Stocks Losing Momentum

Stocks Losing Momentum

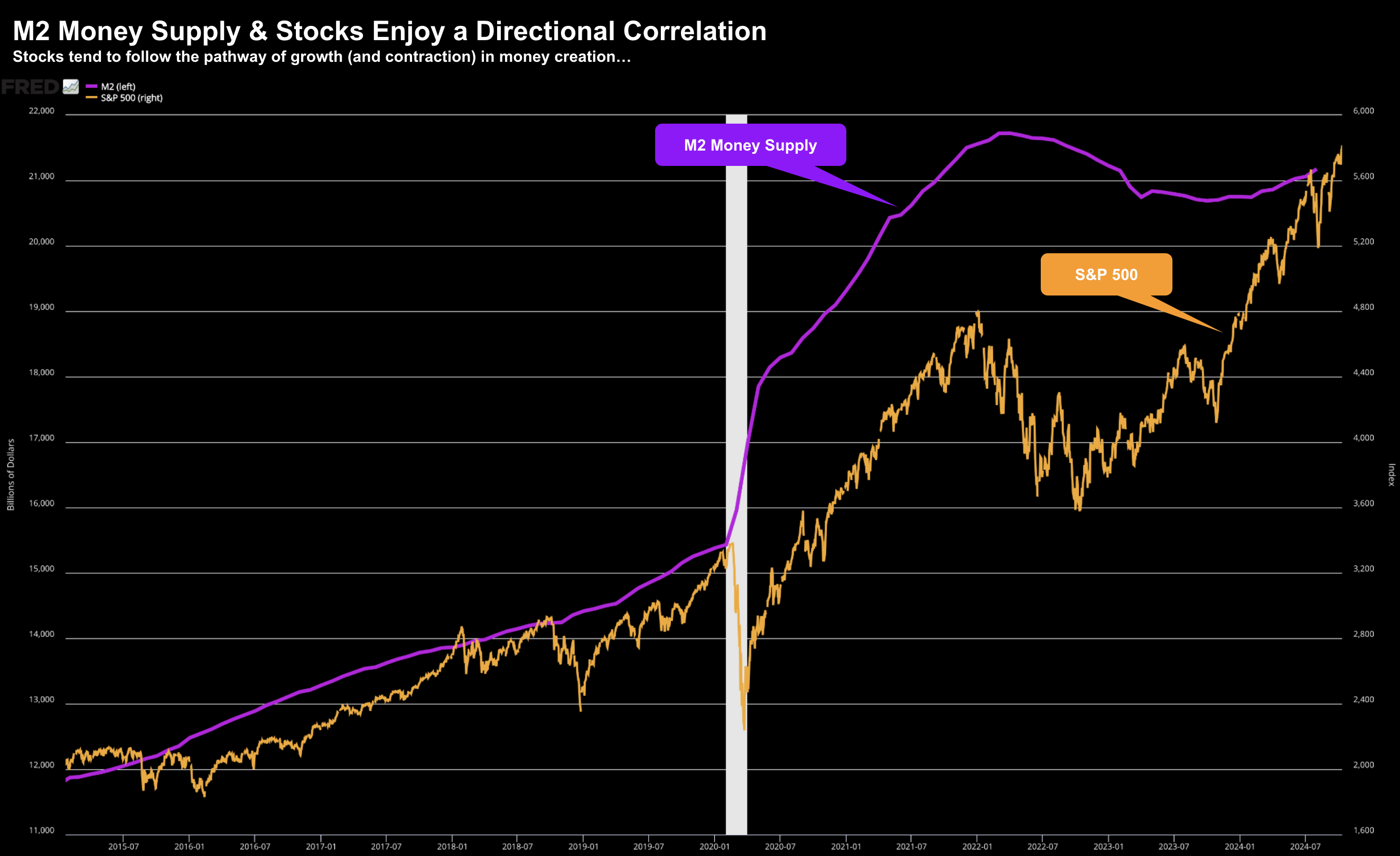

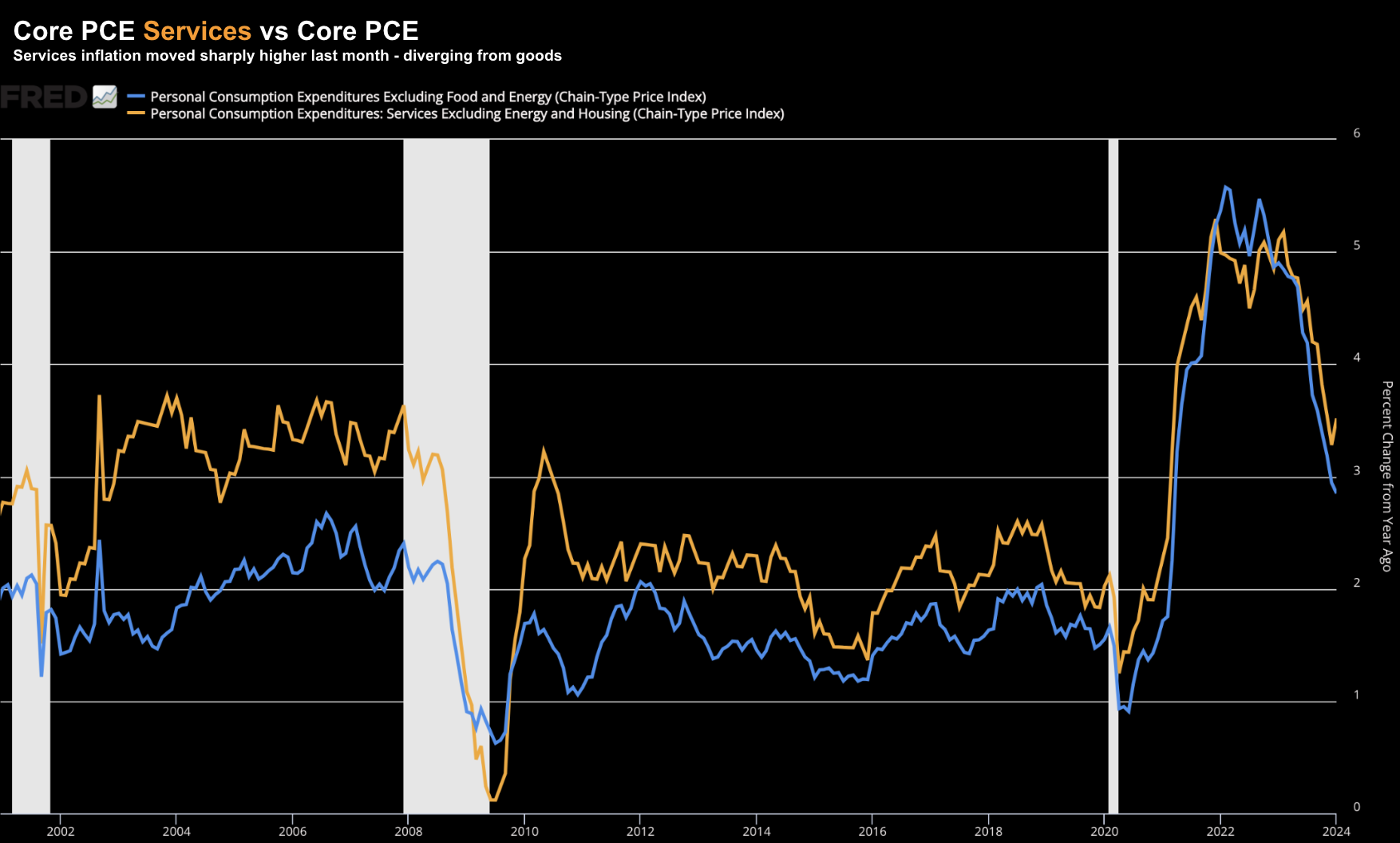

