How Far Will Multiple Expansion Take Us?

How Far Will Multiple Expansion Take Us?

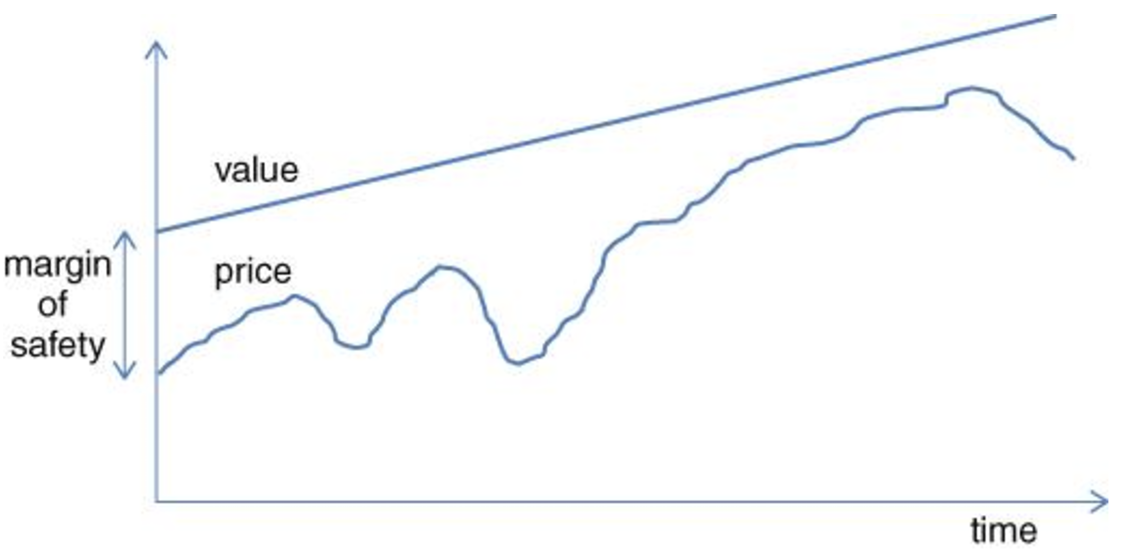

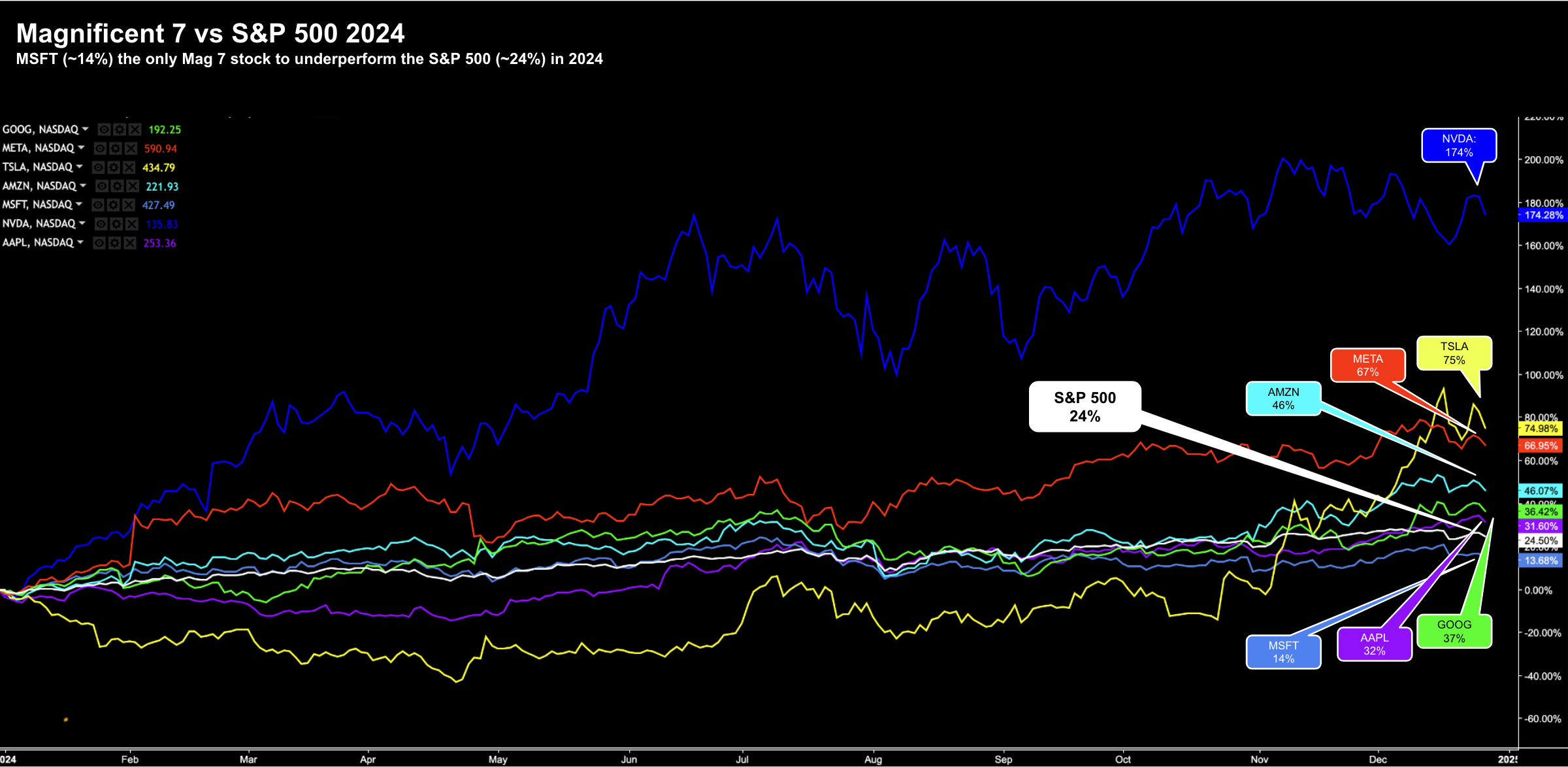

