Trading Per the Script

Trading Per the Script

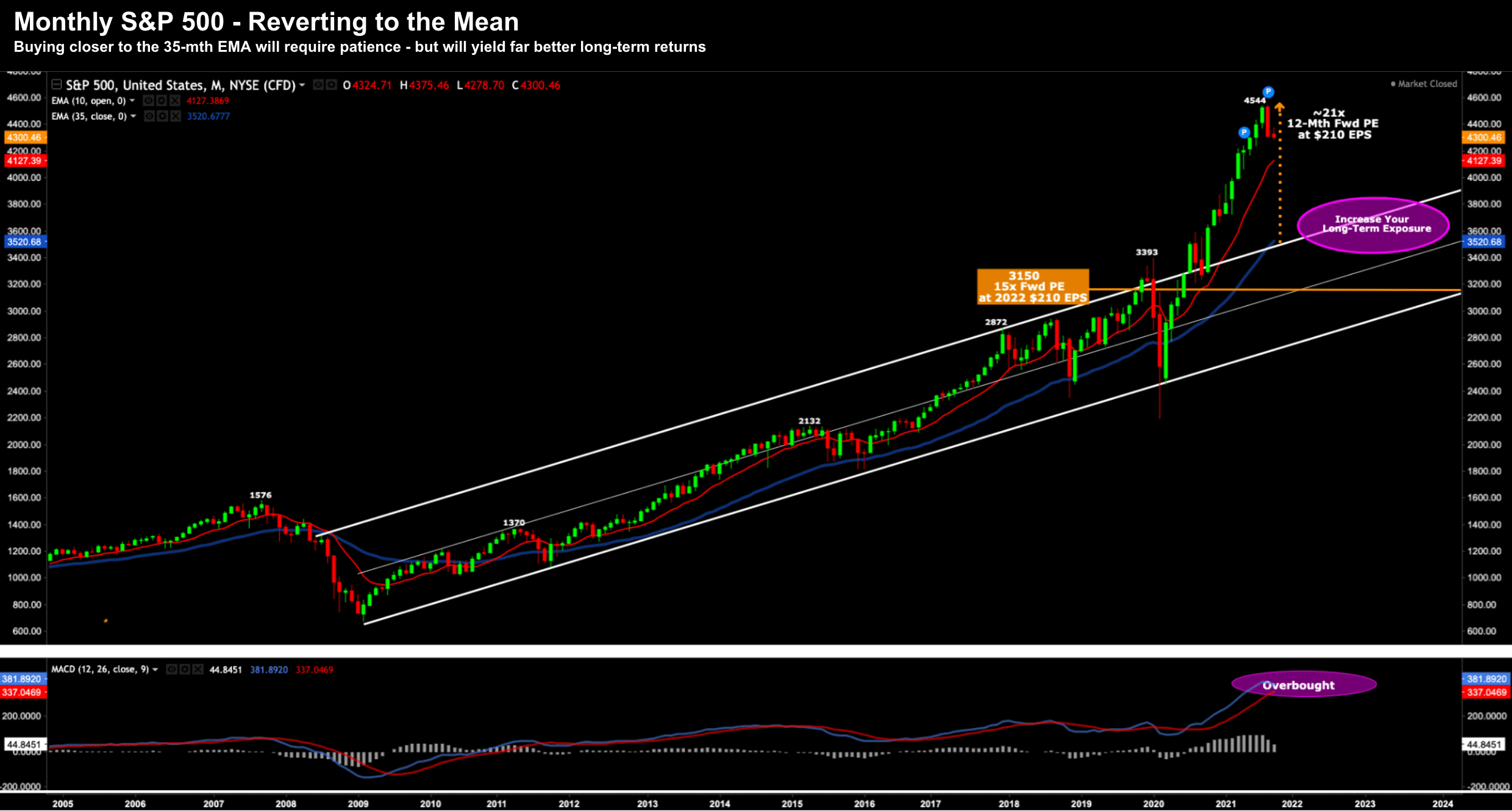

October is certainly one of the more 'opportunistic' months of the year (in my view) - however it comes with a bad rap. October is a whopping 36% more volatile than the other months (on average). But don't let volatility like today scare you...