Trump Wants Lower Rates – Will He Get It?

Trump Wants Lower Rates – Will He Get It?

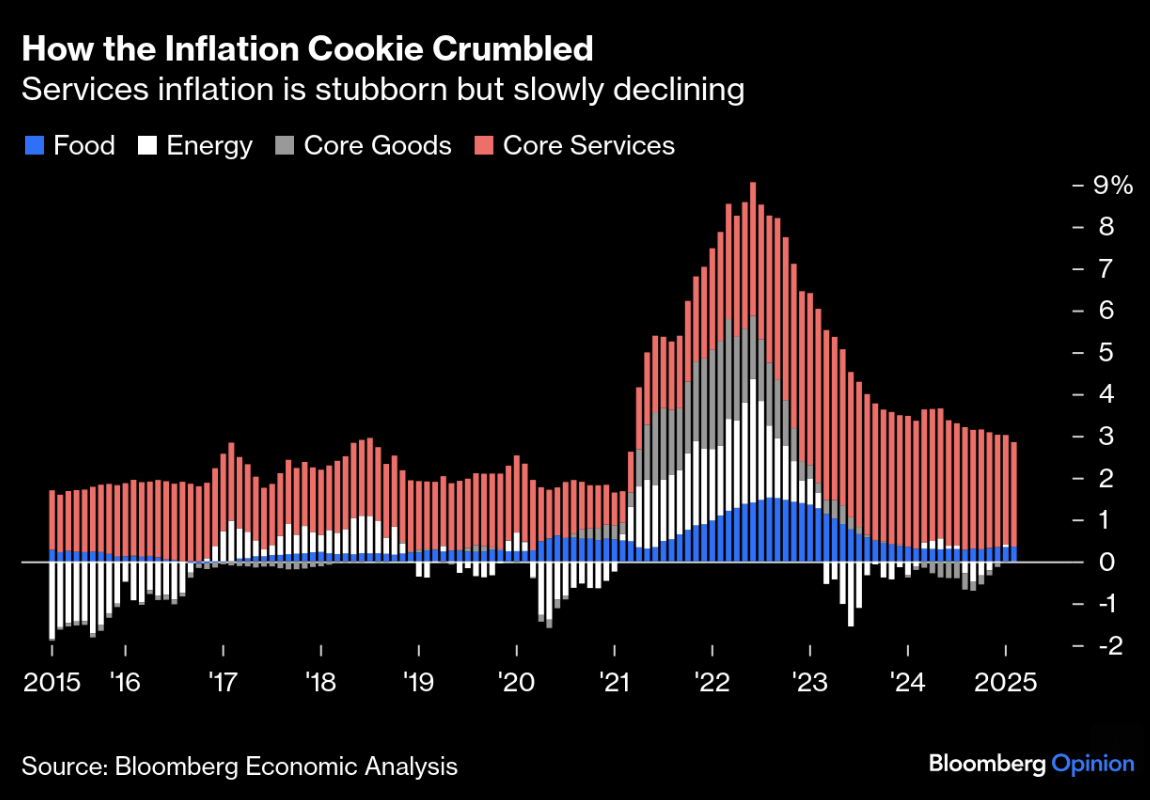

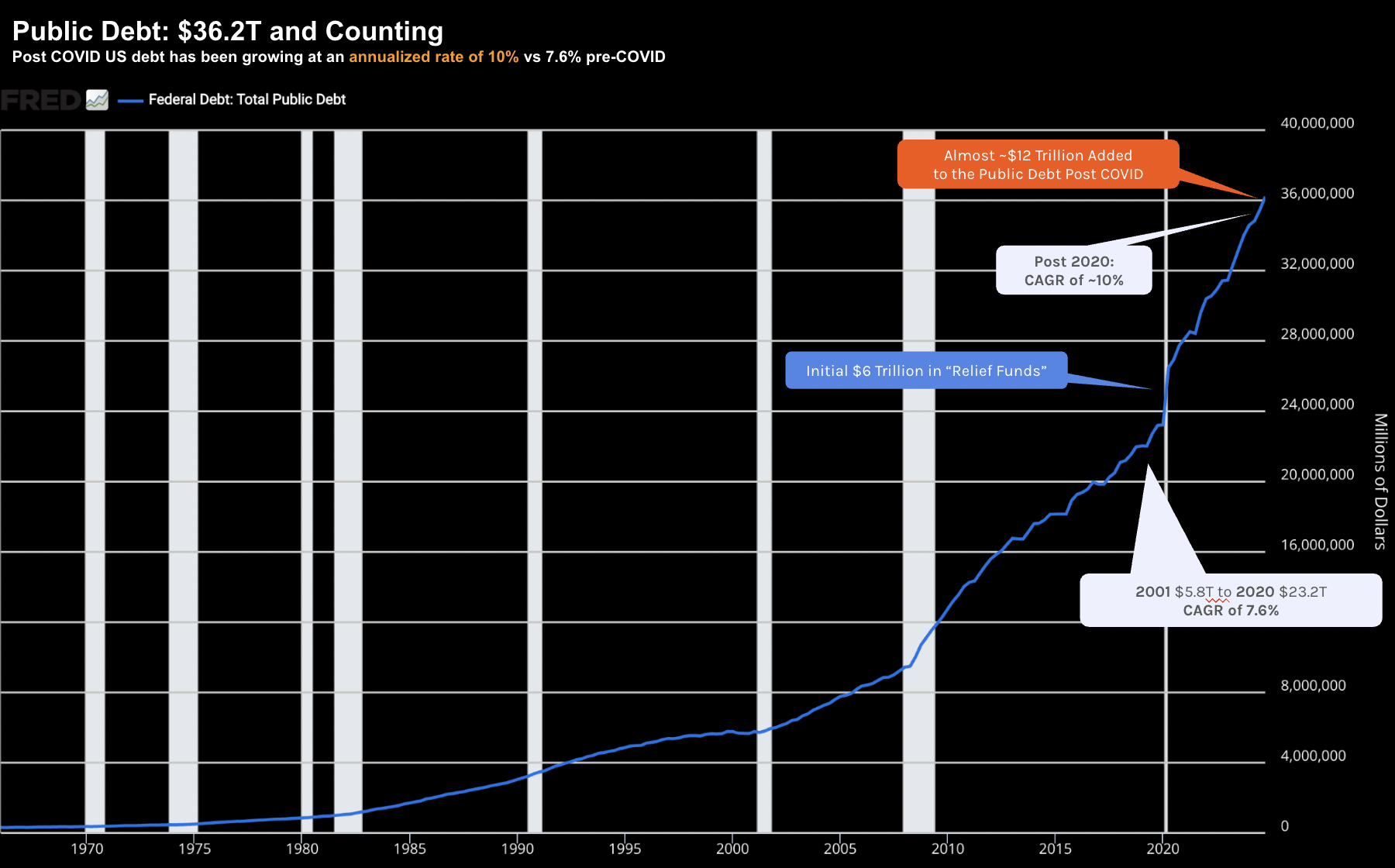

Trump is demanding the Federal Reserve lower rates. However, Fed Reserve Chair Jay Powell - is having none of it (and nor should he). This is setting up another showdown between the President and the world's top central banker... a repeat of what we saw in 2018. As we all know Trump is a real-estate guy. Property is a business that relies heavily on cheap money. And this is the same lens Trump is taking with respect to his growth agenda. But he may not get what he wants...