When the Laws of Probability are Forgotten

When the Laws of Probability are Forgotten

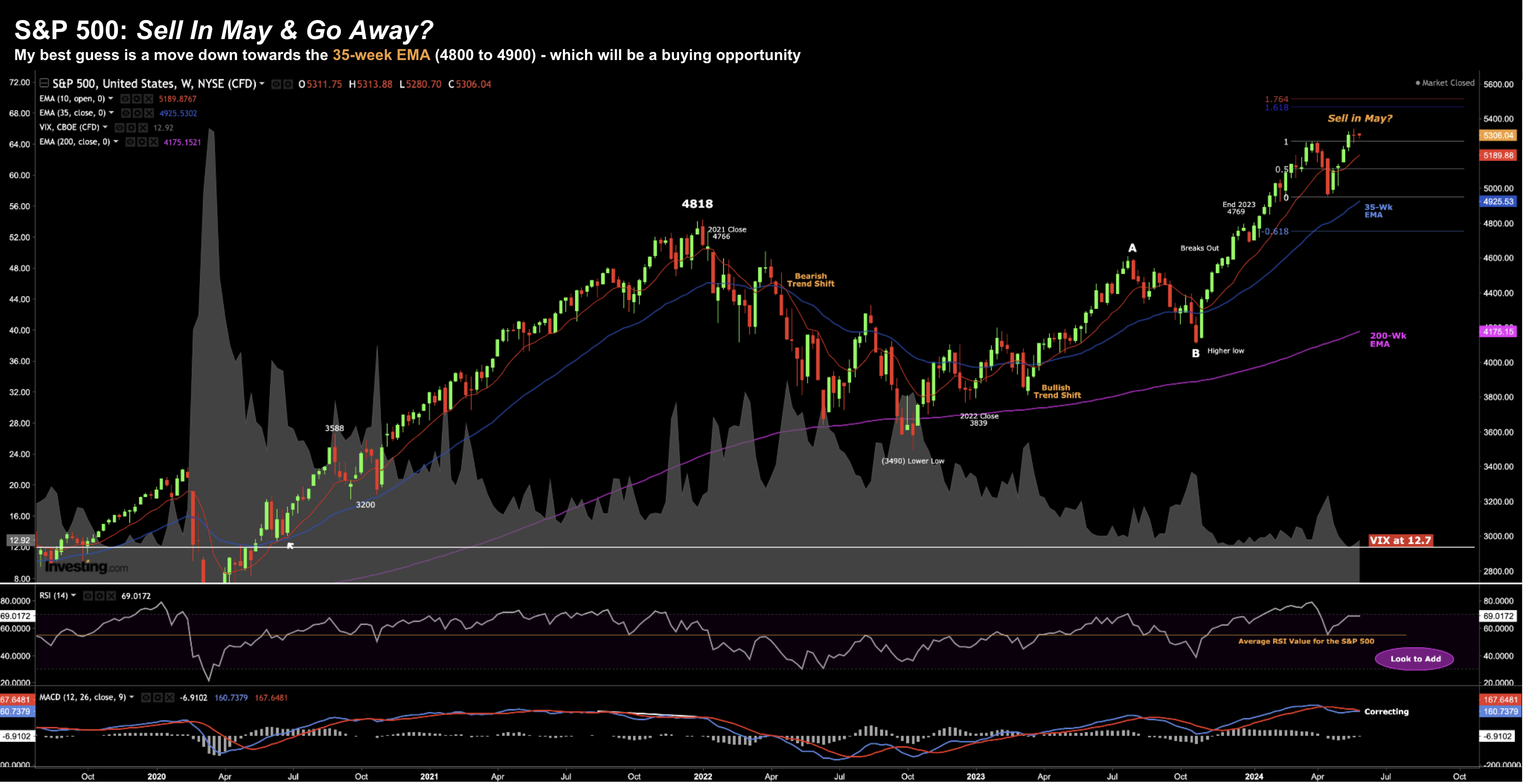

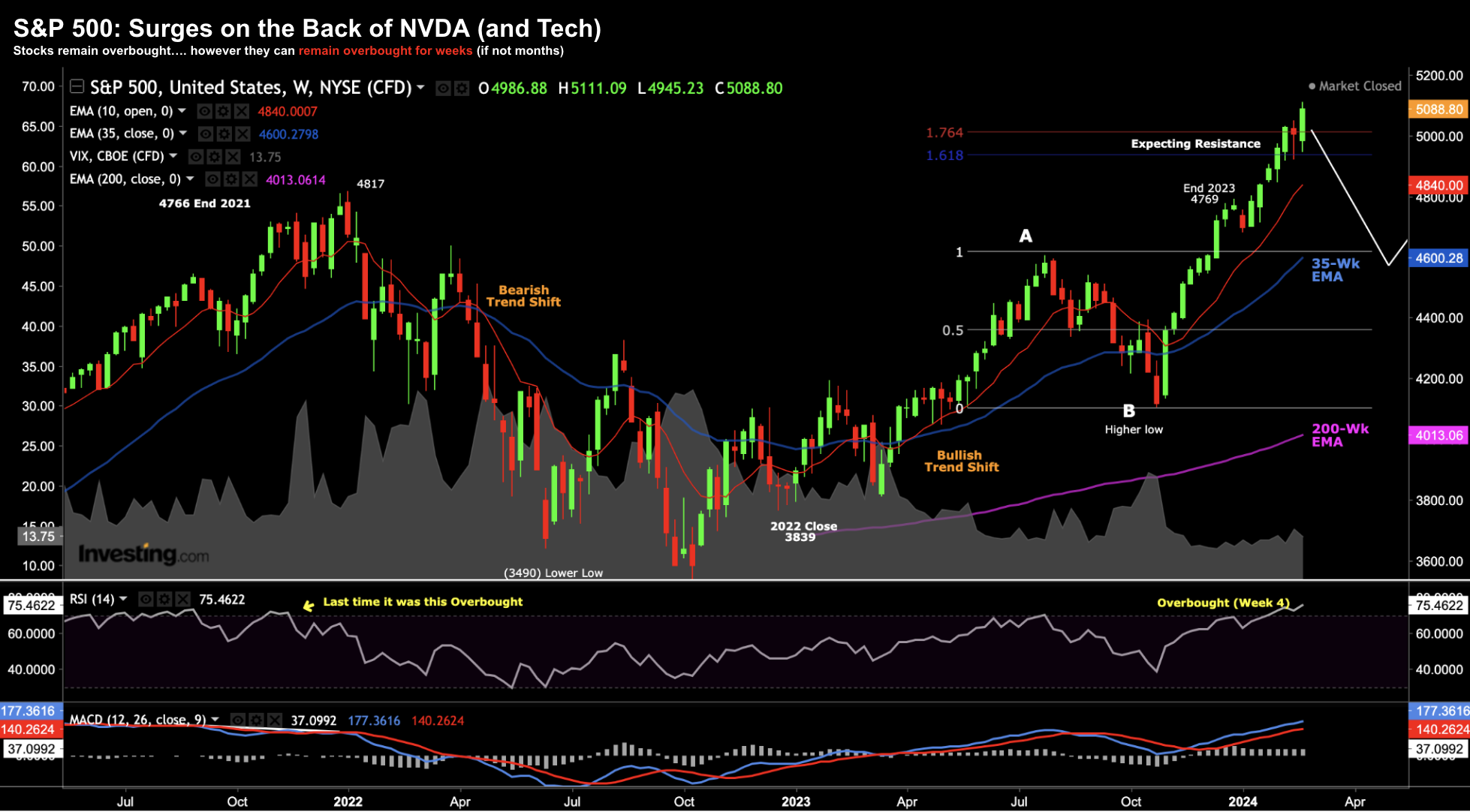

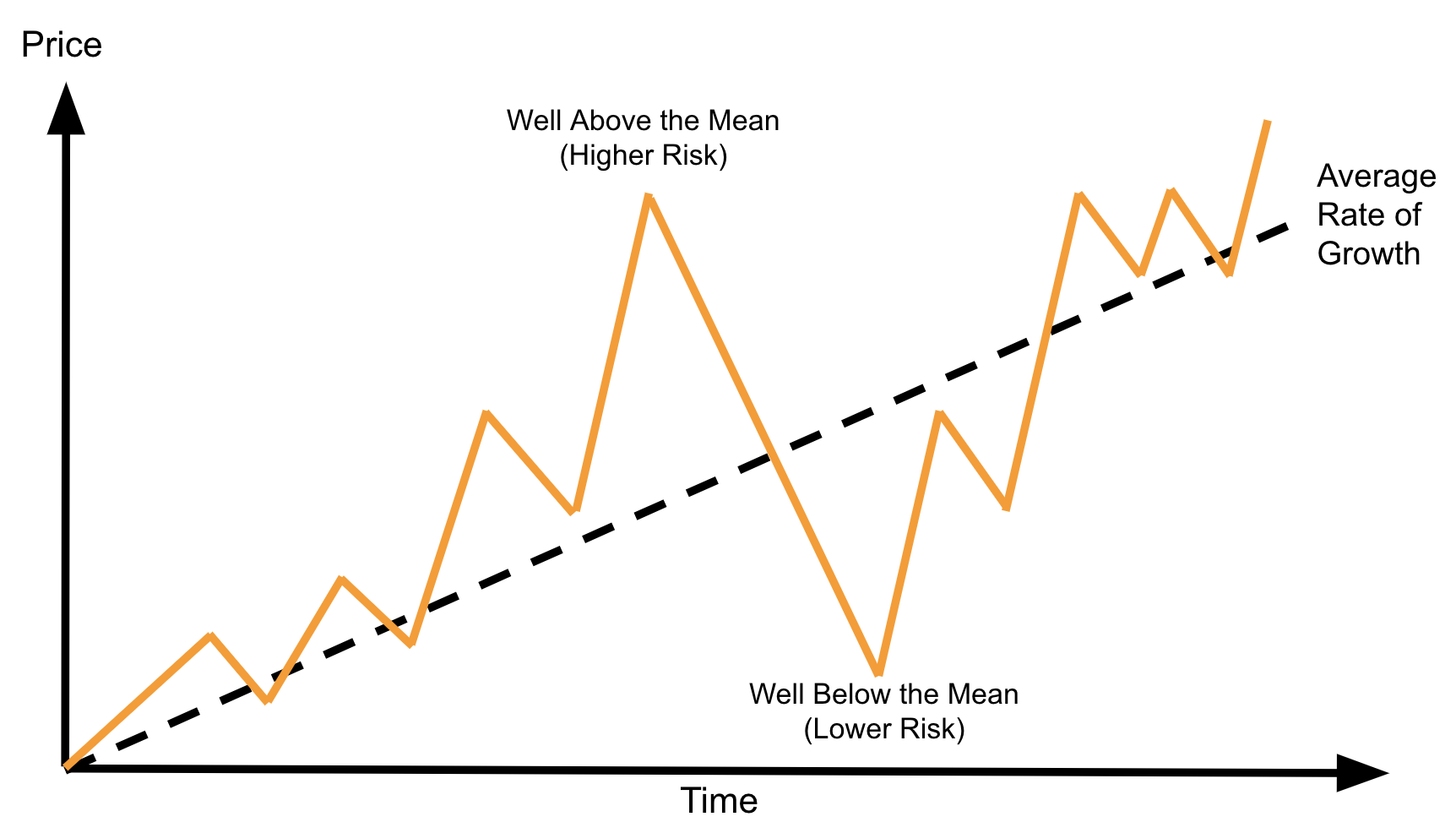

Whilst the S&P 500 posted a negative week - it was a strong month for equities. The world's largest Index managed to add 4.8% for the month - hitting an intra-month record high of 5339. That's four of five winning months to start 2024. Perhaps completely enamored by all things AI (more on this in my conclusion) - investors basically shrugged off sharply higher yields and a series of disappointing inflation prints to push prices higher. What could go wrong? At the end of every month - it pays to extend our time horizon to the (less noisy) monthly chart. And whilst the weekly chart is useful - it tends to whip around. Longer-term trends (and perhaps investments) are often better examined using this lens.