September Didn’t Disappoint

September Didn’t Disappoint

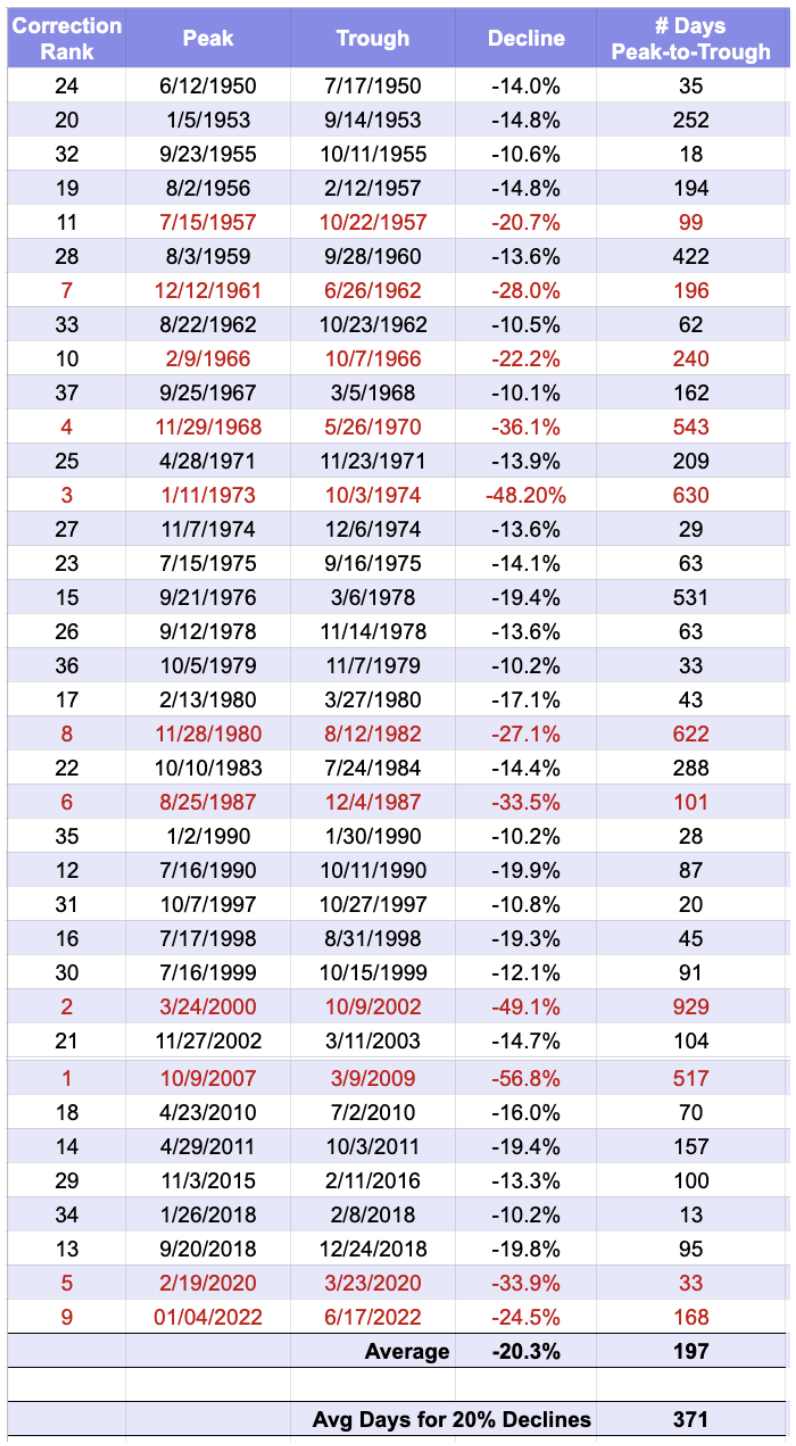

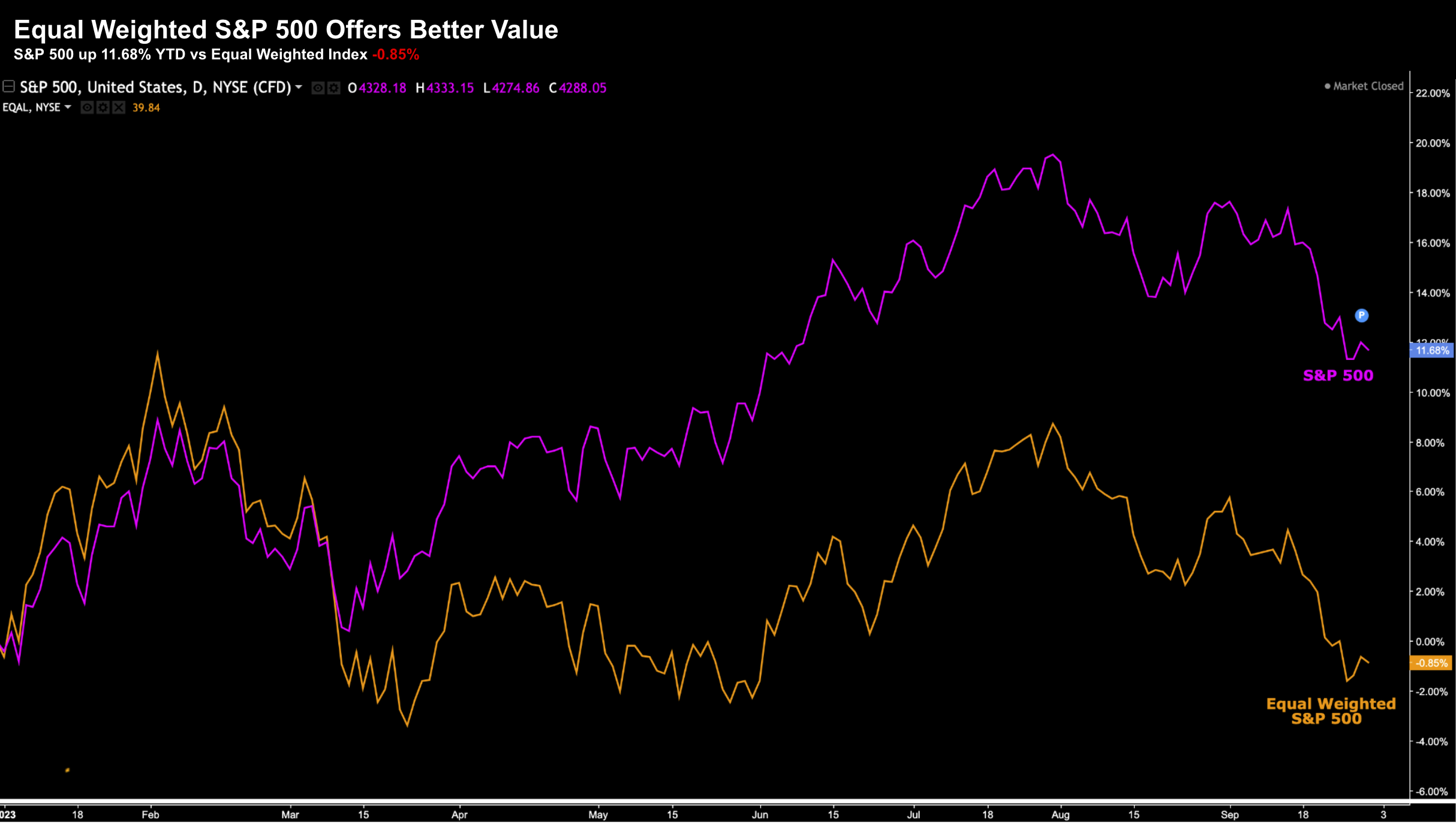

Coming into September - I reminded readers it has the worst record of any calendar month. The Trader's Almanac tells us the S&P 500 has lost an average of 1% each September over the past 10 years. And over the prior 25 years - the average monthly returns are -0.67%. Dismal. This year, the S&P 500 gave back 4.9% for the month. But it wasn't just September - stocks hit the pause button after June. For the quarter, the Index surrendered 3.64%.The Nasdaq fared far worse - losing 4.12%. None of this should come as a surprise...