When Bad News is Bad News

When Bad News is Bad News

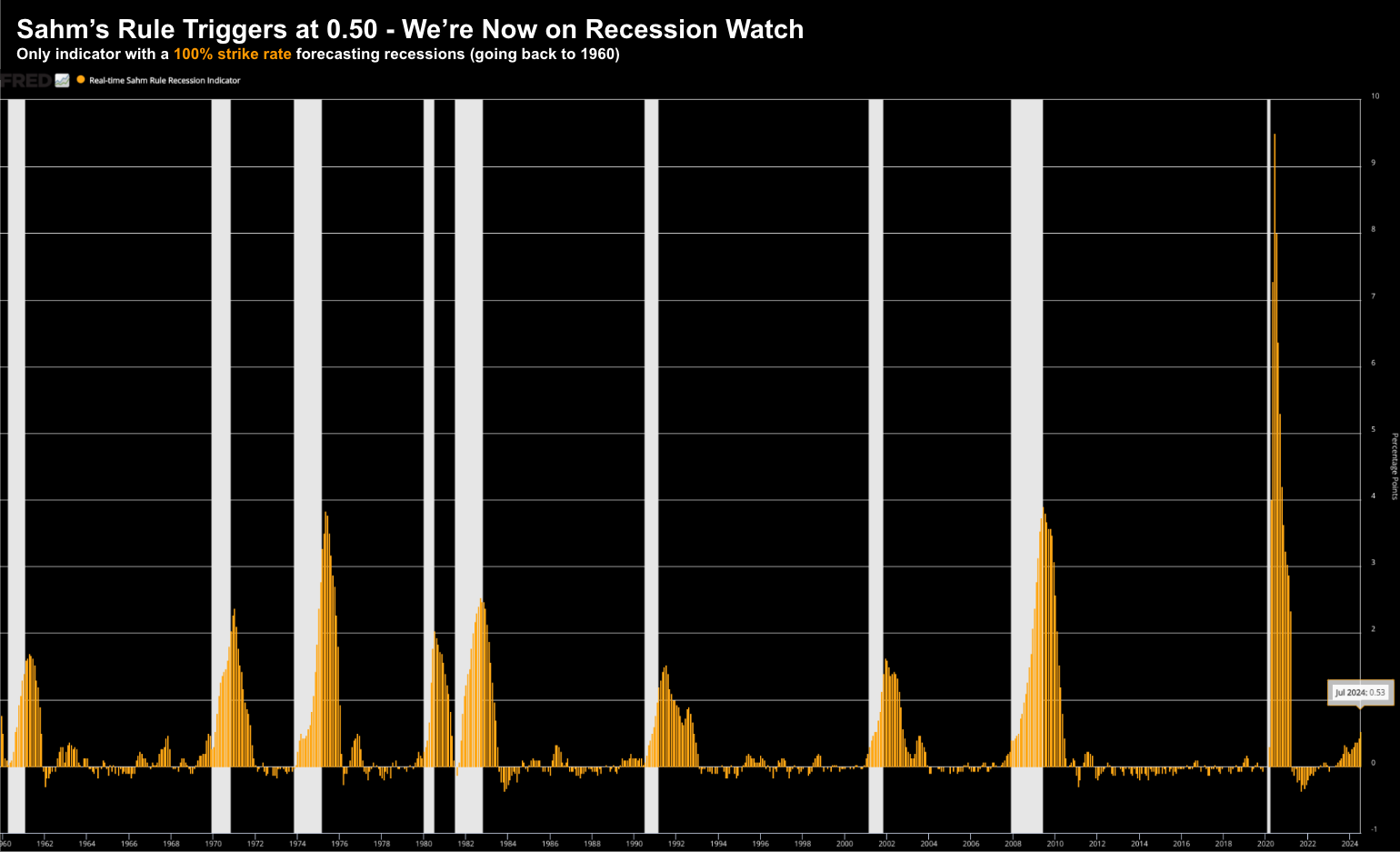

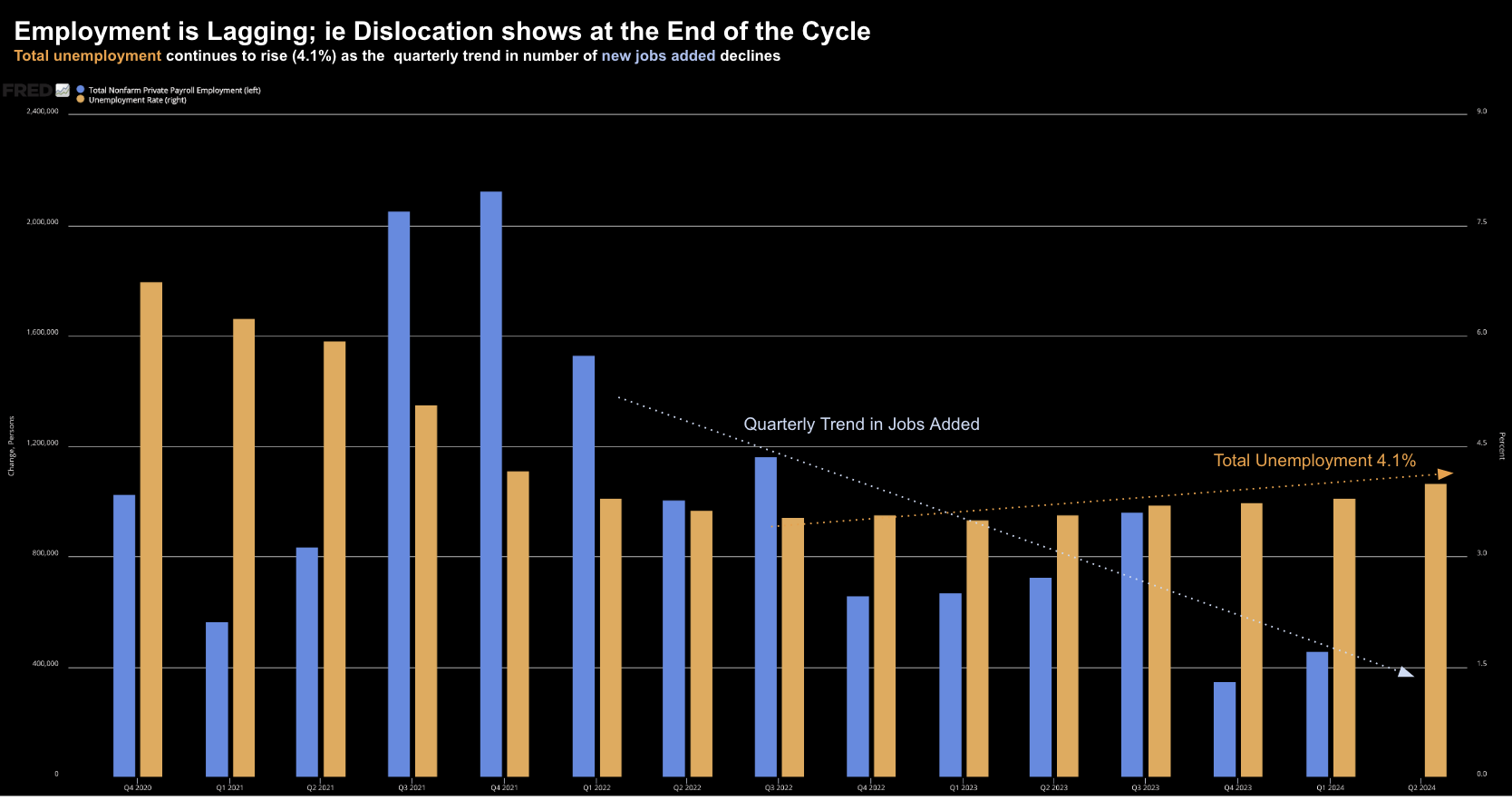

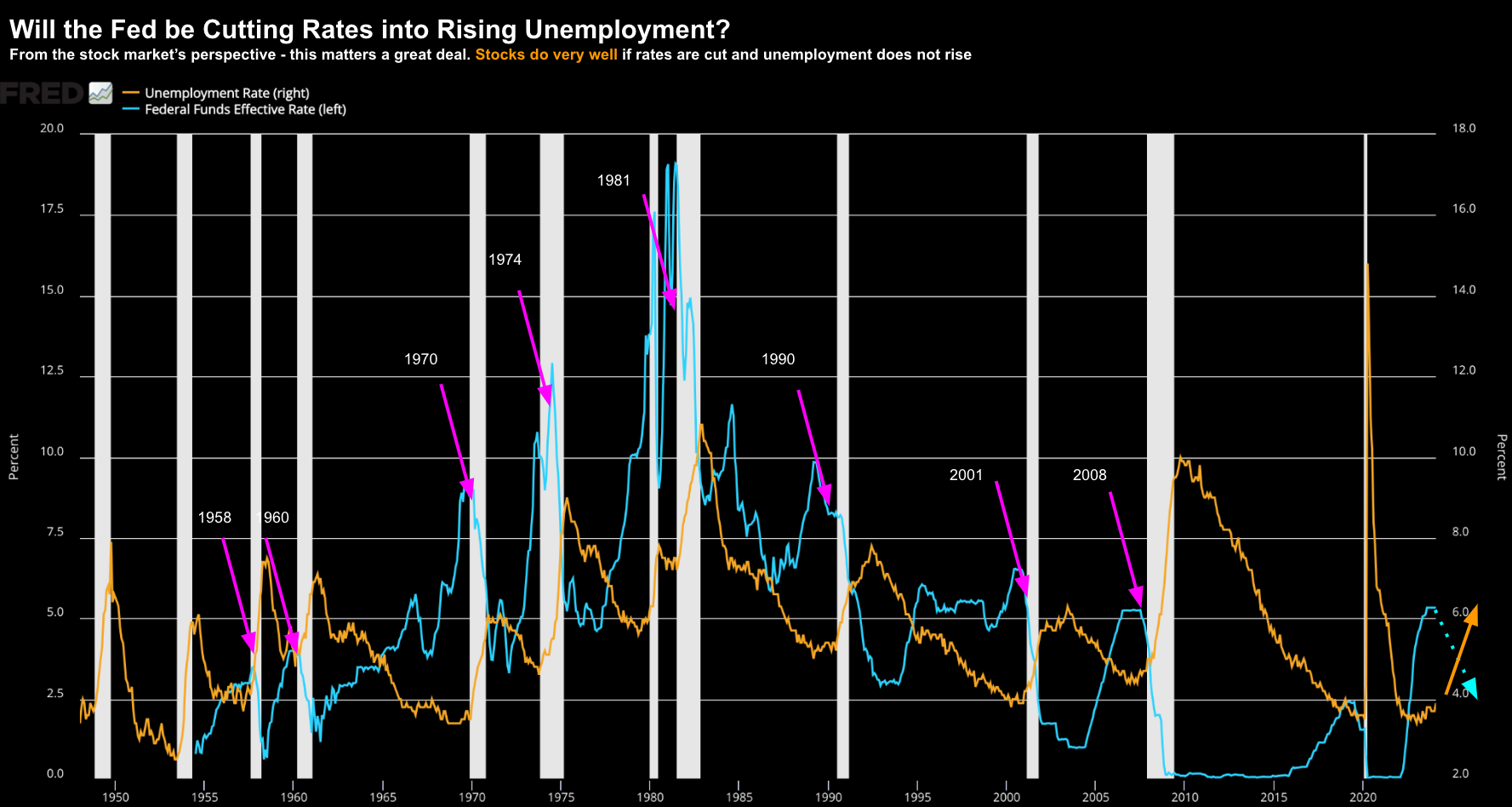

