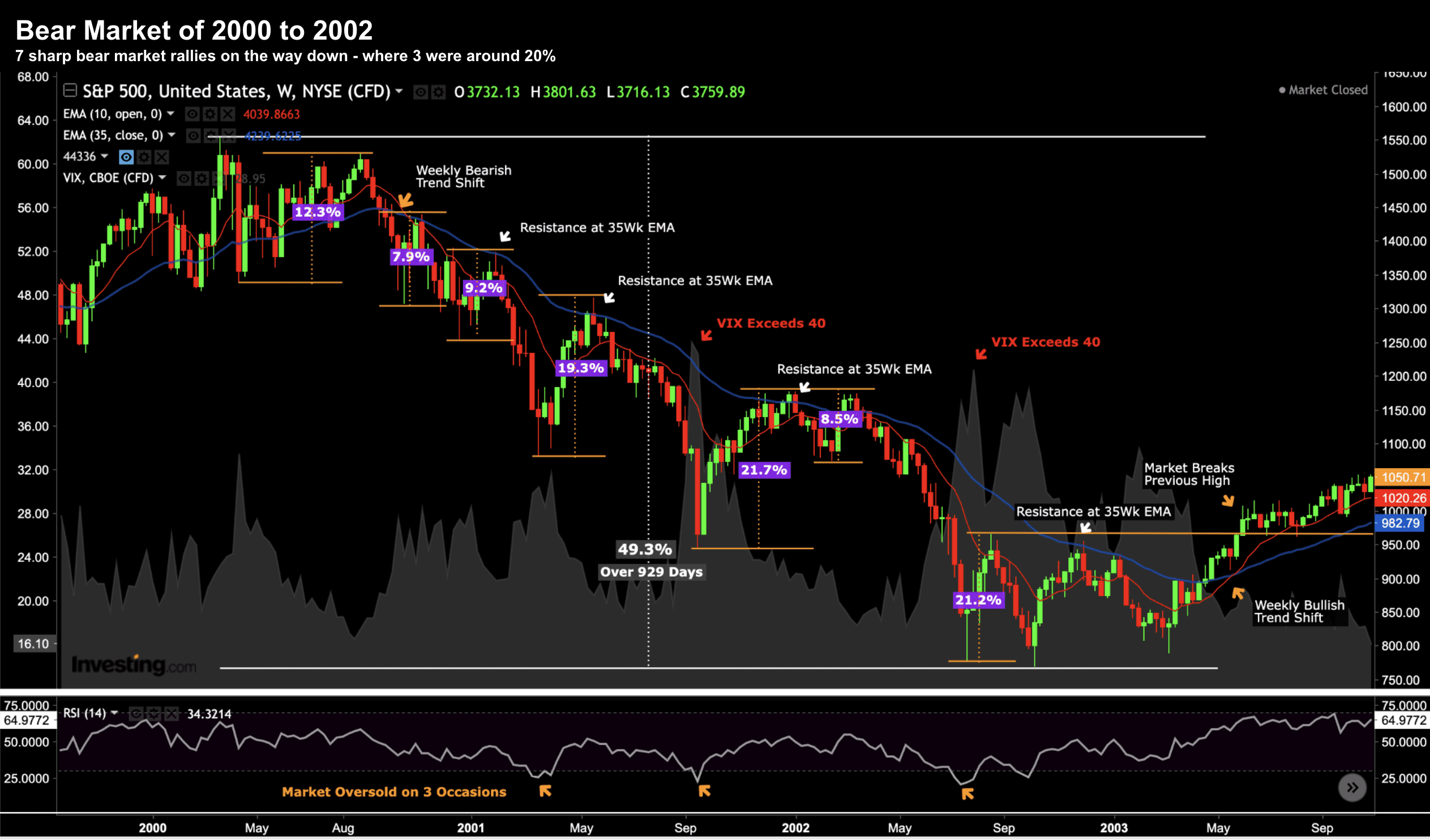

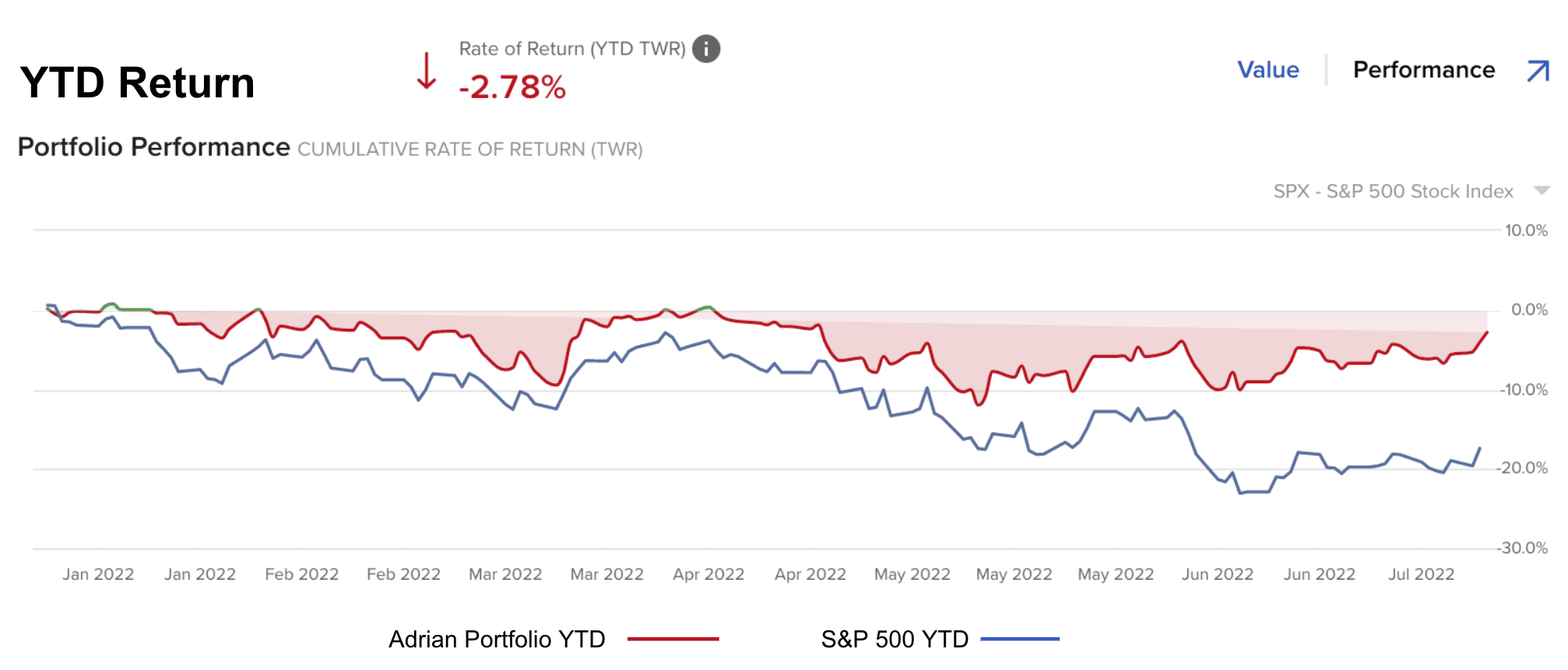

Bear Market Rally? Or ‘the’ Bottom for 2022?Some feel the bottom could be in for 2022. They might be right. Who knows? Sentiment has not been this negative since 2008. However, I think probabilities still favour lower lows.

JP Morgan Warns of ‘Negative Consequences’

JP Morgan Warns of ‘Negative Consequences’There's a very good reason why inflation is likely to come down next year... the dramatic slowing of (M2) money supply growth. However, we will have uncomfortably high inflation for at least 6-9 months yet.