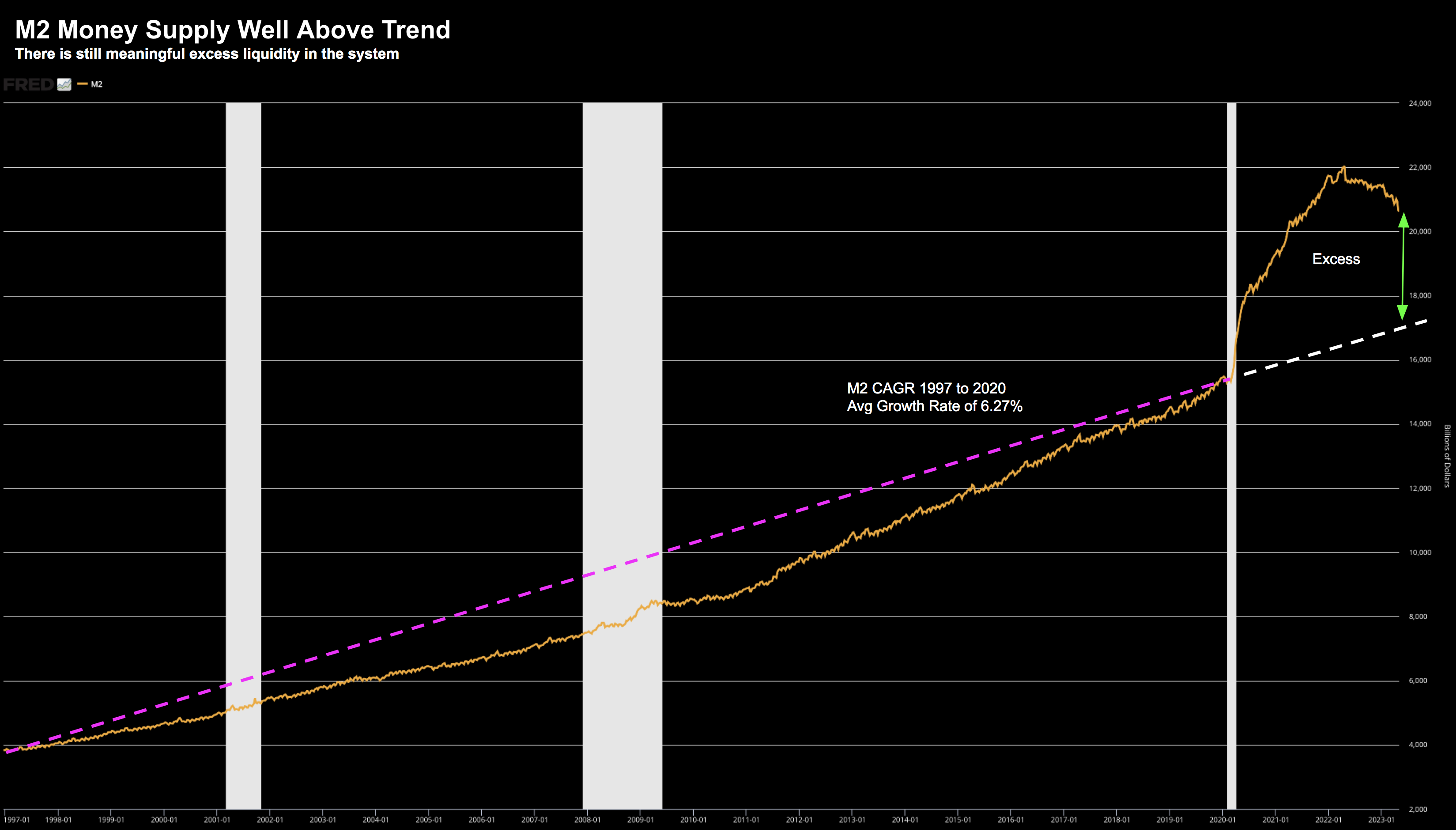

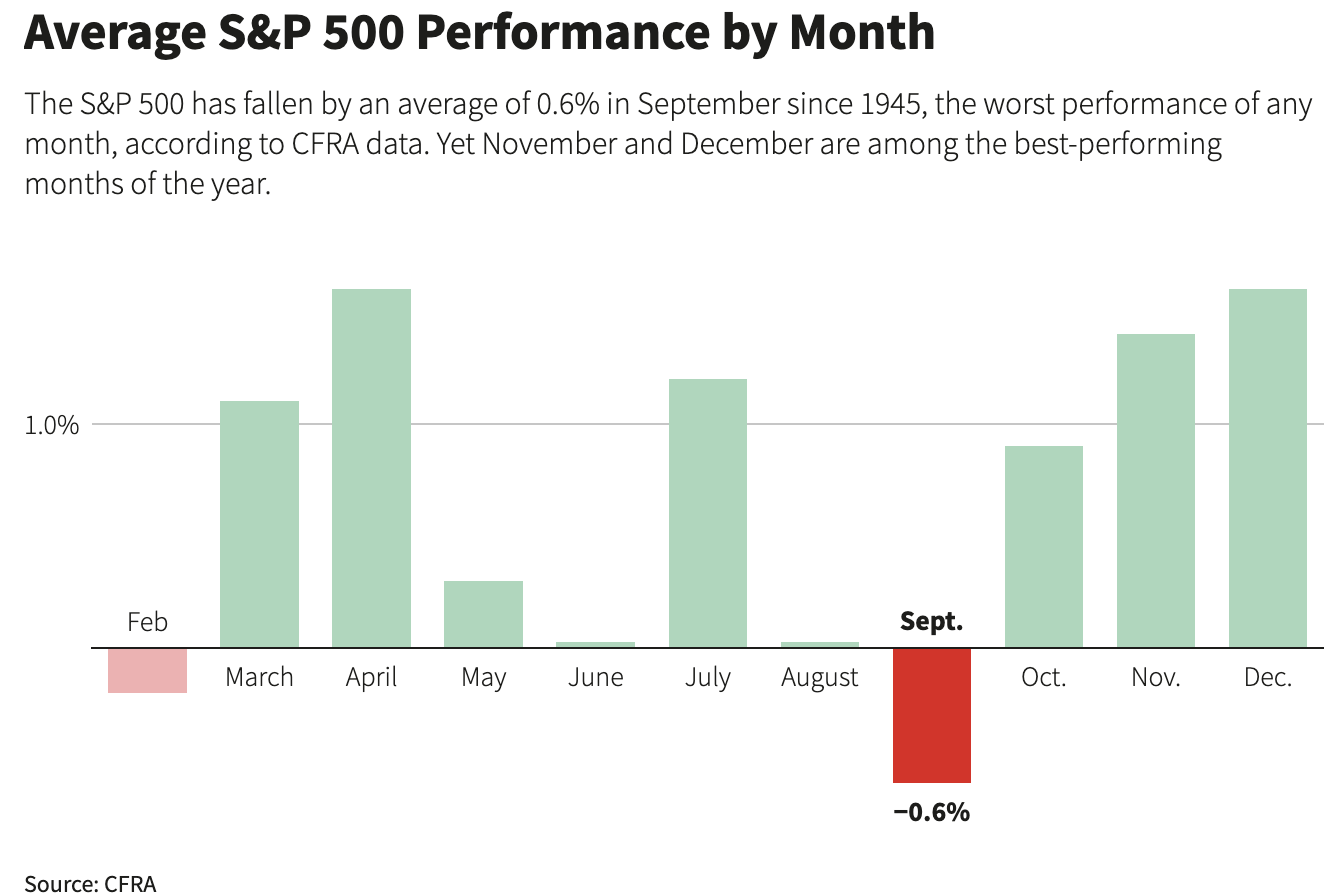

Are stocks starting to lose momentum? This week saw the S&P 500 reverse course - its first losing week since early September. Could there be more to come? My answer is yes - perhaps as much as 7-10%. However, it's a question of timing. Irrespective, paying 22x forward earnings is a higher-risk bet.