Are These Recession Indicators Broken?

Are These Recession Indicators Broken?

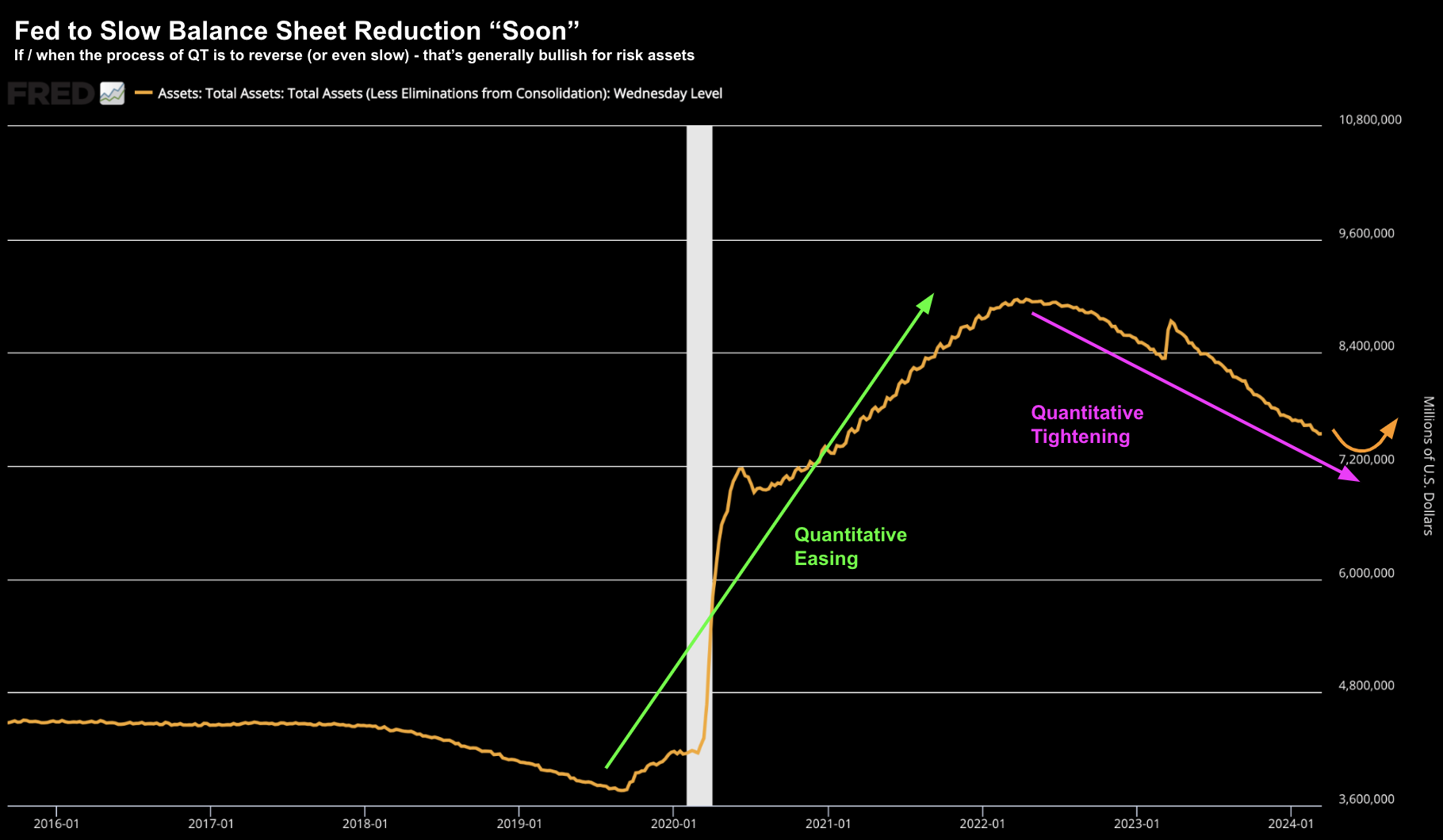

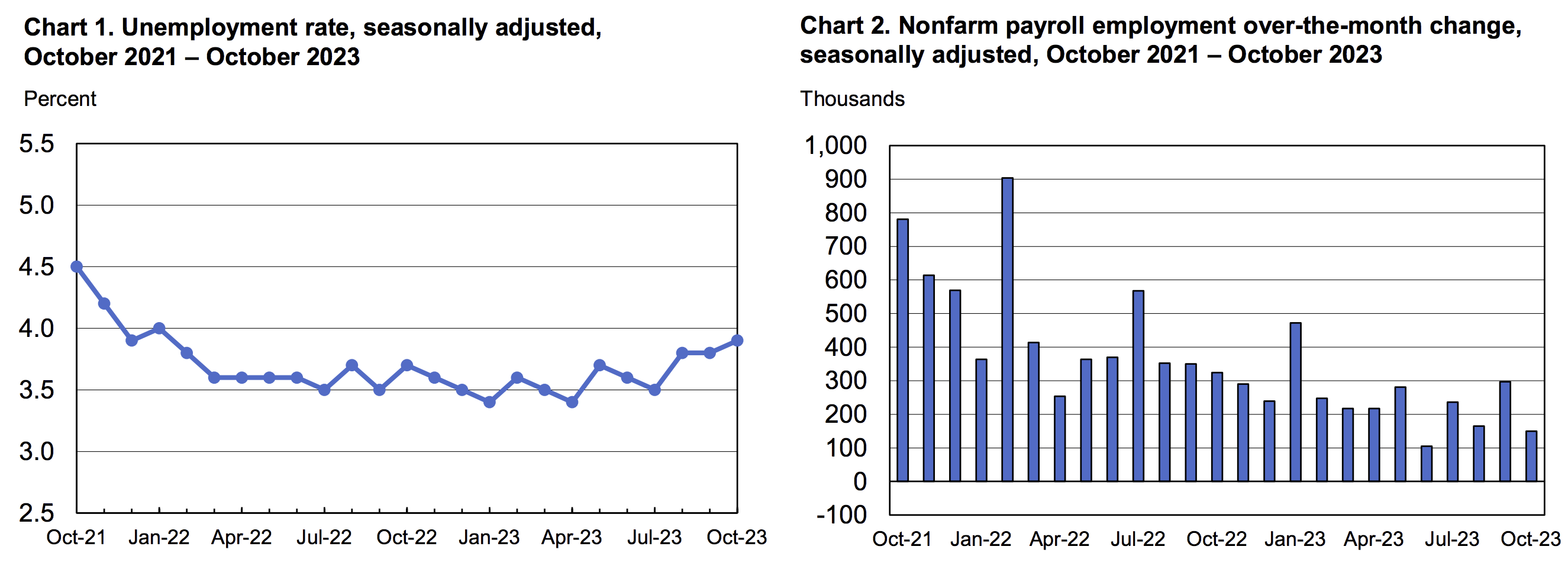

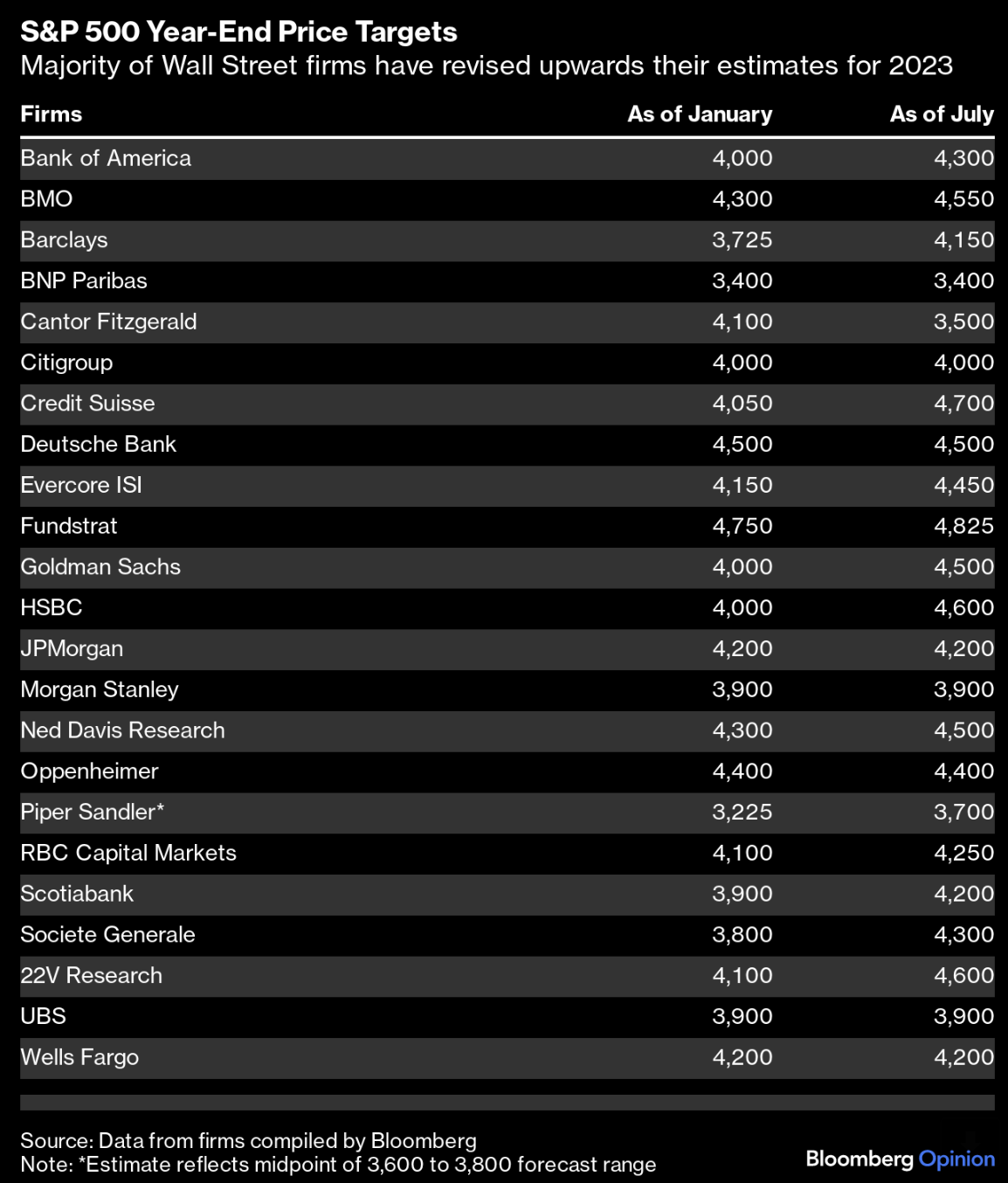

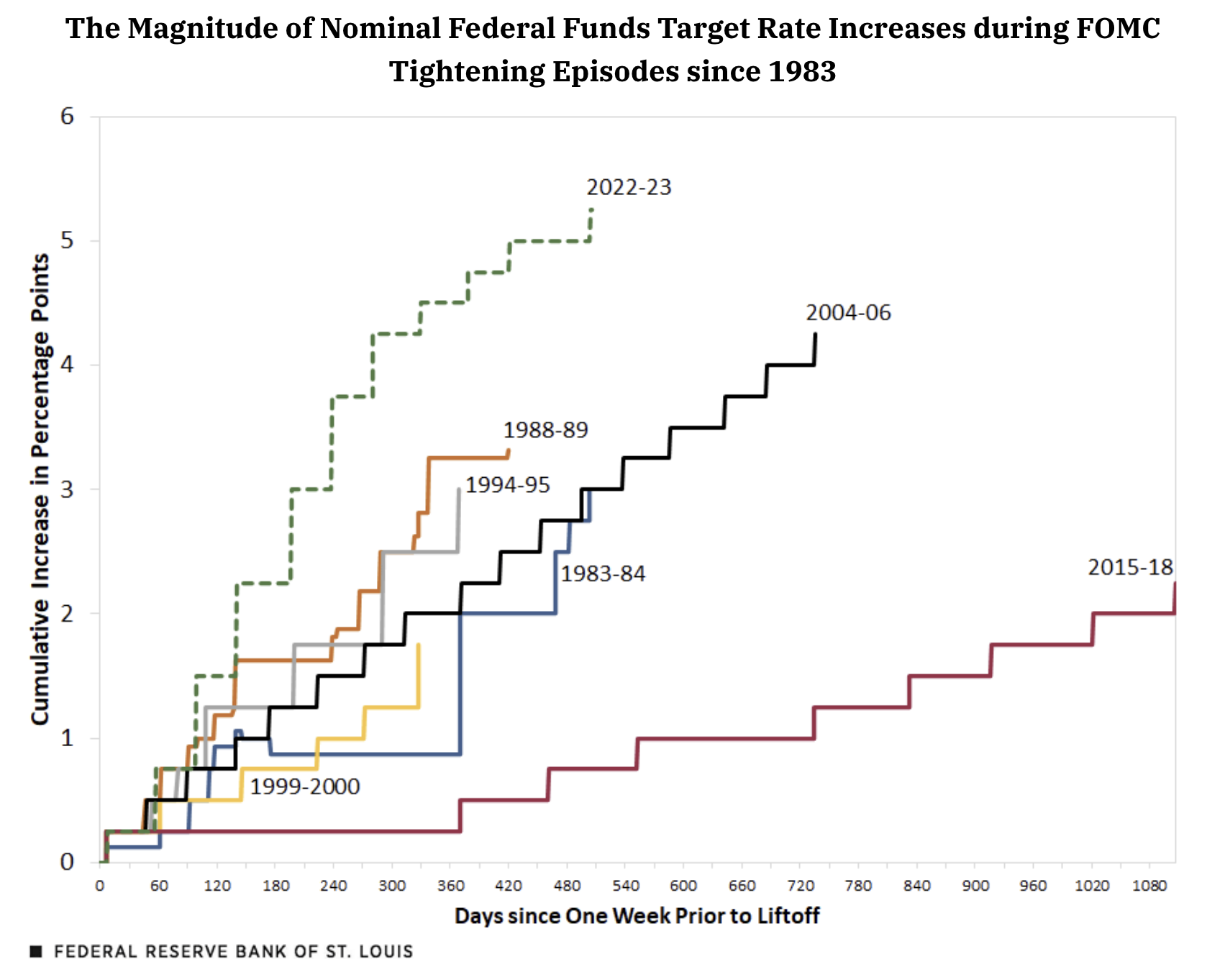

At the conclusion of their July 26 '23, meeting, the Federal Open Market Committee (FOMC) voted to raise the target range of the federal funds rate by 25 basis points to 5.25% to 5.50%. The S&P 500 traded around 4,000 points at the time - some 16% off its ~4800 January high. Markets had reason to be worried... Investors had not seen the Fed this aggressive at any time in the past 40 years... and conditions seemed ripe for a recession. What's more, most widely cited indicators suggested this was a likely outcome. However, it didn't happen? Why not? Are popular recession indicators no longer relevant?