Negative Impact of Labor Costs on Earnings

Negative Impact of Labor Costs on EarningsThere are three things I want to see before I utter the words "the bottom is in". One of those three are Q3 earnings revisions... they are coming and this is one big reason why...

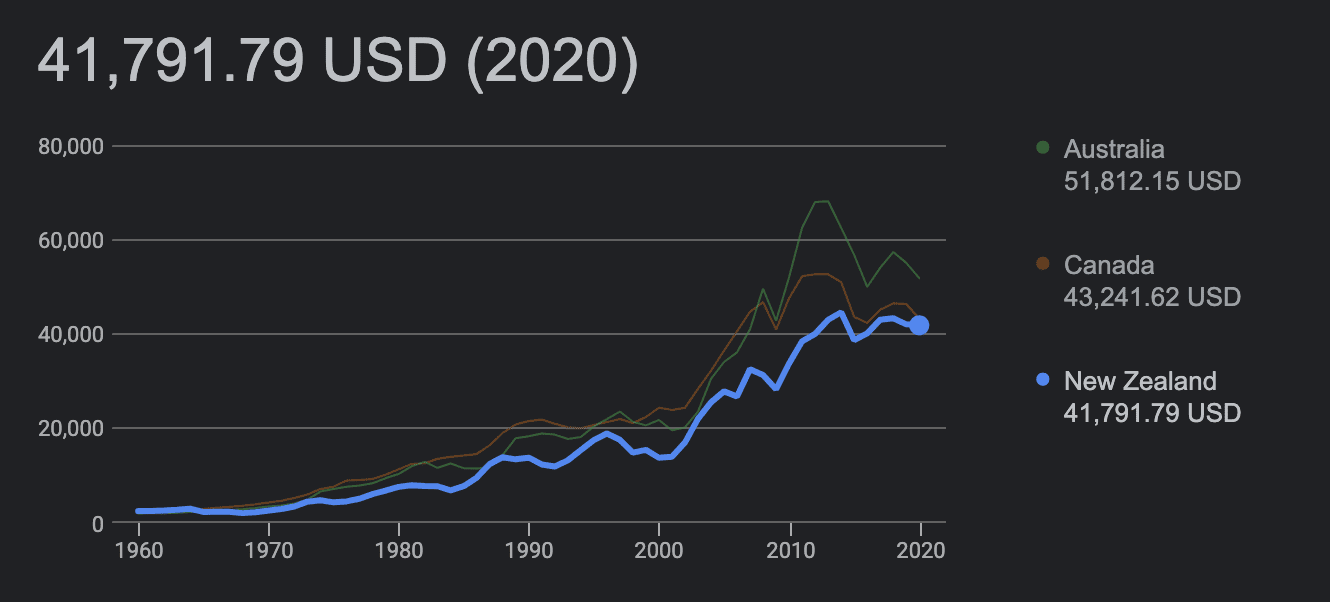

Sell this Bounce… and Why NZ is Worth Watching

Sell this Bounce… and Why NZ is Worth WatchingWe are in the midst of a bear market rally - but I don't trust it for three reasons. Separately, is New Zealand a canary in the coal mine regarding the impact of raising interest rates?