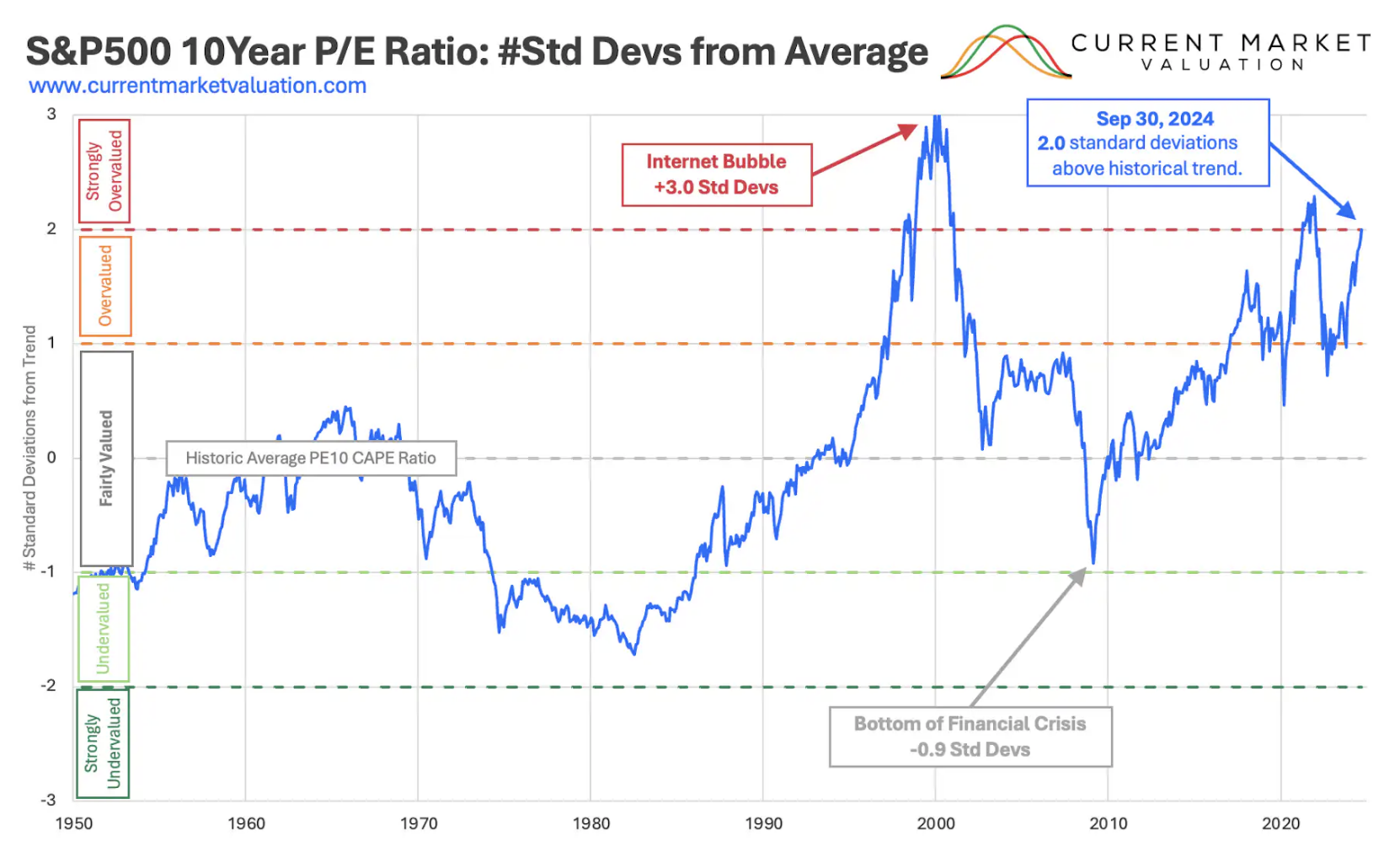

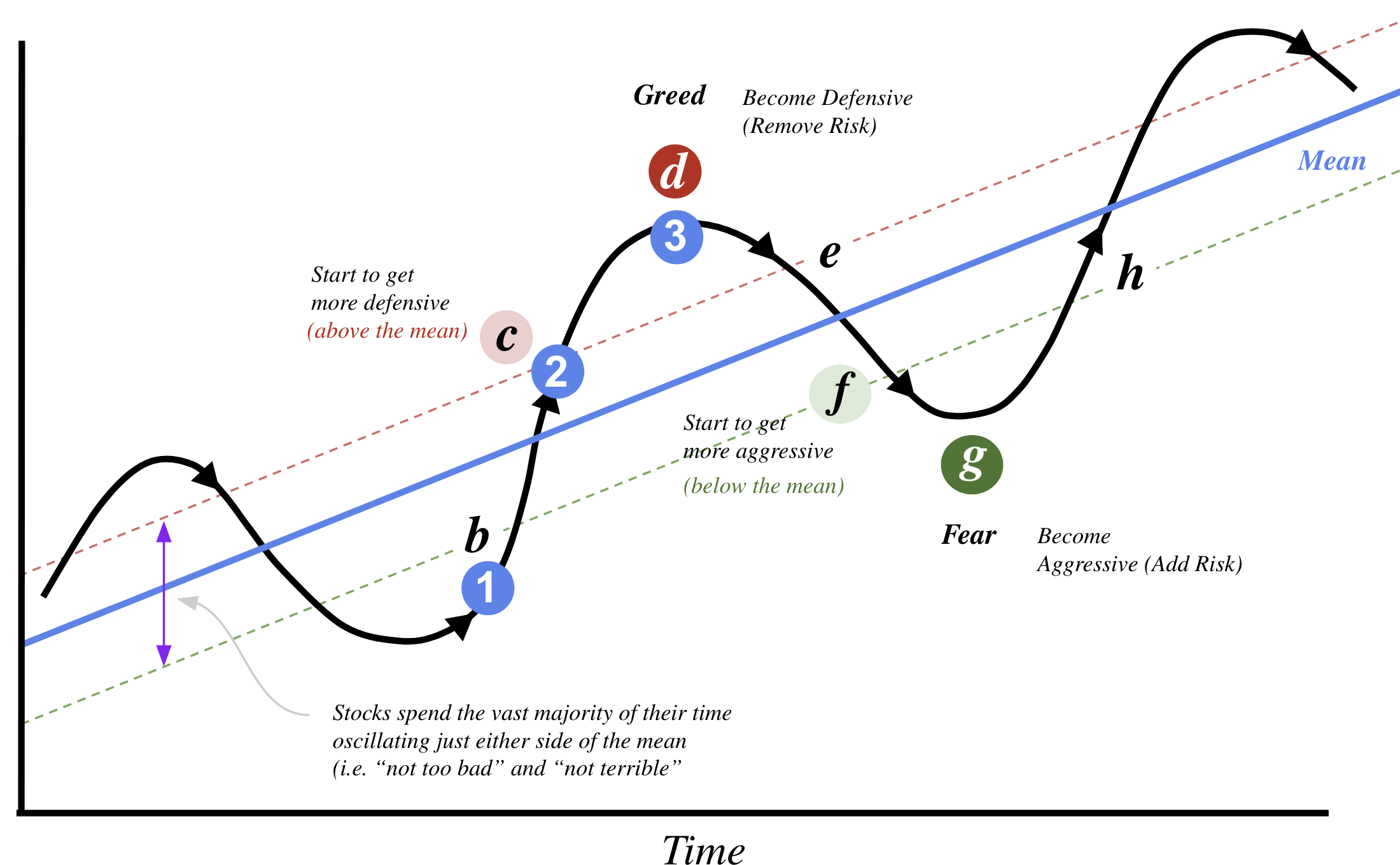

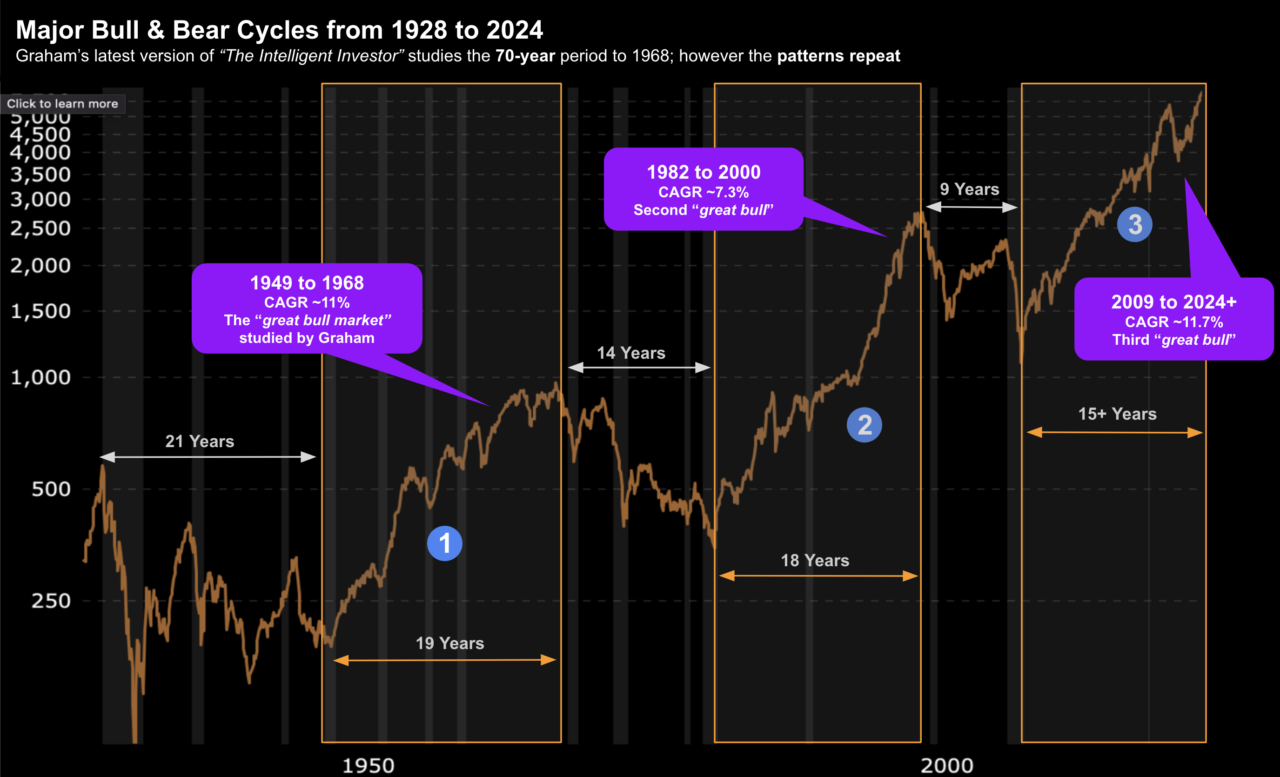

Earnings per share growth has averaged 8.3% pa from 2015 through today. However, capital appreciation in stocks (exclduing dividends) has seen a CAGR of 11.0% over the same 10-year period. This divergence is widening which indicates multiple expansion. From mine, investors should be braced for mean reversion.