What Do Q1 Earnings Tell Us?

What Do Q1 Earnings Tell Us?

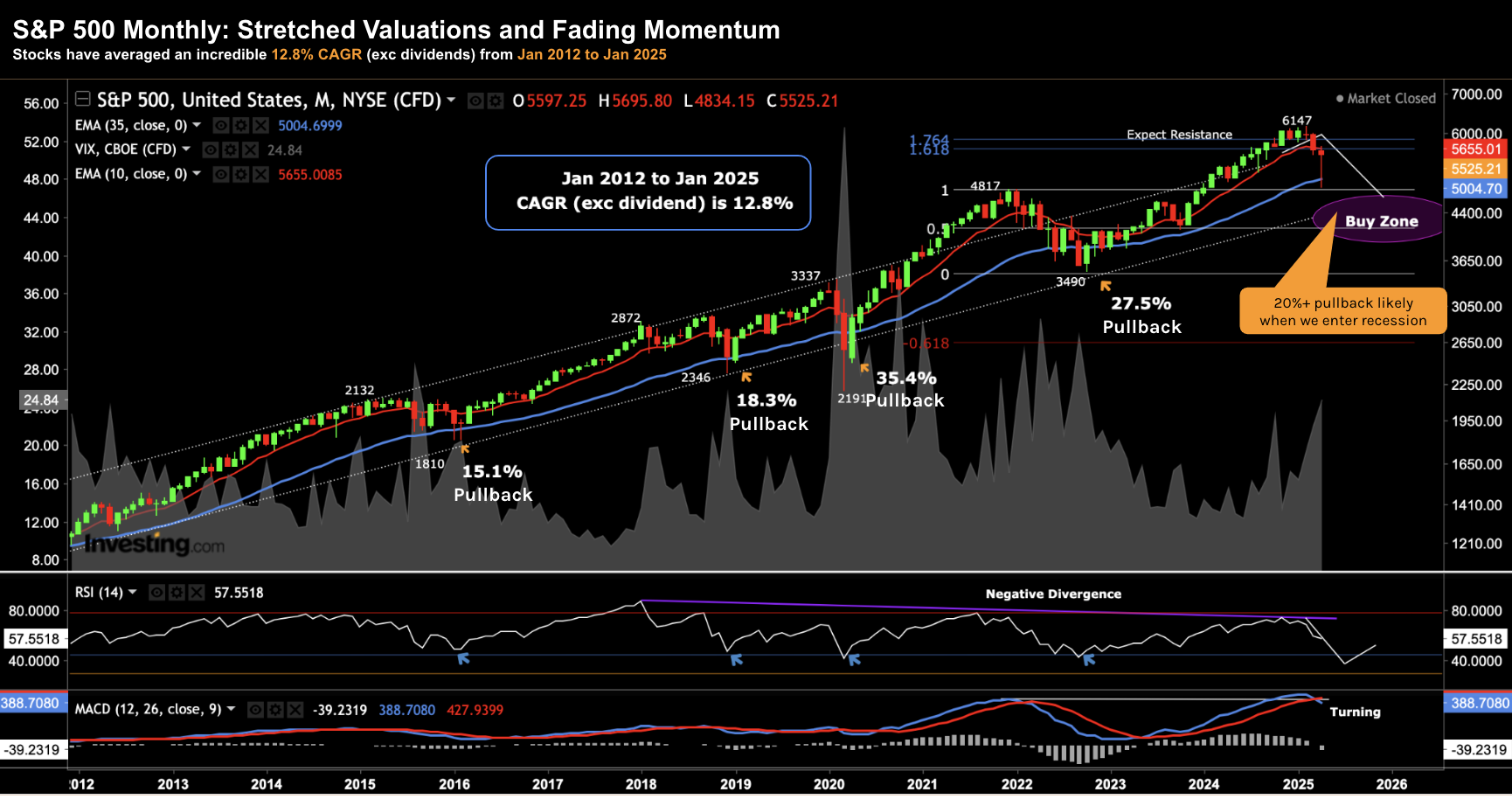

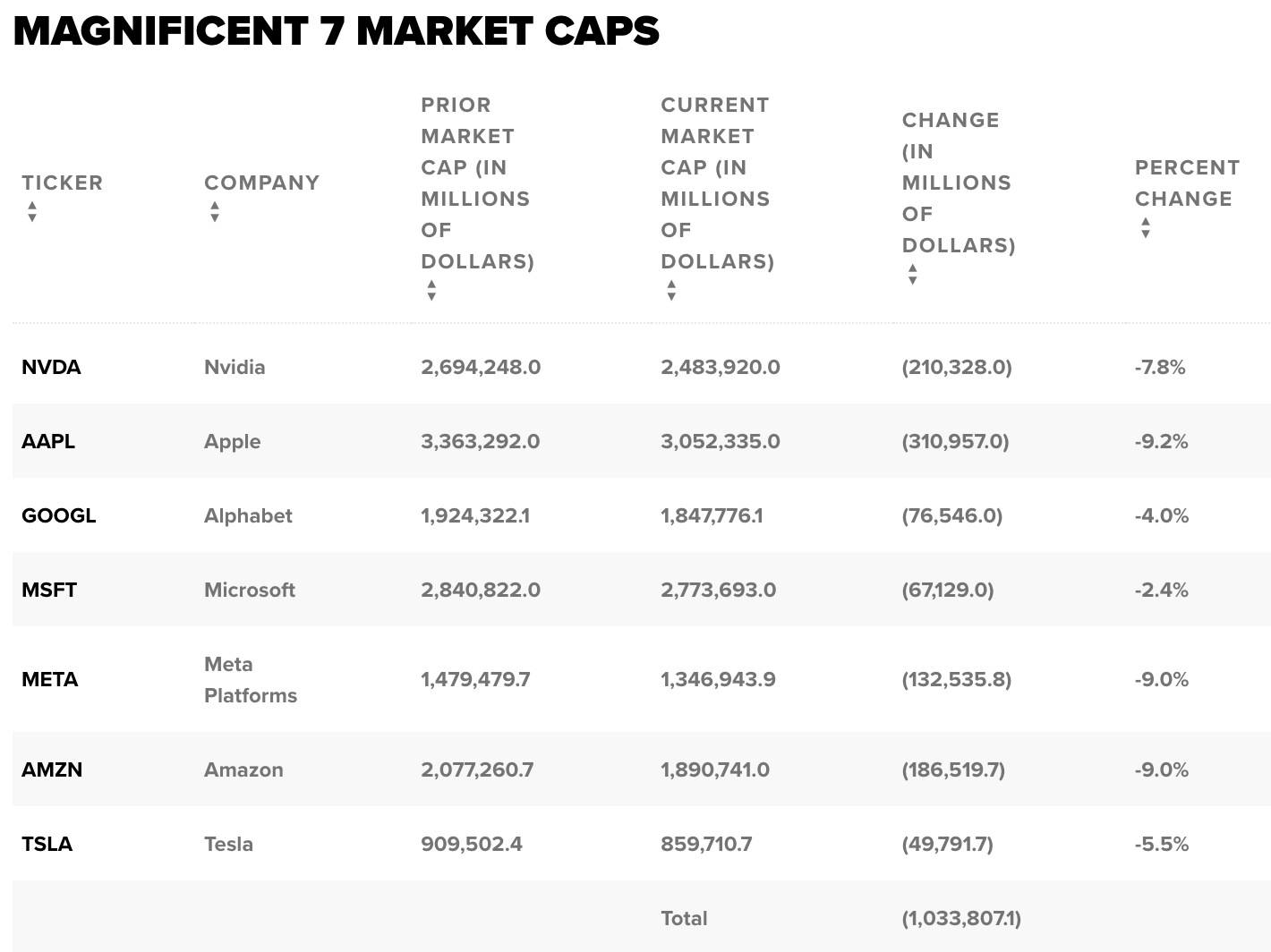

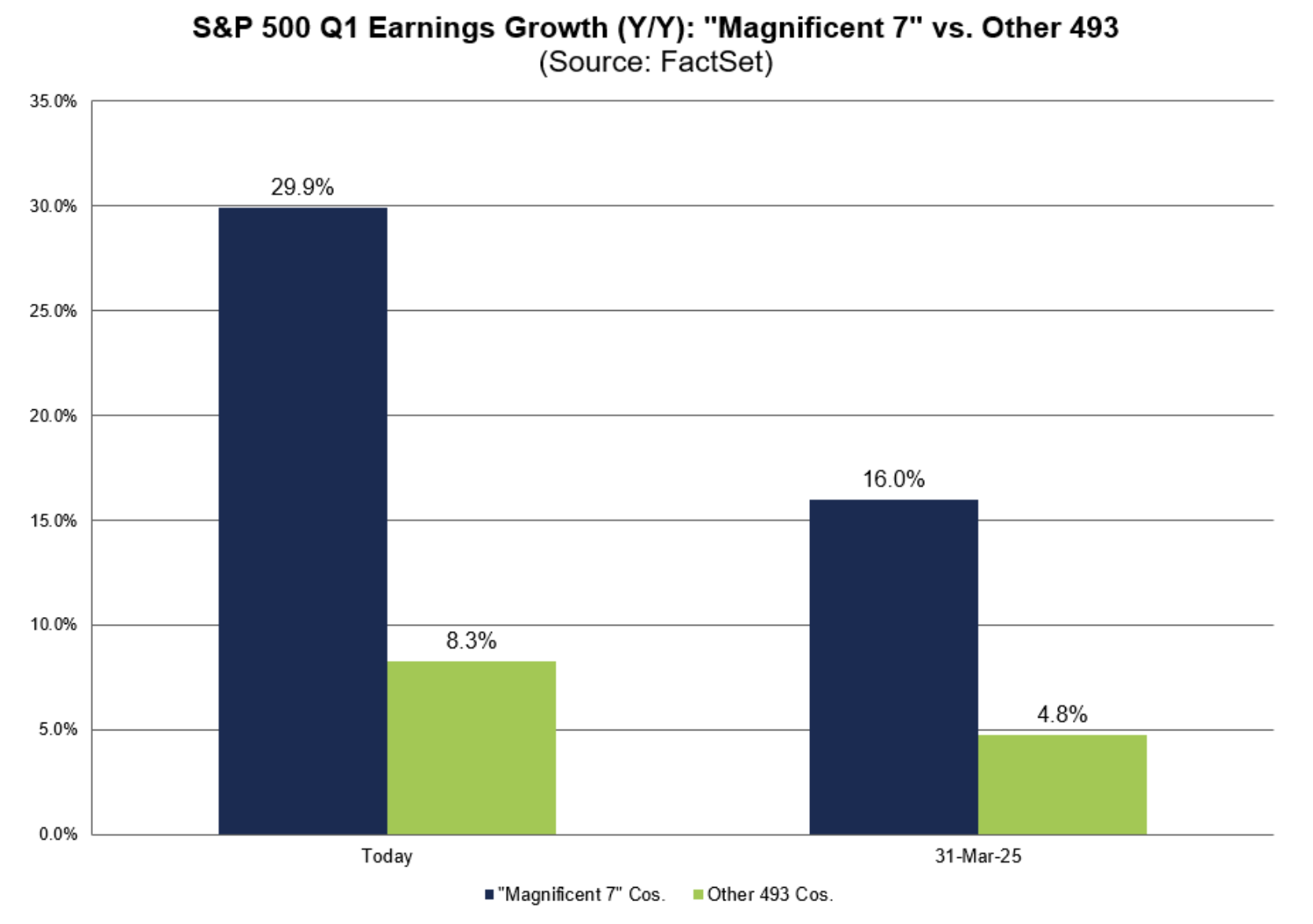

We're about half way through Q1 2025 earnings. So far they're showing double-digit YoY growth. However what companies are struggling with is guidance. They have very limited visibility through the "tariff windshield". And whilst stocks are reacting well to past earnings and optimism Trump will back down on his draconian tariffs - it's difficult to gauge both how much damage has been done? For now, markets remain optimistic however I would treat this rally with caution.