Recession or Weakening?

Recession or Weakening?

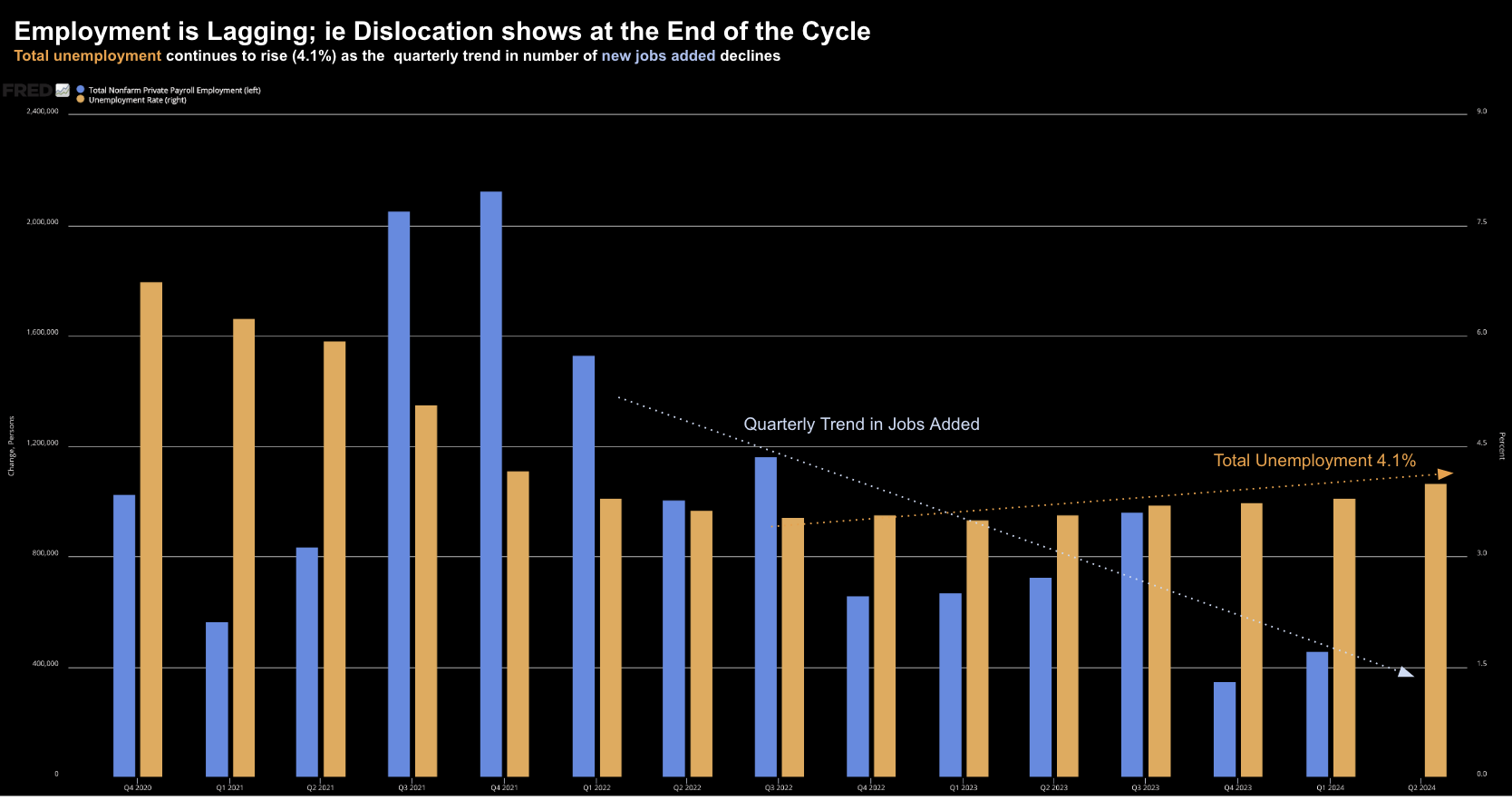

Despite signs of a weakening U.S. labor market, including a recent record-downward revision to job growth figures, investor bullishness remains at record highs. However, it's pure optimism that has pushed stock market valuations to expensive levels, with the S&P 500 trading at over 22 times forward earnings. While market psychology and momentum can drive prices in the short term, fundamentals will eventually prevail. Prudent investors should prioritize buying high-quality companies at attractive valuations, a strategy that currently requires patience.