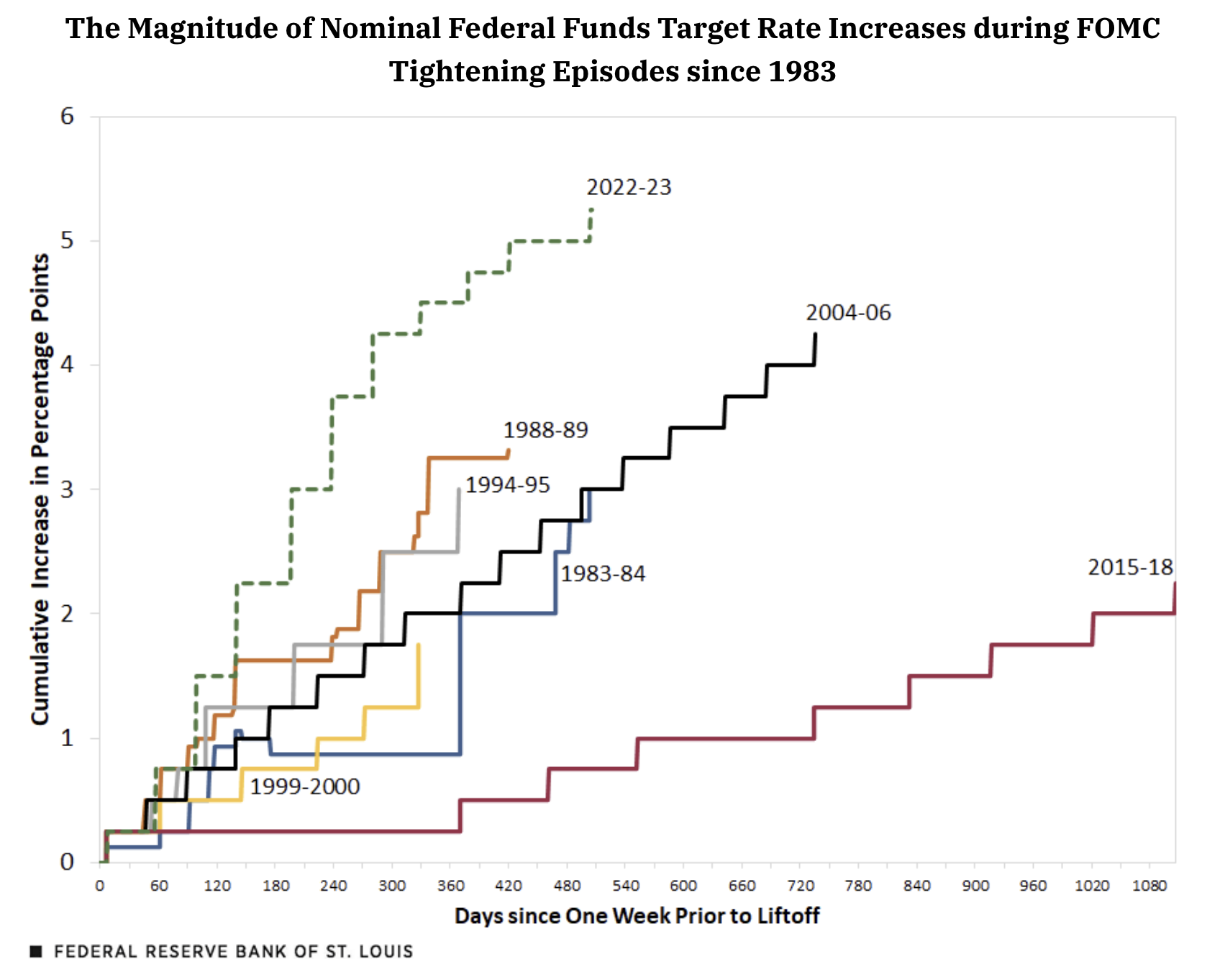

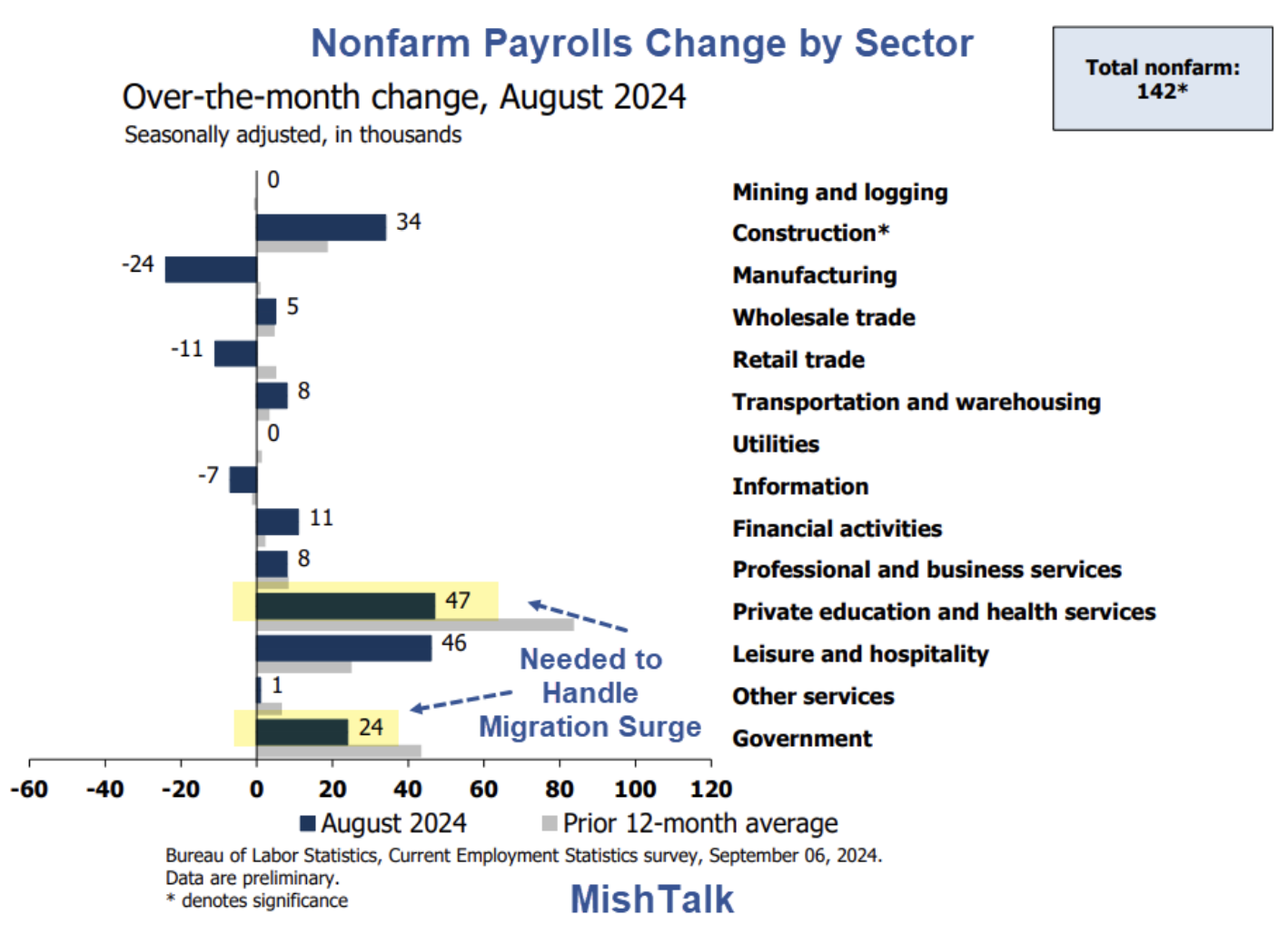

Last weekend I questioned whether markets could break out to the upside; or perform what trader's refer to as a "back and fill". My best guess was the latter. In turns out, things traded 'per the script', where the S&P 500 suffered its worst week since March 2023 - giving back 4.20%. The Nasdaq fared far worse - shedding ~6% - led by large losses in popular AI chip stocks. So why are market's worried? It's concerns about growth. With a market trading close to ~22x forward earnings - expecting YoY EPS growth of 11% -- that's not consistent with 'slowdown' scenario.