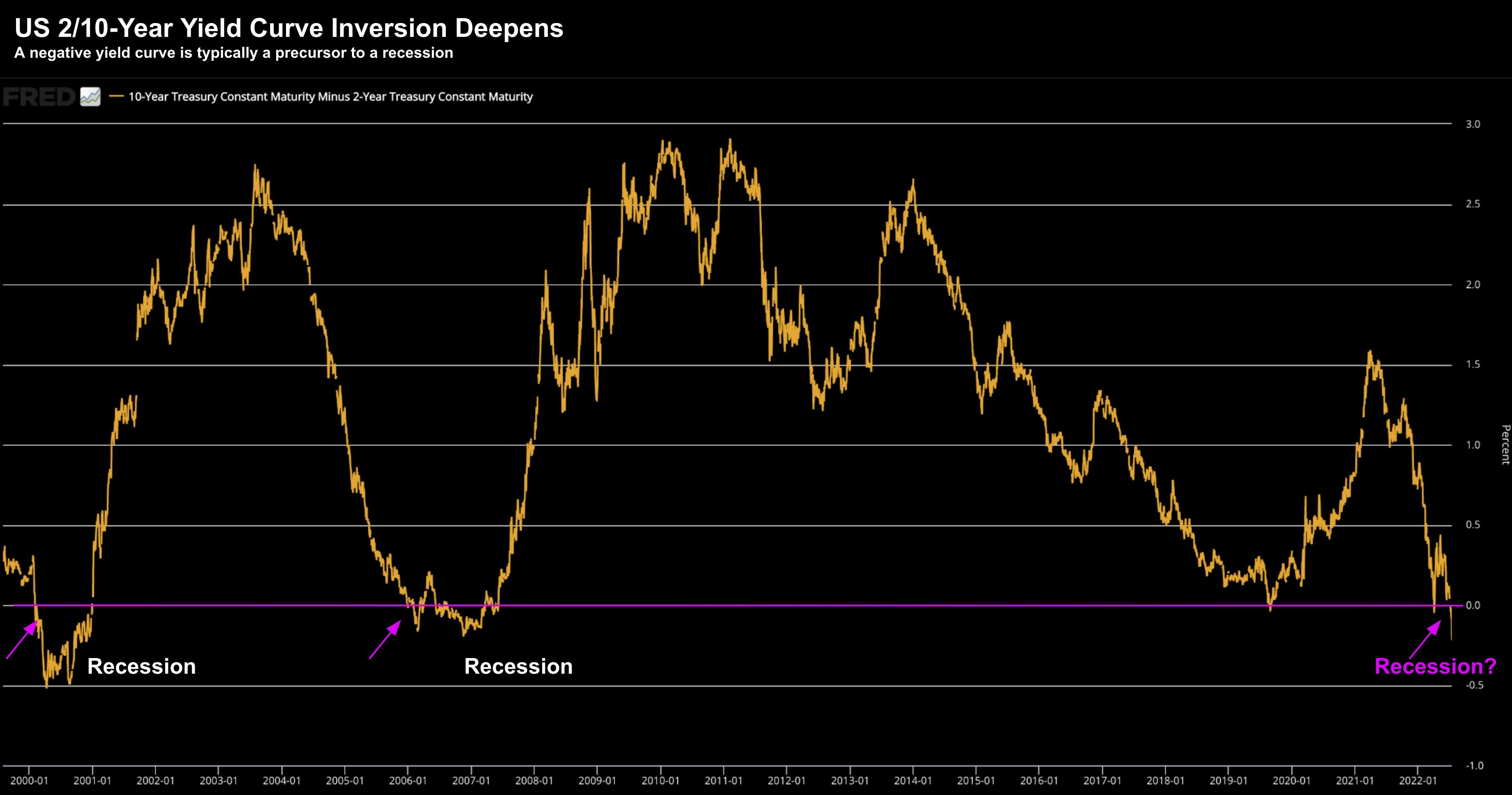

Recession: The ‘Cost’ of Unwanted Inflation

Recession: The ‘Cost’ of Unwanted InflationToday the Fed reminded us they have one objective (and only one): to bring inflation back to its target level of 2.0%. However, the unspoken narrative was sacrifices will need to be made (i.e. expect a recession)

Here’s What We Still Need to See

Here’s What We Still Need to SeeThere are three primary things we still need to see before we can confidently claim we are close to a market bottom in 2022... the first is a pivot from the Fed.

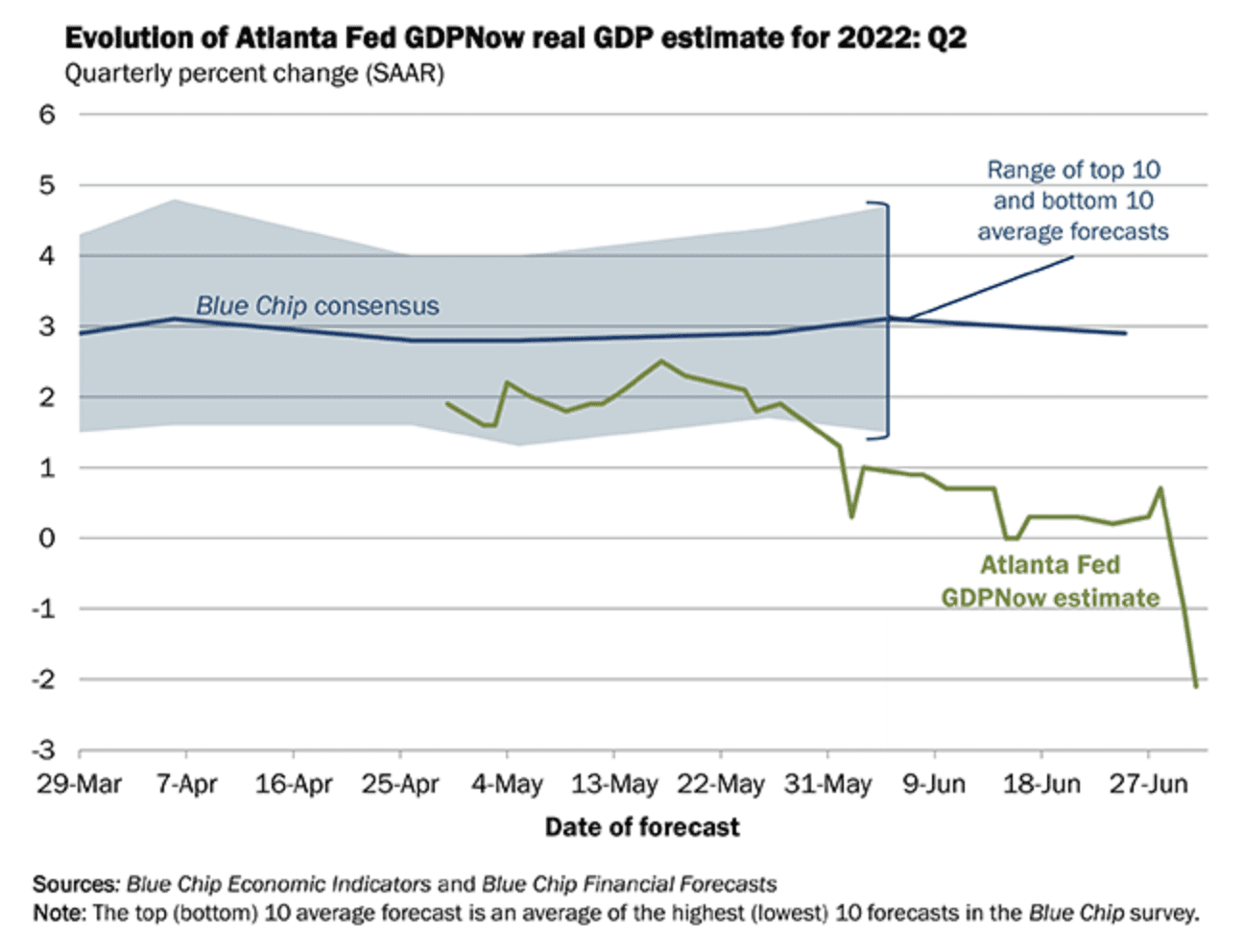

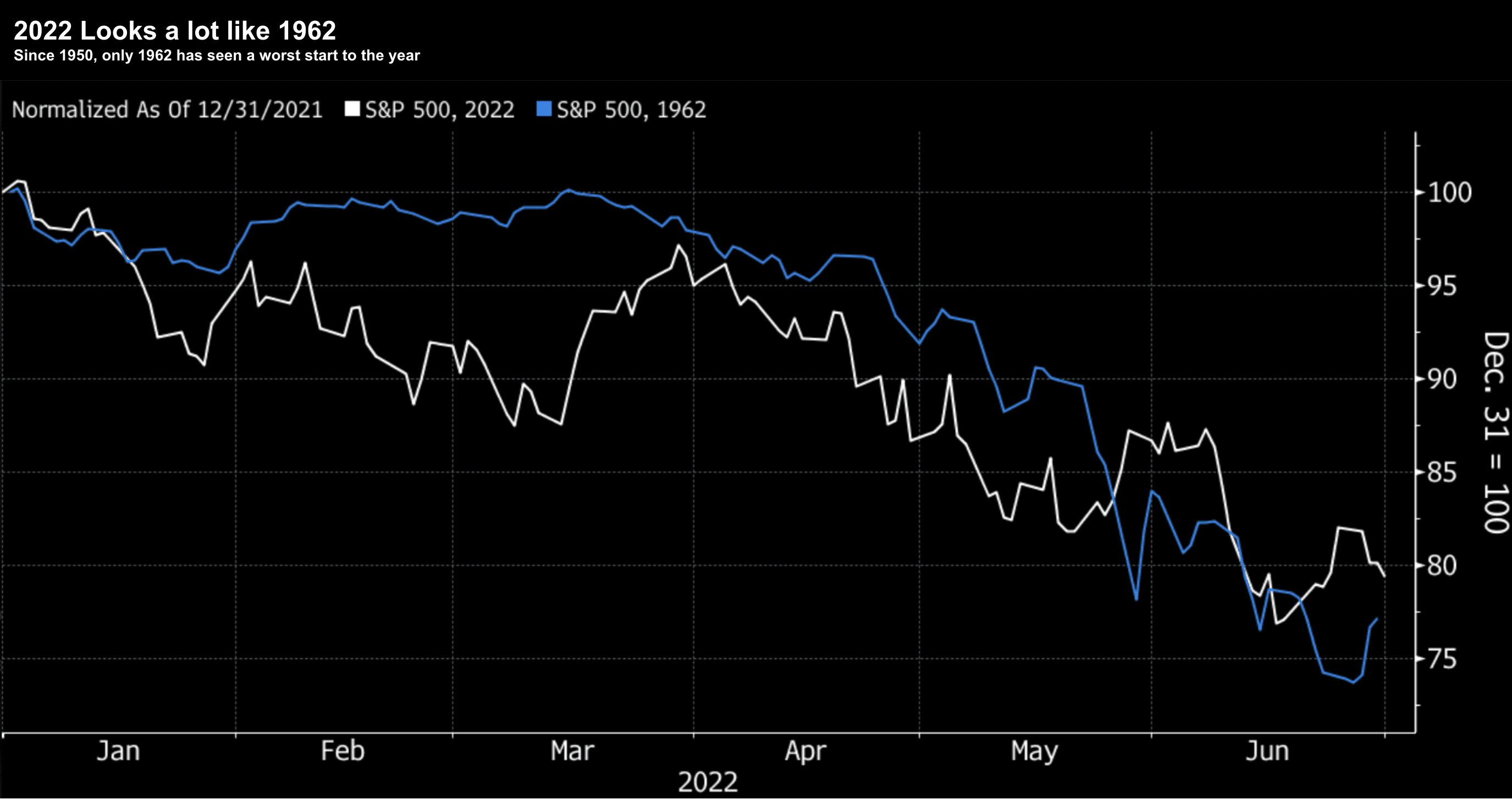

Worst 6-Months to Start a Year Since 1970

Worst 6-Months to Start a Year Since 1970It's becoming increasingly likely we will see a recession next year (maybe before). And there's one thing that every recession has in common post 1950 -- aggressive Fed tightening into a slowing economy.